Well, he did it again. Brandon Donahue dug up another gem about the lack of breadth primarily in the S&P 500 Index. I was originally planning to begin discussing how and why I use Barchart but that can wait; this observation is more important. In addition it allows me to rekindle and revisit with another E.F. Hutton alumni, Edward Yardeni. To be honest I seldom agreed with Ed years ago and we still do not see eye-to-eye but I have great respect for his opinions and work product; he’s consistent. Ed is more of a “perma-bull”. I tend to see the “negative side” of the investment equation, sticking to “best of breed” when I do buy and patiently waiting for followed S&P 500 P/E ratios to align before I act. As such, I’ll finish today’s article with another “trade”, a “wick” I’ve been patiently waiting for and like the days of E.F. Hutton, this is one idea you should “listen” to.

As we are all aware, “herd mentality” is alive and well in today’s marketplace. I talked about it in one of my first articles in early April. When it comes to “AI” and its related investment alternatives, all can safely say that the “herd is back”. The major problem created by significant increases in a few select AI-related stocks is that it “clouds” the underlying market performance. In fact without the AI rally some calculate the return on the S&P this year would be negative. This divergence, known as “market breadth”, masks a higher underlying risk within the markets.

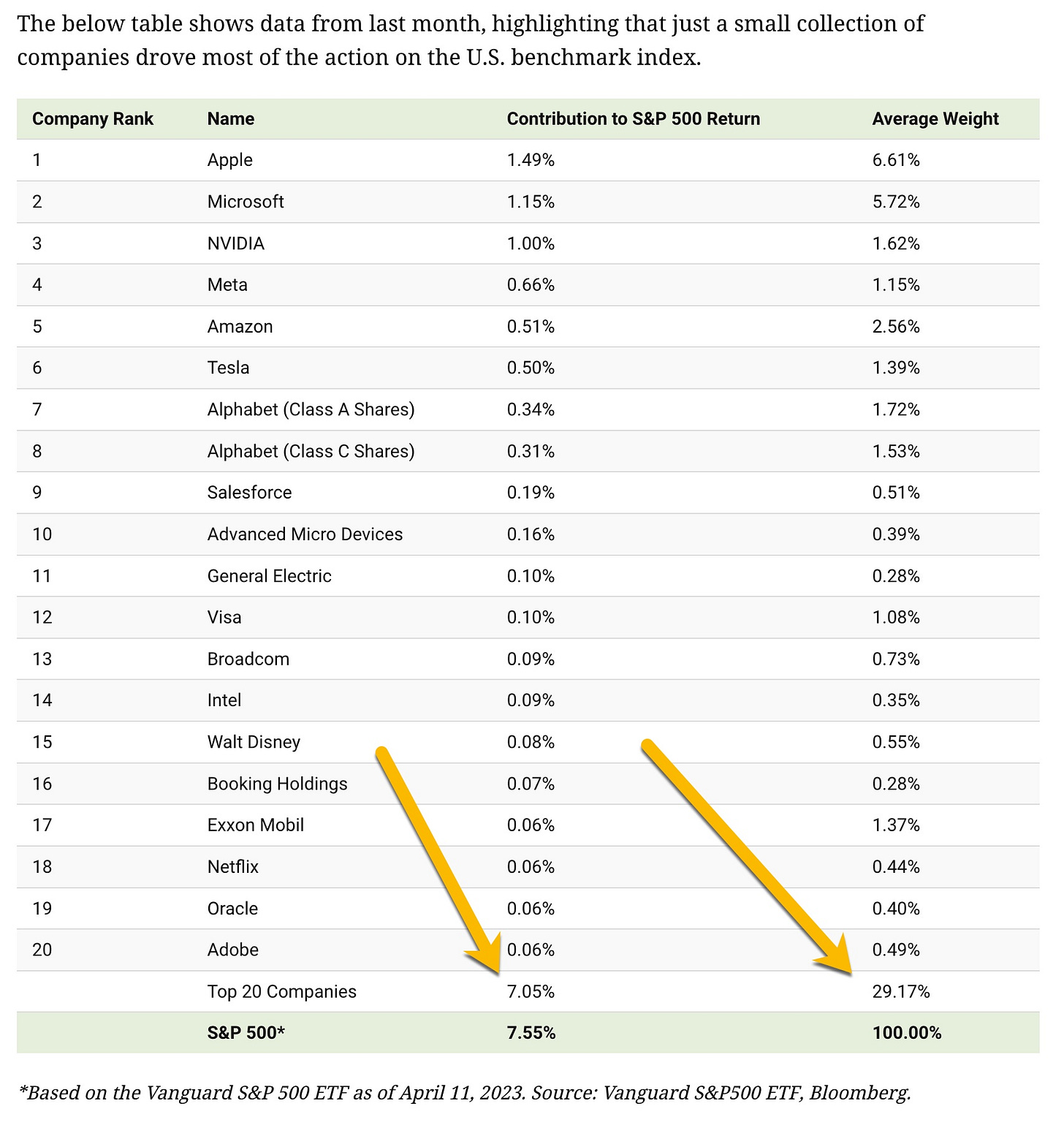

Today’s market breadth is very narrow. About 90% of the S&P’s upside this year comes from slightly more than 29% of the index’s capitalization. That effect of AI is not good but on other aspects of AI’s contribution I tend to agree with Yardeni.

Paraphrased from one of Ed’s recent blog posts, he cites the following:

The rise of ChatGPT could spark the “Roaring 20's” for the stock market.

AI is capable of boosting productivity and living standards.

"If so, then we can spend a lot less time obsessing about what the Fed will do next," Yardeni said.

We differ in that Yardeni views the rally in stocks since the mid-October low as a new bull market. I believe we’re in a bear market rally. Goldman Sachs firmly believes that “generative AI can streamline business workflows, automate routine tasks giving rise to a new generation of business applications”. I think they are right but there’s going to be a better buying opportunity before that transpires. With that tidbit in mind, this is what I’m looking for with the macroeconomic, geopolitical environment we’re now entrenched in. But first go back to another article I published in the past few weeks, “Wick Hunting”.

If you have been following me recently you are aware that my belief is that we are in a “lose-lose” scenario. If they don’t find a solution and cannot raise the debt ceiling, this market is going to crater. In the same breath, if we raise the debt limit, “Uncle Sam” is going to be standing at the “front of the line” sucking every dollar of liquidity out of the banking system. That’s going to cause the market to crater as well beginning with the Russell Index. So in either case, prices are going to drop and the S&P 500 P/E ratio is going to reflect an oversold reading. I’ll practice one of my favorite trading rules; I’ll “buy when they sell”; a true patient, position trading “wick hunter” is ready to strike. If the herd can take it higher, “fear” that it’s “going to zero”, just like they all did when COVID-19 raised its ugly head, the “newly minted” Robinhood traders will close their eyes and sell, sell and sell. There is no reason to believe they’ve “changed their spots” or learned anything. Just remember, say “thank you” if this all pans out. I know I will.

So “Core” came in a little “hotter” today, durable goods pretty much in line, personal spending up but remember those who move “real markets” are on holiday. One tidbit that caught my attention related to futures “clearing houses” doing a “deep dive” on the quality of the short term paper they accept as collateral for margin. It’s going to be interesting what happens over the next few days to weeks. For now go do something, anything other than this; everyone else is, go follow the “herd”.

Because of you, our early adopters, Substack has taken notice. Our thanks go out to Barchart as well as they’ve adopted us. They’re going to form the foundation of how we teach “what we use & how we use it” but like anything else, it’s all on a learning curve. Back to the “curve”. If time allows I’ll start this weekend.

Hope you enjoyed this post. I’m just a young 68 years old; my Dad became a broker when I was 13. It’s time for me to ‘give back’ to all of you what’s in my head. It’s not always pretty but it’s based on history . . . and history, unchecked, repeats itself as you are witnessing..

Everyone learns at their own pace. If you pick everything up the first time through, great but if not email me at david@thetickeredu.com so we can further help. Again, let me know what you want to learn, I’m all ears.

Enjoy the weekend and remember what Memorial Day is all about. Irving Berlin had a way of expressing what I hope most of you, regardless of your political persuasion, feel this weekend, “God Bless America”. Now go out there and have some fun.