Herd Mentality

Just another reality check on Wall Street yesterday as the PCE came in better than expected. The newbie Robinhood traders jumped on the bandwagon shooting for the stars as in their eyes all of the problems besetting our economy are soon to be solved. Seldom does an easier entry point appear; let the “puppies” run the markets higher as they have all week and be prepared to go short the markets when they reopen Sunday night. There isn’t much on the economic calendar during this holiday shortened week so the fuel necessary to keep this three week“wick” burning more than likely will be extinguished.

Weekly US 500 Cash Chart

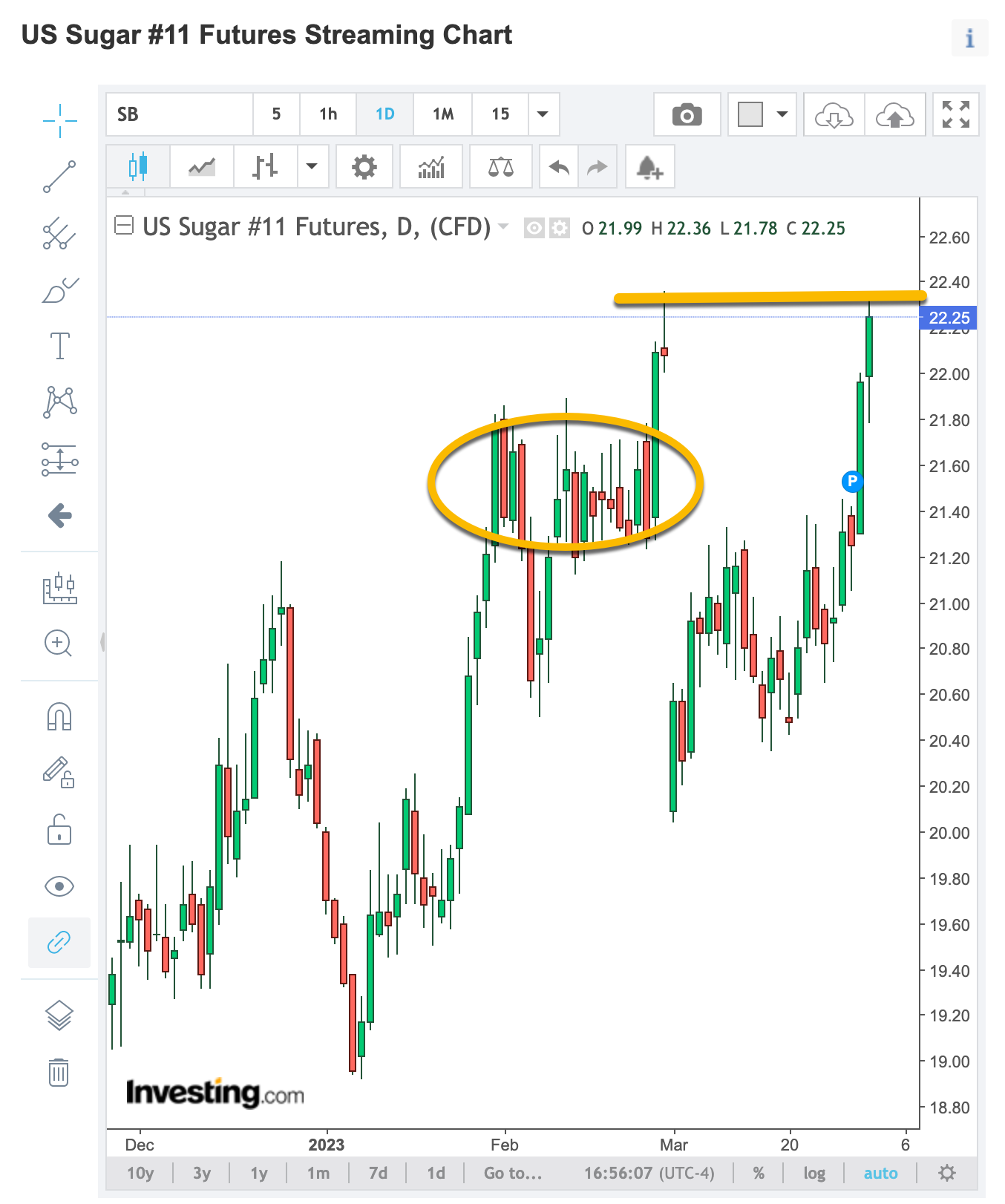

Just like the newly minted traders, people act like wolves in packs; everyone together in the identical direction at the same time until the ammunition driving the move is exhausted. In this case however, as one move ended another, much more important to Jerome Powell started rearing its head; the price of a fundamental manufactured food component, Sugar, was up 5%+ between Thursday and Friday. Inflation, lower than in prior months, is simply “resting”; round two of inflationary increases are on the way. It’s getting better; it’s getting worse and coupled with the heightened probability of another “out-of-nowhere” economic event the bears have an opportunity to roar.

Daily US Sugar #11 Chart

In addition, summer is on the way and we all know what that means . . . vacationers’ travel related demand for gasoline will rise and with that increased demand so will the price of crude oil. History repeats itself and the world, with our “woke” government in place, realizes the time to strike is right. I understand Biden is not shooting down any more balloons after realizing he was an ‘investor’ in the Chinese manufacturer.

Weekly Crude Oil WTI Chart

So how are people going to pay for the next round of inflation? What happens when inflation increases to levels where the Federal Reserve is forced to act? Do they just sit on their hands and let prices increase? After SVB and the dramatic ending to another saga of gross mismanagement in the banking arena do they have a choice? What ever happened to punishing ill-fated business decision; didn’t we learn anything from the last banking fiasco of fifteen years ago.

It’s obvious that capitalism in the banking sector is on life support. What seems to be outside of scope of what happens next, as raised prior, how are people going to pay for these price increases? In essence, inflation is a tax on the middle and lower class. It ‘s my guess that wage / price increases will further fuel inflationary pressure that will be felt as the never ending circular cycle increases spiral out of control. What’s the herd going to do then; sell off their IRAs and 401k accounts just to buy a dozen eggs and a couple donuts?

Stagflation, as experienced in the 1970s, is back. For those of you who remember the skillful Federal Reserve work of Burns and Miller know what happened. They lowered interest rates several times; the only problem they encountered, related to subsequent inflationary increases, was taking interest rates right back up. The “herd” didn’t know which trend to follow as the markets traded within a four hundred point rage through the decade of the 1970s. Today, between the ‘meme’ stocks and the hucksters on social media, the only direction the newbies understand is ‘up’. What will they do when they can no longer afford to buy food in the grocery store or even drive to the grocery store as the price per gallon approaches $5.00 again?

Recession is truly on its way. It doesn’t make much difference how you ‘identify’ what a recession is, when people run out of money they stop spending, recessions happen. Years ago it was obvious to me that the potential for a “soft landing” was minimal, a fact that is proving itself out before your eyes. Stocks rallied over 100% from pandemic lows. There was good reason to enter the markets when the S&P forward P/E ratios plummeted in the 1st quarter of 2020. There was even more reason to sell when the markets topped in the 4th quarter of 2021 as that same S&P forward P/E ratio was hitting inflated levels. Leave it to the herd, in this case the uneducated, cell phone driven buyers of fractional shares, to drive it higher. They’re back having learned nothing from the recent past declines only this time they have a lot less firepower.

So what’s really happening with retail sales? Is the herd going to be responsible for another mass movement in a singular direction and stop economic growth right in its tracks? For some macroeconomists, that is exactly what they’re looking for; but not me. Sure, we want prices to come down; Powell wants inflation to dissipate but no one really wants to see it happen all at once. Think about it, the world’s leaders created the mess we are in right now; they usually do by overreacting. It would be terrible if their recent moves to correct their recent errors causes even more problems, a sharp, steep recession or even a depression.

That’s what happens when there are fewer dollars chasing far too many goods and services; prices decline. If you think inflation is the biggest economic problem you have ever endured think again; it’s not inflation, it’s deflation. At least with inflation, demand drives price and the sellers of goods and services make money. What happens if prices decline to levels below what the goods and services sold cost? That’s not a good thing. When the “herd mentality” wakes up, if they all stop buying at the same time, just like they drove stock prices to unrealistic levels, a deep recession, even a depression is in the cards.

There’s another “group” that could add fuel l to this fire, Congress. Cash, credit and government printing presses are the primary sources of money that drives economic growth. Available cash is history, credit is tight and now, there’s a movement growing to reduce, even eliminate government deficits. You’re starting to hear it on the news; no new spending. Macroeconomist will tell you, balance is a good thing; being out of balance is not. Regardless of which party you support, these clowns, most of whom should be term limited, care about themselves and will do whatever is necessary to get reelected. Not exactly the group I’d want in place to legislate these issues but don’t worry; Powell and other worldwide macroeconomists can always turn those printing presses back on . . . just like they did in the pandemic and “under the covers” to save SVB. If that doesn’t scare the hell out of you nothing will.

I’m a bigger “bear” than I was yesterday and for good reason. There’s a list of stocks I’m looking at and if what happens is similar to what happened in the 1st quarter of 2020 I’ll pull the trigger. Until then I’m going to short the rallies, the “wicks” ,just like the big boys who have been telling you to buy as they sell, sell and sell do.

Hope you enjoyed this post. I’m just a young 68 years old; my Dad became a broker when I was 13. It’s time for me to ‘give back’ to all of you what’s in my head. It’s not always pretty but it’s based on history . . . and history, unchecked, repeats itself.

Everyone learns at their own pace. If you pick everything up the first time through, great but if not email me at dzimmer@substack.com so we can further help.

Looking to learn how to trade futures? Want to trade futures with someone else’s money? Click here https://blusky.pro/?via=david and find out why everyone is talking about The U.S-based BluSky Trading Company.