Far too many “traders” who consider themselves proficient have “never seen the rain”. Chaos leads to calm; so ask yourself what does calm lead to? When it comes down to how the markets react it depends upon more than just day, scalp or swing traders and their reaction to short term technical indicators. Calm represents a period where the current trading pattern is essentially rangebound. The underlying macroeconomic & geopolitical landscape reflects uncertainty and the “powers that be” are just “sitting on the sidelines” awaiting signals that will drive the markets higher or lower. Which way do you think they’ll go next?

The last period I remember, similar to what’s transpiring today began in 2007 ending in 2009. We called it a “financial crisis” yet preliminarily, despite alternate indicators, thought we had it under control; we didn’t. Until the absolute and utter collapse of what we knew as the “financial system” those in the markets felt we had the problem licked. We had that backwards, the financial system, in its then current condition had us licked. If you weren’t in the markets during this period, if you began “trading” after 2008 - 2009 you’ve never experienced catastrophe. The pandemic was essentially more of a manmade fiasco, in reality one of the best buying opportunities ever. The 2007 to 2009 financial crisis was a function of denial; all of the indicators were in place but we chose to ignore them. We’re back; hope you’re prepared for another dose of history.

So we’re back in what some consider a “lull” in market activity. Some attribute it to its being summer. I see a pattern last observed between 2007-2009 about a year after the Fed stopped raising rates. While there are similarities, differences proliferate albeit in areas that exacerbated the 2007-2009 financial crisis. Again it’s the regional banks, the developers of commercial real estate and the smaller Russell 2000 corporate entities who are borrowing at rates higher than they’ve been for more than a decade. Recently we solved the “debt crisis” but in reality all we did was continue down the pathway to future recessionary problems. If you question what’s happening and its possible future effects take a look at China. Prices are falling, especially at the producer price level, exports are declining, municipalities are going broke trying to figure out how to cover debt service and more; sound familiar? The second largest economy in the world is in trouble and that spells trouble for the rest of the world. Take a look at a recent article on “Inflation Versus Deflation” and how decreasing prices effect the macroeconomic world. Here comes “history” repeating itself.

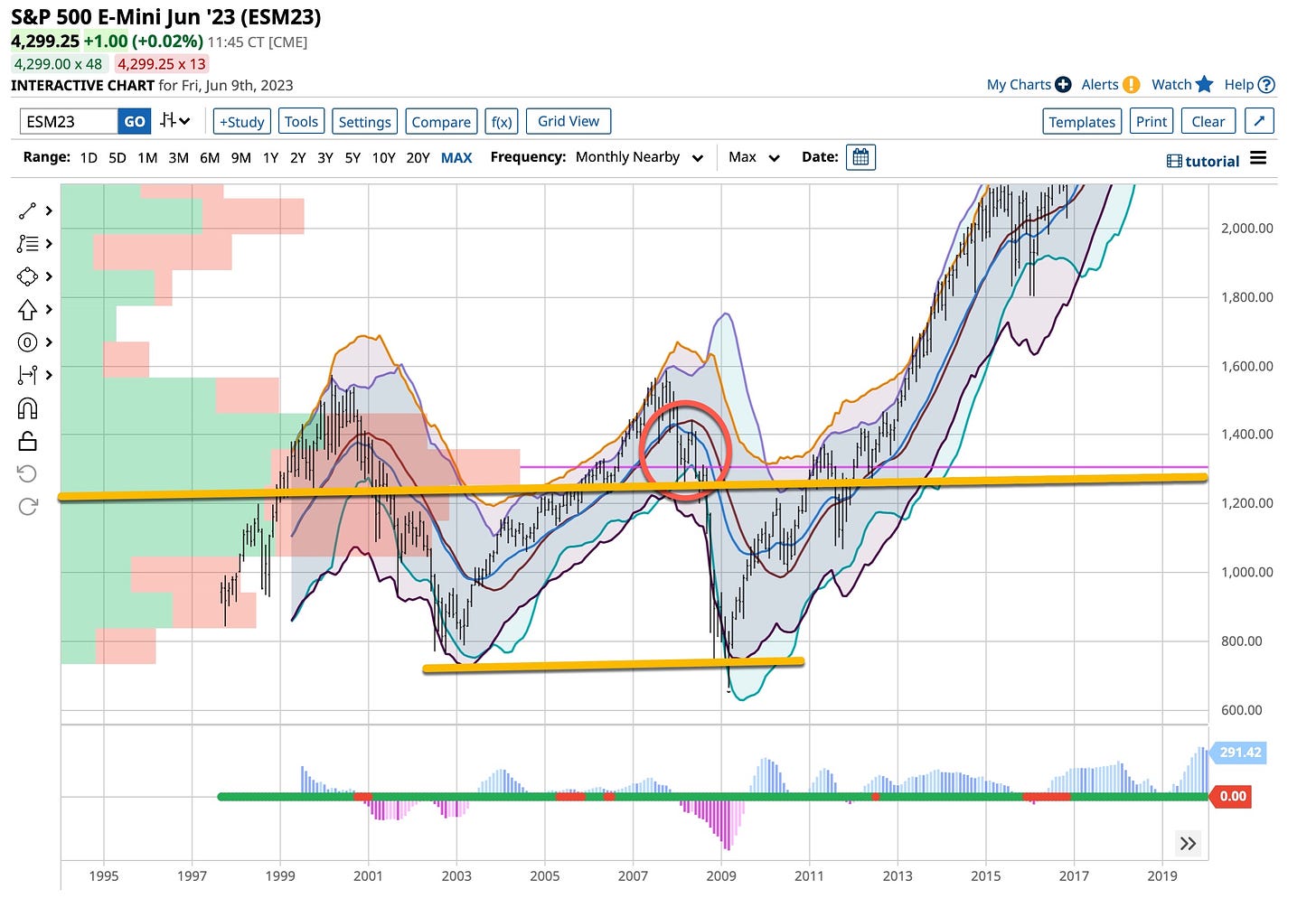

Barchart is an absolutely amazing tool. Hopefully before the end of the month I’ll be able to offer its use to you such that interactive charts can be “clicked” on so showing you how they’re constructed can be shared. Thanks for your patience. In the interim, in the above chart you’ll see the oval, a major support line at its base and the result of what happened next, the 2008 crash. It wasn’t pretty.

Today, despite recent increases in badly deflated stock prices, “blips” as I call them, investors remain concerned about the stability of U.S. banks. The same concerns were in place back in 2008. The majors saw the problems developing then and are seeing it again now. Higher rates, the reversal of the Federal Reserve’s bond-buying programs and overseas strife make for a potentially catastrophic outcome despite the American economy remaining surprisingly strong. There are those who see a soft landing while others like me envision something far worse especially with what’s happening today in China.

History Repeats Itself

It looks like the Fed has enough reason to pause. So after ten consecutive increases we see reason why some prognosticators think a “soft landing” is on its way. After all, the economy is still growing, albeit at a slower rate, but with rates increasing that indeed was expected. That was the objective. Except for the ridiculously massive amounts of money dumped into the economy during the pandemic, we’d be in recession already. Remember, most recessions begin after the Fed stops raising not during the period of tightening the money supply.

The Federal Reserve’s tightenings since March 2022 are its most aggressive series of rate increases in four decades. Bonds matured without being reinvested and the Fed shrunk its balance sheet. Given the increases began at ridiculously low levels, a 5%+ rate, although seemingly low, was diabolically high compared to recent periods so as to “shock” the market. Credit’s now much tighter, unemployment is beginning to tick higher, price points for commodities are decreasing; all that’s left is for the inverted yield curve to return to normal. Read my recent article on “Eventually What Happens When” about the yield curve being the final recessionary indicator.

Regional Banks Are Not Out Of The Woods

Regional banks are still affected by higher interest rates. There’s only so much that the “big boys” can do balance sheet wise to continue buying up assets that are going to be coming their way one way or another. Yellen will continue to suck up liquidity as provided in the debt crisis deal as she refills the Treasury’s coffers. I don’t think there will be enough left to save many additional banks. Mergers are likely but management problems will persist. Another day of reckoning is on it’s way.

Although residential real estate has not yet been affected as happened during the 2007-2009 crisis, the commercial real estate market is in shambles. There aren’t any tenants for “downtown” office space thanks in part to workers remaining in their bedrooms, or their parent’s basements, as it may very well be. Refinancing at higher rates seems unlikely under this scenario as well. It’s only logical that developers will walk away from their investments leaving the regional banks “holding the bag”. Maybe they will just turn them into Pickle Ball courts or homes for our surging population of migrants.

There’s more but it’s apparent to me that we’re on the path to repeating, albeit not the exact same way as the 2007-2009 financial crisis rolled out, history. The Fed is about to pause, the “newbie” traders will buy the news. The worst is now over; “all clear ahead” they’ll all at once extol. I suggest like most herd-like movements, they’re wrong again and it’s best you sell. I’ll be right there along side of you given I’m still getting a 4%+ return on risk free paper. It just ain’t that hard folks and don’t make it harder than it needs to be. Bulls make money; bears make money and pigs get slaughtered. These are times of uncertainty, take the 4%+ and put it in your pocket then come back to “play” on another day when the risk reward ratio is in your favor, not against you.

Hope you enjoyed this post. Back to the usual grind, building The Ticker EDU, taking care of another family crisis, maybe even getting a couple hours to do some yard work. You see, I’m just like you, eh? I’m just a young 68 years old; my Dad became a broker when I was 13. It’s time for me to ‘give back’ to all of you what’s in my head. It’s not always pretty but it’s based on history . . . and history, unchecked, repeats itself as you are witnessing.

Everyone learns at their own pace. If you pick everything up the first time through, great but if not email me at david@thetickeredu.com so we can further help. Again, let me know what you want to learn, I’m all ears.

Credence Clearwater Revival fits today’s article. “Have You Ever Seen The Rain”, I’ve seen it and not too worried about the next time it rains. Experience has taught me that I’ll need a “bigger umbrella” but being a golfer I know where to find it. Go find yours and be prepared. That’s what Sunday’s “The Week That Was & What’s Next” is about. Not every market set up goes higher. We’re at a juncture I’ve lived through before as many of you’ve been before. Get ready, the proverbial “#%&@” is about to hit the fan.