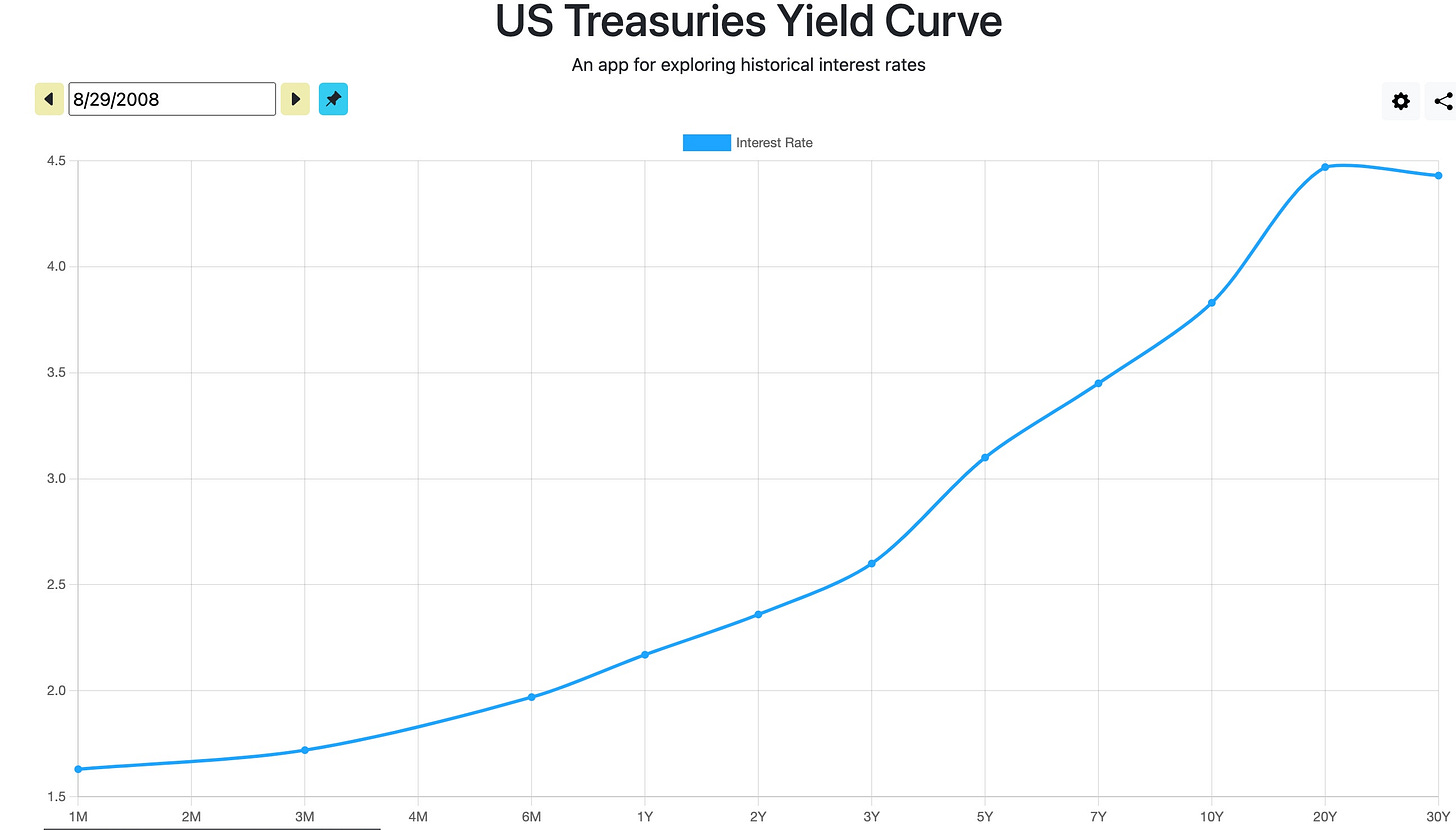

Hot off the presses; like a pilot would announce, “we’re going to be arriving later than originally expected due to “whether” conditions outside of our actual control”. Today’s “whether” in this case is when the extra $4.0 trillion in available debt ceiling increases hit the market. If managed correctly, Yellen with June 15th tax payments hitting the government coffers shouldn’t need to strip as much liquidity from the banking system as originally thought. Perhaps today is the first foray against the misappropriation of our budgetary agenda and Republicans are just starting to fight. 71 Republican House members voted against the bill; unfortunately more Democrats supported the bill than did Republicans; what does that tell you? In any case the initial reaction across the macroeconomic geopolitical markets is what you want in a medical diagnosis, simply unremarkable no reaction. Eventually we’ll return to a normalized yield curve but my “Magic 8-Ball” remains cloudy, regardless get ready for when it clears up.

Being a rather “forward thinking” macroeconomist, a position trader and one who uses yesterday’s history to predict tomorrow’s results, today’s article is undoubtedly premature. That’s OK, most everything, especially financials of this type and nature revert back to the mean. When “normalcy” does return, if there’s a way to define what normalcy is in this time period we’re living in, the roadmap of what to expect is well defined; it has happened before and to expect a different outcome would be, as is too often quoted, “idiotic”.

The uncertainty, brought to you by the “swamp”, the current administration and our beloved Federal Reserve, makes it impossible to accurately predict when so let’s just talk about what is more than likely to happen when inflation is under control and we finally have interest rates coming down. If they do drop another $4.0 trillion more into our monetary system, it’s going to be later rather than sooner but like a Boy Scout and be prepared. Term limits would be a good thing too but who am I kidding. Those with the ability to legislate an outcome of that nature are the very same “clowns” who have put us in the situation we find ourselves in today. If there was a history I’d like to see not repeat itself just turn on any “fake news” channel you’d like and then watch what’s going on in Washington; it’s shameful, the true victims are the generations to follow.

What Is An Inverted Yield Curve

An inverted yield curve is defined by when short-term interest rates are higher than long-term interest rates. Considered to be an abnormal situation, an inverted yield curve effects the underlying macroeconomic environment in many ways.

Signals Economic Recession: An inverted yield curve is a potential signal of an upcoming economic recession. Historically, inverted yield curves often preceded economic downturns. Investors become more concerned, worried about upside down near-term economic conditions. Most prefer the safety of short term paper and long-term bonds to obtain highly secured interest payments versus taking a “risk” investing elsewhere.

Stock Market Volatility: Inverted yield curves contribute to increased volatility in equity markets leading to increased concerns about the overall economic outlook. This, in turn, leads investors to reevaluate their investment strategies quite often resulting in stock market declines and increased market uncertainty.

Flattened Profit Margins for Banks: Inverted yield curves can often squeeze the profitability of banks and financial institutions. Since their borrowing costs tend to be tied to short-term interest rates, while their lending rates are influenced by long-term rates, a flattening or inverted yield curve compresses their net interest margins, affecting their profitability.

Tightened Credit Conditions: Inverted yield curves often lead to tightened credit conditions, making borrowing more expensive. Banks may become less willing to lend, as their net interest margins shrink when short-term rates are higher. This can restrict access to credit for businesses and individuals, usually slowing down economic growth.

Reduced Business Investment: Higher borrowing costs as are associated with an inverted yield curve discourage businesses from making long-term investments and expansions. Borrowing costs are relatively higher for longer-term projects in a period of this nature. As such, businesses delay or scale back their investment plans, which can have a negative impact on economic activity.

Potential Yield Curve Steepening Measures: Policy responses to inverted yield curves include actions taken by central banks to stimulate the economy. These measures can include interest rate cuts, quantitative easing, or other monetary policy adjustments aimed at lowering long-term rates and steepening the yield curve.

It's important to note that while an inverted yield curve has often preceded economic downturns in the past, it is not guarantee a recession will occur. Economic conditions are influenced by various factors, and other indicators should be considered alongside the yield curve to assess the overall health of the economy. It’s a big world out there and out-of-nowhere events have the ability to alter the best made plans in a heartbeat.

What Happens When The Yield Curve Returns To Normal

When inverted yield curves return to normal, again if there is such a thing, it typically signifies a transition from a macroeconomic environment prior indicating a potential recessionary period to a more stable or an expansionary period. Here are some effects that may occur:

Improved Economic Sentiment: Returning to a what’s known as “normal yield curve” is often interpreted positively by investors and market participants. It can boost confidence in the economy, leading to increased investment and spending.

Stimulated Borrowing and Lending: A normal yield curve encourages borrowing and lending activities. Lower short-term interest rates associated with a normal yield curve can make it more attractive for businesses and individuals to obtain loans, stimulating economic activity.

Steadier Housing Market: In a “normal yield curve” environment, mortgage rates are often influenced by long-term interest rates. When long-term rates are higher, mortgage rates may also be higher, potentially cooling down the housing market. However, a stable and predictable yield curve can provide a sense of certainty and stability to potential homebuyers, encouraging activity in the housing market.

Normalized Monetary Policy: Central banks use the shape of the yield curve as an indicator of economic conditions. When the yield curve returns to normal, it may suggest that monetary policy adjustments made by central banks have been effective in reestablishing economic stability. This can lead to a more normalized macroeconomic monetary policy and creates far less of a need for extraordinary measures or interventions.

Enhanced Business Investment: With a normal yield curve, long-term interest rates are typically higher than short-term rates. This provides more incentive for businesses to invest in longer-term projects. Borrowing costs are relatively more favorable. Increased business investment can contribute to economic growth.

Please note the effects of a return to a normal yield curve vary depending on other economic factors and policies in place. Market conditions, geopolitical events, and other macroeconomic factors can influence the overall impact on the economy.

Here’s another graphic and I apologize in that it’s a little difficult to illustrate. With that in mind let me share the website where I found it, Longtermtrends. The spreads between short term and longer term treasuries historically approach where they were way back in the early 1980s. Barchart was not much help either but they’re working on putting together my request to illustrate an interactive chart depicting changing yields on everything from 1-month to 30-year treasuries over the last 50 or so years. That’s why I’ve chosen to work with them and they have confirmed access to their “webinar” series for those who follow me. More on that coming next week so stay tuned.

Planning for what’s expected to happen is a very critical step most macroeconomic analysts, those interested in a longer term horizon, not what’s going to transpire over the next 15 to 30 minutes, employ. If that’s the kind of short term trader you are or want to be I suggest you look elsewhere and have a couple bottles of Tums or Pepto Bismol handy, you’re going to need it. Maybe best to even buy a few shares of The CME Group’s stock as well as they’re really one of the only entities that’s going to make money from your efforts.

Traders die broke. A study from the Autorité des Marchés Financiers (AMF) in France analyzed the trading activity of individual traders over a five-year period finding that approximately 90% of them incurred losses. A study by the Brazilian financial market regulator (CVM) indicated that 97% of active traders experienced net losses over time. Take the time to learn what I’m doing my damndest to teach you; position trading, it does work. Presently putting together the basics for a “Position Trading” course but all good things take time and there’s a lot to teach you from.

Because of you, our early adopters, Substack has taken notice. Our thanks go out to Barchart as well as they’ve adopted us. They’re going to form the foundation of how I illustrate to you “what tools I use & how I use them”. Stay tuned.

Hope you enjoyed this post. I’m just a young 68 years old; my Dad became a broker when I was 13. It’s time for me to ‘give back’ to all of you what’s in my head. It’s not always pretty but it’s based on history . . . and history, unchecked, repeats itself as you are witnessing..

Everyone learns at their own pace. If you pick everything up the first time through, great but if not email me at david@thetickeredu.com so we can further help. Again, let me know what you want to learn, I’m all ears.

Maybe it’s time for you to start following “The Yellow Brick Road” like Dorothy did in “The Wizard of Oz”. It was an arduous journey but it paid off. I’ll do everything in my power to get you there as quickly as possible but remember, learning how to become a long term investor takes time. Nothing has really changed over the years I’ve been in the macroeconomic, geopolitical sphere, the only thing that’s really changed revolves around the amount of and speed at which information flows. See our recent article on Resources We Utilize. It will get you started and keep reading; that makes me happy.