I’m a position trader, I don’t trade much. I am a very patient person. When it comes to trading an index, usually. the S&P or Russell, I wait until the time is right. That time is upon us. So just how does a position trader decide what and when to trade?

The first thing I do is assess the overall macroeconomic and geopolitical environment worldwide. I’m still on the “bearish” side as the watchword that still keeps hitting the “front” page is uncertainty. Complimented by high interest rates, the only criteria that seems to be going in the right direction is inflation. There’s two primary problems to assessing inflation; (1) it’s still too high, is embedded in the core numbers and (2) when inflation does retreat so will prices paid for goods and services leading to decreases in corporate revenues, earnings and related economic ratios. No matter what this market needs to go lower before I’m “bullish”, as in March 2020 when the COVID pandemic took flight. I’ve said it before and I’ll say it again, identify “fear” in the markets then just take advantage of it; buy when they sell. If there’s no reason for increasing stock prices, sell when “they” buy; they’re just “sheep” not knowing what they’re doing.

Several technical indicators have meaning in my life. There was an article published recently, “Can the S&P 500 Still Reach 4300+?”, utilizing the “Elliott Wave Principle” (“EWP”) on the S&P 500 by Dr. Arnout ter Schure. I suggest you read it from start to finish, I did and that’s why the link is provided. He was right, the S&P rose last week. Let’s see if his cycle low prediction of 2,900 or lower on the S&P 500 Index is reached. I’ll bet on that one. Again, a well written article; read it.

The set-up for “wick” hunting is in place. Early next week, several “newbie” traders will indiscriminately “click” the buy button on their iPhones thinking that since the debt crisis is resolved we’re in the clear. I just don’t agree, the resolution is more of a death knell. The “big boys” on Wall Street, those who took the last couple days off in the Hamptons, will be selling into this rally. Short interest, as reported by the CFTC in the S&P 500 Index, rose again this week. How much higher can stocks with forward P/E ratios north of over 200+ like NVDA go. There’s no breadth as published recently in “Lack of Breadth Kills”. So let’s go “wick” hunting as I did in late October 2021.

S&P 500 Case Analysis

Here’s a chart, courtesy of Barchart, of the S&P 500 E-Mini June 2023 futures contract. Please note the two horizontal lines. The top line, the highest level of resistance, the high volume node (”HVN”), sits slightly above Friday’s closing price. I often say that “water flows” from higher to lower levels. The lower line or low volume node (“LVN”), sits at the recent October 2022 lows where there was little to no volume exhibited on the left hand side of the graphic. I expect the S&P Index to fall from the HVN until it hits the LVN or lower as there’s no support until the 2,900 price level, the larger oval.

Russell 2000 Case Analysis

Now here’s a chart, courtesy of Barchart, of the Russell 2000 E-Mini June 2023 futures contract. The data available only goes back to 2014. A true comparison is unavailable. The Russell had one hell of a last couple days. Last time I saw that happen was in late October 2021, I told you I’m patient. If history repeats itself early next week it’s going to fly higher only to be met with “street” selling, taking the “newbies” to the cleaners. Where it goes from there is anyone’s guess but the Russell has become known as the “leader of the pack”; where it goes the other indices follow.

There’s two sides of the coin. I’m looking for an upside “wick” to form so I’ll only talk about the sell side. I promise you that my Position Trading course, now being written, will address all sides of the market, both the bullish and bearish sides. It’s impossible for me to relate the fine detail to what follows, especially on using options, in a single article. I’m putting together another course on Options but remember, “Rome was not built in a day”. Today’s article is general in nature. I’ll follow up, post taking an actual position as time allows, if that transpires, and keep you in the loop.

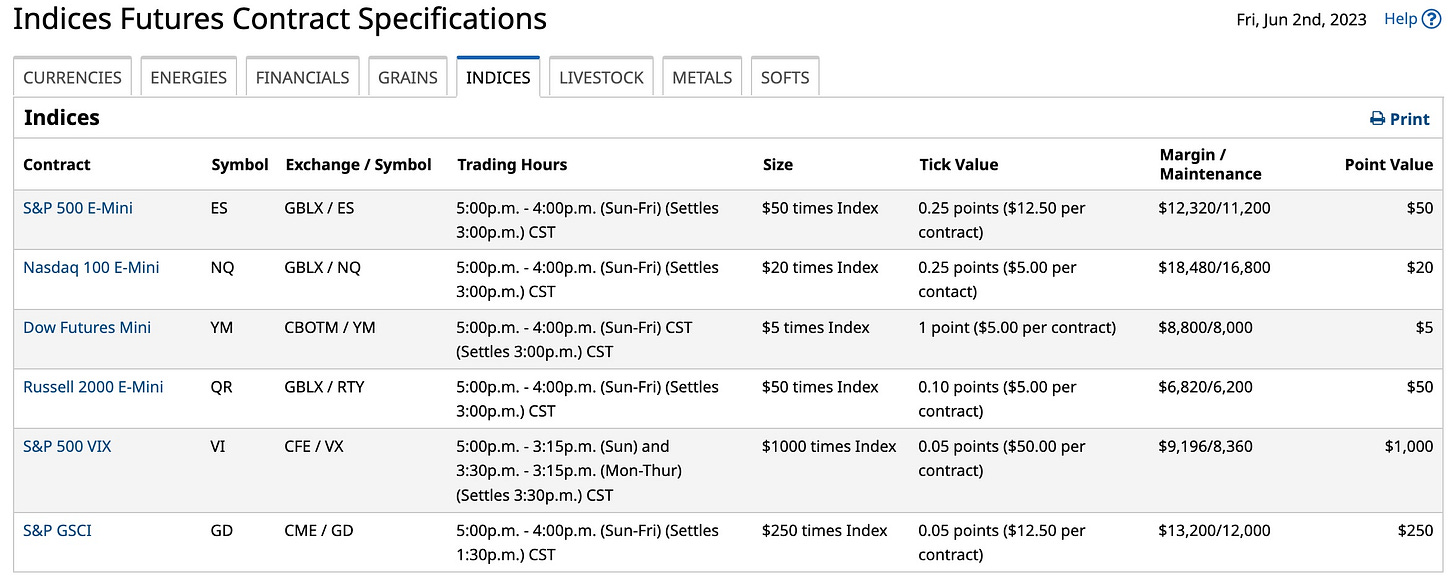

Indices Futures Contract Specifications

Futures provide a “dollar-for-dollar” investment vehicle for “wick” hunters. An order to “open short” gets you started. Keep in mind it’s our intention to “hold the position” overnight so Initial & Maintenance Margins come into play. Both S&P 500 E-Mini and Russell 2000 E-Mini contracts have a $50 “point value”. Russell 2000 margins are about half as much as S&P 500 margins. The choice is yours but you’re going to need to have a “chunk of change” deposited with you’re clearing broker before opening a position.

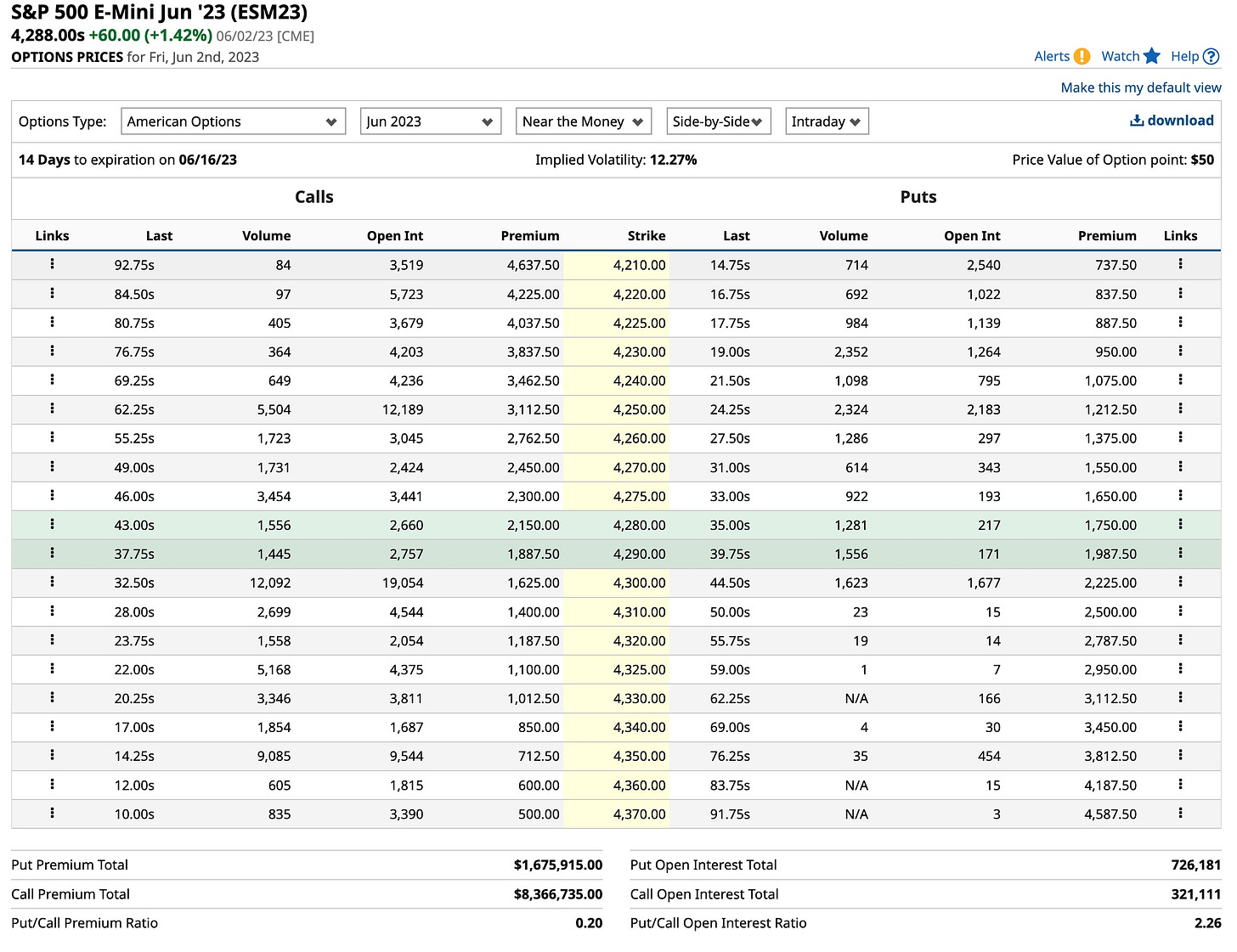

Options on Futures

Futures not only require a significant deposit, the risk of losing more than you deposit should the position go against you is theoretically possible. For this reason people use options on futures to limit potential losses to the amount paid, in this case for an “at the money” put option. You’ll pay a premium to purchase the put, the “right to sell at a specific price on or before a specific date” but your potential losses are limited.

ETFs

If assuming you’ll use margin on a futures transaction, it’s only fair to employ margin with respect to working with ETFs. Let’s also assume that you’ll initiate the position by depositing 50% of the value of the transaction. You’re going to be paying interest on the amount you borrow which is why we start with the chart above. You have to be right to make money investing. Clearing firms and brokers simply need to facilitate the transaction; they make money every time you act. Pretty good business, eh?

Today’s ETFs allow you to speculate the markets going higher or lower. Anticipating the S&P’s decline, you can “short” the SPY (not shown) or you can go “long” the SH. There’s not enough room or time for me to discuss the “short” side but I’ll address it in future articles. For now, since you are looking for the SPY to decline just buy the SH but remember, you have transaction costs, margin interest payments and one more thing to be concerned with, dividend payments. The SH portfolio is essentially “short” the equities it holds. If any of them pay a dividend, the amount paid reduces the value of your position. Nonetheless, for this presentation let’s keep it simple and buy the SH.

The same discussion holds true for the Russell 2000 ETFs. Just buy the RWM since you anticipate the Russell declining in value. The more I write the more I understand how much there is to learn. It’s not easy to relate 55+ years of experience but I’ll try.

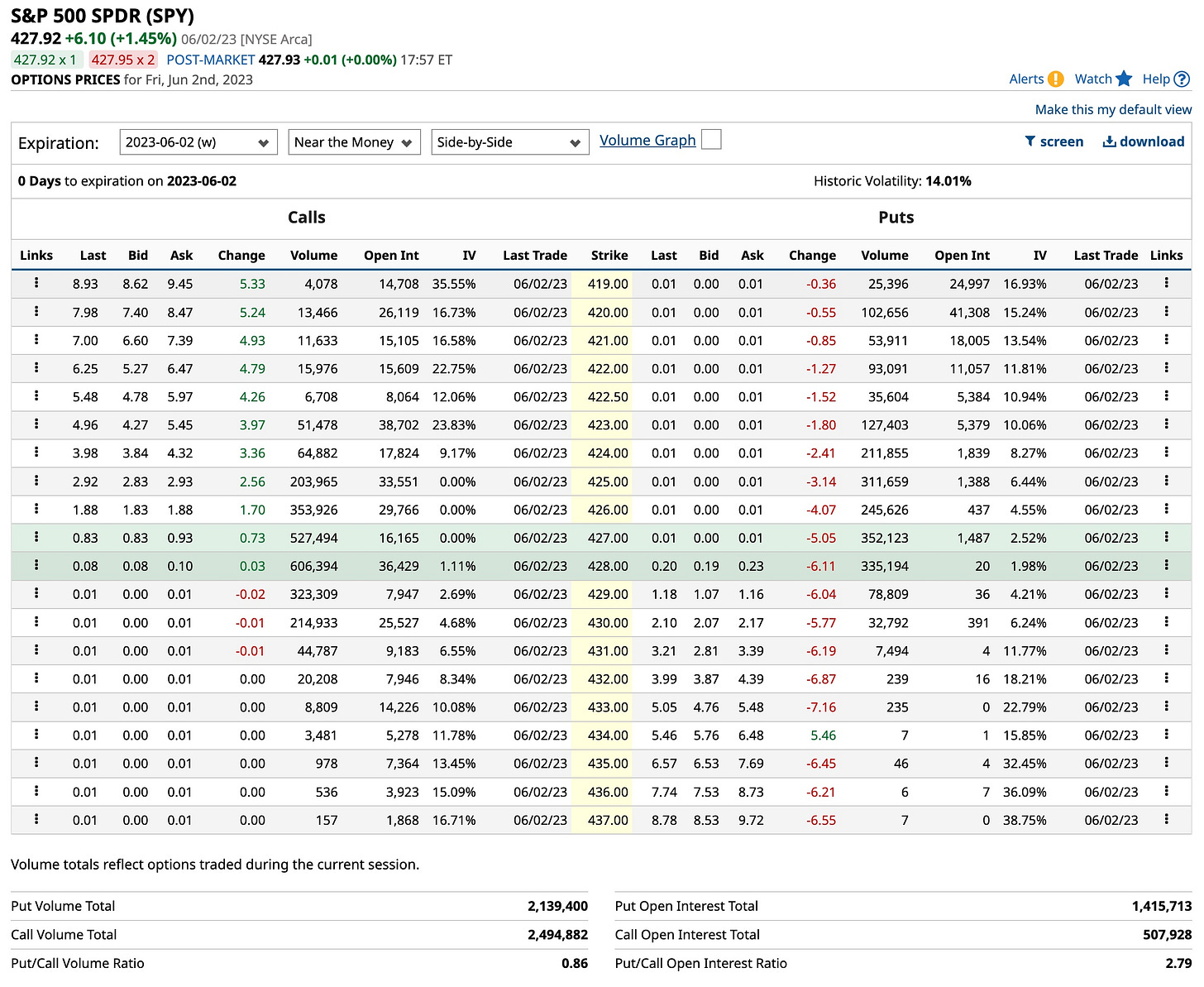

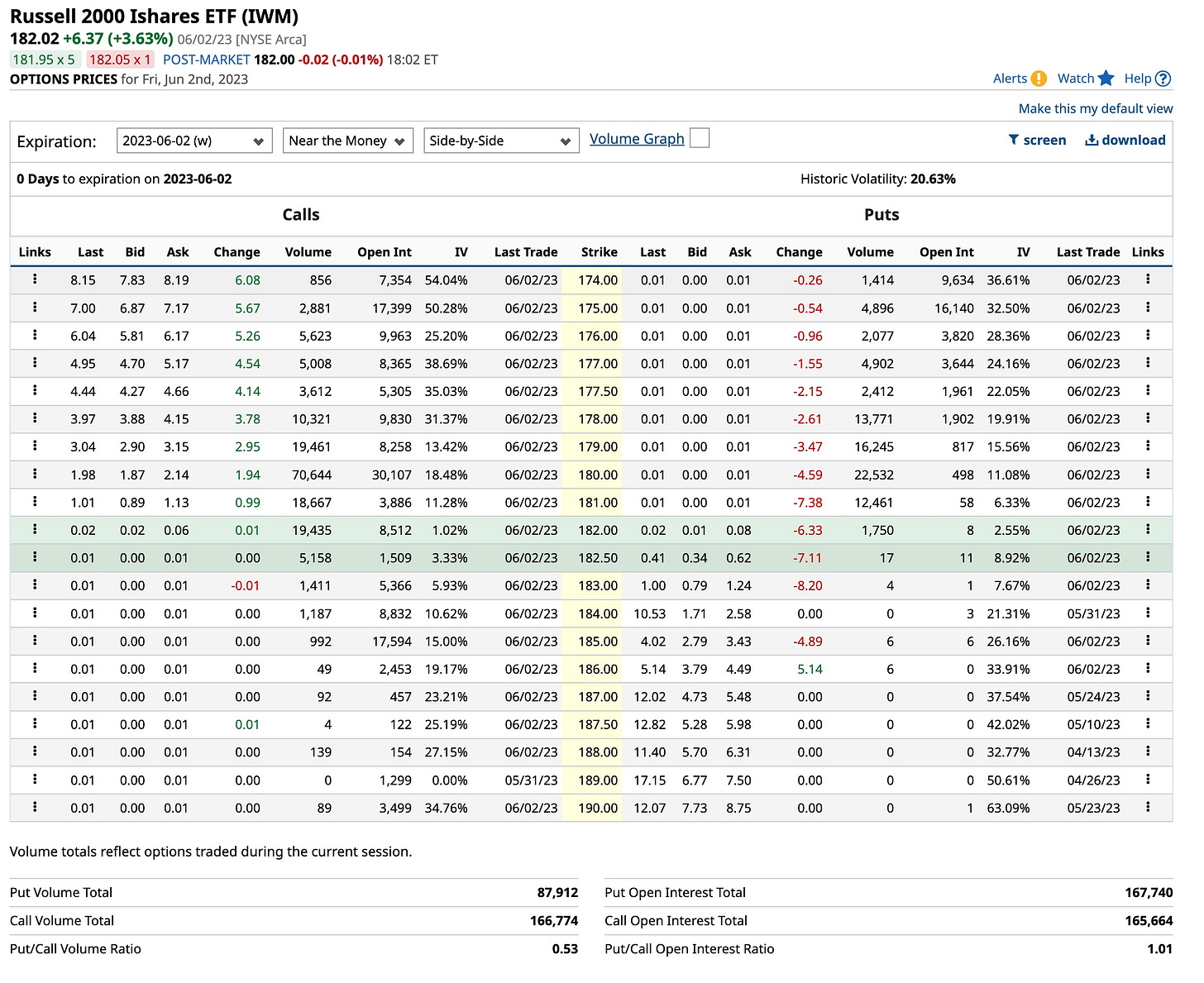

Options on ETFs

Kind of a “rinse and repeat” of what was discussed in the segment on futures options. You are looking to buy a put option on the SPY or an IWM call option. In both cases it is anticipated that the markets are heading south. Buying a put option on the SPY you have the right to “put” the ETF to the seller at a set price on or before a set time in the future. Buying a call option on the IWM you have the right to “call” the ETF from the seller at a set price on or before a set time in the future. Easy, right . . . no it’s not but you need to start somewhere; we’re “wick” hunting and these are the tools you can use.

Stay tuned, I’m going to do my best to teach you not just what i’ve learned in 55+ years but how I actually use it. I’m just a young 68 years old; my Dad became a broker when I was 13. It’s time for me to ‘give back’ to all of you what’s in my head. It’s not always pretty but it’s based on history . . . and history, unchecked, repeats itself.

Everyone learns at their own pace. If you pick everything up the first time through, great but if not email me at david@thetickeredu.com so we can further help. Again, let me know what you want to learn, I’m all ears.

It’s Elmer Fudd time again; he’s a “Wabbit Hunter” and for me that’s close enough. See you tomorrow for “The Week That Was & What’;s Next”. I’ll take this article a step further. There’s a lot here today.Give me you’re time; i promise to improve your skills.