It’s May alright. It’s raising the debt ceiling season again; sure there are some nuances to incorporate into “The Week That Was & What’s Next” but we’ve already witnessed them in the past. More troubling, we’ve been victimized by the aftermaths of our short term decision-making to avoid “problems” only to subject ourselves to “what’s next”. I can go back decades but for today I’ll stick with what’s been identified as a “lose-lose” scenario as it’s related to the current debt ceiling negotiations.

19th century French economist Frederic Bastiat was one of Meltzer’s favorite to quote. I remember when Meltzer quoted his best definition; the difference between a good economist and a bad one, to paraphrase “a good one looks beyond the immediate and forecasts hidden consequences while the bad one just looks at the immediate effects and ignores the rest”. Couple that with “Murphy’s Law” where “anything that can go wrong, will go wrong” and you have a pretty good synopsis of where I’m heading.

Last week is best summed up as Fed speak on steroids, worldwide. There’s a lot to talk about but there were also some interesting numbers reported that further convolute what our already confused macroeconomic, geopolitical “experts” will do next.

On Monday, China missed numbers across the board. That’s not good. Fixed asset investment, industrial production and retail sales came in lower than expected. Japan beat quarterly and annualized GDP numbers on Tuesday only to then report inflation numbers on Thursday higher than expected. Given the reduction of “cash” worldwide Japan, the remaining “dove” internationally has a choice to make, one I’ll discuss later.

Next week brings my “Simon Says” leader, New Zealand back to the forefront Tuesday with an expected 1/4% interest rate increase to 5.5%. The FOMC minutes are released on Wednesday but face it, there’s nothing they can say that has not already been said. On Thursday and Friday we have the following laundry lists:

Thursday

Chicago Fed National Activity Index

Continuing Jobless Claims

Core Personal Consumption Expenditures (Preliminary 1st Quarter) – 4.9%

Personal Consumption Expenditures Prices (Preliminary 1st Quarter) – 4.2%

GDP Annualized (Preliminary 1st Quarter) – 1.1%

Price Index (Preliminary 1st Quarter) – 4.0%

Initial Jobless Claims – 250,000

Friday

Core Personal Consumption Expenditures (Preliminary April) – 0.4%

Core Personal Consumption Expenditures (Preliminary Annualized) – 5.0%

Durable Goods – All Down

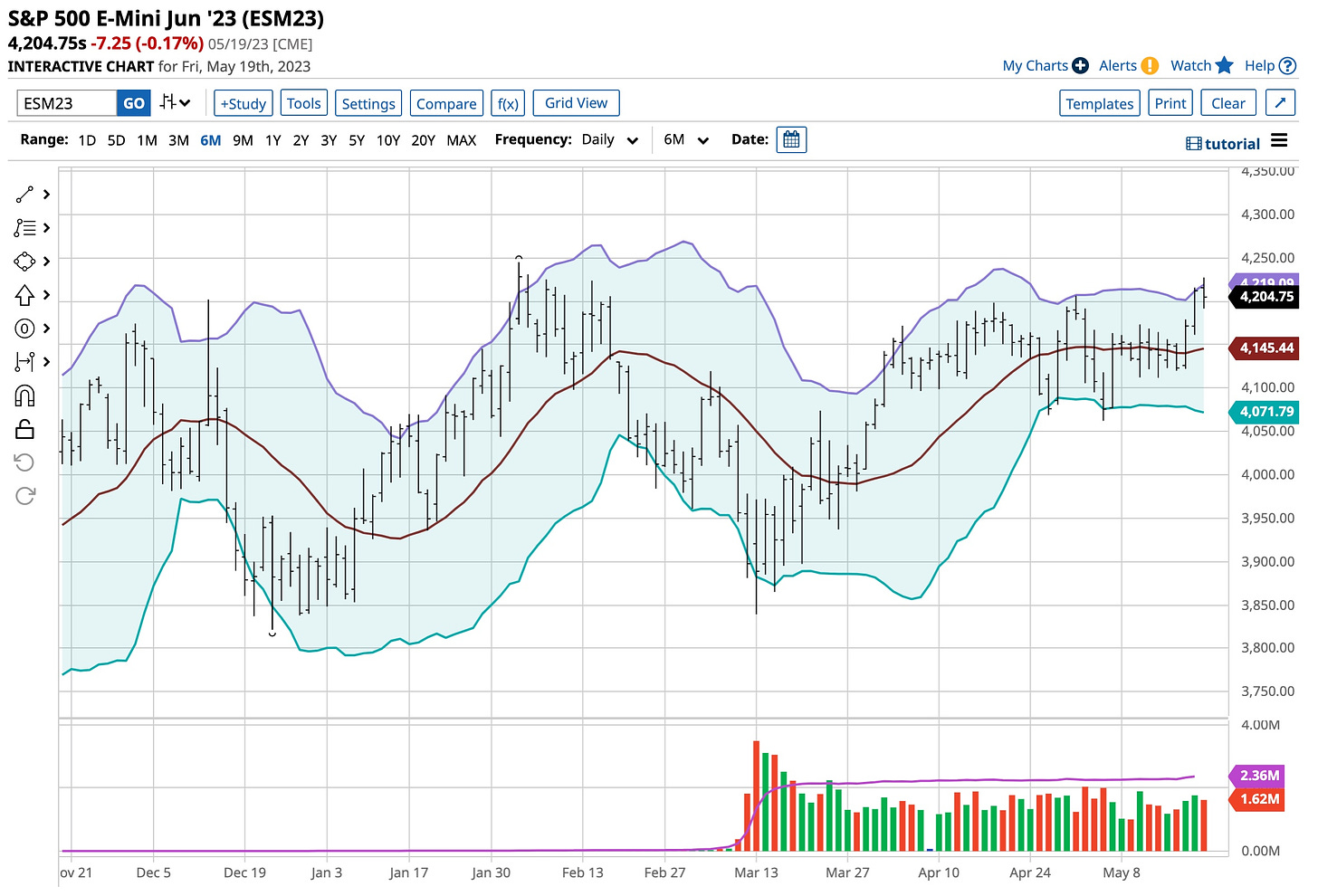

Given the Memorial Day holiday weekend will already be underway, if there’s any deviation from expected estimates there could be some volatility. Narrowing in the Bollinger Bands could set up a big move in either direction.

Barchart - E-Mini - Bollinger Bands

Turning back to “Fed Talk”, Powell said “interest rates not need to rise as much amid banking stress”. He helped cause it, he should have expected it. The banking system strains mean central banks might not raise rates as much to tame inflation. The risks of doing “too much versus too little” are becoming more balanced; isn’t that special. Lorie Logan out of Dallas doesn’t really think economic data supports a pause. Again, who knows but do we really need to wait for the FOMC minutes? I don’t think so.

Could the Fed cut rates? You get a resounding “NO” on that one, not even a recession will change that decision even though the markets disagree. With core at 4.9%, still well above the Fed’s 2% target, inflation remains embedded in our economic system. The growth of employment slowed to 253,000 in April, the unemployment rate still stands at 3.4%. Philip Jefferson has a dour view of inflation but John Williams signals inflation has peaked and is moving in right direction. Like always, scripted statements that don’t really provide much guidance as like always, as a team, they’re talking out of both sides of their mouths.

Debt Ceiling Standoff

Let’s get to the “media speak” prevailing in today’s world; the debt ceiling standoff. I think Yogi Berra was right but maybe Yogi Bear has the answer, right Boo Boo? How much higher will interest rates go in 2023? Did you realize that 42% to 45% of banks tightened lending standards over the past three months. Let’s delve into this further and assume, like always, the debt ceiling is raised at the last second so the U.S. is not going default on our payments. Term limits; give me term limits.

What Are The Potential Consequences

Let’s look at the underlying facts historically speaking:

Bank liquidity is drained when the debt ceiling is raised as Treasury issues bonds.

Banking sector becomes increasingly more fragile and global liquidity sinks.

Same happened in August 2019.

In September, Fed lost control of the Fed Funds Rate.

Bank liquidity dried up with global liquidity evaporating.

As the Treasury refills its coffers, liquidity is drained from the banking system. Let’s look at the Treasury’s General Account (”TGA”), our government’s savings account.

Sat at $87 billion as of Monday down from $140 billion the day before.

Well below Treasury’s targeted year-end balance of $600 billion.

When the Treasury issues debt essentially it comes from primary banks.

The outflows from the primary banks go directly into the TGA.

Essentially this pulls reserves out of the banking system; a huge sucking sound.

This causes reserves in the banking system to decline.

This causes the liquidity and lending capacity of banks to be devastated.

So what we’re creating is a perfect storm, the “lose-lose” scenario I’ve been speaking of. There’s three factors making the Treasury’s upcoming “cash” grab an issue:

1. U.S. Treasury needs to raise a substantial amount of cash to refill its coffers.

The TGA’s balance should soar to $550 billion by the end of June.

The TGA’s balance approaches $1 trillion in the 3rd quarter 2023 just to pay bills.

Our already fragile national & global banking systems will get absolutely crushed.

It’s just like the Fed raising rates another 1/4% to 1/2%.

2. U.S. bank reserves dropped by $930 billion between 12/21 & 4/23; a 23% drop.

The Fed has been aggressive tightening.

Depositors have been moving to money-market funds chasing higher yields.

Reserves are being pulled out of the commercial banking system.

While remaining bank reserves total $3.2 trillion the 23% decline was substantial.

3. Global liquidity has plunged with aggressive monetary tightening worldwide.

Global liquidity plunged to dangerously low levels over the last year.

We had 13 years of far too “easy money” from 2008 to 2021.

Followed by a far too rapid “tightening cycle” in 2022-23.

Economic growth and financial stability is on life support.

Recent regional bank runs are just getting started.

Yellen is even out there suggesting mergers as the big banks are tapped out.

In Conclusion:

Our markets & banks are increasingly fragile after aggressive monetary tightening.

Bank reserves fallen sharply.

Global liquidity has plunged.

Economic growth has slowed.

The Treasury’s massive cash grab is happening at a most unfavorable time.

It’s going to amplify bank stress further sucking liquidity from financial systems.

Now lets turn our attention to the last bastion of “loose money” worldwide, Japan, and why it’s caught in the middle.

As reported on Thursday, inflation is well over the Bank of Japan's 2% target.

Kazuo Ueda is looking for a politically acceptable exit from its massive stimulus.

Maybe the BoJ will end quantitative easing as rising inflation shifts the focus.

There are major side-effects of prolonged easing showing up.

BoJ could stop huge asset purchases as inflation raises its ugly head.

Quantitative and qualitative easing was meant to end deflation; it worked.

But it pushed up property prices to unaffordable levels.

The policy is distorting market pricing and hurting bank profits.

BoJ knows that Japan is no longer in a state of deflation.

Real problem is its potential growth & technological progress has stagnated.

Exacerbated by the lack of liquidity in the rest of the world Kazuo Ueda’s hands may be tied.

Kazuo Ueda’s ultra-loose monetary policy despite high inflation is unwaivering.

He believes tighter monetary policy will hurt Japan’s economy; he’s right.

Recent domestic pay hikes, unseen in three decades, are inflationary.

Japan's core consumer inflation hit 3.4% in April.

Japan’s huge bond buying is causing distortions in open market pricing.

Half of economists predict an end to the BOJ's yield curve control by year-end.

Under yield curve control (YCC), BOJ sets -0.1% target short-term interest rates.

Under yield curve control (YCC), the BOJ sets 0% cap for the 10-year bond yield.

Japan buys government bonds and risky assets to pump money into the economy.

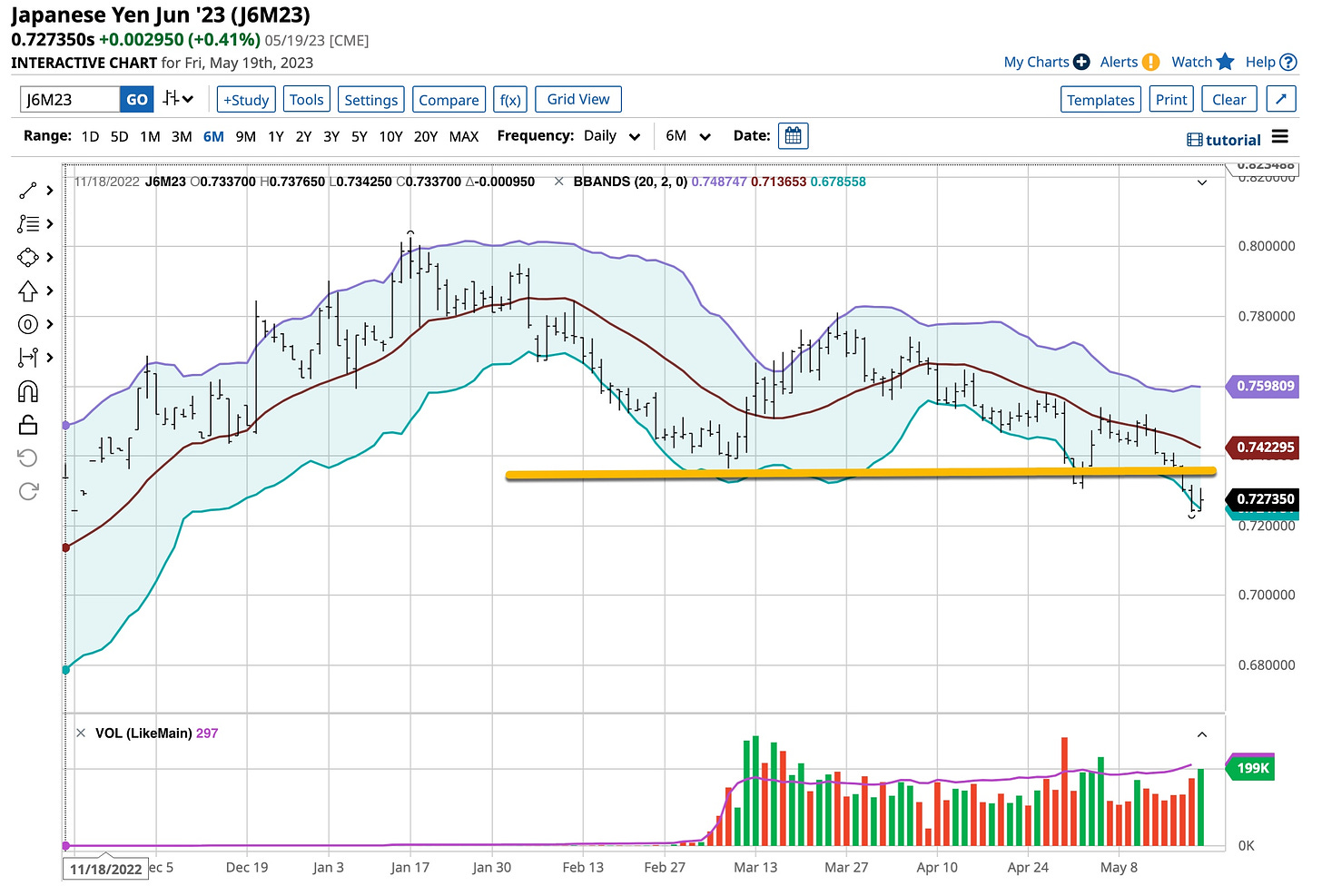

With today’s worldwide backdrop Kazuo Ueda is indeed stuck. In recent days I have been “bottom-fishing”, going long the Yen between 0.7250 to 0.7300. I’m on my 3rd trade and down a few bucks but believe this dam is about to break.

Barchart - Japanese Yen

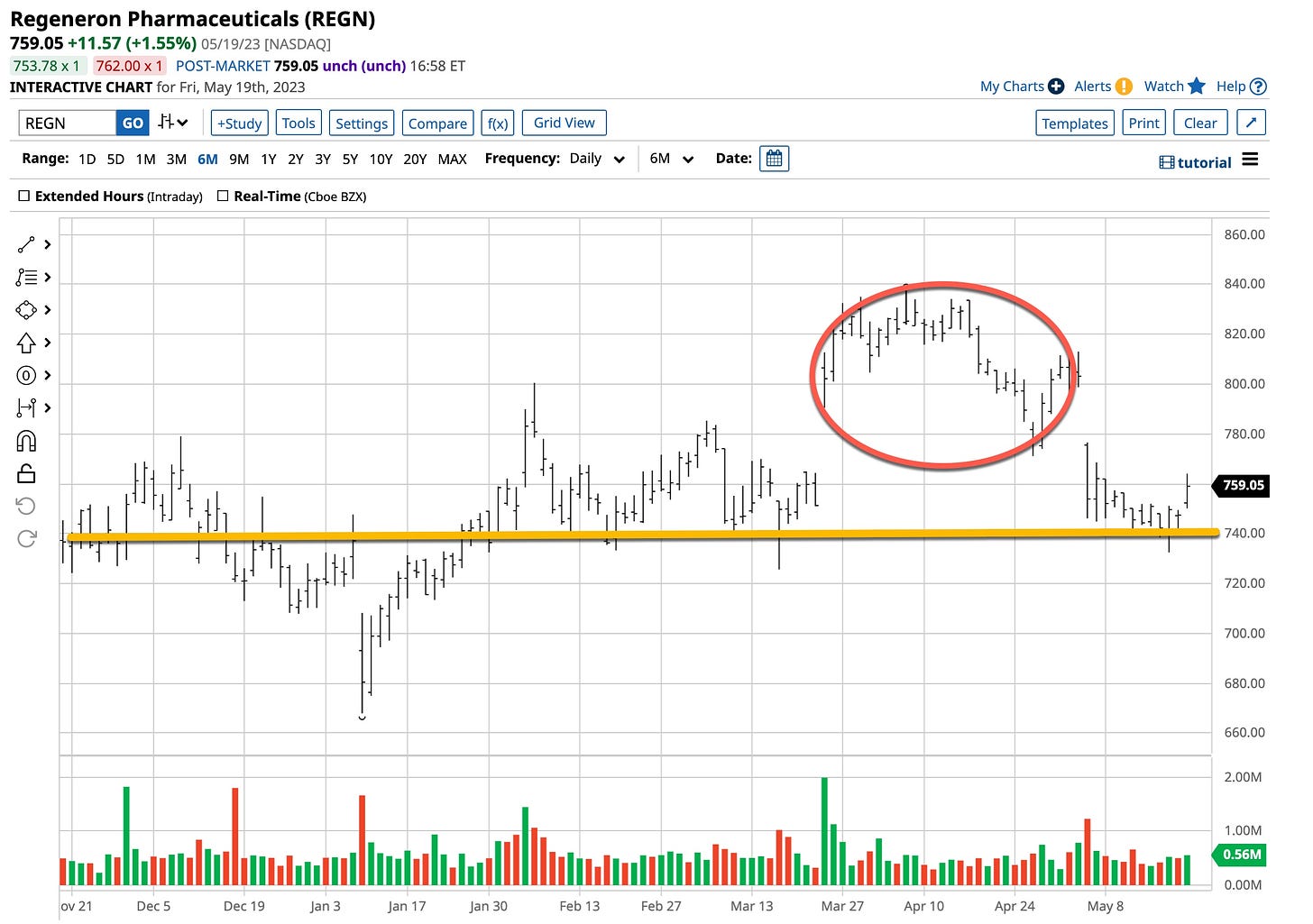

For those who have followed me, I owe you one; I’ve picked my “best of breed” in the Biotech world, Regeneron. Not an easy choice but it’s recent declines due to analysts’ negative thoughts about its margins have provided a “discount” to it’s price and that’s a reason for me to buy a stock. Do your own due diligence. VRTX was a close second; BIIB and GILD are always acceptable as well. I shied away from AMGN as debt laden stocks are somewhat out of favor but when evidence arises rates start going down it will be a solid indicator of that happening.

BarChart - Regeneron

Sorry, I rambled a bit. Hope you enjoyed this post. I’m just a young 68 years old; my Dad became a broker when I was 13. It’s time for me to ‘give back’ to all of you what’s in my head. It’s not always pretty but it’s based on history . . . and history, unchecked, repeats itself as you are witnessing..

Everyone learns at their own pace. If you pick everything up the first time through, great but if not email me at david@thetickeredu.com so we can further help. Thanks again go out to Danny www.mrtopstep.com . . . check him out; he’s worth your “click” and thanks to all of you who have adopted what is being created and presented; we’re humbled by the response and referrals. Again, let me know what you want to learn, I’m all ears.

Can you think of a better song for today’s post than CSN&Y’s “Deja Vu”. I fell like I’ve been here before. Besides I couldn’t find Yogi Berra’s actual “Deja Vu” quote. Have a good week, busy one learning stuff here so I can do better presentations, articles and courses. Any thoughts let me know.