Post McCain losing to Obama in 2008 one Obama quote that was etched in my mind was that “elections have consequences”. That they do, from judicial appointments to Cabinet Members, despite the requisite approval of the Senate, it’s the President who makes the nominations. They are most often politically motivated but in the case of Janet Yellen, from Clinton to Obama to Biden, her selection and reign from being the Federal Reserve Chairman to Secretary of the Treasury has been nothing less than an absolute travesty. It’s not just that I disagree with her philosophy or politics, I do but more so she’s incompetent. If only we could clone Donald Regan we might actually be successful in lowering inflation. Ah, those were the days.

Giving credit where due Janet Yellen is at the top of the list when it comes to breaking down sexual barriers and good for her. Post that accomplishment, her performance in the positions she’s held are at best a political maelstorm. From her “shortest” length tenures to her biased and unqualified stances she’s single handedly caused more harm to our economic system than any other in history. As a matter of fact, given her recent analysis of the timing of the upcoming “debt crisis” the lady has proven she can’t even “do the math”. Keep in mind everyone in the Washington “swamp” regardless of their political affiliation who “serve for life” should be booted out but in Janet’s case it should have happened years ago.

Nonetheless, let’s take a closer look at the resume of this almost seventy-seven year old Keynesian dinosaur and her history of economic disruption wherever she served,

Janet Louise Yellen

American economist - 78th Secretary of the Treasury since January 26, 2021.

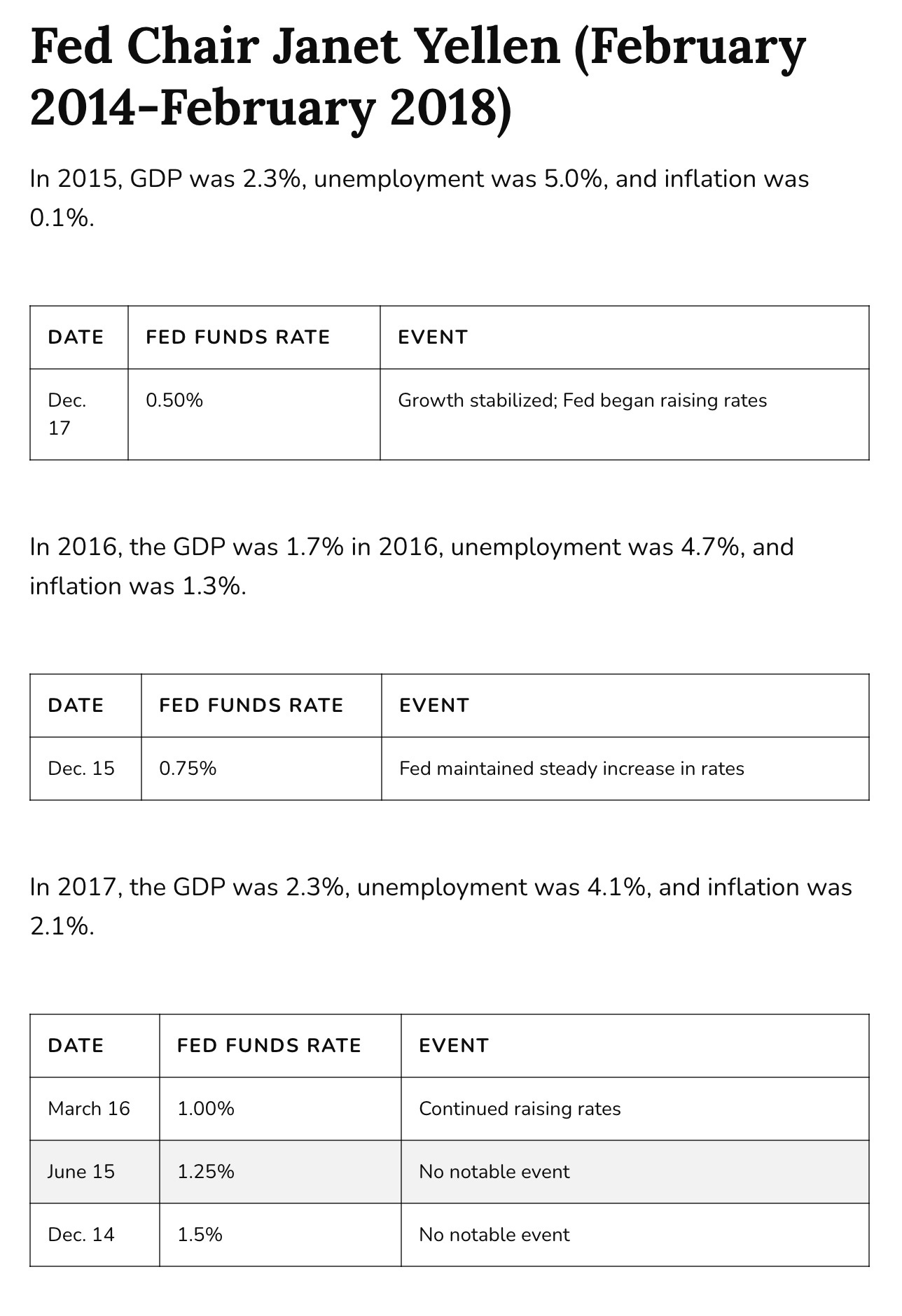

She previously served as the 15th Federal Reserve Chair from 2014 to 2018.

1st to hold all positions and lead White House Council of Economic Advisors.

Yellen Served As:

Federal Reserve Board of Governors from 1994 to 1997 as a Clinton nominee.

Clinton then named her Chair Council of Economic Advisors from 1997 to 1999

On the Federal Reserve Bank of San Francisco Chair / CEO from 2004 until 2010.

Obama appointed her Vice Chair of the Federal Reserve from 2010 to 2014.

She succeeded Ben Bernanke as chair of the Federal Reserve from 2014 to 2018.

She had one of the shortest tenures ever as chair of the Federal Reserve.

Succeeded by Jerome Powell as Trump refused to renominate her for 2nd term.

She then became Biden’s Secretary of the Treasury on January 25, 2021.

Yellen’s Economic Philosophy:

A blatant money printing dove.

More concerned with unemployment than with inflation.

Favors lower rather than higher Federal Reserve interest rates.

Favors more stringent financial regulation to lessen financial system flaws.

Arguably the most liberal Federal Reserve leader ever.

If Yellen Had A Magic Wand She Would:

Raise taxes and cut retirement spending.

Raise revenue and modify entitlement programs.

Completely remove the debt ceiling.

Support global transition to a net zero emissions economy.

Yellen:

Is a Keynesian economist; "Keynesian to her fingertips."

Warned against an over-hasty removal of stimulus post the 2008 financial crisis.

Believes the “state” has a duty to tackle poverty and inequality.

If that’s not enough look at what she accomplished, or lack thereof, during her tenure as Chairman at the Federal Reserve.

Had enough? I have but it’s her recent statements politicizing the lifting of the debt ceiling that trouble me most. Just two weeks before dealing with the most important issue of her tenure as Secretary of the Treasury Yellen remains unsure of the exact date when the Treasury will go broke. It’s just math. She says Biden’s “working around the clock to avert economic upheaval” to avoid defaulting on the national debt for the first time since 1789. The debt limit affects the U.S. and global economy. It would be best if Biden and Yellen, together with both political parties that comprise the swamp, just spent more time at his Rehoboth beach house building “sand castles”. They might even last longer than most of the edicts Congress comes up with. Hey, has anyone said anything about what actions we’d take if the U.S. indeed defaults? It’s shameful, why plan when everyone knows it ain’t going to happen.

I warned you that this week I was going to be “ranting” and for good reason. I’m not done yet; next up is “AI” along with a few more educational segments on Investment & Trading Psychology then kicking off “What Tools We Use & How We Use Them” featuring Barchart, a service we’ve used for more than twenty-five years. By the way we were stopped out of Rough Rice today; will look for a lower price to enter again but our “eyes on the ground” were not as pessimistic about the harvest. When it comes to agricultural futures, while technicals are beneficial, those with hands-on, “on-the-ground” experience are the best source of information you can buy.

Hope you enjoyed this post. I’m just a young 68 years old; my Dad became a broker when I was 13. It’s time for me to ‘give back’ to all of you what’s in my head. It’s not always pretty but it’s based on history . . . and history, unchecked, repeats itself as you are witnessing..

Everyone learns at their own pace. If you pick everything up the first time through, great but if not email me at david@thetickeredu.com so we can further help. Thanks again go out to Danny www.mrtopstep.com . . . check him out; he’s worth your “click” and thanks to all of you who have adopted what is being created and presented; we’re humbled by the response and referrals. Again, let me know what you want to learn, I’m all ears.

Elections do have consequences folks . . . it’s been talked about for years . . . what a different outcome we would have had if 2020 turned out differently . . . vote, “early and often”; it’s important . . . ;-)