Why Did The Chicken

Buy When Others Sold

Unfortunately, most traders start with too little money. Few understand that having a “nest egg” is an essential part of investing. Diversification works, as does plenty of buying power sitting on the sideline.

No one can buy at the bottom and sell at the top. In addition, what’s right for the upside today might be wrong tomorrow. It takes time to learn all of these things, but in reality, all I’m trying to do here is teach you from experience. Are you listening?

Transportation Is King

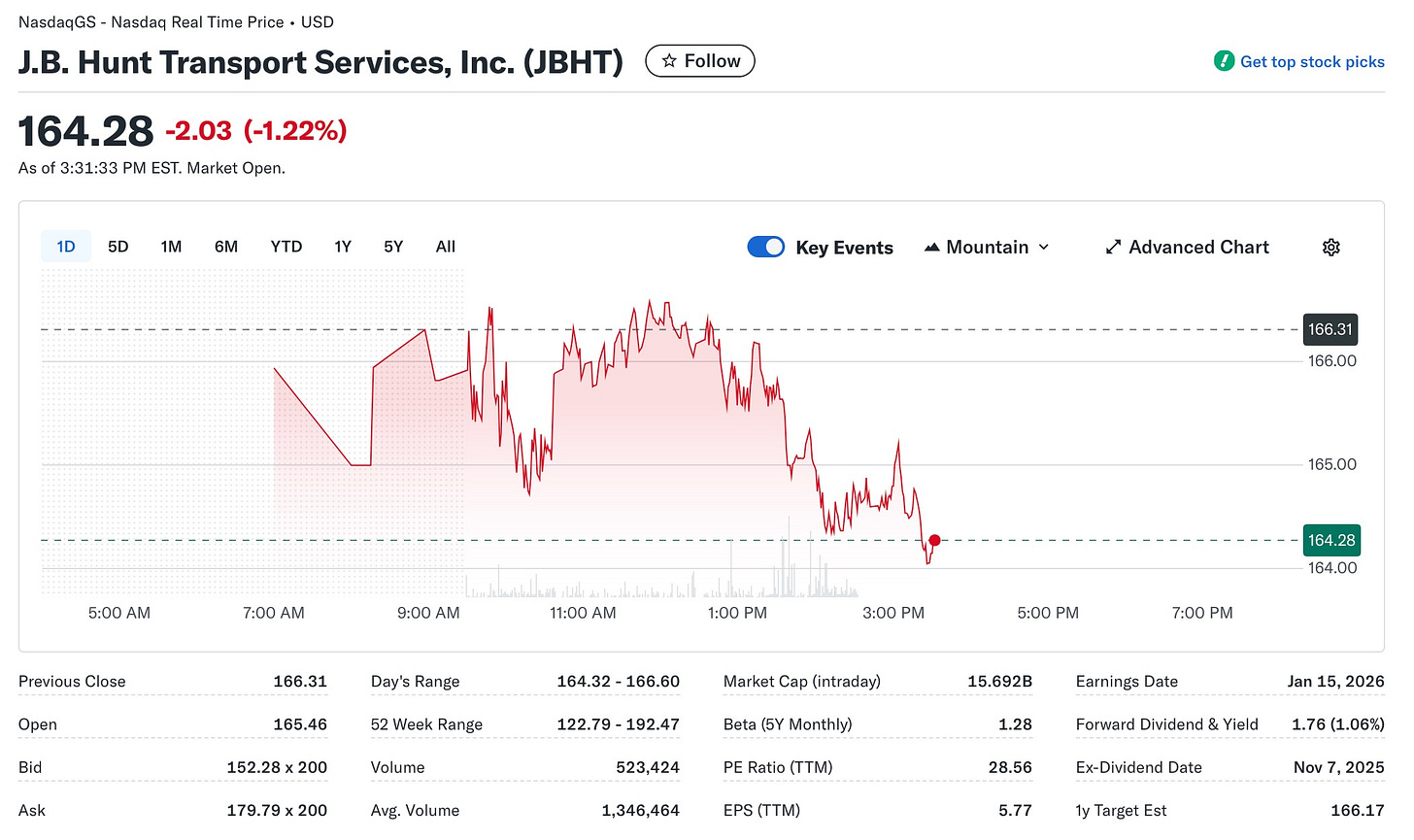

At least for the next couple of months. I own lots of long-term six and nine-month call options in UBER. They won this battle, but there’s more to buy in the trucking world. I started buying six-month call options today in JBHunt (“JBHT”) with the stock down a couple of points. I like buying at a discount.

🔍 Company overview

J.B. Hunt is a U.S.-based logistics and transportation company, founded in 1961 and headquartered in Lowell, Arkansas.

Its businesses cover several segments: Intermodal (JBI), Dedicated Contract Services (DCS), Integrated Capacity Solutions (ICS / brokerage/third-party logistics), Final Mile Services (FMS), and Truckload (JBT).

Intermodal means combining, e.g., rail + truck transport, which is a strength for J.B. Hunt and somewhat differentiated vs pure trucking.

Here are key metrics and recent performance notes:

Currently trading around $160-170/share territory.

P/E (Price to Earnings) ratio around ~28.8x according to one source.

Market cap on the order of $15-17 billion (depending on time) per one snapshot.

The ROIC (return on invested capital) has been in the mid-teens percentage area historically (e.g., ~11-14% recently) but trending down in some periods.

Diversified service offering: Because J.B. Hunt is not just standard truckload but also intermodal + final-mile + logistics/brokerage, it has multiple levers.

Intermodal strength: With rail + truck combined, they potentially benefit when freight shifts from over-the-road to rail/truck combos. Past results show intermodal volume upticks. For example, in Q3 of 2024, they beat expectations thanks to improved intermodal volumes.

Scale & efficiency: As a large player, J.B. Hunt may benefit from scale advantages, fleet, network, equipment, and perhaps equipment optimization.

Dividend & share repurchase: They have historically returned cash to shareholders via dividends and buybacks.

J.B. Hunt is a well-established logistics company with diversified operations and a strong position in intermodal transport. That gives it a structural advantage relative to pure trucking firms. However, right now it’s operating in a fairly challenging environment: soft volumes, rate pressure, cost headwinds.

From an investment perspective:

If you believe the freight/logistics cycle is turning up, volumes, capacity tightening, better rates, JBHT could be a good play.

On the other hand, if the macro/freight environment remains weak or deteriorates, JBHT could struggle.

The valuation (~28x earnings) is not cheap — you’re paying for expectations of improvement. If the improvement doesn’t materialize, that’s a risk.

For a longer-term hold, the diversified services and scale are positives. But for a near-term play, the key is whether the turnaround signs are strong.

Do your own due diligence. I’m long and will get longer in the transportation side over time. Diversification works.

I never saw the Grateful Dead, but I did play their music. Truckin’ was just one of my favorites. I liked the tune, and there’s a reason behind today’s connection. JBHunt is a leader in this field. It’s time for the Dow Jones Transports to rise in price. I’ll stick with leaders in the field like this one and UBER. How about you?