Do you remember the original Wendy’s commercials? That makes you both wise and old, like me. Great commercial that differentiated an entire industry. Take a look.

One of my first hedge clients owned several Wendy’s franchises. It was easy to hedge the beef markets at that time. Determine the amount of “hamburgers'“ clients were going to buy and cover this amount with monthly long live cattle futures. The hedger contract was inexpensive as the owner was just covering their needs. Price went a lot higher. That’s when it all fell apart as my hedge client became a speculator. The hedge margin to sell the futures was about ten times the amount of the buy side hedge. Like anything else, it was a good relationship until it wasn’t.

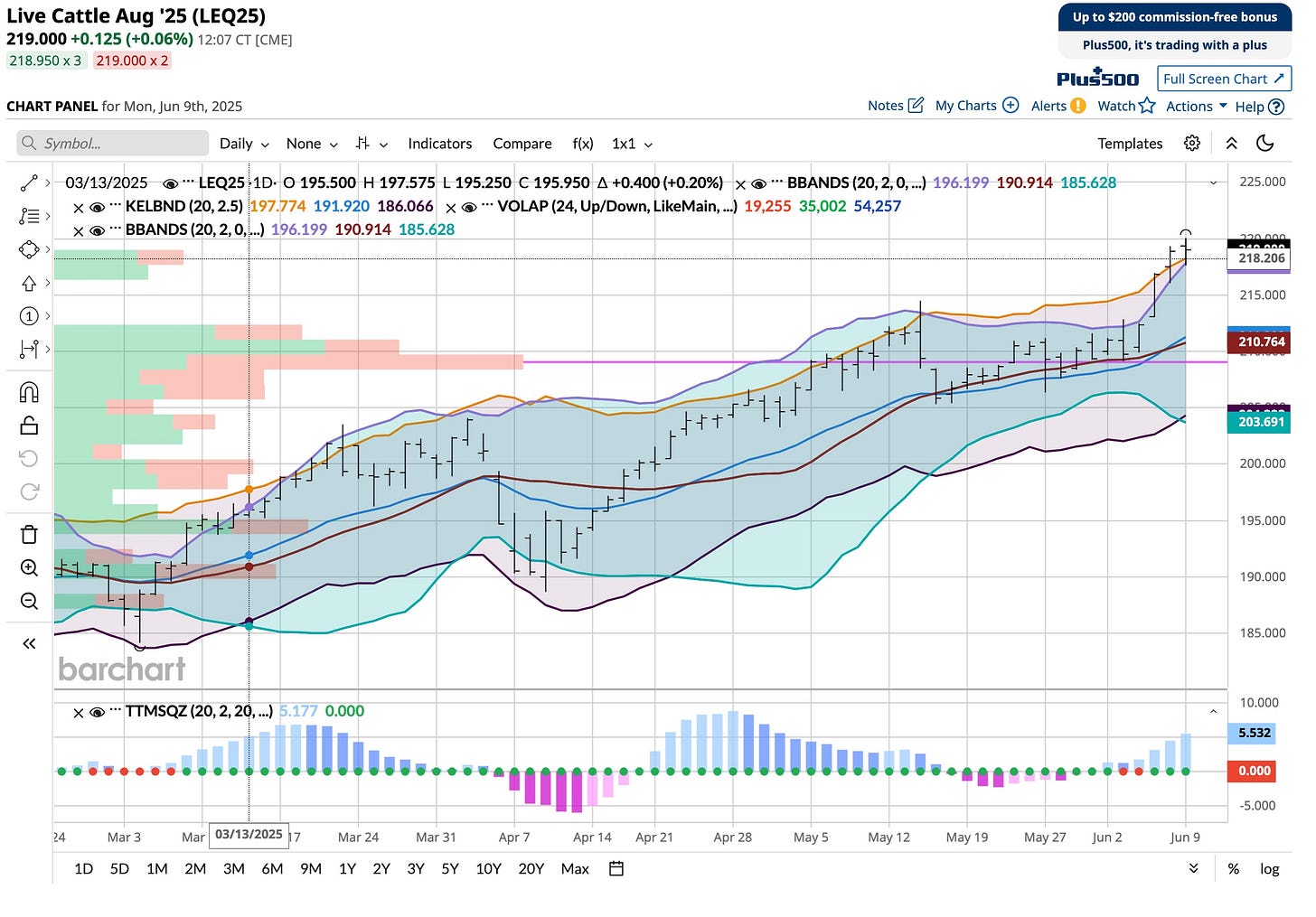

Where’s The Top

I watch more than I trade or react. Sometimes I just look for information. I’ve read a few articles that say the U.S. cattle market has problems. The regional grocery stores I work with push pork. It’s cheaper but people still want to grill a good steak here in the great State of Texas over the summer. I hope they don’t look too closely at the price of live cattle in the underlying market.

How About The Rare Earth Elements

I’m always happy to do your homework so you don’t have too. There’s only a couple of rare earth oriented stocks I’ve bought over the recent months, but I’ve watched many more. It’s my target industry for many reasons. It is also very much like the loaded gun side of the great west years ago. Many of the following symbols are found in foreign exchanges, the Vancouver exchange in particular. I remember these from the very late 1970s. you can always get in, but you might not be able to get out of the trade. Here are the symbols I have on my list:

ARA, AREC, ARLYF, ARU, GMA, ILU, LYC, MKA, MP, NB, NEO, SOLB, TMC, UCU, UMI, USAR & UUUU

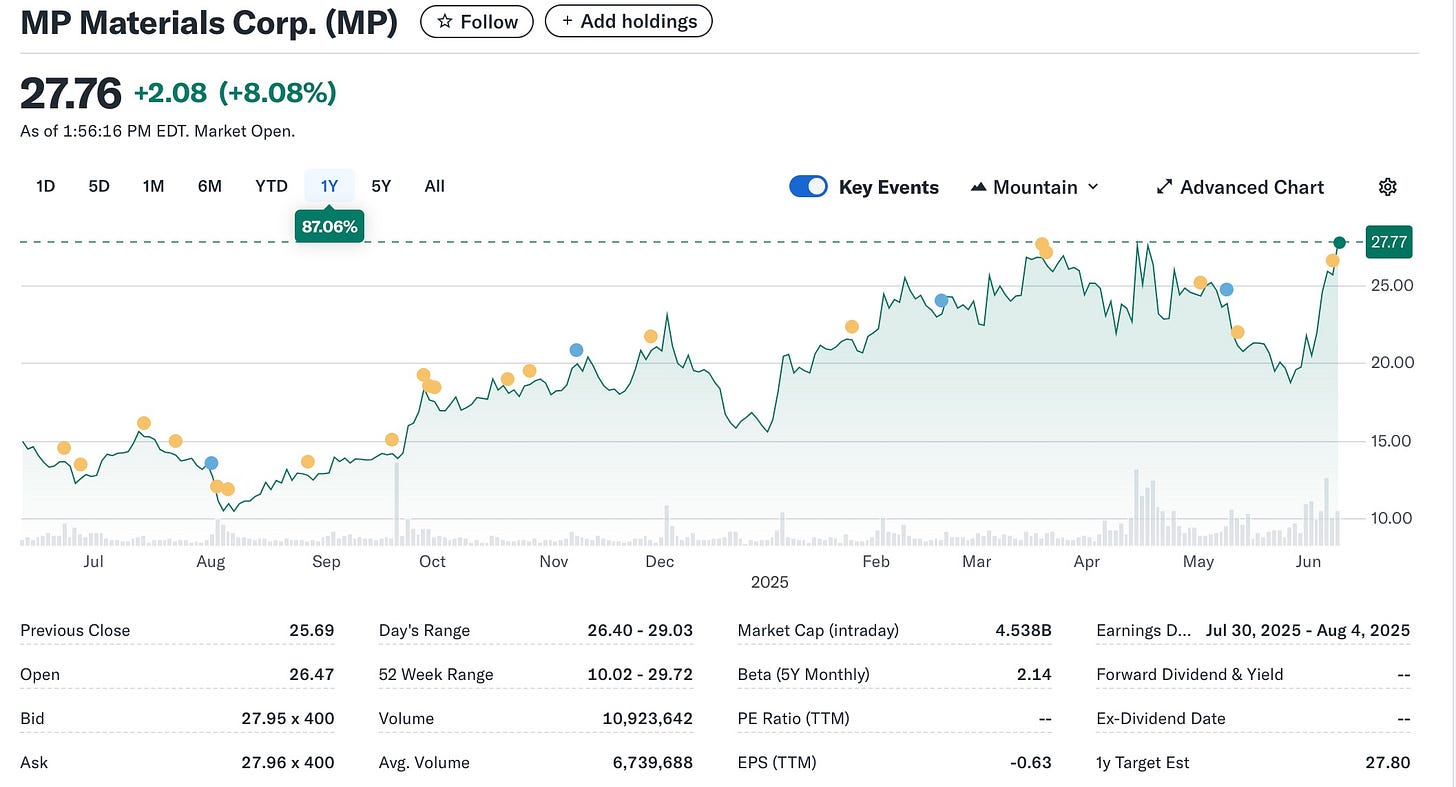

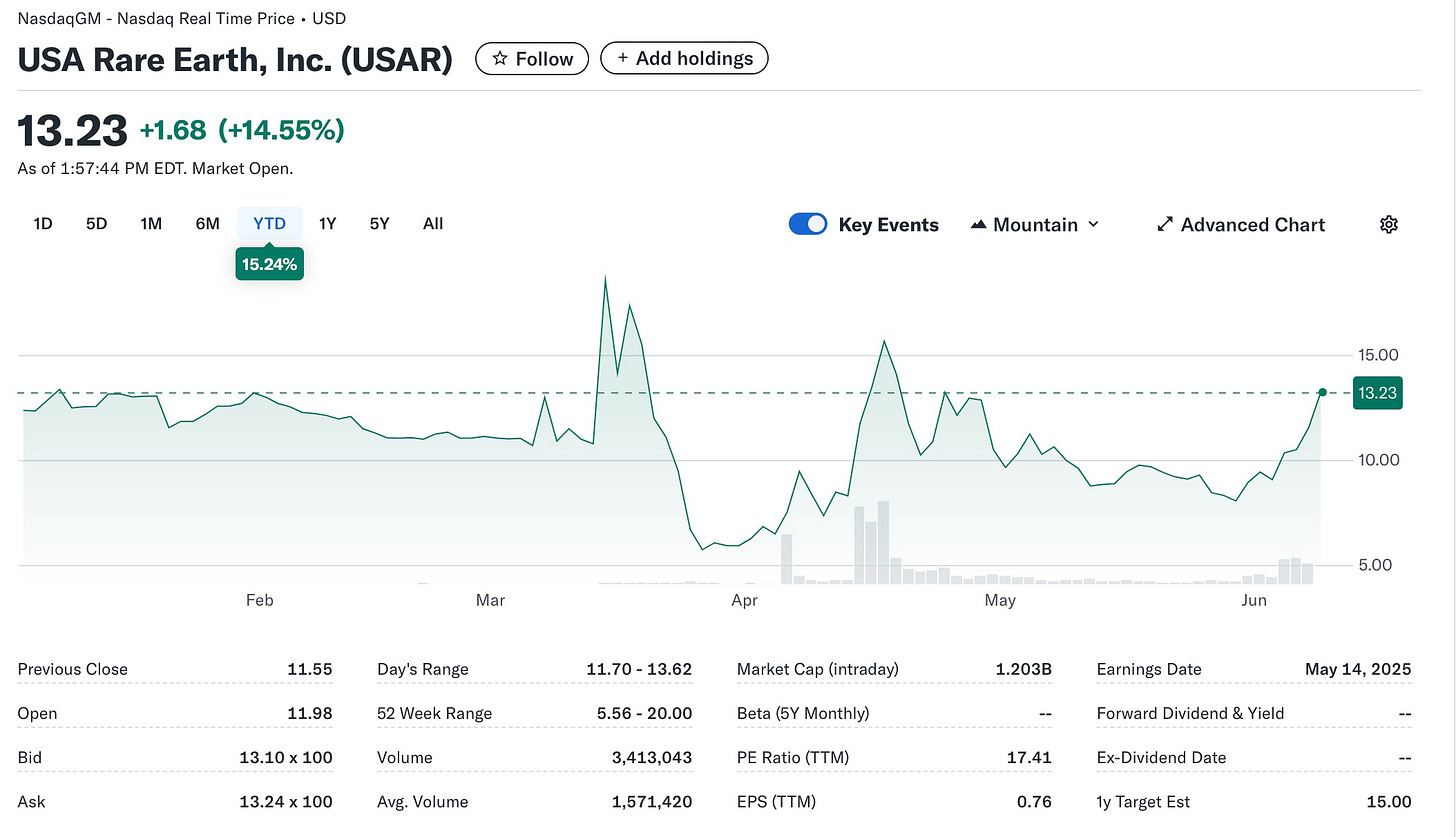

I’m acquiring shares in MP and USAR. So are my advised Roth IRA accounts and those in my direct influence.

Mountain Pass, CA: MP owns the only rare-earth mine in the U.S., focused on NdPr (neodymium–praseodymium) used in permanent magnets. It has continued to scale refining and produce NdPr metal at its new Fort Worth, Texas plant, marking the first U.S. production in decades. It has agreements with GM and the U.S. Department of Defense, along with export shifts and tariff impacts. It reported a net loss of $22.6M ($0.14/share), following increased production & interest costs, but production output (12,213 t REO) and refining (563 t NdPr) were up notably. Achieved record production of 45,455 t REO and 1,294 t NdPr oxide. Q1 concentrate prices rose 12% Y/Y, although NdPr prices dipped around 16%.

Strategic U.S. rare-earth vertical integration is difficult. Margins compressed by low NdPr prices strong output growth and customer deals. Net losses were mostly driven by interest costs. It should benefit from U.S.-China supply tension,but remember, this is a volatile trading environment.

MP Materials is a strategic domestic clean-tech asset, benefiting from government support and supply chain urgency. It stands at a turning point: operational growth is clear, but profitability depends heavily on improving rare-earth prices and refining efficiency.

USA Rare Earth is developing an integrated U.S. supply chain centered on the Round Top heavy rare earth deposit in West Texas. They plan to mine and process the heavy rare earths (e.g., dysprosium, terbium) and the associated critical minerals like lithium and gallium,in support of magnet and defense-related industries. It officially traded under the ticker USAR beginning March 14, 2025, following a merger with Inflection Point Acquisition Corp. II. This transaction raised nearly $50 million via PIPE. The company has no meaningful revenue or earnings yet, operating at a loss as it builds its mining and processing infrastructure.

This flagship deposit hosts 16 of the total 17 rare earths and key critical minerals (e.g., lithium, gallium, beryllium), making it a potential strategic asset. New plans are just underway to build North America’s largest NDFeB (neodymium-iron-boron) magnet facility to serve EVs, defense, aerospace, and reduce reliance on foreign sources.

A strong strategic resource base with heavy rare earths, unlike most U.S. projects typically favoring lighter REEs, exists. Executive orders and congressional support are helping drive domestic critical-minerals efforts and a push for new supply-chain independence. Investors are betting on future production, and will undoubtedly face execution and financing risk. USAR is developing mining and magnet-manufacturing infrastructure will require significant investment beyond the SPAC proceeds .

If successful in shifting Round Top from concept to production, USA Rare Earth could become a cornerstone of the U.S. critical-minerals supply chain and domestic magnet manufacturing. Execution delays, cash shortages, or lower-than-expected market uptake could lead to diluted value or steep losses for early investors.

The Fixx was right years ago. One thing leads to another. That’s an important trait to possess and develop. Quite often people learn to look for information that enhances their beliefs. They do not know how to look at the big picture. We have access to all of the money we’ll ever need on our project. The amount has decreased as we listened to the advice we discovered. We’re up about 50% in the few stocks we’ve purchased and we will continue to watch them grow. I don’t trust any deal made with China.