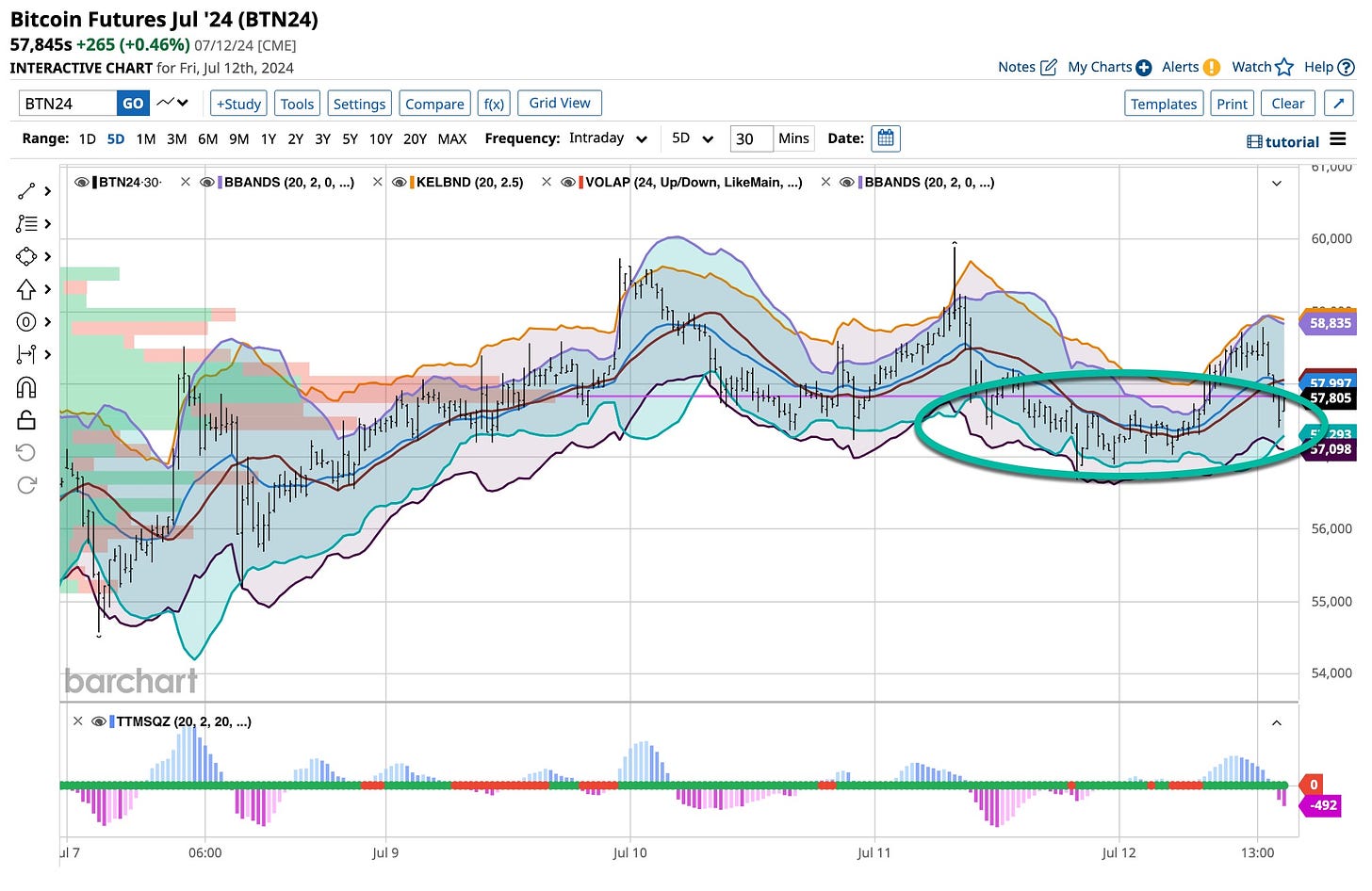

While there is always something to learn, it’s often a great idea to keep it simple as they say. Many opinions are floating around in the markets. Some of the “big boys” think we’ve seen our tops. Some think the 10-year bond is headed much higher while others predict we’ll see higher prices in tech.

I’m one to read everything. I’m also one to hedge potential outcomes based on what is the probability of their happening. The market is hitting new highs daily and rotation in the indices is evident. Breadth is as narrow as it has ever been but as we know, this market is alive and no one knows what tomorrow will bring.

It’s always a safe bet to be hedged. If the market does head lower it will be smart to be in 2024 December 16 VIX call options. If interest rates on the 10-year note head lower it is best to be long those futures and options. Regardless, it’s always best to own most of the out-of-favor brand name equities and higher dividend-paying stocks especially if you’re managing tax-free Roth IRA accounts. That’s what we do. it’s a plan that will work and it’s what we teach.

Now and then we hear about and then act upon an idea that traverses our normal style of investing. We’ve been a buyer of an old-time favorite that’s hit today’s radar screen with a vengeance. Let’s take a deep dive into Groupon (“GRPN”).

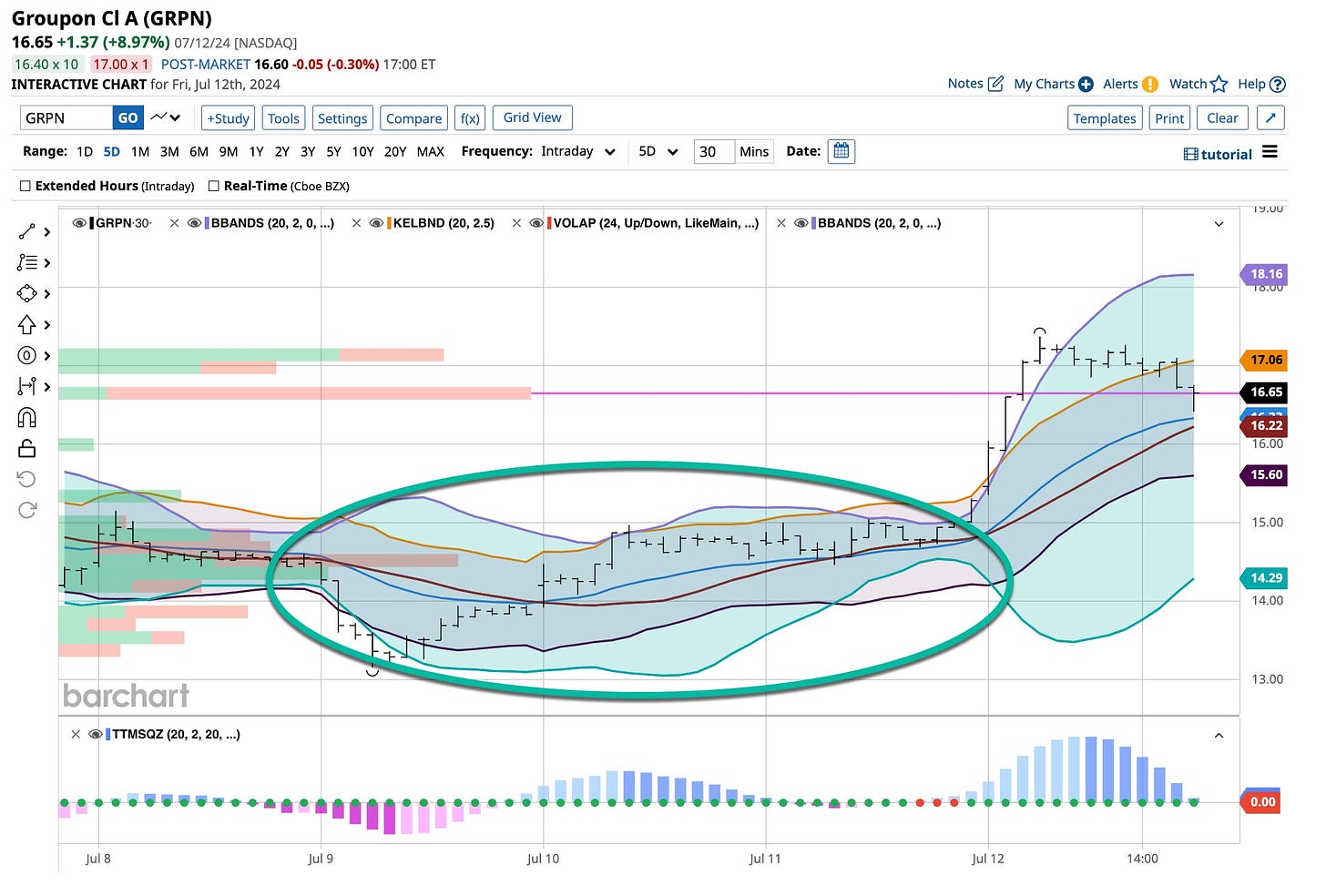

Momentum Is On Groupon’s Side

To those of you who follow what’s written you know that we like former “brand name” stocks that are due to come back to life. When the company offered “viable” products that once ruled the Internet, ones we searched and used, our interest increases. When we start to see many people begin to talk about it we jump on board. It’s not common but it fits our style. A little more nimble than not but in this case, I like my odds so we are long on Groupon (“GRPN”).

Groupon, Inc. (“GRPN”) is an American global e-commerce marketplace connecting subscribers with local merchants by offering activities, travel, goods, and services in more than 15 countries. Groupon, founded in 2008, is now headquartered in Chicago, Illinois Here’s a brief overview of Groupon's stock and some key aspects:

Groupon’s stock has historically been volatile, reflecting many changes in its business model and competition in the e-commerce and “discount” market space. Its revenue has seen significant fluctuations. Initial rapid growth has been followed by challenges in sustaining user engagement and revenue levels. It has struggled with profitability over the years, often reporting losses despite undergoing many restructuring efforts to improve financial health. Cash flow from operations is a very crucial metric, given the company’s business model which involves prepayment for services and goods.

Groupon faces a lot of competition from various e-commerce and Internet discount platforms, including Amazon, LivingSocial, and local deal sites. Groupon's market share in the “deal-of-the-day” space has been significant, but it faces pressure from competitors and changing consumer preferences.

Groupon has explored international markets but has also pulled back from some to focus on core areas. The company has tried diversifying its offerings to include more direct-to-consumer products and services. Investments in technology to improve user experience and operational efficiency are ongoing.

The COVID-19 pandemic affected Groupon significantly, with local deals and travel segments hit very hard. Recovery trends are a focus for investors. Groupon has been engaged in restructuring efforts to streamline operations and focus on its profitable areas. Recent stock performance has been influenced by market conditions, investor sentiment, and the company’s financial results. More so, it has been often mentioned as becoming a “meme” stock.

Social media lit up on this stock early last week. I’m a long-term adopter of AI when it is used correctly. any of the articles you find I’ve written. It is natural to find events of this nature emerging. It takes a lot of work to know what to look for and then how to act when you find it.

Join Us At The Ticker

If you are a member of The Ticker you would be the first to know what action we took yesterday as the shots rang out in Butler. I’ll speak more about it on Monday here on Substack. The opportunity is just beginning but remember, we are long-term in nature.

That’s why The Ticker exists today. We are happy to bring this Groupon investment to you here. For those who are already “members” of The Ticker, you heard it early this week as we saw it happening. Those who followed my thoughts on The Ticker are up 15% in the stock. The Ticker is worth it so check us out and sign up sooner than not even though it’s summer.

It’s hard to believe that “Eyes Wide Shut” hit the screens 25 years ago. Shostakovich is a master and one of my favorites. The world and the information flowing within it can change on a dime. When you are sitting on a pile of cash, it makes sense to keep your eyes and ears open. That’s what I’ve done for more than half of a century. It’s not that difficult to do but it is costly. Interpreting information takes time and it costs money to discover what’s next. Are you interested in always being in the loop? For $247 you can be for life as a member of The Ticker. Making money is important. Being right is more important. Check out The Ticker and come join us. It’s worth it.