It’s busy here in The Ticker EDU’s world but when “something” appears on our screen to learn from it’s best to post it up as it’s happening. That’s what seems to be taking place today so here’s a couple quick tidbits.

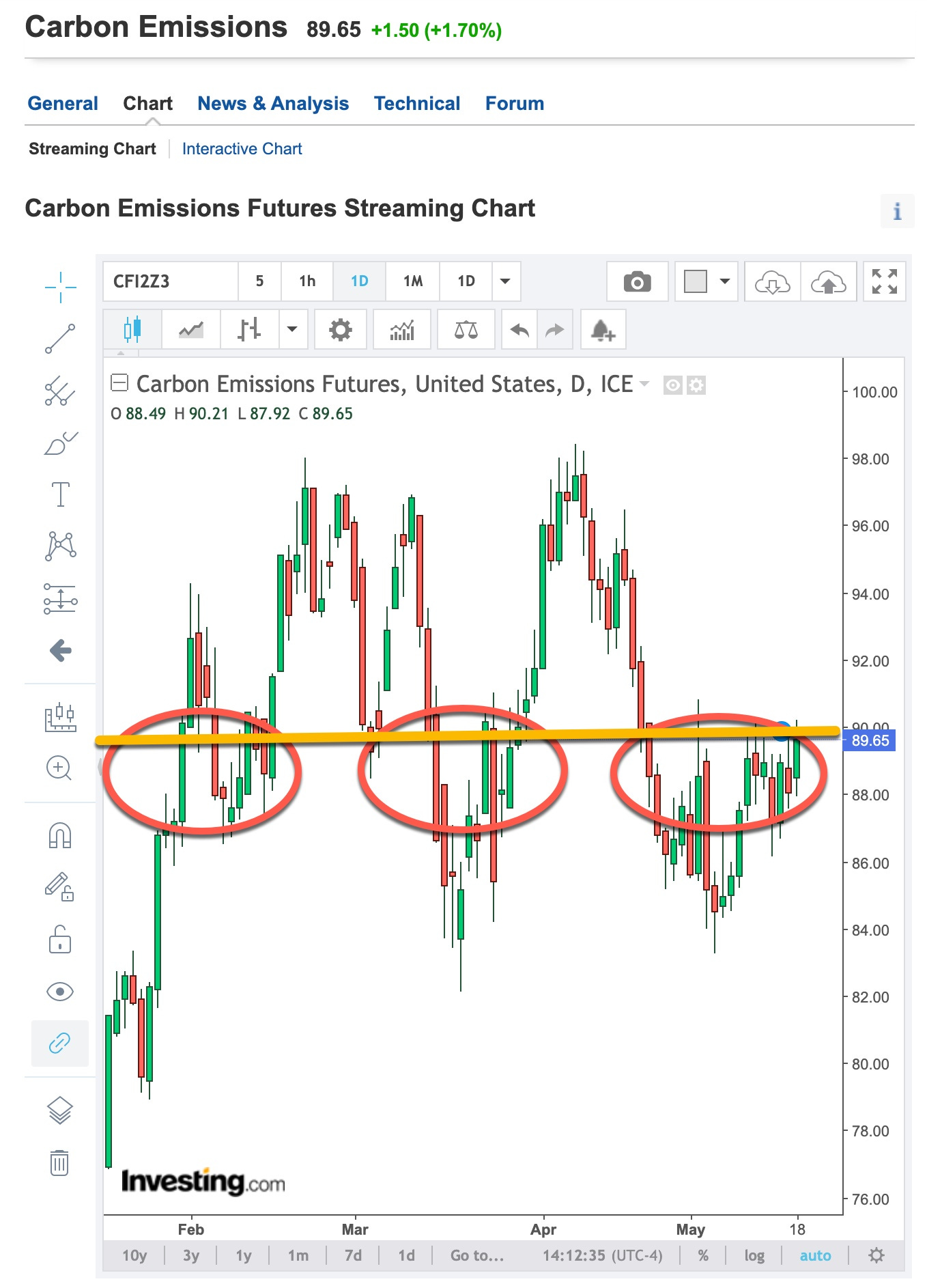

Carbon Emmission / Euro Correlation

The set-up is in. If Carbon Emissions are going higher, maybe even break through the “glass ceiling” at 100 this technical pattern is one it can launch from. If the correlation written about is real there’s added fuel for the fire. No one ever knows but conviction in one’s beliefs is important . . . and I believe.

SMCI - Let Your Winners Run

USD / JPY - Cut Your Losses Short

Practice what you preach. SMCI is heading higher. Let your winners run. The Yen can’t get out of it’s own way. Macroeconomic, geopolitical analysis says it will but for now it’s not. Cut your losses short and look for a better entry point.

Because of you, those early adopters of The Ticker EDU, time is fleeting but thanks. Our thanks go out to Barchart as well as they’ve adopted us as well. They’re going to form the foundation of how we teach “what we use & how we use it” but like anything else, it’s all on a learning curve. Back to the “curve”.

Hope you enjoyed this post. I’m just a young 68 years old; my Dad became a broker when I was 13. It’s time for me to ‘give back’ to all of you what’s in my head. It’s not always pretty but it’s based on history . . . and history, unchecked, repeats itself as you are witnessing..

Everyone learns at their own pace. If you pick everything up the first time through, great but if not email me at david@thetickeredu.com so we can further help. Thanks again go out to Danny www.mrtopstep.com . . . check him out; he’s worth your “click” and thanks to all of you who have adopted what is being created and presented; we’re humbled by the response and referrals. Again, let me know what you want to learn, I’m all ears.

“There’s something happening here” . . . something to learn from . . . thanks for following The Ticker EDU.