It’s an interesting world we live in. Israel hates Iran, Russia hates Ukraine, India hates Pakistan, and China hates the United States. I’m sure I left a few out, but in general, it seems that this world is upside down. In a way, that’s a good thing. Uncertainty sucks, but it often reverts to certainty.

Rare Earth Elements Are A Certainty

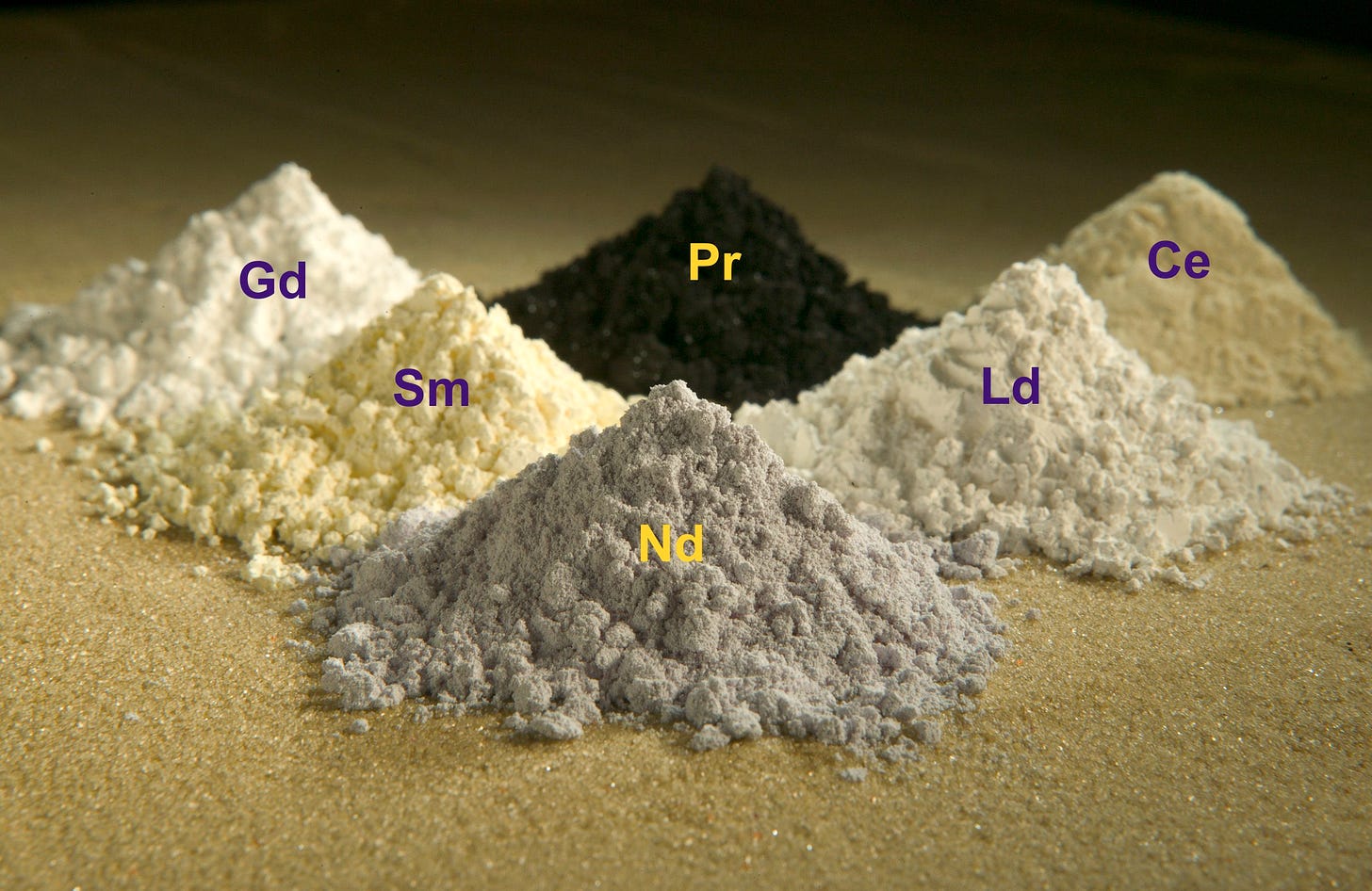

We first struck oil in this country in Pennsylvania. Today, while still important, along with Natural Gas, there’s another game in town, rare earth elements. Go back a few of my posts and make your decisions for yourself. We realize that most of the available rare earth elements are dependent on Jules Verne. They are under the sea.

That’s a good thing, that is, if you have all of the tools, personnel, contacts, and base academicians necessary to be successful. Assembling this team took time. Now, it is taking more time to identify where our endeavor fits best. Most of the entities we’ve looked at are unworthy of our attention. A few are, but it is going to take us months to determine which are best.

In the interim, enjoy trading the list of symbols provided. Only one security has been recommended, MP Minerals, but they are only land-based. They need to better realize this is a diverse industry. Maybe we’ll work together. It depends. It’s the ‘real world’, and it changes every day.

Oil & Gas Still Rules

Uncertainty is good for this industry. Hedging is, too. I like liquified natural gas, and the producers of the raw material, natural gas. I like oil, too. It’s not going away as he world needs plastics as much as fuel. Nonetheless, Israel and Iran have kept this basic market at levels higher than they should be. Take advantage of higher-than-normal prices, but don’t get greedy. Buffett never got greedy. Neither have I.

Learn To Recalibrate

What do I mean by that/ It‘s simple. When a stock you have invested in goes higher by more than 25%, don’t be afraid to take profits and distribute the proceeds into other areas. We did that in Boeing, Constellation Energy, and Live Oak Bancshares recently. In each case, most of the proceeds have hit the “rare earth” securities, TLT, T. Rowe Price, and the 30-year bond. I like cash, especially when interest rates are too high and the world is somewhat uncertain.

Metallica was never my favorite, but their song “Nothing Else Matters” is good. I do not know what tomorrow will bring. I’ve hedged the future. I do not look to be at the top of the heap. i look to exceed the averages while at the same time protecting client assets. It’s not that hard. Greed is a bad word. Stay away from it.