Have you been watching and listening to everything out there? I have, and while many of you find the signals confusing, I do not for many reasons.

First of all, I’m a hedger. I love uncertainty, especially when the VIX and the world are reacting to what might be. As reported, a small fortune came my way from long-term VIX calls, and doing quite well on WTI calls as the Middle East is far from settled.

At the same time, when no one wants to own certain bell-weather and “brand name” stocks, throw them my way. I’ll be happy to buy them. For these reasons, it is best to take advantage of a “herd” that is usually wrong. Versus a dissertation, let’s just look at a few things I’m doing. It’s a plan I stick with folks and I trust you are listening.

Buy When They Sell

It’s easy when it comes to name-brand stocks. I’m a buyer of Amazon (“AMZN”) and the Trade Desk (“TTD”). Using naked puts and low-priced share purchases, over the last couple months, I’m a slight loser in Amazon and up more than 15% in Trade Desk and they are just getting started.

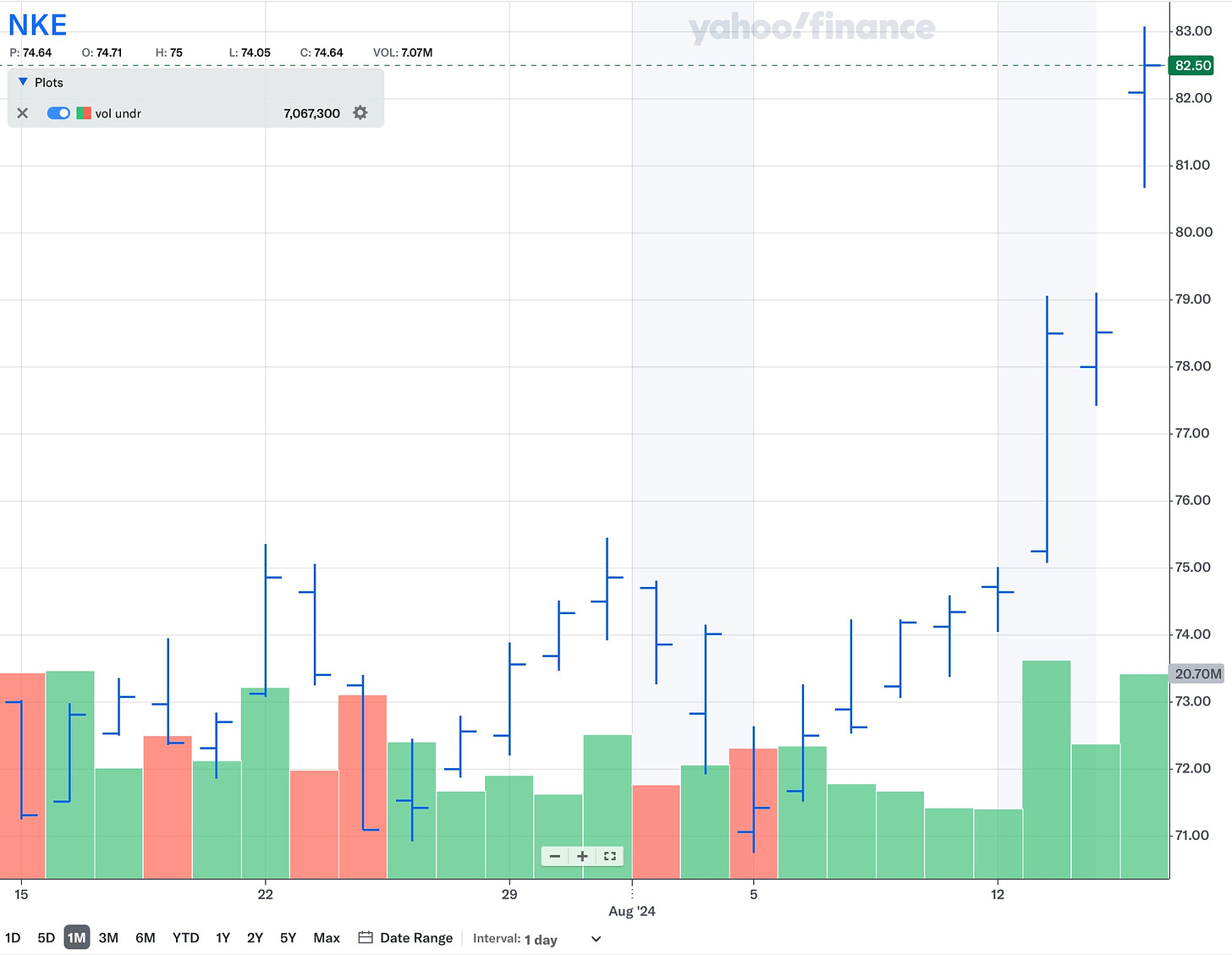

Boeing (“BA”) is one I’ve been buying and also selling naked puts on as well as selling covered calls on existing positions when the stock touches $190. It’s a plan: buy low & sell high, especially when you are waiting for revenues to return. I’m back in Groupon (“GRPN”) after cashing in on the first run and looking closely again at Disney (“DIS”), Nike (“NKE”), and Dollar General (“DG”). I don’t change my spots or targets. I just sit and wait for the time to be right; it’s called patience.

Stop Watching The Candidates

It is simply not worth your time. Regardless of which party wins, the result is going to be the same. Inflation is here to stay. The economies of the world are in trouble, and it seems that no one has a solution for the coming twelve to eighteen months.

If Kamala ever tells us what her true platform is, her chances of victory will decline. If the “Orange Man” wins, it’s going to take some time for the changes he seeks to work. In short, this country and the world are poised to stagnate, so buy quality, shorten the length of debt maturities, buy higher-dividend stocks, and shop wisely. Prices are not coming down, and if you think they are, I have some beachfront property to sell to you that’s only underwater half of the day.

See You Sunday

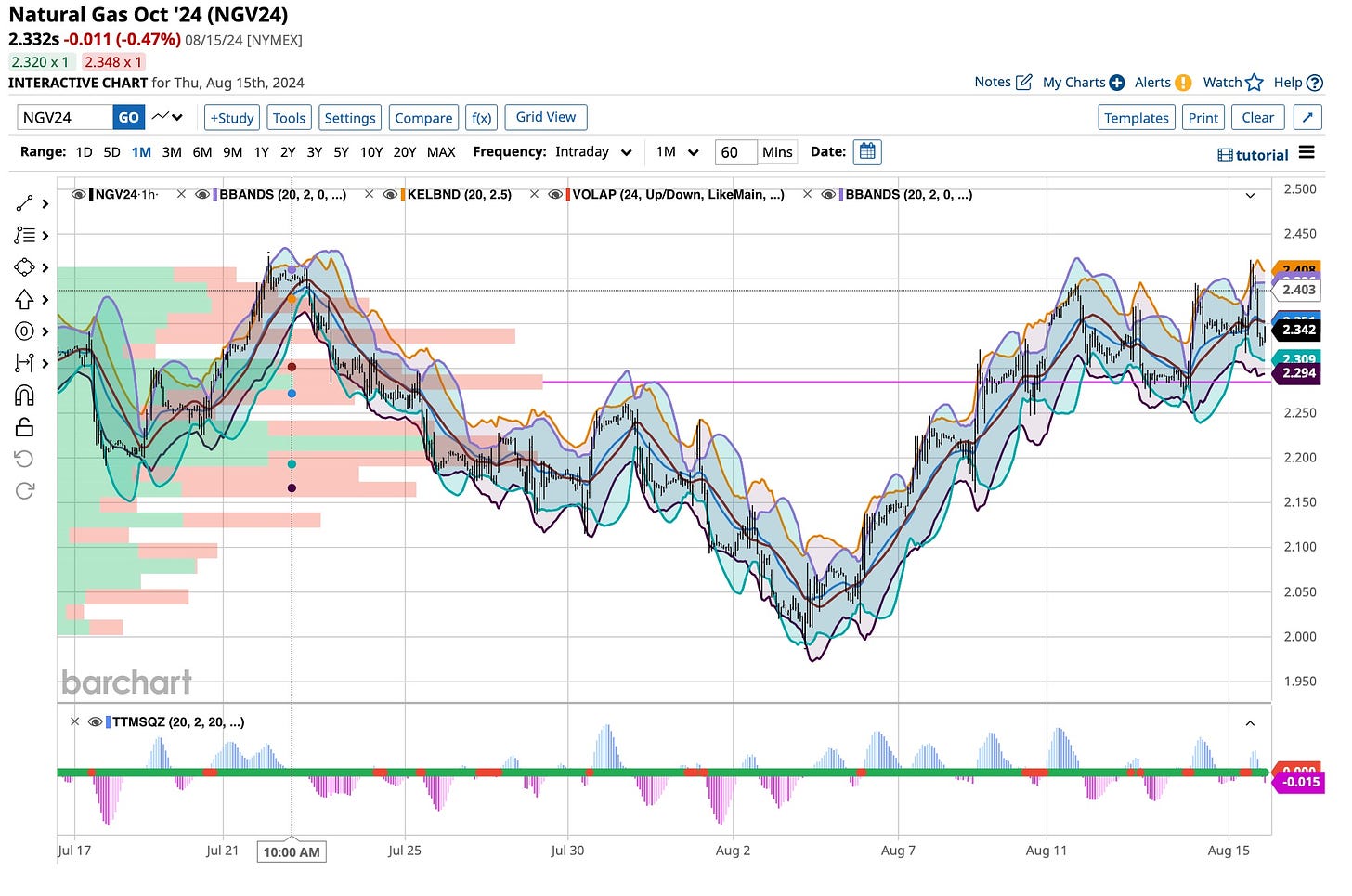

I’m not one to waste your time or mine. In just a couple of short paragraphs, I am one to let you know where I stand. I am long on one commodity as it’s time, seasonally to buy it. On August 1st I started buying Natural Gas. I’m up more than thirty cents on my first purchase and I’m a buyer on dips. It’s that time of year so I’ll be long in the “widow maker”. Hope you followed my recommendation.

More on The Ticker by the end of the month. My new administrator is from the UK and you know what that means, he’s on holiday. Hey, I knew it was coming and that’s fine with me. He has some good ideas so stay tuned and best always.

Tom Lehrer was pretty sharp and funny, too. Send in the Marines when in doubt was a classic. In today’s political dynamic, it’s exactly what we’re doing. Unfortunately, we do not know why but we’re sending them anyhow. That’s my point, do both sides. Is the market going up or down? Yes, it’s going to do both so protect yourself and buy good stocks. It works, patience works, and keep following. I’m usually early but more often than not right. Be well.