When An Inverted Curve Normalizes

What Investors & Traders Should Do

It’s just like Paul Revere warning the troops that “the British are coming”. This is a warning, “the inverted yield curve” is about to normalize, if there is such a thing. In the recent past everybody and their brother or sister has been predicting recession. You know, they just might be right this time. Economists and fundamental analysts have been perched on their platforms screaming the obvious. Inverted yield curves lead to recessions and recessions lead to normalized yield curves. The question’s the same every time, when? Enquiring minds want to know and I’m no different.

Well, yesterday the first quarter GDP for the United States hit the wires. It was not at all what the administration wanted to see. Remember, they are going to “revise” this number in the future so give it all time. While most of last quarter’s earning have hit or exceeded their marks, many are talking about ‘tough times’ ahead. What does that mean? It means that this quarter’s numbers are more than likely better than what will be reported going forwarded. It’s an election year so anything can happen but missing as badly as GDP did sends a signal. It’s time to buy dividend stocks and the short end of the yield curve. I’ll put forth my “dividend” paying stocks this weekend in my ‘paid’ Sunday post but for now, for ‘free’ I’ll talk about what to do when inverted curves turn into normal ones.

What Are Normal & Inverted Yield Curves

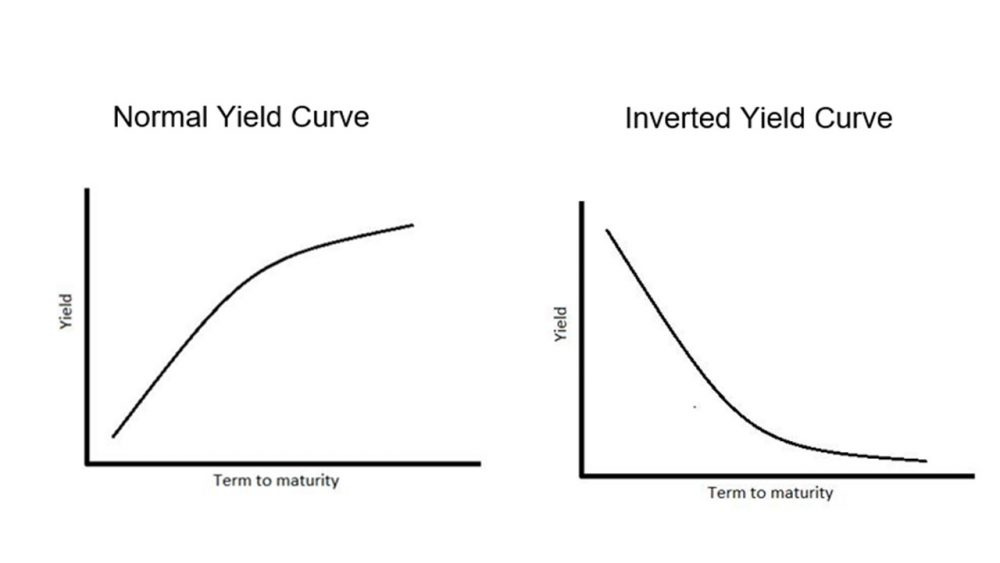

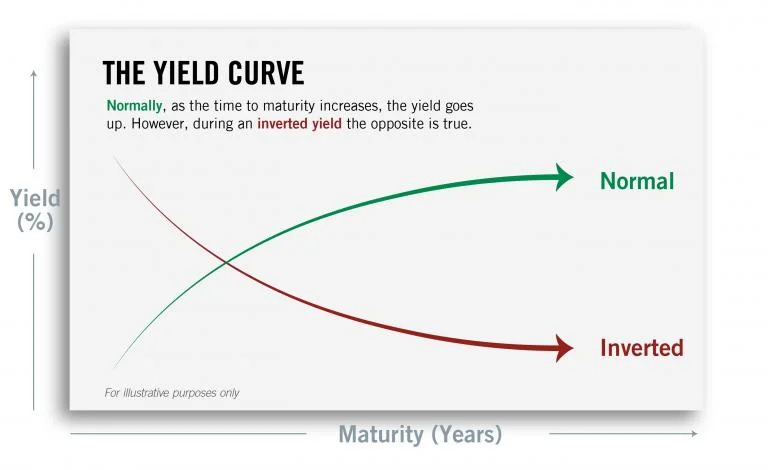

Yield curves are graphical representations of the relationship between the “yield” on bonds of the “same credit quality” but different maturities. They are crucial indicators for understanding the state of the economy, particularly in terms of overall inflation expectations, monetary policy and market sentiment.

A ‘normal’ yield curve, a positively sloped yield curve, is one where short-term interest rates are lower than long-term rates. This is the most common shape under ‘normal’ economic conditions. It reflects the expectation that the economy will grow steadily and inflation will remain moderate. Investors demand ‘higher yields’ locking in their money for longer periods due to the uncertainty of future economic conditions.

An ‘inverted’ yield curve, a negatively sloped yield curve, occurs when the short-term interest rates are higher than the long-term rates. Inversions are less common but are significant predictors of economic recessions. They suggest investors are ‘expecting’ economic growth to slow down, possibly leading to a recession. Inverted yield curves occur when the central bank raises short-term interest rates to combat an inflationary pressure or when market participants anticipate future economic weakness.

The most closely watched inversion is the one between the yields on 2-year and 10-year U.S. Treasury bonds. When this part of the yield curve inverts, a recession has followed, though the timing can vary widely.

Central banks, policymakers and investors monitor yield curve dynamics because they provide insights into the overall health and direction of the economy. It's important to note that while yield curve inversions have preceded most U.S. recessions, they are not foolproof indicators and other economic factors should be considered when assessing the state of the economy.

Not a bad definition to start with but if you are a long term student of the world, you want to know more. There’s not much more to it as described in the charts exhibited. I see change in the future and began to take action on what I believe will be a return to normal. I’ve been holding back for quite some time for good reason. When I invest or trade, expecting a change in the curve, I use ‘margin’. It’s worthwhile if it is used at the right time. This is the right time and here’s what I’m doing.

Look Short Term Young Man

I’m a bond trader. That’s where I have not only protected my assets it’s where I have made the most money trading. The secret is using ‘margin’ effectively, knowing how to hedge the position and above all, timing the trade correctly.

So for years I’ve been pretty much invested across the board when it comes to dealing in the U.S. Treasury markets. Although it’s not exactly my position, let’s assume that I own an equal amount of bonds across their thirty-year time span. They are all paying an interest rate of about 5%, even the money markets so I’m beating inflation in Roth IRA accounts managed. The yield curve is about to steepen so I’m doing this.

Selling Longer Maturities - The long bond, let’s say the 20 and 30-year varieties are about to increase in yield or at least their yields are not going to ‘decrease’. May as well grab a few bucks of capital there to offset what I’m going to borrow elsewhere.

Buying Shorter Maturities - For me that means the 2 to 7-year variety. Believe it or not, their annualized yield is about the same as longer and shorter maturities. In my history book, I’ve always seen them ‘move’ first when yield curves change.

So what exactly am I doing. It’s easy, like clockwork but remember, I’m operating in Roth IRA accounts and I do not pay taxes on anything. That’s important. So let’s say I sold a bunch of longer term bonds. I’m going to take all of that money, multiply it by a factor of “10” and buy shorter term notes between 2 and 7-years in maturity. Some will ask how I came up with a factor of “10”. That’s the effect of using ‘margin”. Worst case I’ll have to “put up” a dime on the dollar to buy these. It’s all just timing and fortitude at this point. I have a strong stomach for making decisions of this nature. I seldom use ‘margin' and neither should you. If I get the move I expect and the curve “normalizes” my returns will more than double, possibly triple. I’ve done it before and historically it is a time to do it again.

While this may seem to be a risky venture, it is not. I know what to ‘monitor’ and if it comes down to it, using options I know how to hedge my position. It a little riskier as this is an election year and everything is basically still ‘up in the air’ but I have a great deal of faith in Jerome Powell to do the “right” thing. He has so far and I sense he will going forward. Powell sees the negatives coming and he’s prepared to handle the trade just like Volcker did in the early 1980s when my reverent ‘retirement clientele’ made a lot more trading bonds than they could ever imagine.

Remember, there is another, less risky way to approach this scenario. Dividend paying stocks work, especially those in secure sectors that raise the amount paid annually. I’ll talk more about those investment types on Sunday in a ‘paid’ format so sign up. Learn as uch as you can when taking it all in and following the suggestions offered will serve you well. Opportunities like this do not happen every day.

No one said it better than “Elmer Fudd” so I’ll chime in as he would and say “that’s all folks”. The inverted curve is going to change. Regardless, the time to assume it will be happening is upon us. It’s taken longer than I thought but who am I. Like you I’m just a student of this market. I learn something every day. That’s why we’re kicking off our latest way for you to learn for free The Ticker Free Community. My good friend and early adopter Mahdi Nikpour is going to send you an invitation to join. Join with us and learn from me, Mahdi and others like you who always have something of value to offer and add. Hell, I learn from you every day. It’s time you learn from each other.