It’s still summer but that’s not preventing the opinions from flowing. There is a lot of rhetoric running on the airwaves. Reacting prematurely can get investors and traders into trouble. That’s why we’re sifting through what we read and hear but react to little of it. It’s part of our plan and we’re consistent. We’ll stick to our plan. You should too.

Federal Reserve Decision Making Time

Former President Trump is gaining “momentum” in the polls. With Powell’s head on the chopping block, how the Federal Reserve navigates the potential economic shocks of a Trump victory is real.

The Fed is focused on maintaining a strategic stance leaving it "well positioned" for a range of scenarios by mid-2025. Potential pressure from Trump to “delay” interest rate cuts, his jawboning should not dissuade the Fed from cutting in September. I expect the Fed will remain focused on inflation and employment data without adjusting its baseline outlook based on speculative impacts of possible Trump policies.

Starting in December, if Trump wins, the Fed will incorporate estimates of Trump policies into their forecasts, supplementing with scenario analysis. Federal Reserve updating will likely move more slowly than most are thinking. A disconnect between market expectations and the Fed's Summary of Economic Projections is likely.

I expect a strategic, cautious approach by the Fed, aiming to avoid any sudden, drastic changes. A possible "saucer-shaped” rate path in 2025 utilizing gradual adjustments to avoid the need for deeper cuts followed by significant hikes is likely predicted. In this way, the Fed will maintain stability and flexibility in an uncertain political and economic landscape.

Looking Past The Election

The contrasting economic policies of the two political parties will have significant implications for trade, fiscal policy, immigration, industrial policy, and also antitrust enforcement. Under a potential second Trump administration, the US is expected to adopt a much more protectionist stance. Trump’s proposed aggressive tariff policies, including a 60% tariff on all Chinese imports and a 10% universal tariff on all imports. These measures will raise significant customs revenue but will also increase consumer prices by around 1.1% and 1.5%, respectively.

When it comes to fiscal policy, the Democratic approach includes extending the Tax Cuts and Jobs Act provisions for individuals earning under $400,000 while reverting to higher rates for those earning more. They aim to increase the corporate tax rate from 21% to 28% and raise the Global Intangible Low-Taxed Income tax rate to 21%. Trump has been less specific about overall its fiscal policy strategy favoring a middle-class, upper-class, lower-class, business class big tax cut.

On immigration, the party politics diverge sharply. Biden has ‘tightened’ border entry rules but maintained firm immigration numbers. Trump will shut off the “southwest” border and begin large-scale deportations of unauthorized immigrants already in the country,” the note states.

On the industrial side, the Democrats’ strong support for green transition through the Inflation Reduction Act and the CHIPS Act “spurred” investments in semiconductor and clean tech manufacturing areas. This supports business investment outlays in the challenging capex environment. A second Trump administration, however, could pose risks to this spending by opposing the green transition, hindering investment in these critical areas.

Still, analysts said their energy research colleagues see this as manageable due to two factors. A full repeal of the IRA would require a Republican sweep, which is unlikely, and much of the IRA and CHIPS Act spending is in Republican counties, possibly softening their opposition.

Another area that will likely be differently impacted is antitrust enforcement. Biden has taken an aggressive approach, targeting major tech companies like Google and Meta. In contrast, a Trump administration is likely to adopt a more lenient stance, analysts said, potentially reducing regulatory pressures on large corporations.

As Cat Stevens sang, “it’s not time to make a change” but it is time to listen and read everything you can. That’s what we’re doing. How about you?

Slowly We Turned

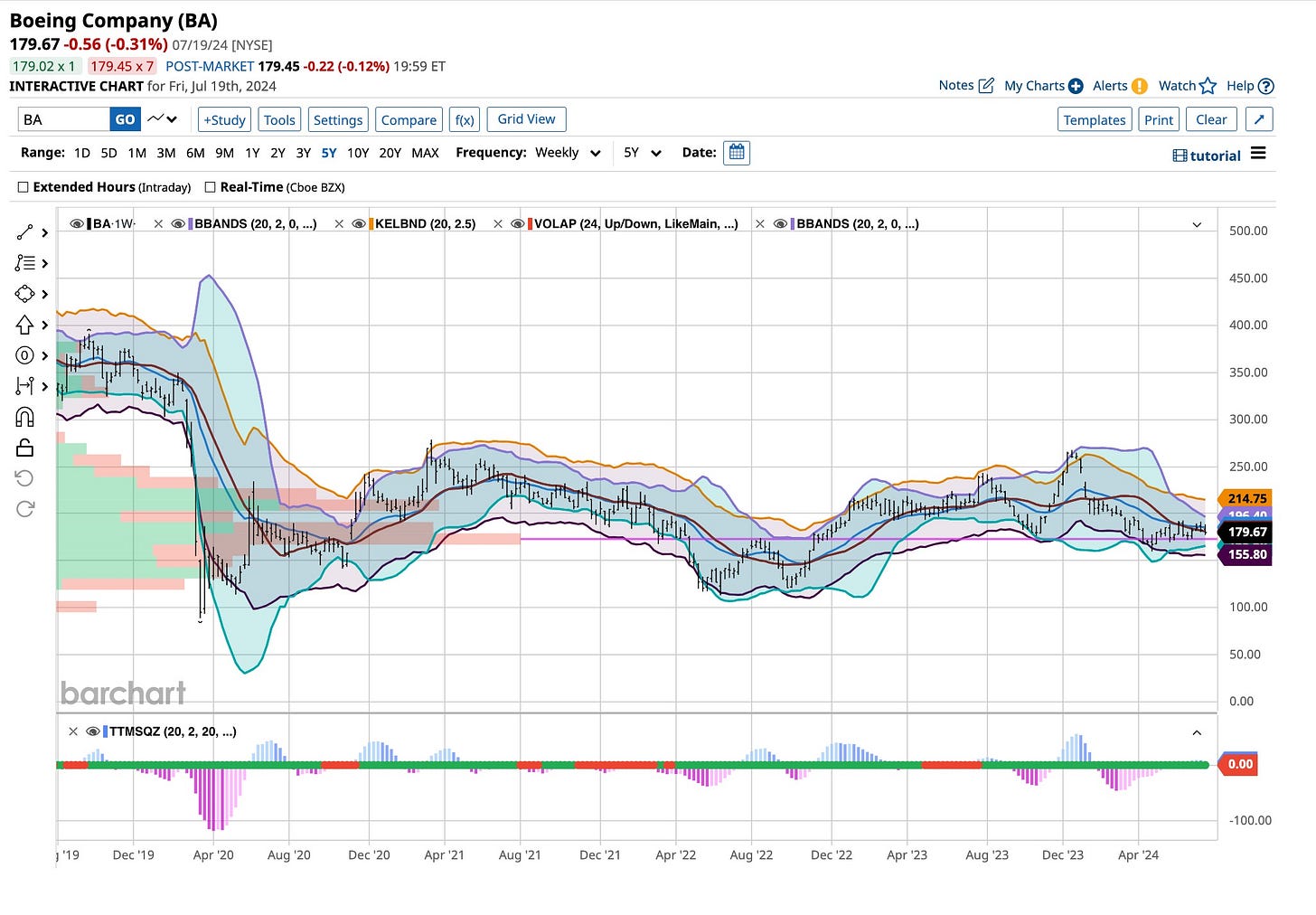

Boeing is seeing a significant improvement in production flow at its 737 MAX factory, its new commercial planes chief said on Sunday, as the U.S. planemaker overcomes a safety crisis.

Stephanie Pope said the changes Boeing was making to the Seattle-area factory were significant. "This isn't a minor change. This is transformational change," she said in her first remarks to media since being appointed earlier this year.

Boeing is a stable company. It’s mired in crisis after a cabin panel on a 737 MAX 9 jet blew off midair in January. This prompted a slowdown in production of its top-selling plane as well as heightened regulatory and legal scrutiny. It agreed to plead guilty to a criminal fraud conspiracy charge related to a couple of earlier fatal 737 MAX crashes.

Boeing is seeing a "significant improvement in the flow in their 737 factory. Chances are that Boeing will be more predictable on deliveries after its production slumped. If their revenue flows show a promising increase the stock price should follow.

Change is inevitable. Timing is the critical element. The worst thing any investor or trader can do is act prematurely. Hedging your “options” makes the most sense. This market could crash. In the same breath, it could move higher. I do not know exactly “what’s next” but I’m sticking with my plan. Patience is a virtue and it is required. If you want to be successful it’s best to sit on the sidelines and wait for opportunities to find you versus looking to find them. Best always and thanks for following.