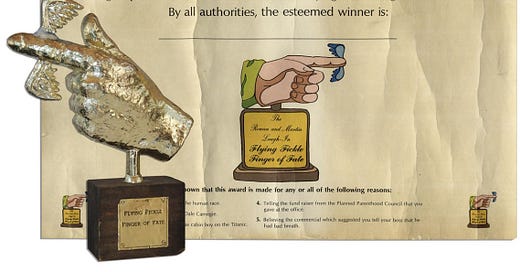

Most of you are far too young to remember “Rowan & Martin’s Laugh In” and if you are not, chances are you’ll not admit watching it. You would probably admit that the Smothers Brothers were a hit but not old Dan & Dick. Well, I watched them both and loved “the news” and their “Fickle Finger of Fate” award. Well we had them both take place today and they’ll more than likely be repeated tomorrow.

Today, Governor Ueda from Japan was the runaway winner after announcing that the rates in Japan were no longer negative. Big deal, eh? That’s exactly what the ‘market’s’ initial reaction was but who’s watching? Tomorrow we get “Jerome Powell & the Fed”, sounds more like a ‘rock group’ strutting their stuff. Who knows what Jerome will talk about. It all depends on whether he had lunch with Janet Yellen before speaking.

Either way, they’re this week’s winners of the “Fickle Finger of Fate” and both deserve it. Face it, their crystal balls are still pretty cloudy so whichever way the herd initially goes, wait a couple minutes and go opposite their initial direction. Maybe the “herd” should get the award? I don’t know, what do you think?

Japan Speaks Softly

Japan's central bank voted Tuesday to hike its benchmark interest rate out of negative territory for the first time since 2016 and overhaul its accommodative monetary policy aimed at combating decades of economic stagnation.

Bank of Japan Policy Board members voted 7-2 for a 20 basis point rise in the rate on current account balances held by financial institutions at the bank, up from -0.1% to 0.1%, effective Thursday, the BOJ said in a news release.

"Unprecedented monetary easing is now over," Governor Kazuo Ueda told the press, stressing the actual pace and magnitude of further rate rises would be dictated solely by the normal Japanese economy and inflation. "Based on the outlook that we have at the moment, rapid increases will be avoided," he said. That’s what the trading market took as their primary key and sent the Yen lower versus the U.S. Dollar.

I said “thank you” very much and increased my position, now standing at 24 contracts with a breakeven of 150.25 looking for a 125 target sometime in the future. When, who knows but the “table is set” and at some point I’ll be ‘eating well’. Patience is a virtue when you are dealing in these markets and more so when dealing with the Japanese. I have been there. “No” is not part of their vocabulary.

Prime Minister Fumio Kishida, welcomed the decision as presenting an ‘opportunity’ for Japan to escape years of deflation plaguing the economy calling it "appropriate." The move to positive rates will increase the cost of “borrowing” for companies and households, especially home buyers the majority of whom have variable interest rate mortgages. However, it will be a boon to the fortunes of the financial sector.

The last time the bank raised rates was in 2007, thereafter cutting them bit-by-bit in a bid to encourage banks to “lend to businesses”, ultimately charging ‘interest’ to leave funds on deposit at the BOJ. The board said the move was supported by a "virtuous cycle between wages and prices" that had brought its 2% inflation target within sight, which it expected to be achieved "in a sustainable and stable manner" toward the end of 2025 in line with its January 2024 outlook for economic activity and prices.

BOJ will also halt its purchases of exchange-traded funds and real estate investment trusts, another plank of its monetary easing strategy, along with YCC, but not stop its purchases of government bonds in order to head off any spike in interest rates.

The BOJ also said it would switch strategy for delivering the price stability target to one of using its short-term interest rate as the main policy tool, adjusting it according to the inflation implications of what happens with prices and economic and financial conditions. The wheels on the bus keep on turning at a slower rate but nothing really changed much, a very common outcome for Japanese economic policy.

Powell Carries A Bigger Stick

OK, Japan is out of the way and it is time for Jerome Powell to step to the plate with a “bigger stick”. I’ll be honest with you, I like him. He inherited a hornet’s nest when he was appointed and it has only became much bigger. At this point however it’s time for Jerome to put on his “big boy” pants, quit eating Yellen’s ‘mushrooms’ and tell us all the truth.

Chairman Powell needs to talk about the real path of inflation. It is not coming down as expected and more than likely will head higher. Instead of his just “cherry coating” the future he needs to swing that “big stick” and tell us like it is. If inflation does not behave in accordance with the Fed's projected path rates are not coming down, they just might be heading higher.

Powell needs to tell “everyone” who is listening that the Fed will not cut interest rates or taper ‘Qualitative Tightening’ until overall and core inflation are down to 2.0%. The Fed needs to warn the market that the Fed will move swiftly to raise Fed Funds and to take any additional steps if inflation starts raising its “ugly head”.

Remember, it is a “political year” so how he will speak to the country or react to what is obvious remains in question. We’ll know tomorrow and we’ll also know if Jerome is wearing his “big boy” pants and carrying a “big stick”. If he does great. Either way it seems obvious to me that investors should be prepared for a significant and dangerous inflation shock in the second half of 2024 especially with this administration in place. It is obvious they like Yellen’s mushrooms and want more of the same going forward.

Trailing Stops Work

Have you been watching copper trade? I have for quite some time and more so after I bought a decent sized position in the 2024 May future around $3.83. About one half of the total holdings were sold as I slept this morning for a nifty profit all with the help of a well placed “trailing stop”. I’m not a greedy person and I am definitely not going to let a winner slip away. That is why I use trailing stops and you should too. Learn a bit more about them with our course and our “1-on-1” tutorials. All you need is but a single trade to more than breakeven. Hell, many of you hope to do just that when you trade so breaking even with knowledge is ‘priceless’, eh?

Off & Running

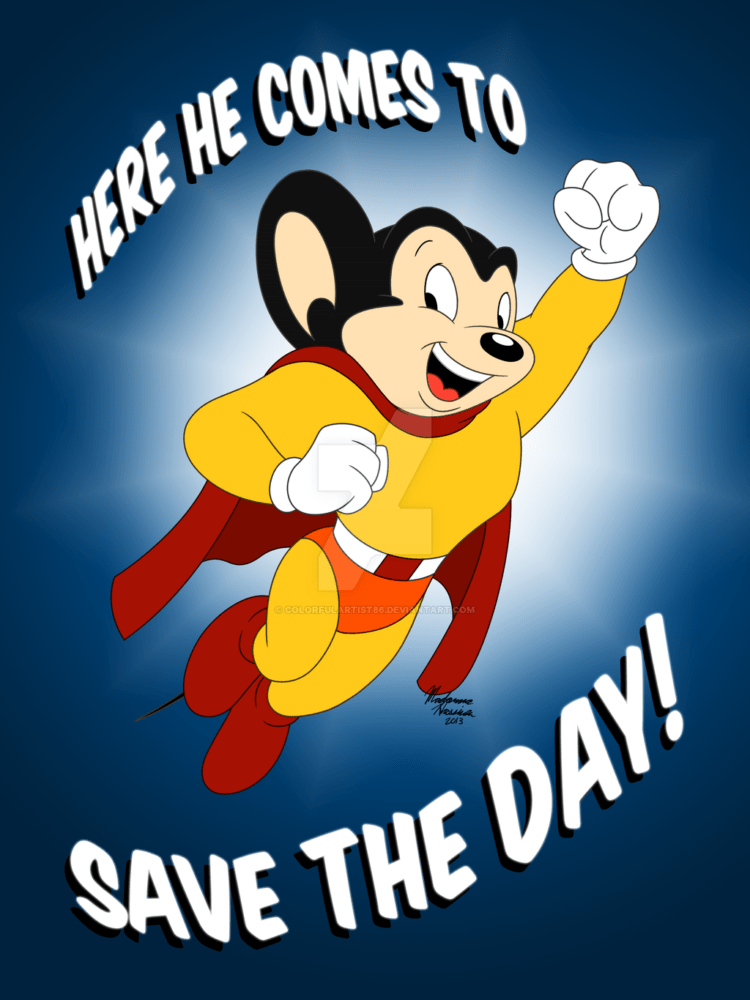

Here “I come to save the day”. Damn, I loved that little “Mighty Mouse’, a hell of a lot more than Mickey probably because I liked his cartoons better when I was about three years old. For whatever reason I think I’ll use Mighty Mouse’s characterization for the www.tickeredu.com rollout as we are just killing it with our soft launch thanks to you.

As always, time’s not on my side as we have been deluged with requests, literally from around the world for our “1-on-1” online tutorials. I knew they were going to be a hit. What I underestimated was investors and traders seeking direct contact with me. One never knows what drives sane people to interact with a ‘crazy’ person like me but I am not one to question reality. All I can say is thanks. Hopefully we are doing it all “right” but the only ones to answer that is you. Let us know and thanks, we care what you say.

Interested in getting on board with our “1-on-1” tutorials let me know. We realize that we both have a lot to learn and the deals we are making to get started are “insane” just like ‘Crazy Eddie” advertised years ago while he was still on what we call the ‘straight and narrow’. So take advantage of our ‘insanity’ and take us up on our offer to help you become the “best damn trader or investor” you can be.

I never took a liking to Mickey Mouse but Mighty Mouse, he was my all time hero. I remember “Adventure Time” with Paul Shannon on WTAE, Channel 4 in Pittsburgh. After a round of “The Three Stooges” Captain Kangaroo & Mr. Green Jeans hit the “old boob tube” but my favorite was when cartoons of “Mighty Mouse” aired and this little mouse just won battle after battle. There is another “mouse” out there on my radar who is going to make her mark on this investment world, I guarantee it. Stay tuned and watch for her story to be written as it’s only “a matter of time”. She has what it takes to be successful, dedication, and we are all dedicated to ensuring she becomes the “best damn investor or trader” she can possibly be. Stay tuned and just watch as this “field mouse” takes flight, just like Mighty Mouse did years ago.