When it comes to The Three Stooges, everyone has their favorite episode. Mine is “Niagara Falls”. It’s been performed over time by others but seldom with a quality expressed by Moe, Larry and Curly. There’s no way this type of slapstick humor is possible to recreate today except when it comes to our current administration and the puppets that rule the decision making process. Enter today’s Stooges, Joe, Janet and to a degree the Federal Reserve.

Today’s Numbers Were A Predictable JOLT

There were an estimated 8.7 million available jobs in the month, according to data released Tuesday by the Bureau of Labor Statistics. There are an estimated 1.3 jobs available for every unemployed person, BLS data shows.

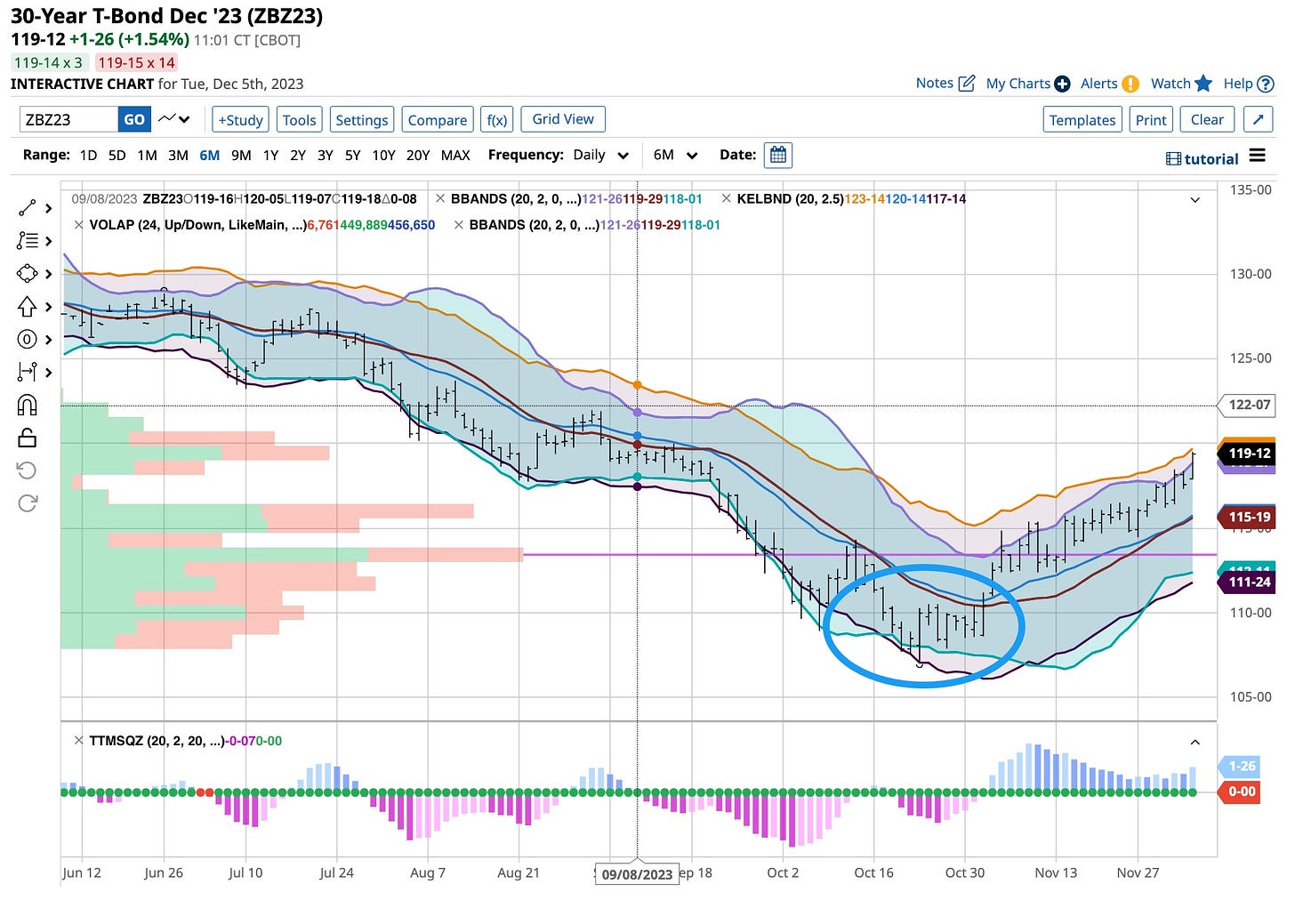

That’s the lowest number job openings seen during a month since March 2021 and is evidence of a cooling US labor market and economy. October’s numbers, significantly lower than the record 12.03 million positions hit in March 2022, are just what the Fed was looking for. I’m long the longer term bonds and sitting on a solid profit and happy to see what’s expressed.

The Federal Reserve has been hoping to see more slack in the labor market to help in the central bank’s fight to bring down inflation. Imbalances in the actual supply and demand for workers is important to watch. Most industries pulled back in the number of available jobs, with the sharpest decreases coming in the financial and in the retail industries. That’s a good sign of a slowdown. Looks like the Fed was right. Recession is on its way as are lower rates across the board. Hopefully Yellen is done eating her mushrooms and can clearly see what Powell has been patiently waiting for. Joe does not have a clue but that’s been a reality for quite some time.

Look At That Long Bond

I’ve been buying the ETFs known as TLT and GOVT for a long period of time. I love bonds. Some of my best trades come out of this area especially when rates are due to decline, like now. Here comes the “herd”, you know the ones who screamed “the end is near” as bonds bottomed. It’s time to be careful again as “they” were wrong at the bottom and more than likely “they” will be wrong, or premature, on the upside target.

Keep buying stocks that have exhibited significant downside in 2023 especially those that pay a decent dividend. Keep your eyes, both of them, on declining consumer softs that look like the end of their never ending run up is over. Stay tuned to this Substack site for more but for now remember, the market giveth and taketh away. Take what it gives and don’t be greedy.

While you are at it enjoy “The Three Stooges” and their rendition of “Niagara Falls”. The scenario of “slowly we turned” is real. Macroeconomic themes take time before the “herd” catches on. When “they” do it’s usually too late but for reason or not, the trend usually continues. As I have always said, buy when “they” sell / sell when “they” buy. I’d rather be early than not and with respect to this trade I was early.