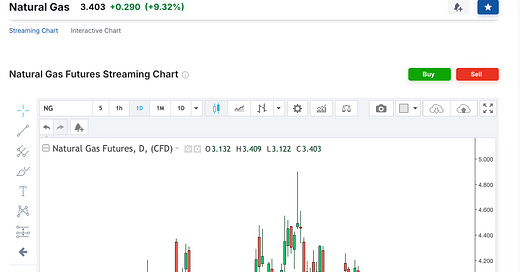

You can go back to my posts regarding Natural Gas being better known as the “widow maker.” It’s true, and no one can change that moniker, especially during these summer months. Remember, stops, trailing stops, and understanding the risk is critical.

Know Your Signals

It takes more than chart watching to be right. Anyone in the trading industry is more than aware of the importance of options, especially the effect of “gamma” on short-term, close-to-the-money active series. Signals hit yesterday when the market price tumbled. The entities involved in the LNG markets disregarded the move as it was more expected than not. They’re the watchdogs to keep an eye on.

If you do not have the “stomach” for rapid and, essentially, abnormal change, trade something else or stick with stocks in the related industries. I’m not one to work in the Natural Gas markets during the summer months, but there is something about Trump’s overall tariff “game plan” that just keeps me here.

Mungo Jerry was a very interesting character in 1970. T. Boone Pickens was more interesting as he tried to corner the Natural Gas market in the middle 2000 period. In my book, if the Hunts could not control the Silver markets, no one really can control anything. It’s been a great career, folks. It is event-filled. More importantly, it is made up of memories. That’s my strength, as history repeats itself.