Howdy, y’all from down here in Texas. It’s still summer. As most of you have realized we tend to “take a break” from the real world during this season. We’re invested the “right way”, hedged for disaster, and positioned to take advantage of “what’s next”.

Given that “what’s next” is quite illusive we’re sitting on a big pile of cash bringing in about 5% so as they said in Evita, “don’t cry for me Argentina”. In as much as all of the money managed is in Roth IRAs, we’re happy to sit and wait. I like to say we’ve been a bit fooled before but we won’t be fooled again.

I’m serious. I just listened to Joe Biden say absolutely nothing about the real reason he dropped out of the presidential race. Say it ain’t so but, he wasn’t going to win. Given that was the case he punted. Joe imitated a lot of what I see daily as most AI prompts do the same, they “punt”. It happens when there is no real answer available and that’s what we have today.

No one has the answers to what the outcome of the November elections will be. A few of the best I follow say the markets are going higher while others predict a tragic end to life as we know it. A few think a recession is the solution, some want to print more money and others just want to “drill baby drill”. I don’t know the answer but I know it is not apparent, at least not to me.

What Is Apparent

A long time ago, my Dad taught me to listen twice as much as I spoke. He’d say “it is better to think you are a fool than to open your mouth and leave no doubt”. He might not have been right about everything but he was dead on with this one. That’s why if there is nothing to talk about you are not going to hear from me. Sure, there is always a trade or two up my sleeve but you’re going to need to follow me on The Ticker if you want to know what I’m up to. For now, the only certain thing is uncertainty.

Unless you were dead from the neck up like Joe Biden it was obvious he was not going to be the Democratic candidate. His fate was sealed by his dismal debate performance but the actual timing remained unclear. Once Trump survived an assassin’s bullet, the handwriting was on the wall but who was going to take his place in line? Right now it looks like Kamala Harris is “tugging on the reigns” but it’s a very long time before the Democrats will meet in Chicago and decide.

Trump is going to keep doing what’s brought him this far and his picking J.D. Vance is a good thing without question. Now there are two Trump-like characters out there trailblazing, a feature that serves Republicans well but it’s months until the votes get counted. From my perspective, the race is wide open but in reality, Kamala is not the answer. Chances are she’ll open her mouth and insert her foot so just like Joe, Kamala is being “battle’ tested.

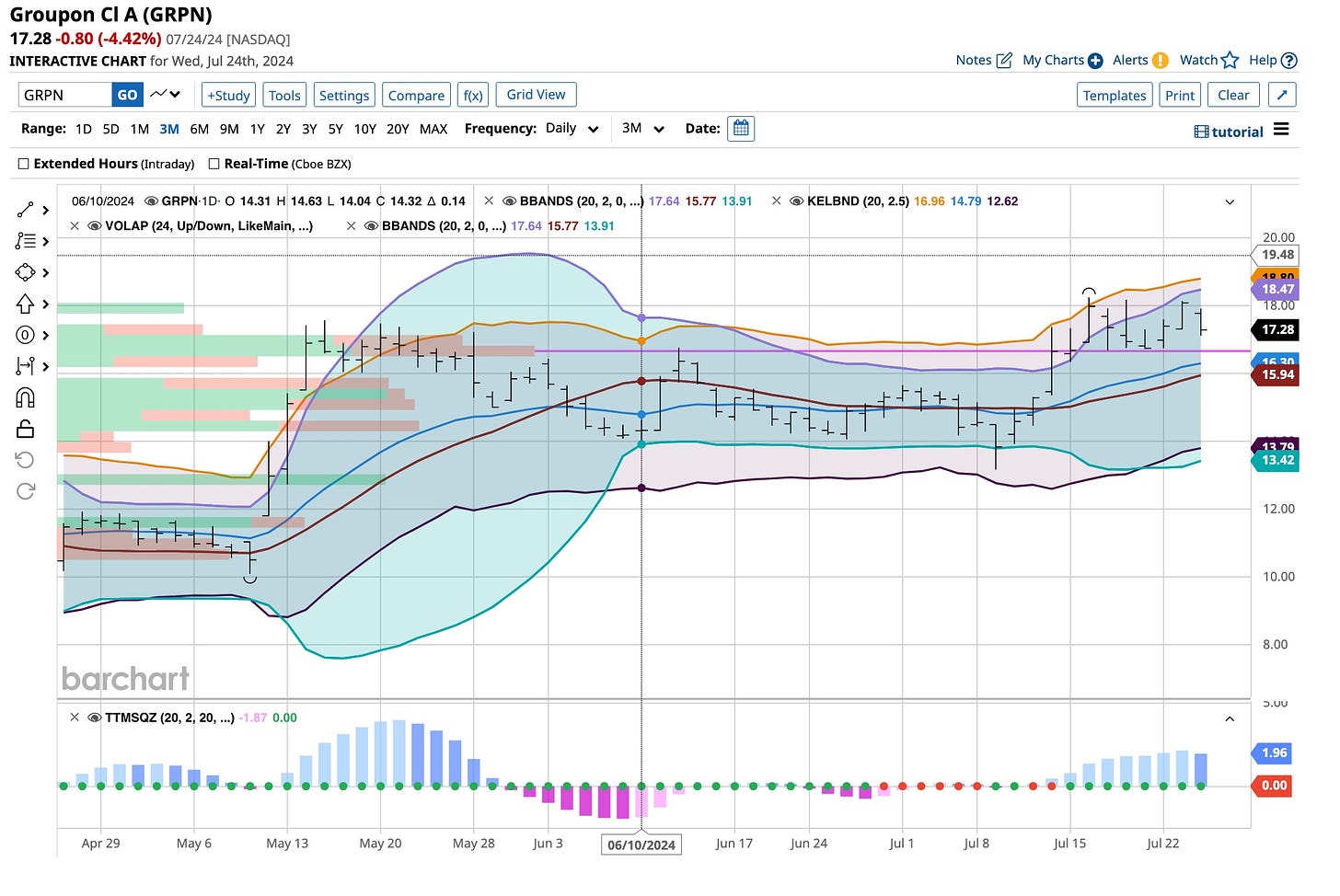

The markets are not convinced that a Trump presidency will produce lower rates with an increase in inflation more likely to happen than not. Although I’m sitting ‘squarely’ on that fence, I’m hedged to the downside with 2025 March 20 VIX call options. I’m a bit of a chicken except for my selling TTD 80, 85, and 90 put options and buying up a few shares of BA and GRPN. I’m consistent and quite protective. Try it, it works.

What Else Do I See

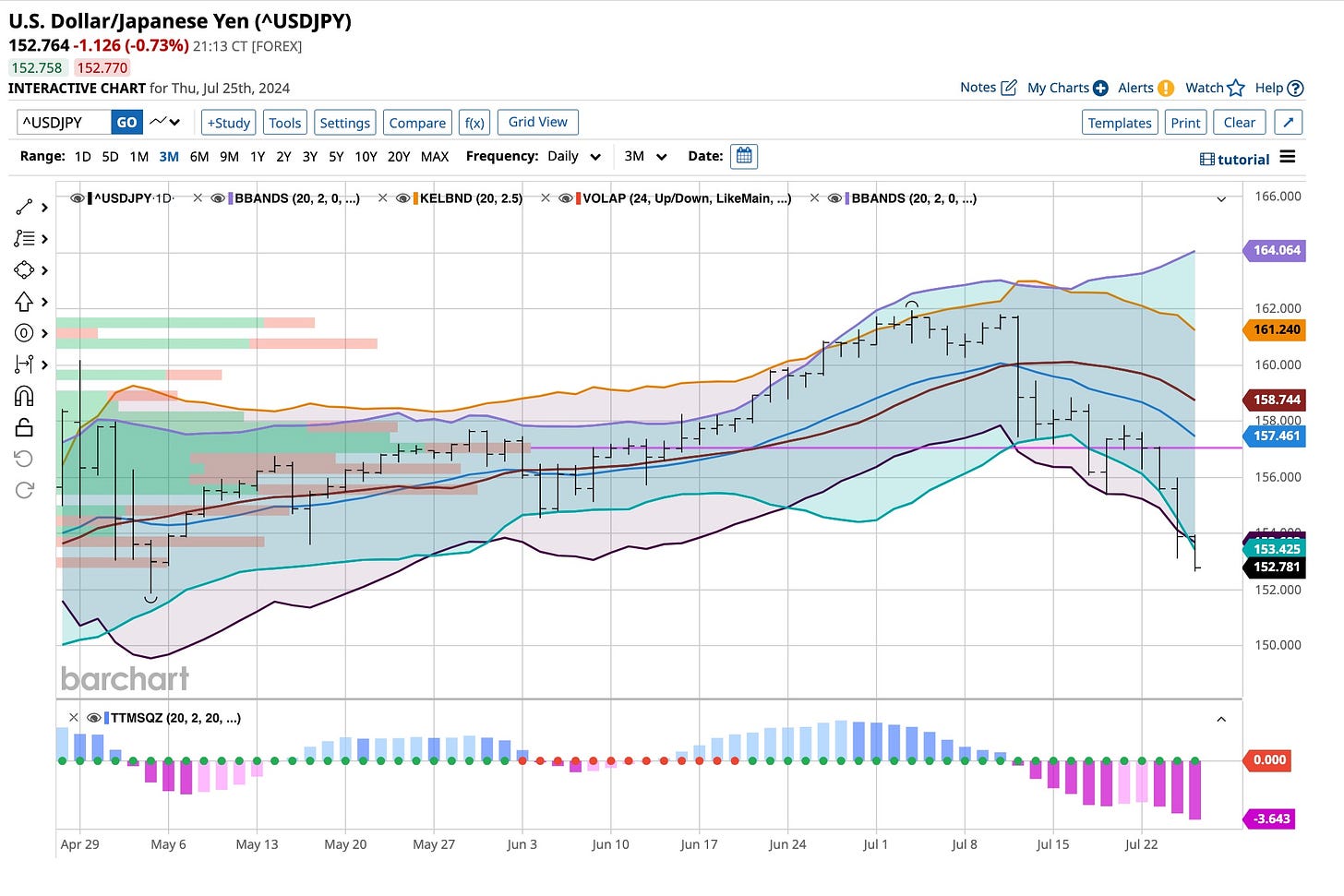

Well, Canada came down 1/4 point today in rates, and the U.S. Dollar has been getting hit but the decision on its future moves remains uncertain. I’m looking for the Yen to return to normalcy but I’ve been on that bandwagon for more than a year. The trend is my friend but it depends on what happens here in the United States.

Everybody wants to know “what’s next”. Me too but sitting on a pile of cash earning 5% is fine with me. Waiting for a normalized yield curve works too and as reported to you I’ve continued to shorten my maturities on Treasuries. Yeah, it’s a boring plan but it works. Sometimes it’s best to be patient and wait.

Joe didn’t fool me and he probably didn’t fool you either. The Democratic party is not being fooled either. They have Kamala out there doing a “test flight” where they get to kick the tires for a while. Makes sense to me and it should to everyone. I’m not fooled here and as The Who sang, I “Won’t Get Fooled Again”. I’m early with my picks. That is just the way I am but when it comes to major market moves I’m usually right. I will always seek certainty and we simply do not have it so check me out on the sidelines, that’s where I’ll be.