When it comes to March, the tournaments are expected to be crazy. Calamities of a worldly nature, while somewhat frequent this time of year, “spring” up sporadically with no rhyme or reason. Many think the market is due for a correction, perhaps it will “crash” like it did in 2000 but who knows.

What we do know is that ISIS is alive and living in Moscow and the atrocious results leave the world to wonder what’s next. You have to wonder if the United States is the next target. Just exactly how many of the “got aways” have terrorist ideologies? I have a feeling they exist in the shadows and it is only a matter of time. All this Democratic administration cares about is votes and artificially increasing their Congressional size in an expected way. It’s an important election year folks so let your voices be heard.

As mentioned several times, it would be nice to have a third party emerge or at least a choice between two candidates who are closer to middle age than the grave. So far we do not have that choice but in today’s world one never knows. All we can do is hope.

What we do have is a political witch hunt that seems to be falling apart at the seams. From Florida to New York, from duly appointed “special” counsel Jack Smith to one that’s “special” for other reasons, Fani Willis, it seems that everyone has an agenda, get Trump. What doesn’t kill you makes you stronger and with the merger of Truth Social into Digital World Acquisition Trump gets a much needed “monetary” shot. It seems to me that the current administration is oblivious to the ”rule of law” so it is time for the Supreme Court to set the record straight. Again, where are the candidates necessary to move this country forward, those who if elected will reflect the role of the electorate, not just their own agendas?

Enough of my long windedness. I’ve got a “free” and “paid” scenario that follows. This Sunday, we will take a look at a “commodity” we love to eat yet hate to pay for, Cocoa. I’ll follow it up with a couple speculative and downtrodden security picks that interest everyone. We have just published our second of three “originally” planned courses in Ticker EDU so take a look. We started with the “foundation” and this second course is the “bricks”. “Mortar”, one that will be completed, available and published in the early days of April, completes our original teaching intent. Coupled directly with what we call our “1-on-1” online tutorials we’ve hit the mark and thank you, our early adopters. It’s just getting started folks and remember we learn from you as you learn from us.

Cocoa Is Making Candy Bars A Luxury

Chocolate is hot right now, but not just because Easter is coming. It’s shortages and soaring prices of its main ingredient cocoa, and “everybody is panicking.” That’s how the head of Guan Chong, one of the world’s biggest cocoa processors, summed up the situation in the market right now.

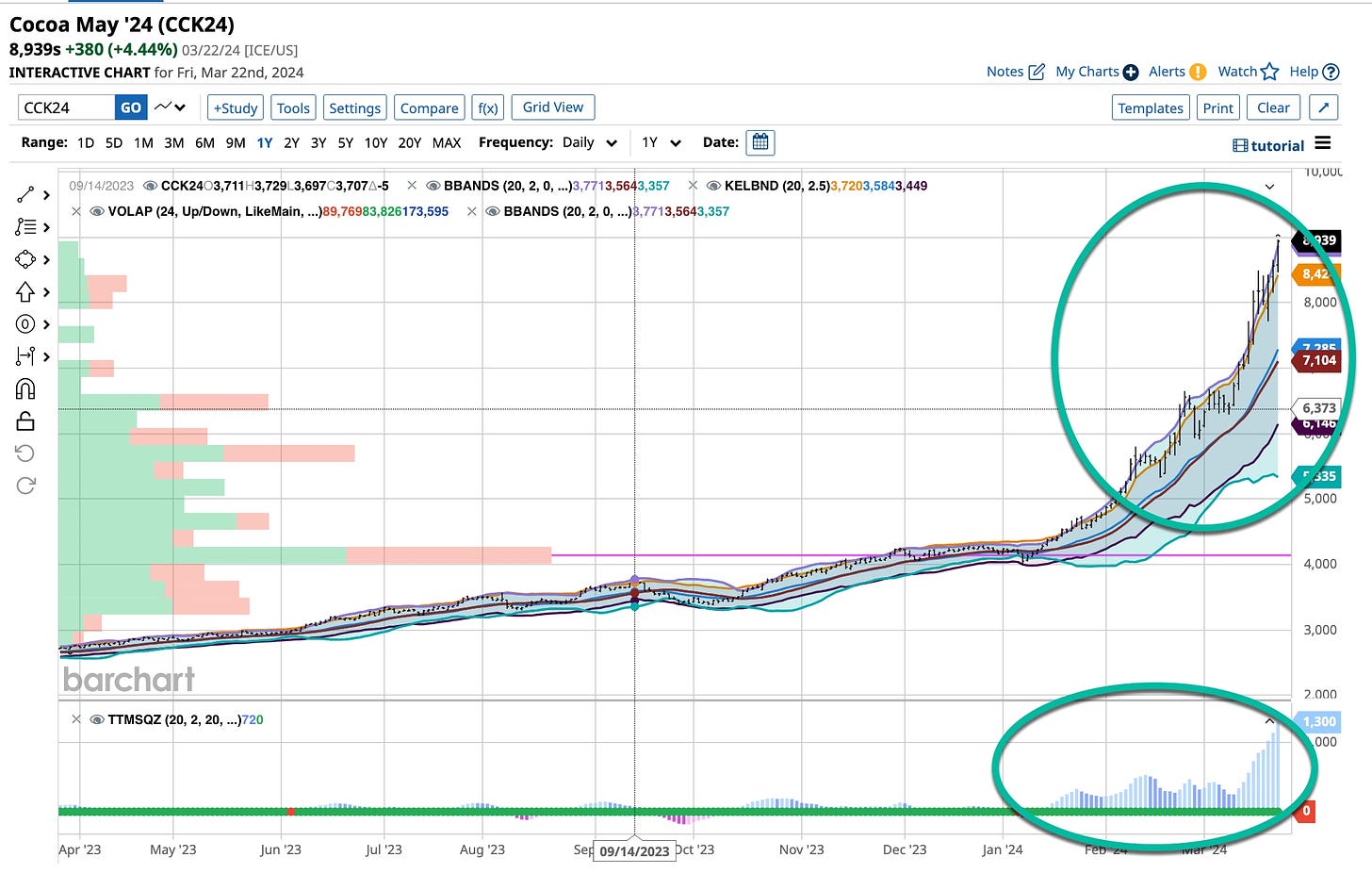

Prices have skyrocketed, setting new records day after day. They’ve already doubled so far this year to exceed $8,500 a ton, and $10,000 looks like a real possibility. The main reason is poor harvests in West Africa, a result of drought and disease but decades of underinvestment and insufficient support for millions of impoverished farmers have contributed too.

Malaysia’s Guan Chong is scouring the world for cocoa and paying premiums to book beans from ‘minor’ growers amid worries that some sellers in top growers Ivory Coast and Ghana may default on supply contracts. It’s looking to buy from countries such as Ecuador, Peru and Indonesia, CEO Brandon Tay Hoe Lian said.

Surging cocoa prices, as shown in these charts, are prompting candy manufacturers to crank out new products with less of the pricey ingredient, or none at all. So far they’ve passed on higher costs to consumers. But the breakneck rally shows no sign of easing any time soon, and major chocolatiers have warned that acute shortages will persist into next season.

Focus is now turning to the upcoming mid-crop, the smaller of two annual harvests, and Ivory Coast’s regulator expects that to “shrink” this season. For the season as a whole, the world is facing a third straight deficit. A major worry is that harvest losses triggered by aging trees and crop diseases may prolong the shortfall and turn into a structural supply issue, keeping costs high. So you may say goodbye to any chance of cheaper chocolate and Easter eggs for quite a while.

Keep reading with a 7-day free trial

Subscribe to Ticker EDU to keep reading this post and get 7 days of free access to the full post archives.