No real reason to reiterate what was presented yesterday; nothing has changed. What the actual CPI report reveals and the “market’s” subsequent reaction will speak more loudly than anything I could write. I know my limitations, dealing with uncertainty is one of them, so I believe preparing for both sides of the coin makes the most sense at this time.

Not being a day, scalp or even a swing trader in this market has its benefits. Most of you will be glued to your screens; I’ll just look to interpret what the report gives to us. If past historical patterns prevail traders will take the averages in one direction then reverse. A strategy I used to employ was to purchase out of the money calls and puts, harvesting one side or the other when the initial movement reversed then holding on to what was then the “losing” side waiting for the inevitable bounce. That required me to figure out two “if and when” answers. When is it time to sell the winner, in other words when the initial move was complete, then how long to wait for the reversal to complete. That’s what most of you applying your new fangled tools on your multiple screens are looking for, right? I wish each and every one of you the best of luck; may your “Magic 8 Ball” be accurate and you hit your trade dead on; me I’ll be listening to the “powers that be” as they shed light on what the CPI report indicates. I expect a “rinse and repeat” dissertation from most who tell us what happened and why.

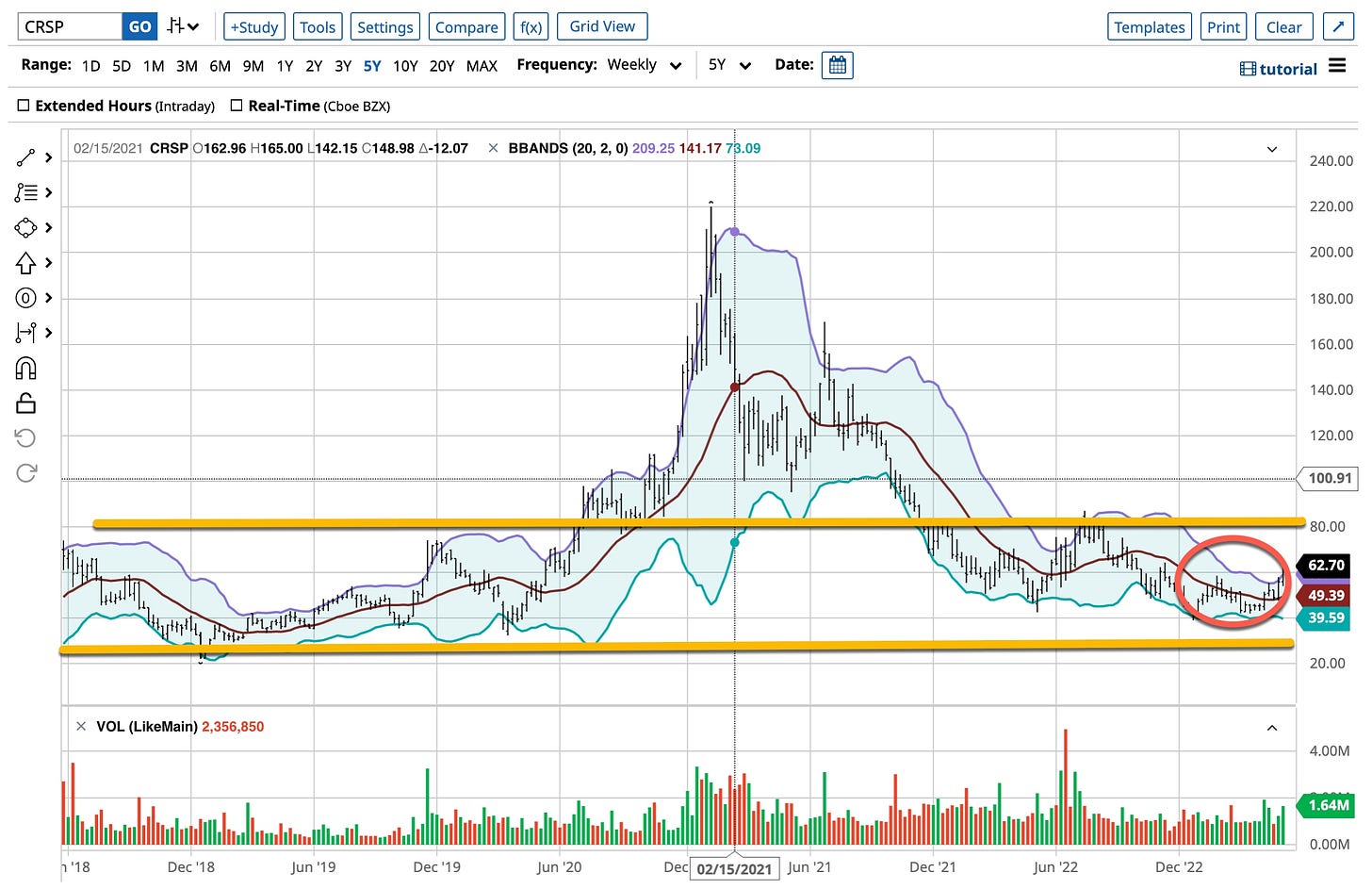

With that being said it’s time to really start digging into the Biotechs. The short list of the behemoths is coming into line; AMGN, BIIB, GILD, REGN and VRTX. The single outlier on the list so far is CRSP, you know the one risk takers are looking at for that 10X bagger. The only one I ever had that performed in this way was Celgene before it was bought out by Bristol Myers Squibb. That one for me was a 40X bagger, I held it for more than 15 years. Imagine a drug company employing Thalidomide as a cancer cure. All it takes is one good idea . . . coupled with the foresight of discovering it then holding it in your portfolio. I’m an old fashion long-term investor. Blame it all on Graham & Dodd and Warren Buffet. You traders ought to give it a try; it works and you’ll be far less stressed.

So without further ado, here’s a couple barchart.com charts of what I’m starting to analyze. Good product to learn how to use; give me a couple weeks to learn how best to put together the Camtasia tools necessary to teach you from what’s exhibited.

Amgen - AMGN

Biogen - BIIB

Gilead - GILD

Regeneron - RGEN

Vertex - VRTX

CRISPR - CRSP

There’s lots more involved in an exercise of this nature. I’m going to do my best to illustrate the subsets of my work to you so the next time you can do it yourself. Like the old adage “give a man a fish, and you feed him for a day; teach a man to fish, and you feed him for a lifetime”. At The Trader EDU I’m going to show you what tools I use, how I use them then hopefully you can learn how to “fish”.

How about that PYPL? It’s not the move of almost 13% to the downside that troubles me, it’s realizing the same “gurus” and big broker analysts who were singing its praise when the stock hit $300 are now taking it to the woodshed. I remember less than two years ago when some were talking about S&P 500 forward ratios being understated as they passed through the middle 30s heading towards some of the highest levels ever seen. With the “meme” stocks running, you remember those Robinhood gems that all on TikTok were agog over, the ones that had no “ratios”; they had no earnings. They were wrong on PYPL at $300 and they are once again wrong at $66. I guess this means when “they” say “buy” you should “sell” and vice versa. Like anything else I look for consistency; be consistently wrong or consistently right, either one works for me.

Bought some insurance for half of my Japanese Yen position. It’s kind of my way to “cover my ass” if the CPI comes in stronger than expected. I’d rather be safe than sorry and insurance for anything, is often a smart move. I’d like to say it helps me sleep but on days like this I’m usually up watching Europe to get a feel for what to expect in the states.

This is an important month for the CPI. Large monthly increases from a year ago are going to start “dropping off”, be removed from the calculated “annual” number, giving the appearance that inflation is under control. This helps drive the equation that the Fed is done raising rates and the analysis does make sense. The Fed’s established rates would then exceed the annual inflation rate giving credence to a pause. We’re going to find out quite a bit today. The market’s reaction should be far different than what has been exhibited over the last couple trading days.

There’s much more to come from The Ticker and our developing educational side The Ticker EDU. Stay tuned and as always, let me know what you want to learn; I listen.

Hope you enjoyed this post. I’m just a young 68 years old; my Dad became a broker when I was 13. It’s time for me to ‘give back’ to all of you what’s in my head. It’s not always pretty but it’s based on history . . . and history, unchecked, repeats itself.

Everyone learns at their own pace. If you pick everything up the first time through, great but if not email me at david@thetickeredu.com so we can further help. Thanks again go out to Danny www.mrtopstep.com . . . check him out; he’s worth your “click” and thanks to all of you who have adopted what is being created and presented; we’re humbled by the response and referrals. Again, let me know what you want to learn, I’m all ears.

What better way to end today’s post than with Simon & Garfunkel’s “Wednesday Morning 3:00 AM” . . . I was nine years old when they recorded this track. Some songs just stick with you for life just like experience investing and trading; 55+ years is a long time. Trust that what we’re providing is beneficial and you enjoy reading it as much as I do writing it.