Wow, two “oldies but goodies” to kick off tonight’s The Ticker Thoughts, one brought to you by Simon & Garfunkel, the other by Buffalo Springfield and reality. It’s not just what you observe. Quite often it’s what’s missing from what should be happening but for some reason it’s not. It’s information that’s hidden “between the lines” but that’s what I’m here for.

Last night The Ticker Thoughts was kicked off. Thanks for the positive commentary. I will do my best to continue with the “relationship” premise but in reality, tonight it’s not what I’m seeing rather it’s what I’m not seeing, at least not yet but with markets it can change on a dime..

Let’s assume the Fed is going to pause tomorrow. With that being the case, especially with the ECB needing to head higher by 1/4 point, the Dollar should be down against the Euro & Pound; it is. Equity indices are heading higher, run lemmings run, don’t miss being trapped again but someday you’ll learn, then again maybe you won’t, that’s up to you. Copper rallied upward with some I follow looking for the metal to explode to higher levels; soybeans caught a bid as well and why not, these commodities trade in an inverse pattern and manner to the Dollar. So that’s what happened yesterday all but confirming that the Fed is going to take a break. So what’s the point, you ask. The point’s that two important contracts didn’t react as they should, perhaps because of an extraneous force I’ve been talking about for quite some time; China, China and China.

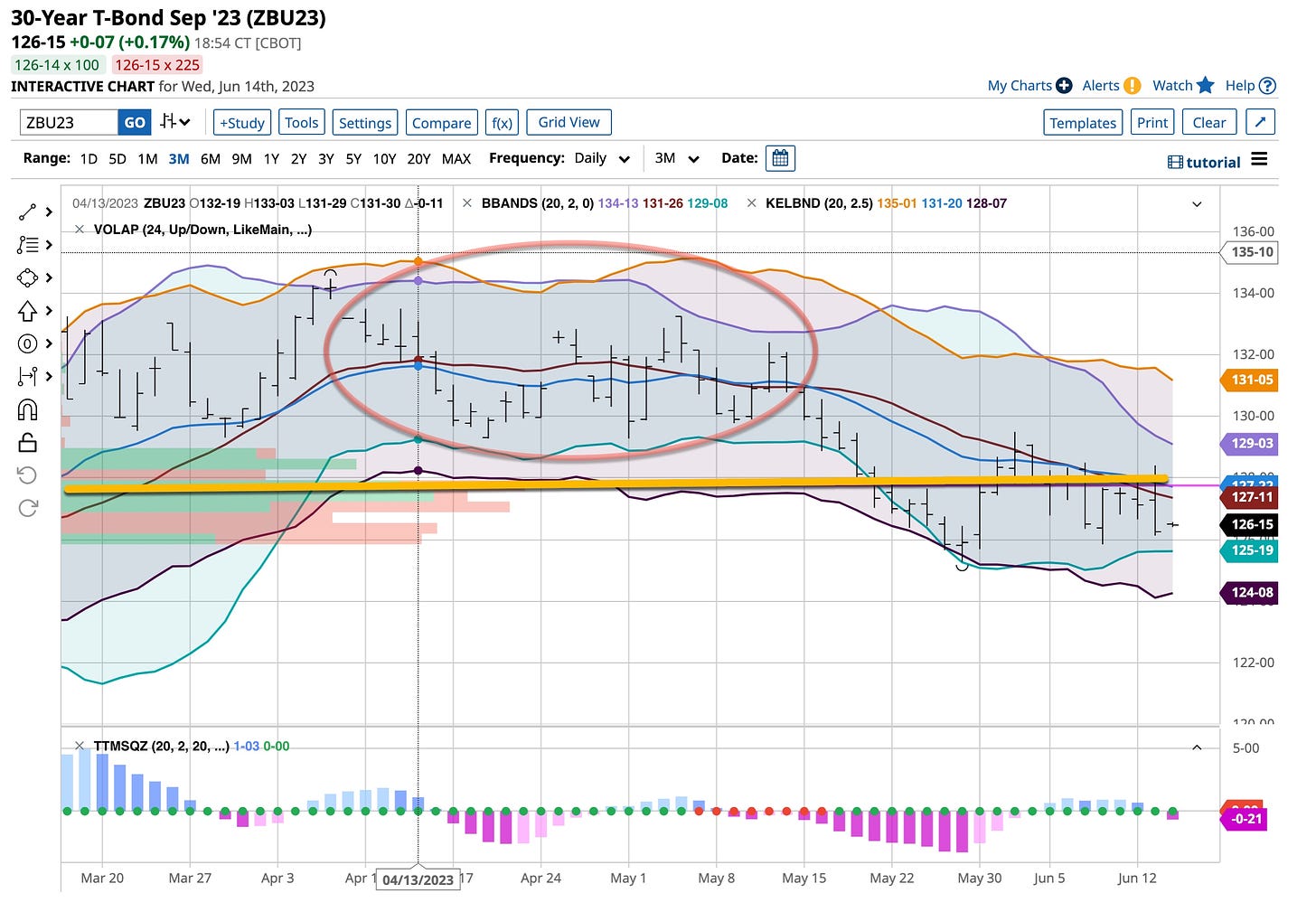

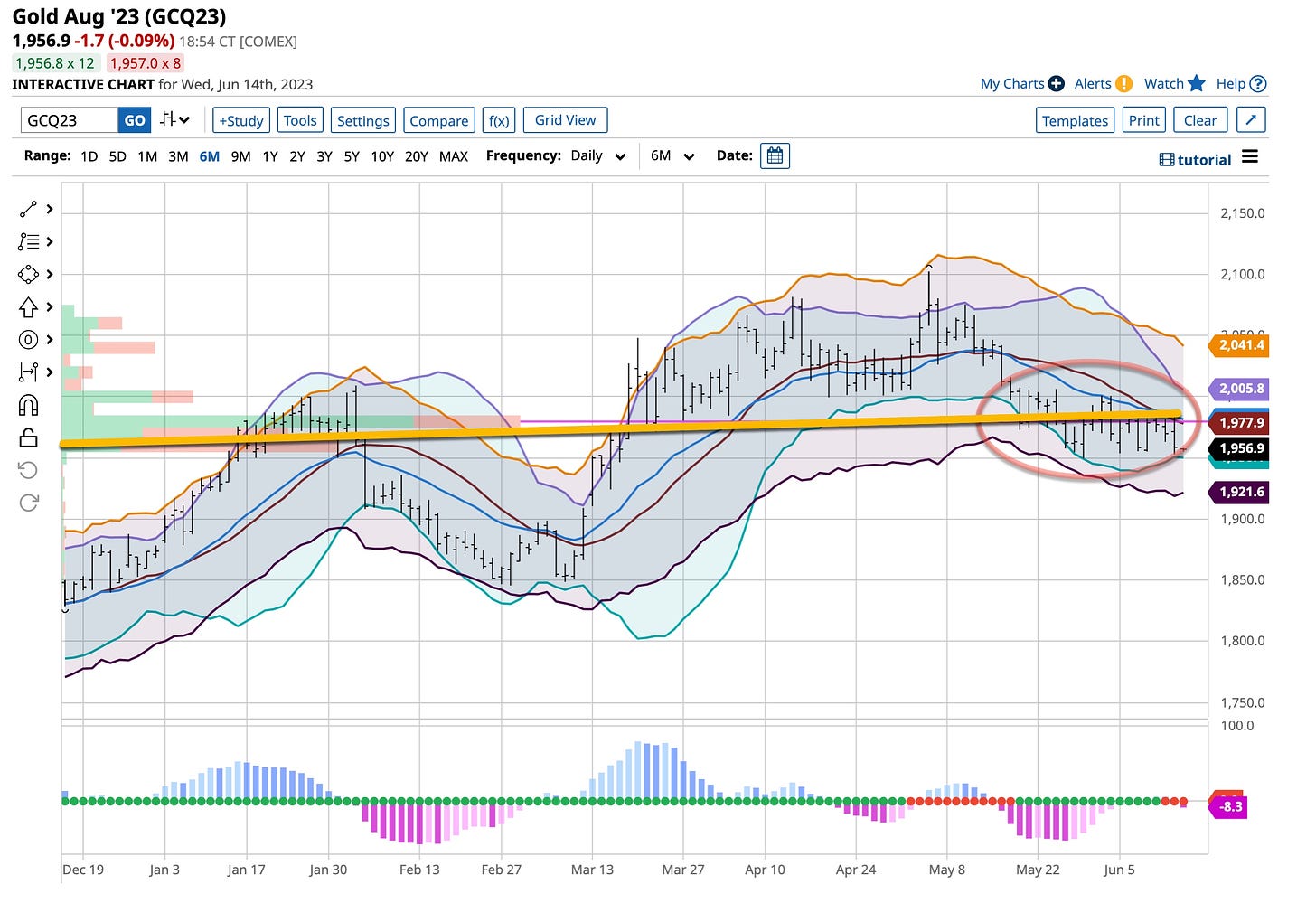

One would expect different action in Gold and the 30-Year Treasury to be consistent if the Fed was about to “roll over and play dead”. However it’s Gold and the 30-Year that are playing dead. It’s not always what you “see” that’s controlling outcomes, it’s often what’s below the water line and in this case it’s China; they’re broke, simply lowering interest rates isn’t going to solve their problems. Remember deflation is a death knell to economies and China is heading that way. Looks like COVID backfired. So what do they have “up their sleeve”? They hold in excess of $1.0 trillion in US government debt and from what we’re told, a very large “pot of gold”. Maybe down deep they’re Irish.

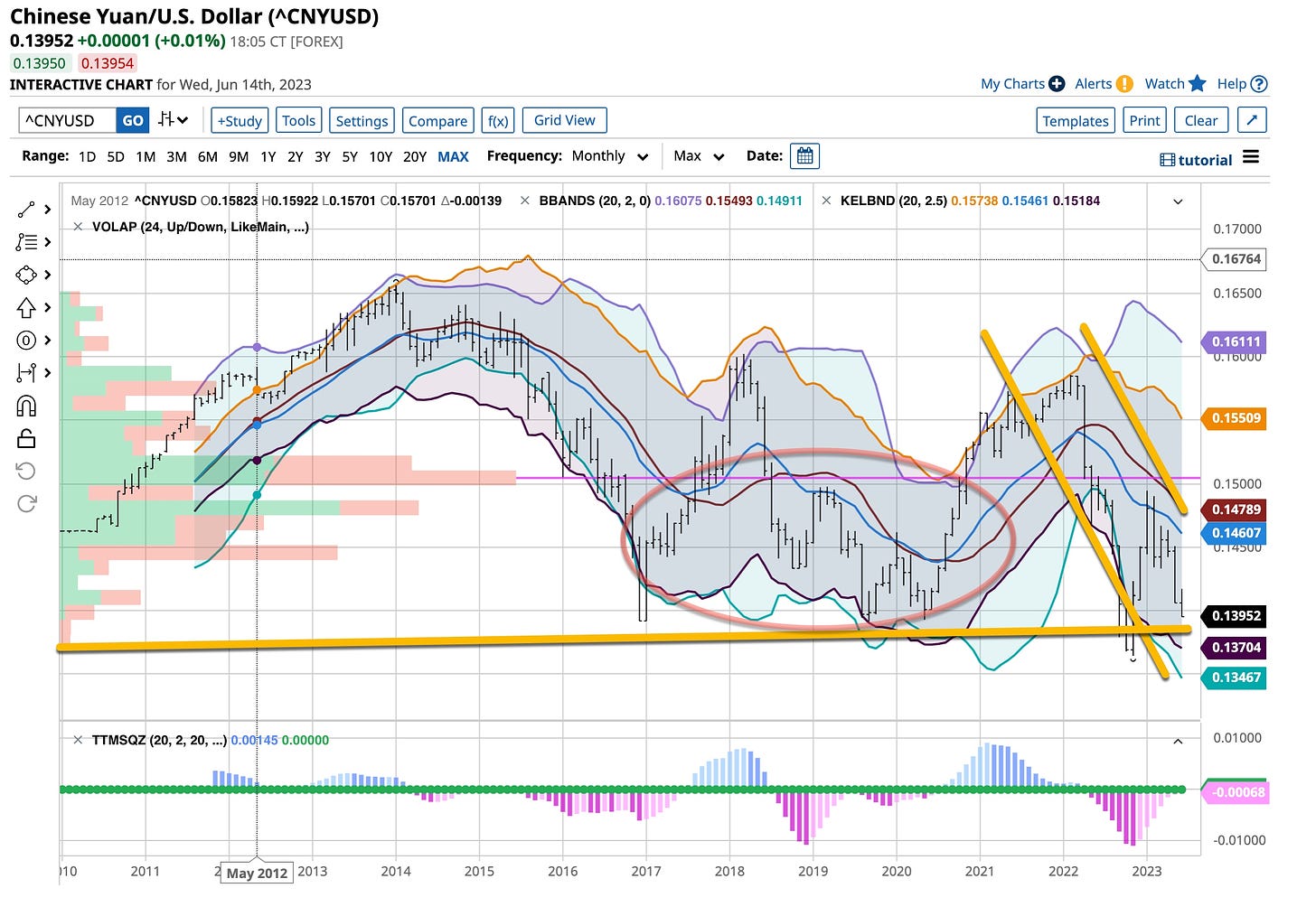

Oh, and by the way did you see what the Yuan did yesterday, albeit against a falling US Dollar; take a look; it fell like a proverbial rock. Selling Dollars for Yuan right now gives China a pretty sweet exchange rate. Maybe that is why Gold and the 30-Year didn’t react as anticipated yesterday but don’t worry, we have Janet Yellen at the helm. I’m sure she, Powell and the “big guy” are well prepared for the Chinese to dump their holding in US debt and gold, aren’t they? Yeah right, the next financial crisis is right around the corner, like always, the “powers that be” don’t have a clue, let alone a plan, how to handle it. Besides, Joe Biden’s become more like Alfred E. Newman from Mad Magazine fame; he’s already “cashed out” with respect to China so for Joe the quote “what me worry” is quite appropriate.

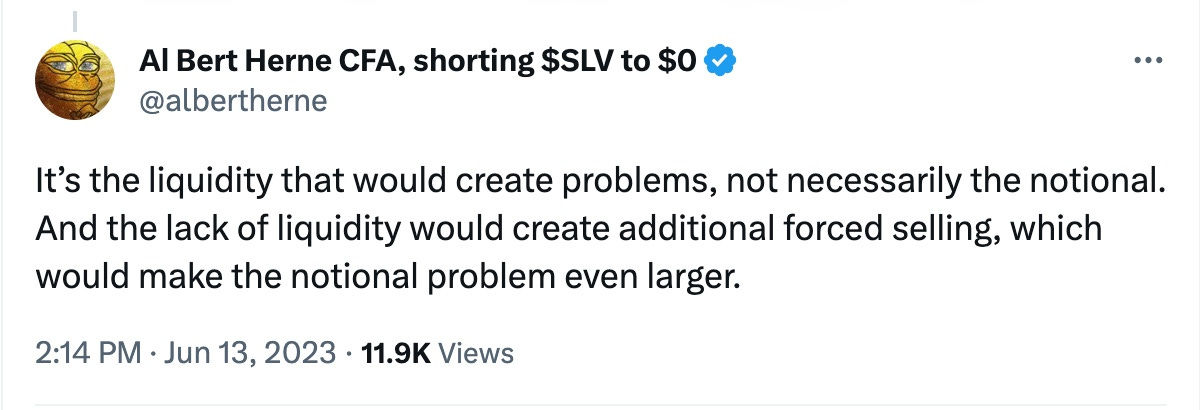

So as I joke with my friend Brandon Donahue, “hey Juan, say bye bye to the Yuan”. He just sent me this tweet from Twitter from someone he follows. Brandon’s been helpful to me from the start with my prognosis on China; thanks buddy, enjoy the T-shirts; by the way what “vowels” did you buy?

That’s it folks. I stayed awake this long but tomorrow is a pretty important day. Powell is stepping up to the plate, Yellen’s standing on the pitcher’s mound and the “big guy” is down crouched behind the plate with Merrick Garland calling “balls and strikes”; we’re screwed again, right?

Hope you enjoyed this second in a line of many nocturnal The Ticker Thoughts post. Paint is drying a little faster tonight but it’s getting tougher to cover up the “cracks”. I’m just a young 68 years old; my Dad became a broker when I was 13. It’s time for me to ‘give back’ to all of you what’s embedded in my head. It’s not always pretty but it’s based on history . . . and history, unchecked, repeats itself as you are witnessing.

Everyone learns at their own pace. If you pick everything up the first time through, great but if not email me at david@thetickeredu.com so we can further help. Again, let me know what you want to learn, I’m all ears.

Two for the “price of one” song wise leading off with Simon & Garfunkel and ending with Buffalo Springfield. They’re both making their second appearance on The Ticker but like everything else, history repeats itself when the time is right. Chairman Xi let’s hope you’re not looking to be the next Herbert Hoover; I’m starting to see many of the same problems that preceded our very own Great Depression of the early 1930s start to roll out in China. Let’s hope I’m wrong but if I’m not, at “3:00 AM” there just may be “something happening here”.