As Emily Litella often remarked, “it’s always something”. The market seems to be a bit “overbought” but that’s been the touted rhetoric for quite some time especially related to the Artificial Intelligence (“AI”) arena. What goes up must come down. The overall question that needs to be answered is when.

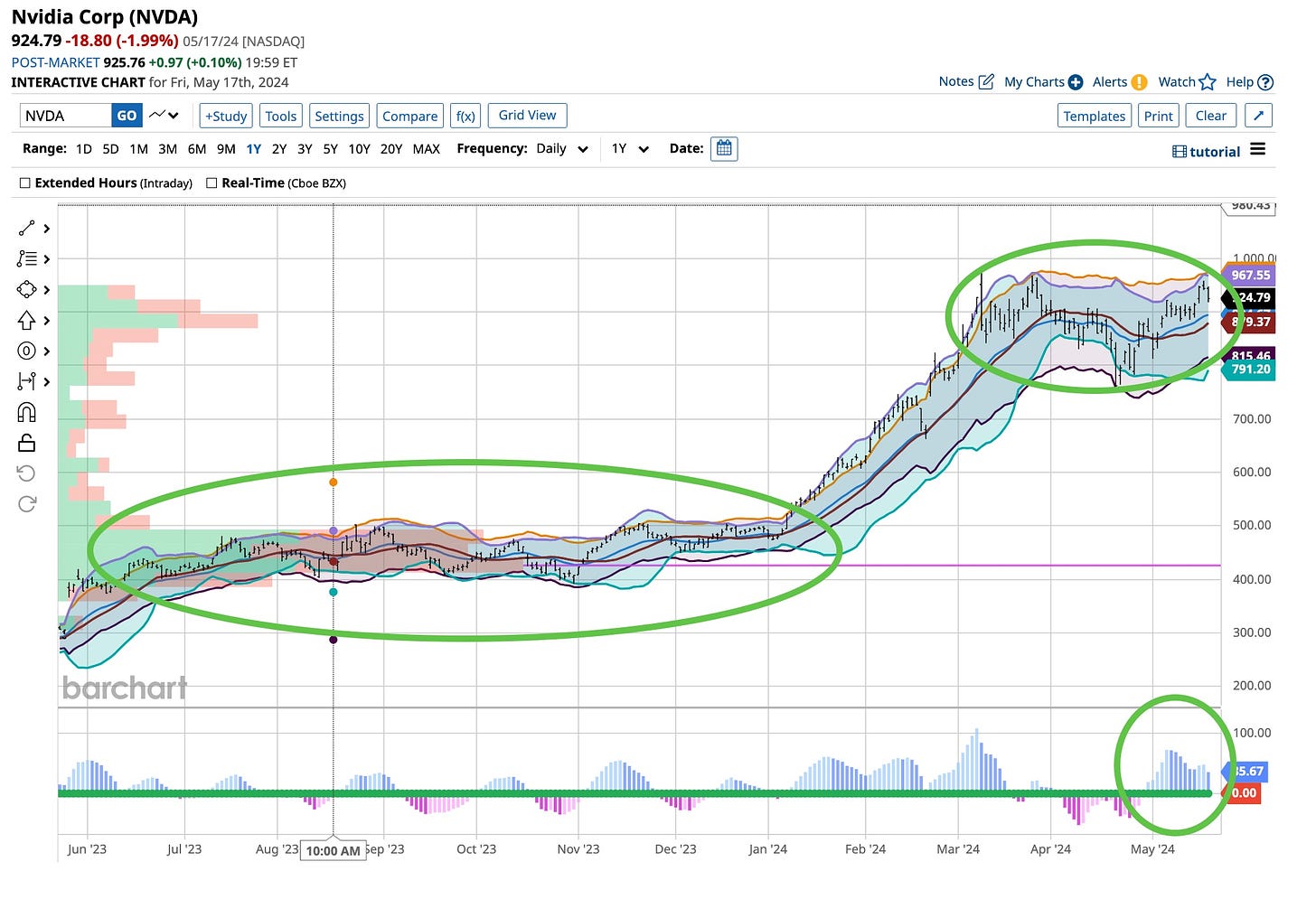

Nvidia (“NVDA”) is having a great year with shares up 86.74% crushing the S&P 500 index's 27.52% return. The stock's longer-term performance is even more stunning. A catalyst that might propel Nvidia stock higher is coming this Wednesday, May 22nd, after the market close. That's when it’s scheduled to release its results for its quarter ended on April 28th.

Expectations are high and built into the stock price. For the stock to rise the company will likely have to beat street estimates for the quarter and issue guidance for the next quarter that's notably higher than analysts are projecting. What do you think?

Nvidia’s seems poised to beat estimates do to management "visibility." Good visibility into near-term sales in its data center business is important. It's because a backlog of orders to fulfill, due to demand being strong for its AI-enabling data center chips and related products, appears to be real. We’ll soon find out.

The better management's visibility of near-term sales, the better its overall near-term financial results. Nvidia's savvy top management team set fiscal Q1 guidance at levels it feels very confident the company will exceed. Analysts have grossly underestimated the company's growth potential for years. My bet is that this will continue. The recent quarterly reports of “several” of Nvidia's biggest customers like Facebook parent Meta Platforms, Alphabet and Microsoft are continuing to ramp higher, a huge positive for Nvidia and something that should continue.

For instance, Meta now expects its full-year 2024 capital expenditures to range from $35 million to $40 million, up from its prior plan of $30 million to $37 billion. This is due to it continuing to accelerate infrastructure investments. Throw in that the street is talking about a potential NVDA “split” and the table is set. The question remains as to what’s the best way to “play” this upcoming earnings announcement.

Short Term Options Are Available & Active

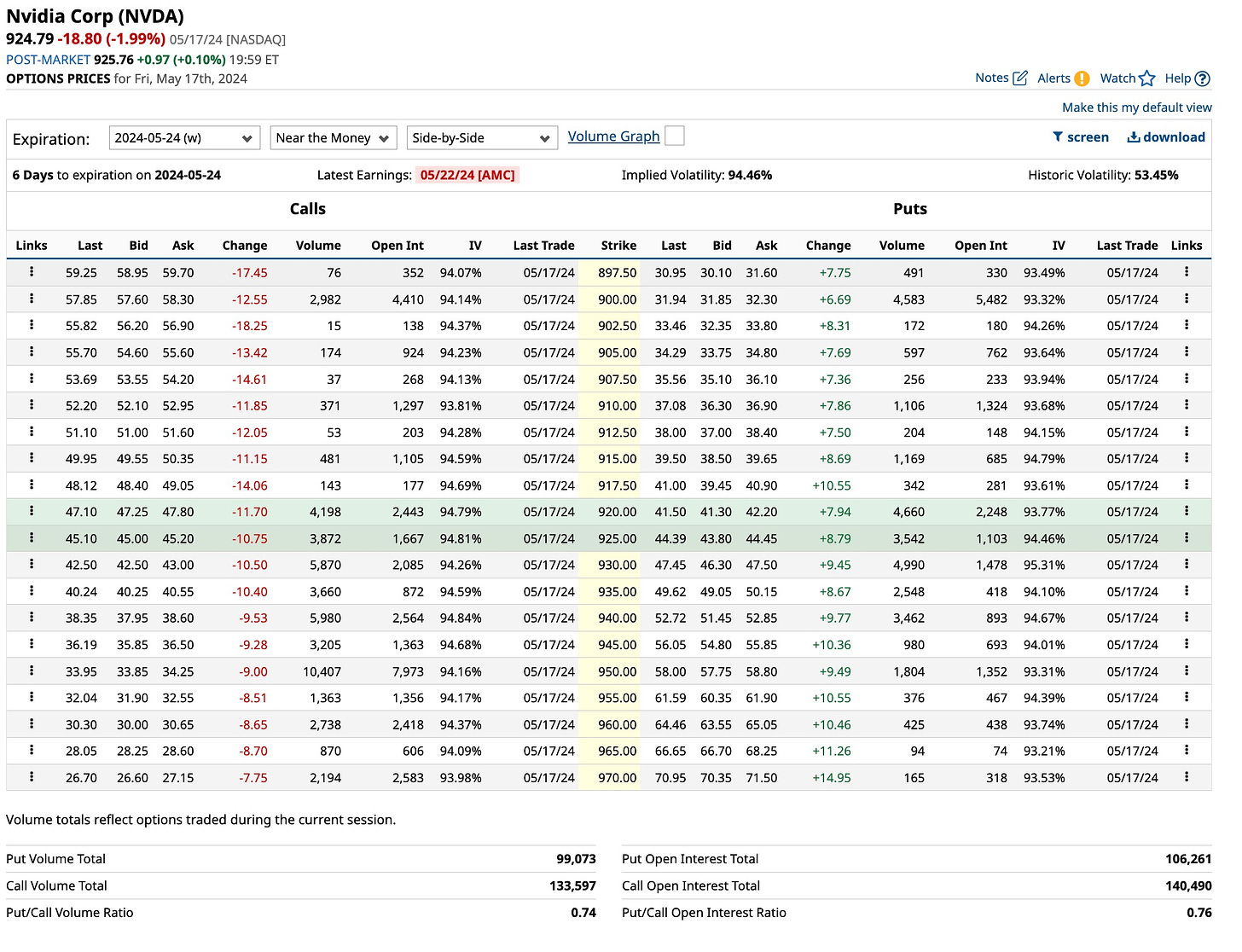

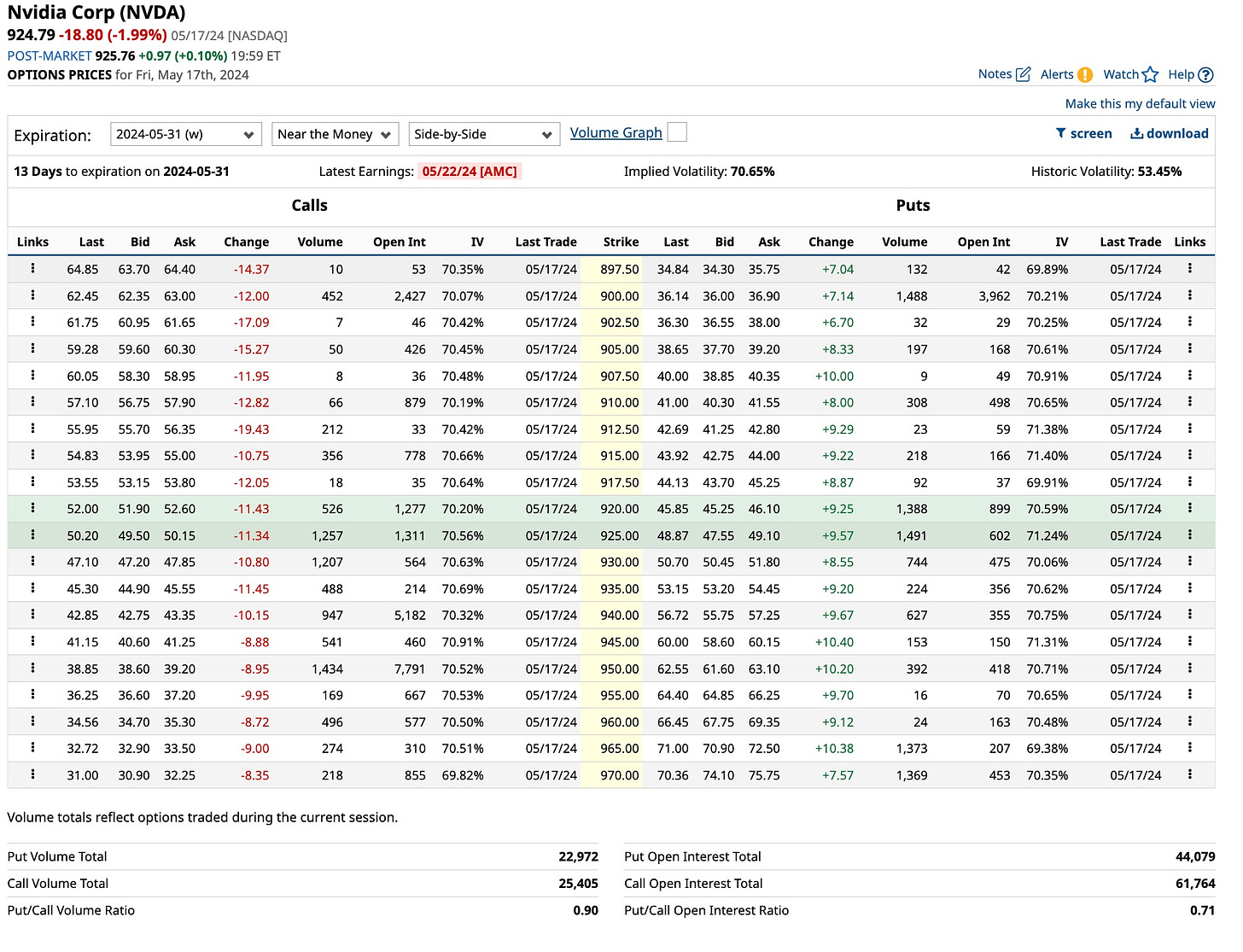

Nvidia’s options, especially the shorter term ones, are some of the highest traded. The daily volumes normally approach or exceed 5,000 contracts daily so the marketplace is very liquid. That’s very important.

The premiums are excessive for most, upwards of 5% with implied volatility of 94.46% for the options expiring on Friday, May 24th. Options expiring May 31st is 70.65%. All traders need to take this into consideration regardless of the direction you expect. The potential permutations traders can take are voluminous. To keep it more simple let’s look at just a couple of the basic strategies.

I Think It’s Going Higher Or Lower

With this strategy, a trader thinking that the report will be “positively” received, will buy call options. If they’re right and they are nimble traders, these call options should increase in value. If a trader thinks the report will be negative, they’ll but put options. If they are right and the stock reacts negatively, they’ll profit if the stock crashes. But there’s another way, play both sides.

Uncertainty Rules Buy Puts & Calls

I’m a hedger at heart and the following trade is how I would react to this situation. I’d buy both the puts and calls, five to ten points “out-of-the-money”, more likely options for the May 31st, or later expiration than not. Either way, I’ll probably wait until right before the market closes on Wednesday, May 22nd to decide. Stay tuned and look for a post on LinkedIn around that time to see what my final reaction is.

Through my graduate school, I’ve been an active participant in Artificial Intelligence. Through Nvidia’s beta program and more, AI’s been a very important and useful part of my life. It should be part of yours. If it isn’t, get started before it’s too late.

In 1982 The Fixx released “One Thing Leads To Another”. It’s true and the advice is as strong today than it has ever been. While the world spins on its axis, ‘change’ is always apparent and something you must keep up with. The introduction of the Internet was a very important one and so is Artificial Intelligence. From my perspective I just need to address the future and ask, “what’s next”. I’m constantly evaluating this world as I watch it spin. What will AI lead to? I’m not sure but something will follow, perhaps not in my lifetime, but most certainly it will in yours.