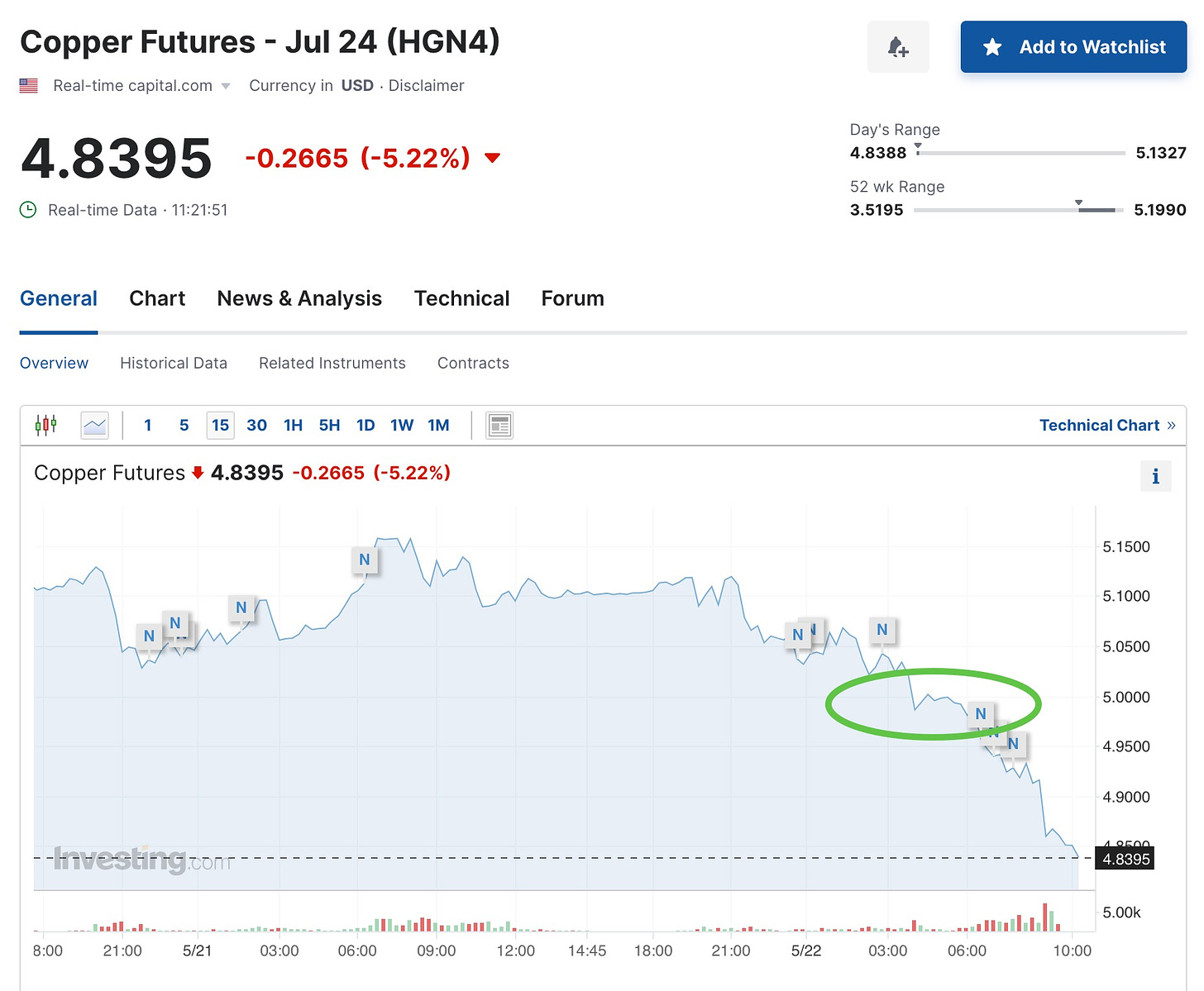

I can preach until I’m “blue in the face” but if you are not listening or reacting, it all falls on deaf ears. My regular tutorial clients have complimented my use of stop orders in particular trailing stops. Such was the case overnight with Copper. A solid profit was booked and now I’m just waiting for a price to enter again. I hope you all were listening. If not this time, consider using trailing stops in the future.

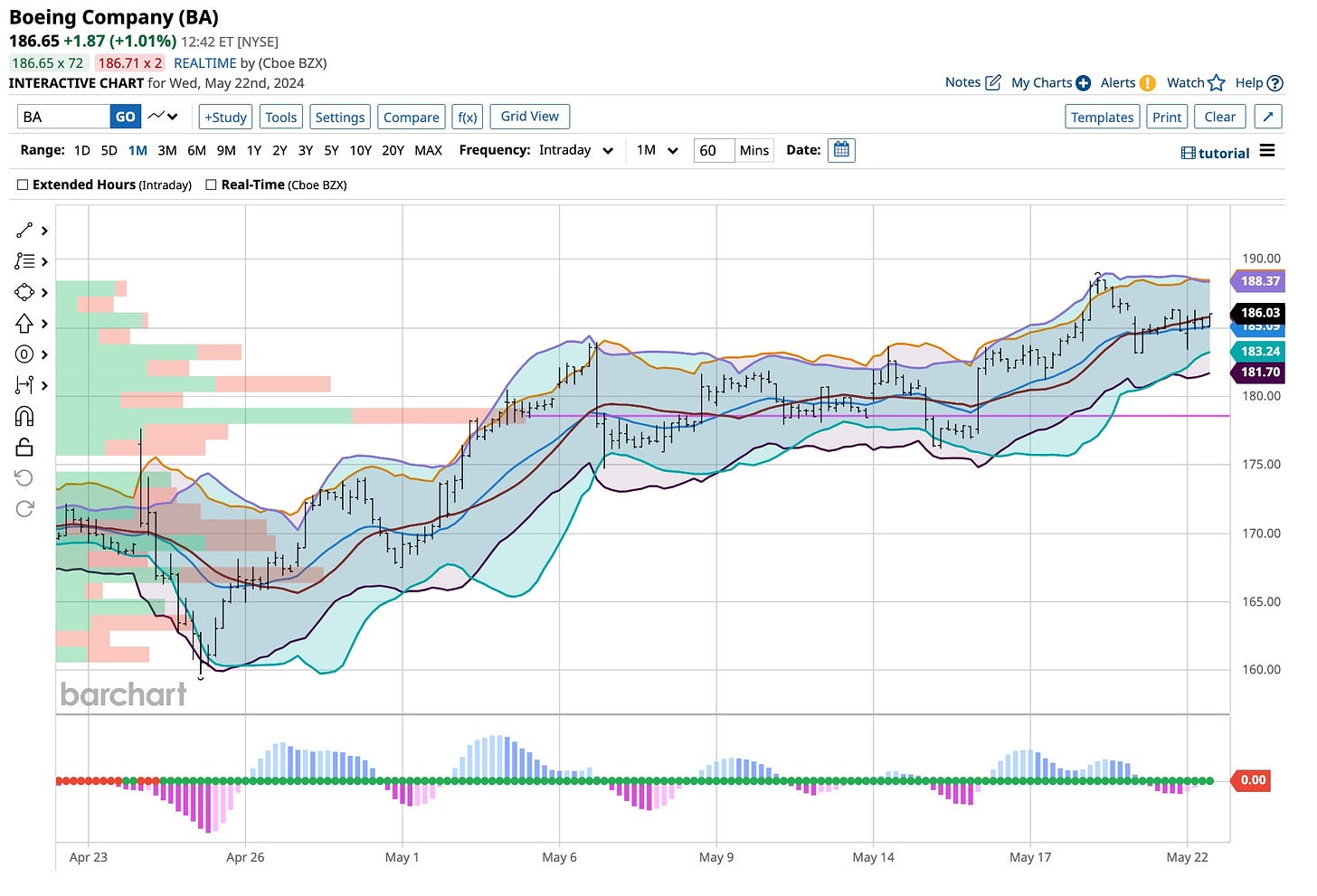

Boeing Is Ripe

I don’t like too many “players on the street” but I have to agree with what TD Cowen's latest note suggests about Boeing (“BA”). They properly recite that while Boeing “may face a challenging second quarter, a strong recovery is anticipated in the latter half of the year”. OK, I’ll buy that but let’s look deeper.

Boeing's productivity enhancements will substantially increase free cash flow to about $10 billion by 2026. It’s next quarter will “underperform” market expectations due to sporadic 737 deliveries and ongoing production issues. Management has warned that deliveries would be "sporadic" and "lumpy" until mid-year. It looks like the internal “powers that be” at Boenig told the truth. About time, eh?

This quarter’s delivery numbers will be lower than the first quarter’s and, as expected the estimated revenue will come in light as well. Cash outflow is expected to reach $3 billion however and this doubles what the “street” is looking for. Until TD Cowen hit these points head-on, no one else was forecasting solid cash flow. Cash is King as our friend Andrew Carnegie said, “Cash flow will dictate my business”. He’s right again.

TD Cowen forecasts a "hockey stick" recovery in the second half of 2024. The delivery of "clean" 737 fuselages will increase Boeing's overall productivity and delivery rates will improve significantly. They believe Boeing will achieve a total delivery rate of 38 aircraft per month by the end of 2024. One can only hope but for now, I’ll believe that they know more than me like everyone else. I’ll just pick ‘em.

Like TD Cowen, I’m optimistic about Boeing's long-term prospects. Significant gains should begin in the latter half of 2024 as ‘production’ processes stabilize and strategic initiatives take effect. There’s light at “the end of the tunnel” and it’s time to buy. How about you? What’s your thought?

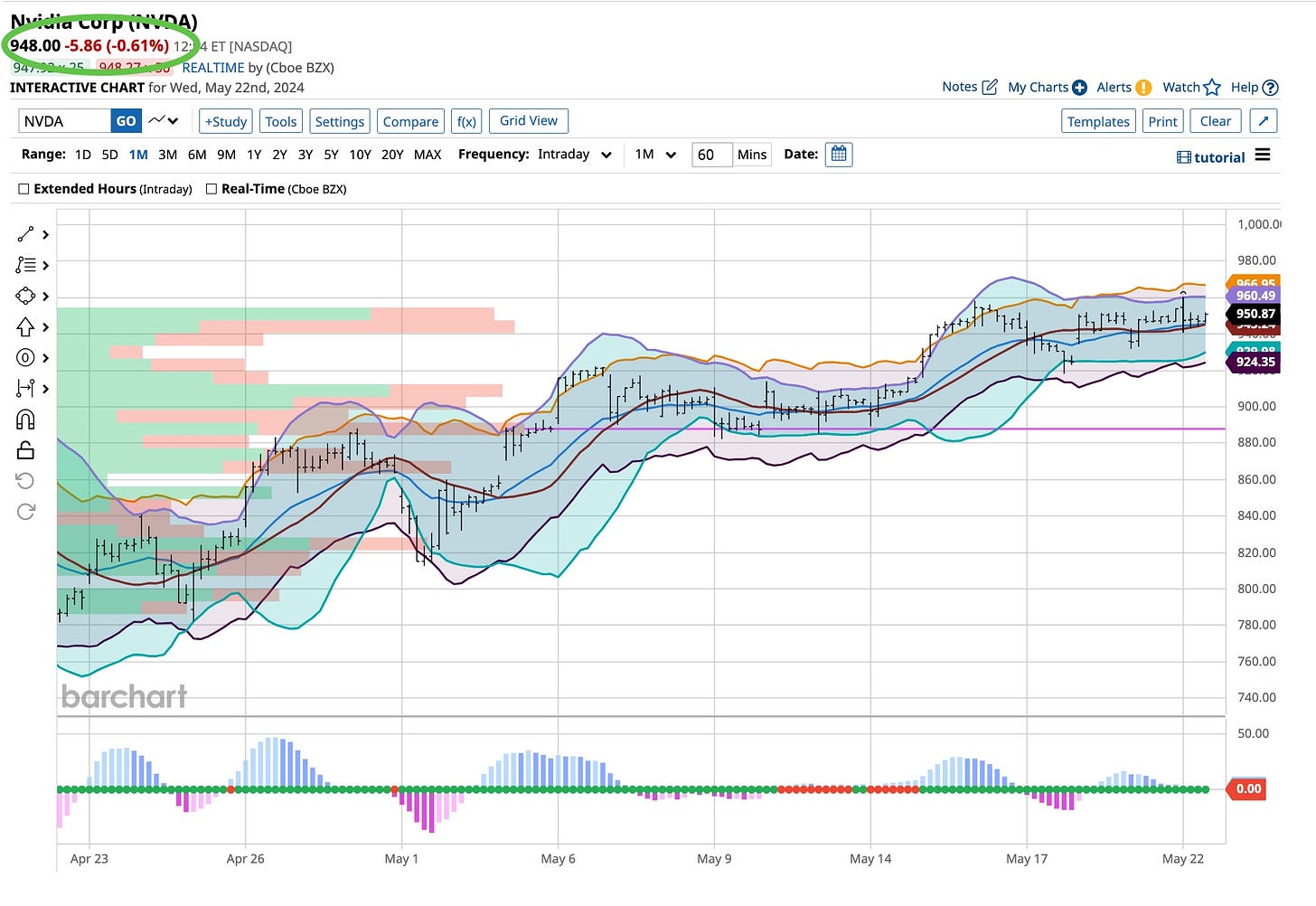

It’s Nvidia Time

I wrote recently about a couple of things. First, Nvidia reports its earnings after the market close. Second, this is the week before Memorial Day so books are thin, and just about anything can happen. With these in mind, here’s my thoughts. Remember, you are not just unique you are smart enough to do your due diligence. How I act may not fit your plan so think for yourself.

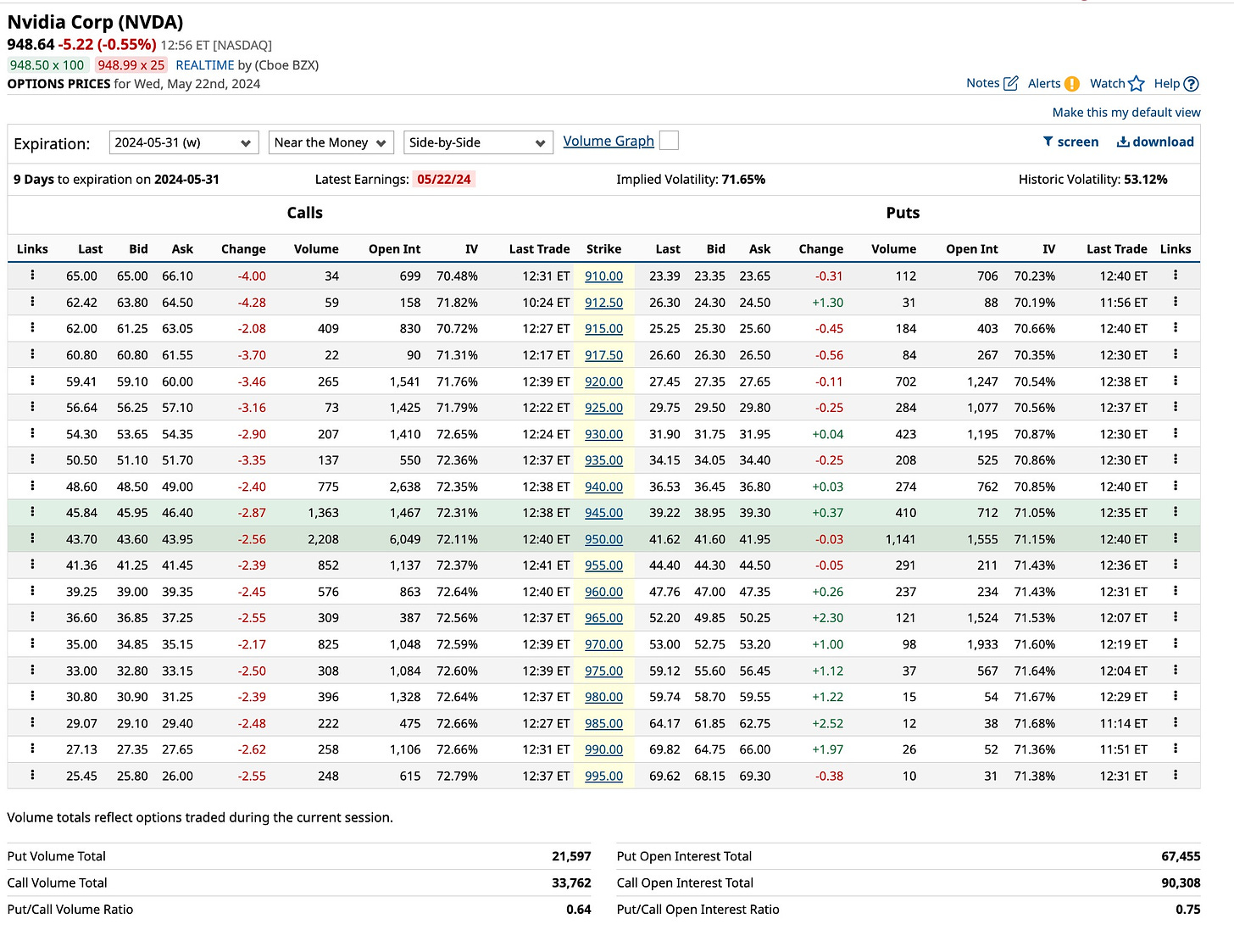

Late last week I bought 2024 May 31st Nvidia calls. I’m up quite a bit on those calls so I’m going to protect myself and my profits by buying the 2024 May 31st Nvidia puts at the same strike price as the calls. Then I’m going to watch, just like you.

If you are sitting naked on this announcement, I suggest you buy both “puts and calls” on the 2024 May 31st Nvidia option series slightly “out-of-the-money” for each. Use the May 31st expiration versus this Friday’s expiration unless you are a risk taker. I’m not but maybe you are. Remember having a plan is important. Sticking to that plan is more important as is consistency. Being consistent is our “watchword” and it should be yours as well.

While Nvidia remains a solid AI tool, several tech stocks offer compelling investment opportunities amid the current rally. Investors are looking to diversify their portfolios with high-potential tech stocks. I’ve picked a couple out to consider and will feature a few of them this coming weekend in a “paid” article. Each company is well-positioned to capitalize on industry trends and technological advancements, particularly in AI, making them attractive choices.

I don’t care what you call him, to me he’s Cat Stevens and he’ll always be. That’s who I grew up with. His song “Wild World” fits today’s scenario. Not just because Nvidia is going to report, no, this world is simply upside down. From the “Trump” trial to the actions taking place surrounding the Middle East, what’s happening today is different than what I’ve experienced in the past. Certainly ‘times change’ and people’s opinions change with them but the laws, both here and worldwide are simply “out of order”. All I can do is sit, watch, listen, and above all vote. I suggest you do the same.