Over time, I’ve opened an important channel to you in the investment world, options. It is important to understand the basics before delving into the intricate strategies we use teaching you how to employ these techniques. Most are found in The Ticker basic courses, in particular the “mortar” section. We go in-depth in our “1-on-1” tutorials as that’s the only way to handle the education we provide. Regardless, today we’re going to dig into the basics where expectations meet reality and ensuring performance rules.

Dollar General Reports Earnings

A while back Dollar General was selected as a “brand name” turnaround investment. I take great care in selecting stocks of this nature. First, the stock’s selling at a discount to what’s considered to be a “normal” price. Second, errors in judgment often created this opportunity. The balance sheet and other ratios are in line and the management team needs to be seasoned. While we depend upon several services to identify those stocks selected, we continually revisit these ratings as things change. Dollar General is no different than others and we have two eyes and two ears on it.

Consensus estimates for the first quarter ending March 31st are $1.57. The “whisper” number is slightly higher but only $1.63. Revenue should hit at around $9.85 billion. None of these numbers are earth-shattering and the overall price performance of the stock since its last report is down about 10%. If you followed our actions back then it is not going to surprise you that we’re taking the same action now.

Before the last earnings report, we bought short-term put options “at-the-money” and sold slightly “out-of-the-money” two to three months calls to pay for the put purchase. It worked out pretty well. The puts were harvested after producing a solid return with the calls expiring worthless. Given the stock is down 10% since its last report, with the use of insurance, buying puts, and selling covered calls, we did not miss a beat. Dollar General’s performance has been very good to us.

So What Are We Doing Now

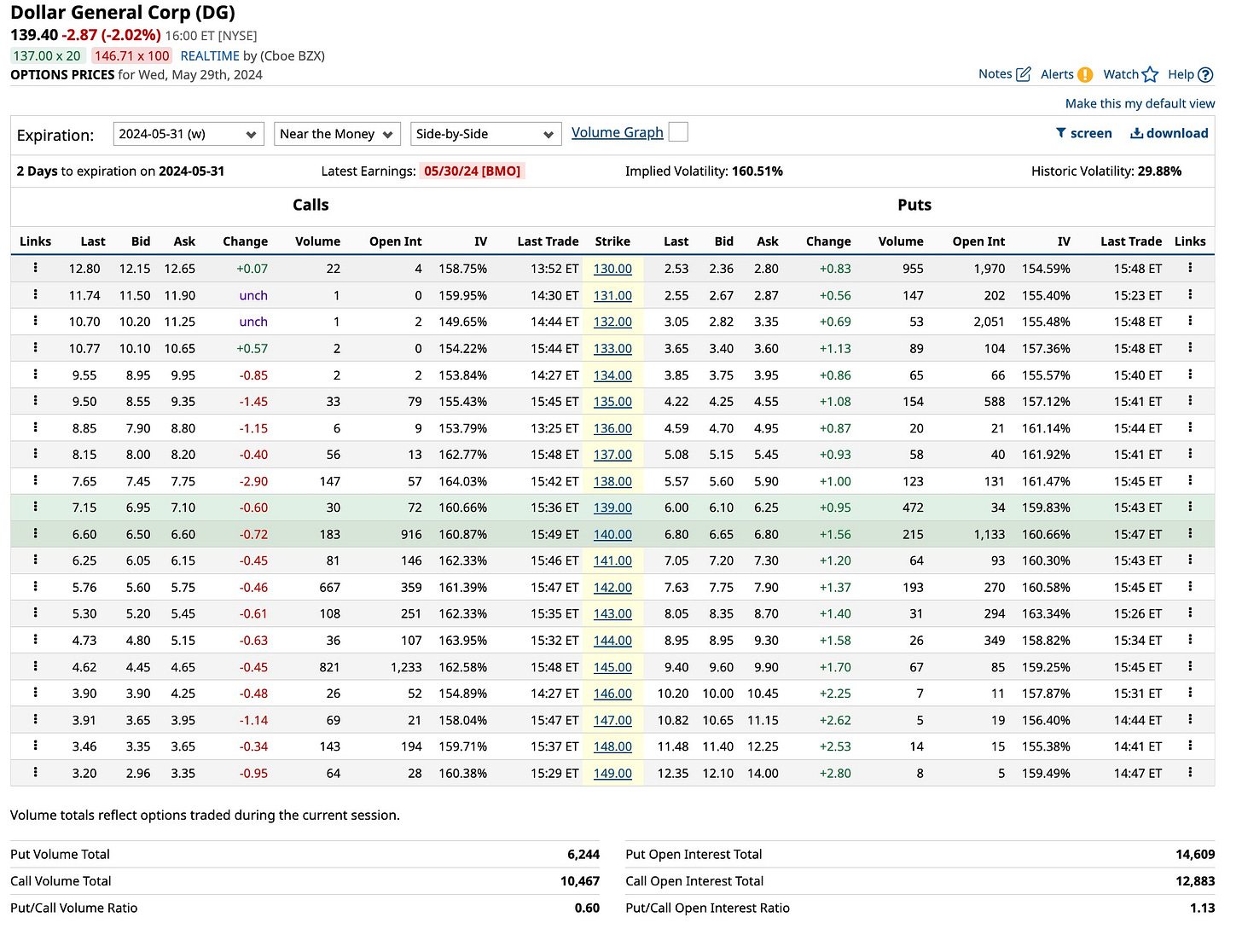

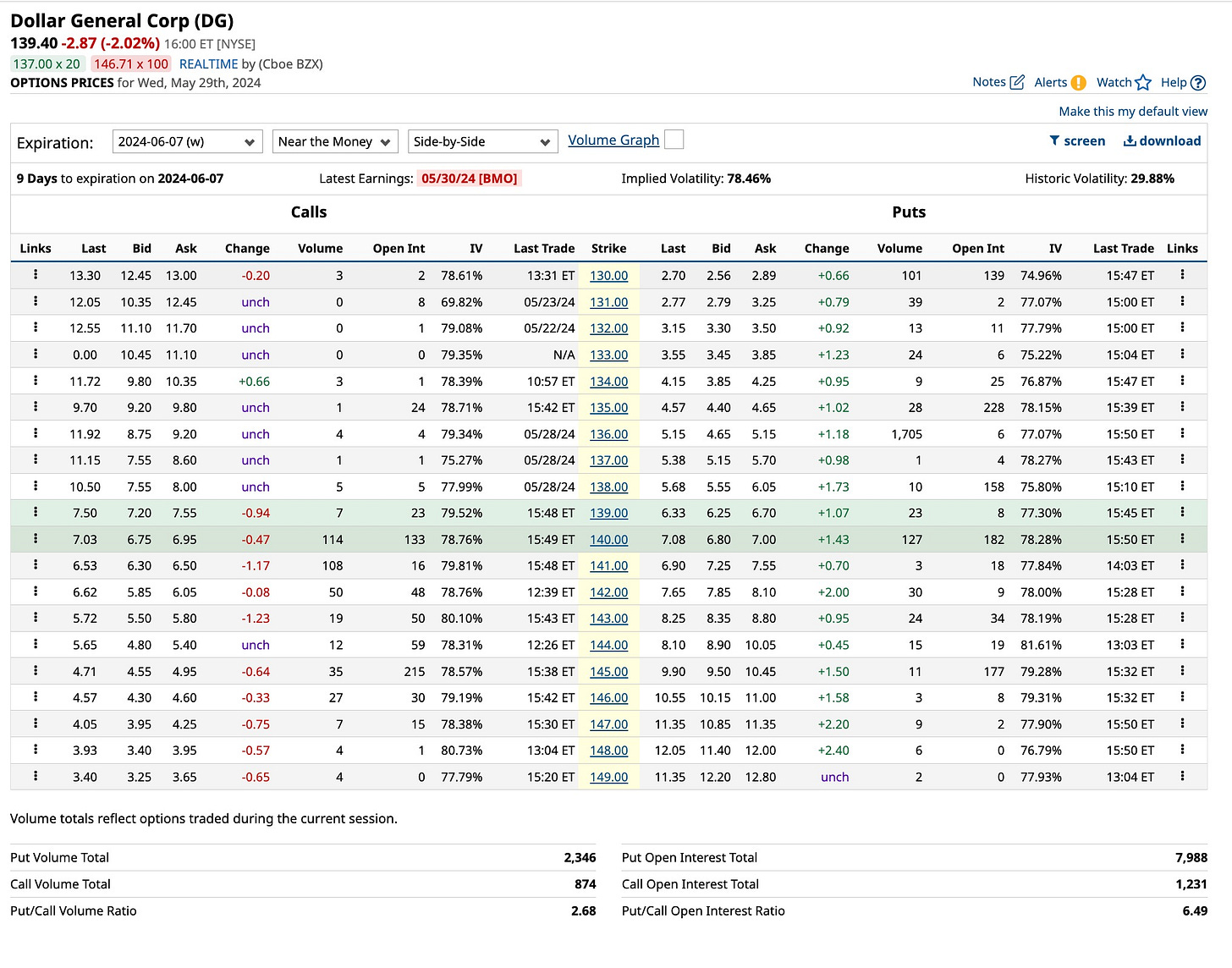

Funny you should ask. We did the same thing at today’s open but at lower prices. We stuck with buying short-term “at-the-money” put options expiring Friday, May 31st & June 7th. To cover the out-of-pocket cost of purchasing this insurance, we once again sold covered calls above the current market price but lower than the last set of covered calls we sold three months ago. There's no reason to extend expiration to more than two to three months so we essentially executed the transaction exactly as before.

Remember two things. First, stick with the options that have the largest open interest. Second, work with the “option contracts” exhibiting the largest volume. If the stock goes up after its report we’ll lose on the puts but that’s OK. We will make it back on the stock price moving higher. If the stock runs higher, assuming “future” statements are strong, we’ll be happy to sell, or deliver shares at a higher price where “covered” calls were sold.

We do not have a crystal ball so just like you we are in the dark. We have made 30%+

in this transaction and want to protect that gain. In the same breath, if the stock goes up, we’ll be happy to harvest our trade at these higher prices. Again, we do not know so we’re going to “hedge” the report as discussed. If you’re long Dollar General please consider following our actions and do the same.

In 1968 Tommy James & The Shondells released “Crystal Blue Persuasion”. It was a hit then and today, it’s a classic. No one knows what tomorrow will bring. That’s why it is important to do your homework. There’s no excuse for not doing your due diligence. I do it every day but that does not mean I’m going to act on everything I research. More often than not I “sit on the sidelines” and just wait. Patience is not just a virtue, it’s a key to success. So is hedging. Many people associate hedging with commodity futures. We do as well, using these derivatives and other derivatives on derivatives more often than not like an insurance policy. Nothing goes to the moon. It’s best to protect what you own and control.