Here, on LinkedIn and in The Ticker Free Community, the results of “common sense” are always posted. Sometimes it is very important to “drill” this information into that space “between your ears” where it matters most. Today’s article does just that.

Brand Name Turnarounds Take Time

Far too often traders and investors are looking for the “big one”. You know, the ones that go up 100% or more in a short period of time. It doesn’t happen too often and if you do hit one realize, it’s luck. It’s not what we look for and neither should you.

What we do look for is “brand name” turnaround candidates that over time will ‘right’ their ship and chart a viable course going forward. Disney (“DIS”) is an entity and we identified it. We own a significant number of shares in the couple Roth IRA accounts managed slightly below $80 a share. Despite Disney’s recent decline we’re up slightly less than 50% because of our use of options.

Options are our friends and they should be yours as well. We use options to “increase” the “income” received in the portfolio and to protect our investment during events as was witnessed this morning. Again, while we teach you what to do it’s important to follow what we preach and actually talk about it and show you.

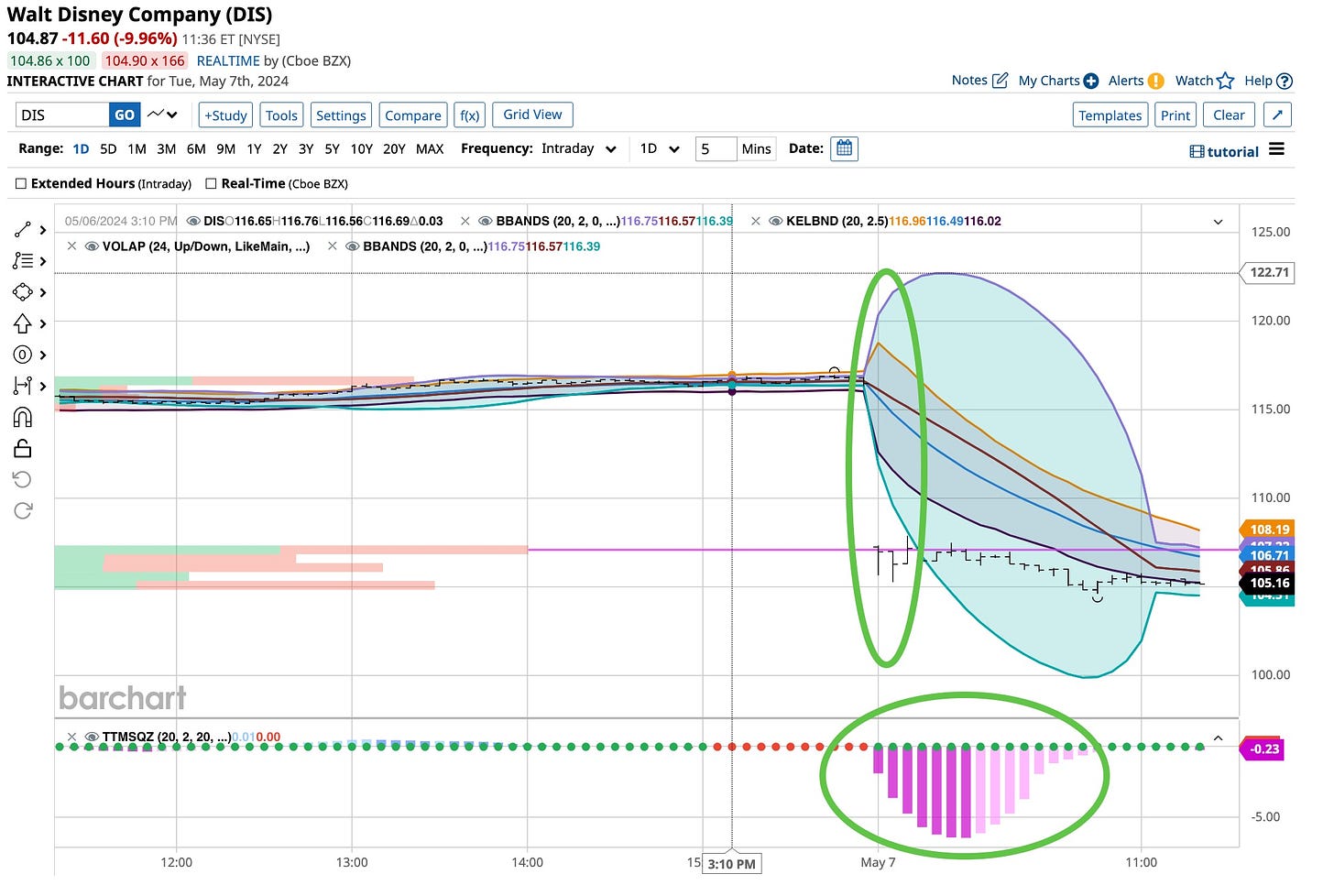

When Disney stock hit $120 we reacted. We sold “covered calls”, the 2024 June $130 & $140 calls to increase income. If the stock rose to either level it would have been called away from us. That’s not a problem but it didn’t. More than likely, the entire premium we received will expire worthless and we’ll book it all. Not too shabby, eh?

Now take us to May 7th when the stock was trading around the $116 level. It was time to protect our assets against the real potential that the “street” would react negatively to Disney’s earning report. We bought 2024 May 11th slightly “out-of-the-money” put options and protected our gains. Right again, the stock got killed but we didn’t. Using “short term” put options in this fashion protected us on the downside. 2024 June calls premiums declined but the put premiums increased significantly. We’re in a position to either “put” our stock to those who sold us the put options or simply sell them and book our profits. We have a couple days to decide so we’ll do what we do best, watch.

If I were running the company, I’d realize that Disney is a “real estate” company. Any segment of the company not involved in this sector should be divested but who am I. I would love to see management adopt a strategy of this nature and sense that is exactly what’s being considered. I’ll sit on my hands and wait for them to come around.

Boeing Is Next

I love “brand name” companies that, for one reason or another, have just “fallen” on a series of hard times. There’s no better example of this than Boeing. Boeing, one of the most prominent names in aerospace and defense today has been influenced by various factors, market sentiment, global economic conditions, geopolitical tensions, and the company's own operational challenges.

Boeing's sensitive to developments in the aviation industry like orders for commercial aircraft, changes in air travel demand and regulatory issues. The grounding of its 737 MAX aircraft following two fatal crashes had a significant impact. Overcoming these current challenges requires substantial efforts in terms of safety upgrades, regulatory approvals and restoring customer trust.

That’s what has brought the stock down to today’s level. In our book it’s time to start to buy the stock. We do that directly. We use options to reduce our price of acquisition as well. Boeing has been trading around the $165 to $180 level. We want to buy shares so we use “naked” out-of-the-money put options, close to expiration to accumulate. If the stock goes up, that’s fine with us. We get to keep the put premiums as they expire “worthless” and use those proceeds to buy 2024 September $200 to $210 call options as we expect others, like Warren Buffett, have their eyes on acquiring the company.

While our position is small it’s growing. We want to buy as much as possible at prices as low as possible. We’re patient as having patience in this investment world s critical. I trust we’ve drilled that into the “space between your ears” enough that you are too.

I have more on my plate than expected but that’s a good thing. To the tens of thousand people that follow The Ticker thanks. We’re doing our best to keep you informed and to teach you what we’re doing as we do it. With Substack, LinkedIn and now with The Ticker Free Community we’re accomplishing that goal and it’s “free”. Making sure we get the message out to y’all is taking up our time. Answers to our questions about how to do that are coming to fruition. Thanks for your patience and thanks.

The Who released “Tommy Can You Hear Me” in 1969. I was listening then and y’all should be listening to me today. Look folks, this is a labor of love. It takes a lot of time to decide niot just what to teach you but how to do it. As much as possible we want to give you what we’ve experienced for “free”. Many of you have asked for and started to take our course where we each the “foundation - bricks - mortar” topics to help you to become the “best damn investor or trader” you can possibly be. Everything that’s good takes time and we’re no different. Keep listening and thanks.