Trump was convicted. Was there anyone out there who expected a different decision? This is an election year. Democrats have sought a way to dispose of Trump for almost ten years. Congratulations are in store for them, I wish them well. It’s now time to get down to business and watch, listen, and react to what we see, hear, and witness. From five miles up there’s a situational analysis that must be considered here. Trump is now defined as both a felon and a victim. This is a strategy that benefits both parties. How it rolls out remains a question but for certain, as the Rolling Stones sang, “You can’t always get what you want”.

Sitting On Your Hands

Gershwin’s Porgy & Bess was first performed in Boston on September 30, 1935. It was a little past summertime but that song took center stage. Most financial professionals know that the world spins a little slower during the summer months. We are “deeply” entrenched in a presidential election here in the United States, one that will change a philosophy one way or another. Powell is fighting inflation and the world is not a safe place so keep your eyes and ears open.

Nonetheless, keep the faith and seek cover. By that I’m suggesting to (1) raise cash; (2) sell covered calls; and (3) sit on your hands. That’s not easy, especially for those of you who feel the need to do “something” every day, sometimes every hour or minute. For me, I’ll wait until the “opportunity” finds me versus trying to find it. In the Roth IRAs managed I’m sitting on almost 25% cash, everything is covered and I’m just waiting.

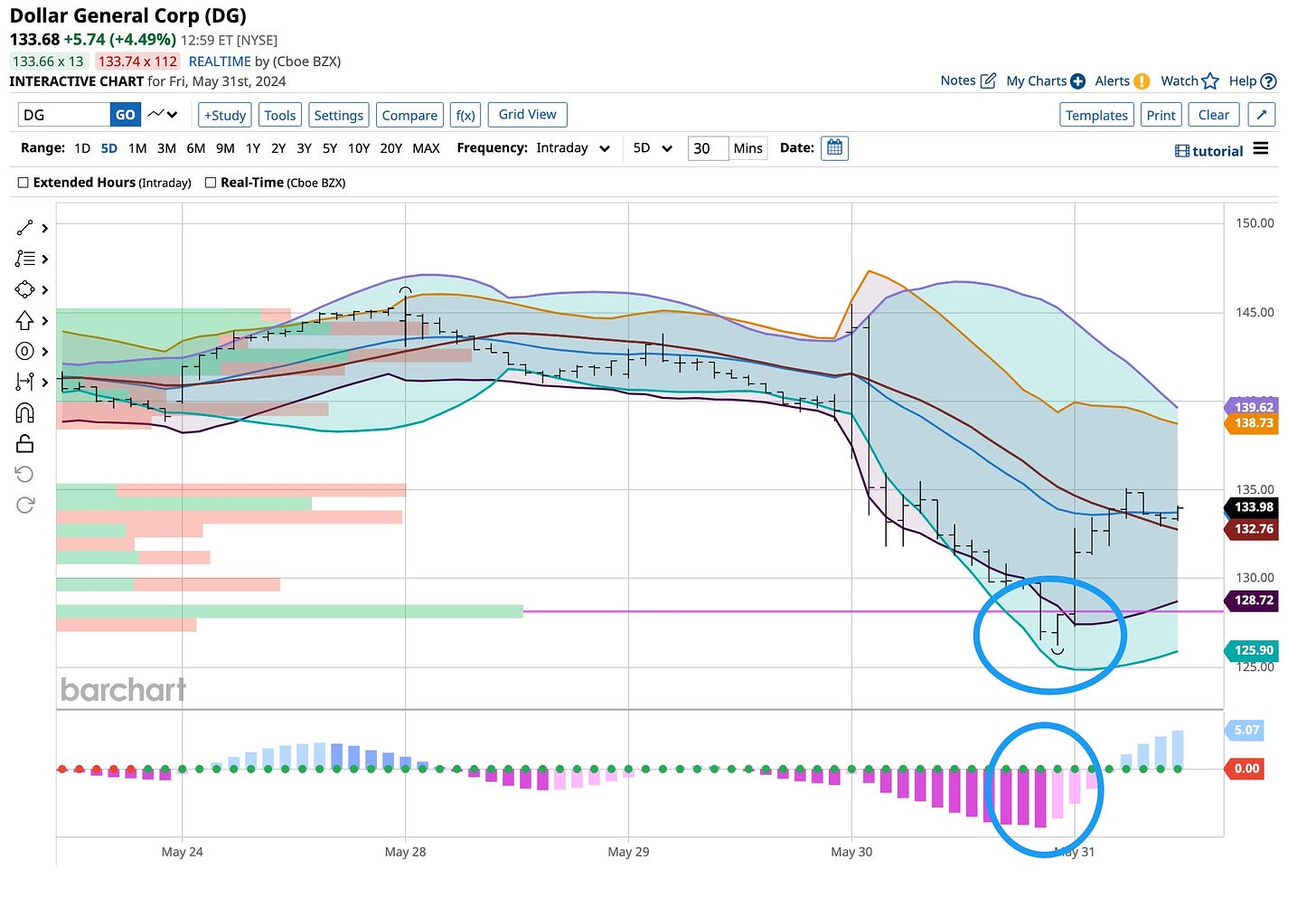

The Dollar General option hedge worked out very well. I took profits out of the puts. I am sitting with a reduced covered call position against my remaining long position. It was an opportunity that found a home and it fit the plan so we acted. Again, it found a home in a simple protective strategy and we took advantage of it. Now with remaining Dollar General shares we’ll sit back and wait, maybe even buy more Boeing shares.

It’s Not Time To Make A Change

This portion of today’s note is directed to one of my favorite The Ticker members. He sent me a great email late last night asking me how to react to the Trump decision. In addition, he suggested some great alternatives. We agreed that consumer durables had a bit of a headwind ahead of them. That’s why I passed on Whirlpool but there was a bit more to that decision than not. China cannot get out of the way. From real estate to basic economic problems, President Xi has troubles on his plate. For these overall reasons I agree, stay away from consumer durables.

He’s right about the energy trade as well but we are looking at apples versus oranges. I’m long the companies that (1) are well-diversified producers; (2) distribute products across all sectors; and (3) pay a solid dividend. The current administration plays up to its base and that’s something to consider but it’s too early to do that. Democrats have just received the boost they expected. What remains is the actual reaction to the news. Like before, I’m sitting on my hands and waiting. Makes sense to me, it’s summertime.

Damn, these guys looked a lot younger years ago. I guess we all did, eh? The Rolling Stones released “You Can’t Always Get What You Want” fifty-five years ago in 1969. It could very well be true again but it’s too early to decide. Trump fully expected that a “deep-blue” jurisdiction would find him guilty. Biden would face the same in a place where “red” ruled and I’m not talking about a new Tiger Woods “Sun Day Red” shirt. Sit on your hands folks. Let the opportunities find you. And remember, “Father’s Day” is coming, I wear an extra-large and yes, I wear “red” on Sundays. Be well.