It’s a Saturday in Texas. What that means to most is not consistent with my own life. That’s OK. I love what I do and hope you do as well.

Two More

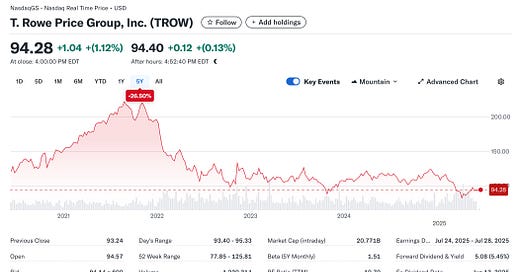

T. Rowe Price (“TROW”) is a global investment management firm based in Baltimore, founded in 1937 and headquartered at 100 East Pratt Street. As of June 7, 2025, the stock trades around $94.28, up slightly on the day. Here are a few tidbits:

Revenue: $1.76 billion – essentially flat year-over-year

Adjusted EPS: $2.23, beating consensus estimates of $2.09 by 6.7%

Net outflows: $8.6 billion, but total assets under management (AUM) rose 1.6% year-over-year to $1.57 trillion

T. Rowe Price operates as a pure active manager, with $1.51 trillion in AUM and revenues of $6.48 billion in 2024. Q1 saw a fee rate decline to 0.40%, down from 0.416% a year ago, due to AUM mix shifts. 12-month average price targets range from $80 to $120, averaging $94–96, indicating minimal upside.

T. Rowe Price strategists foresee selective opportunities in equities, particularly under lower interest rates, favoring financials, small-cap, and value-centric stocks. However, macro risks such as tariffs and policy shifts could remain headwinds.

I love the ETF TLT. Nonetheless, many have sought an alternative. This is it.

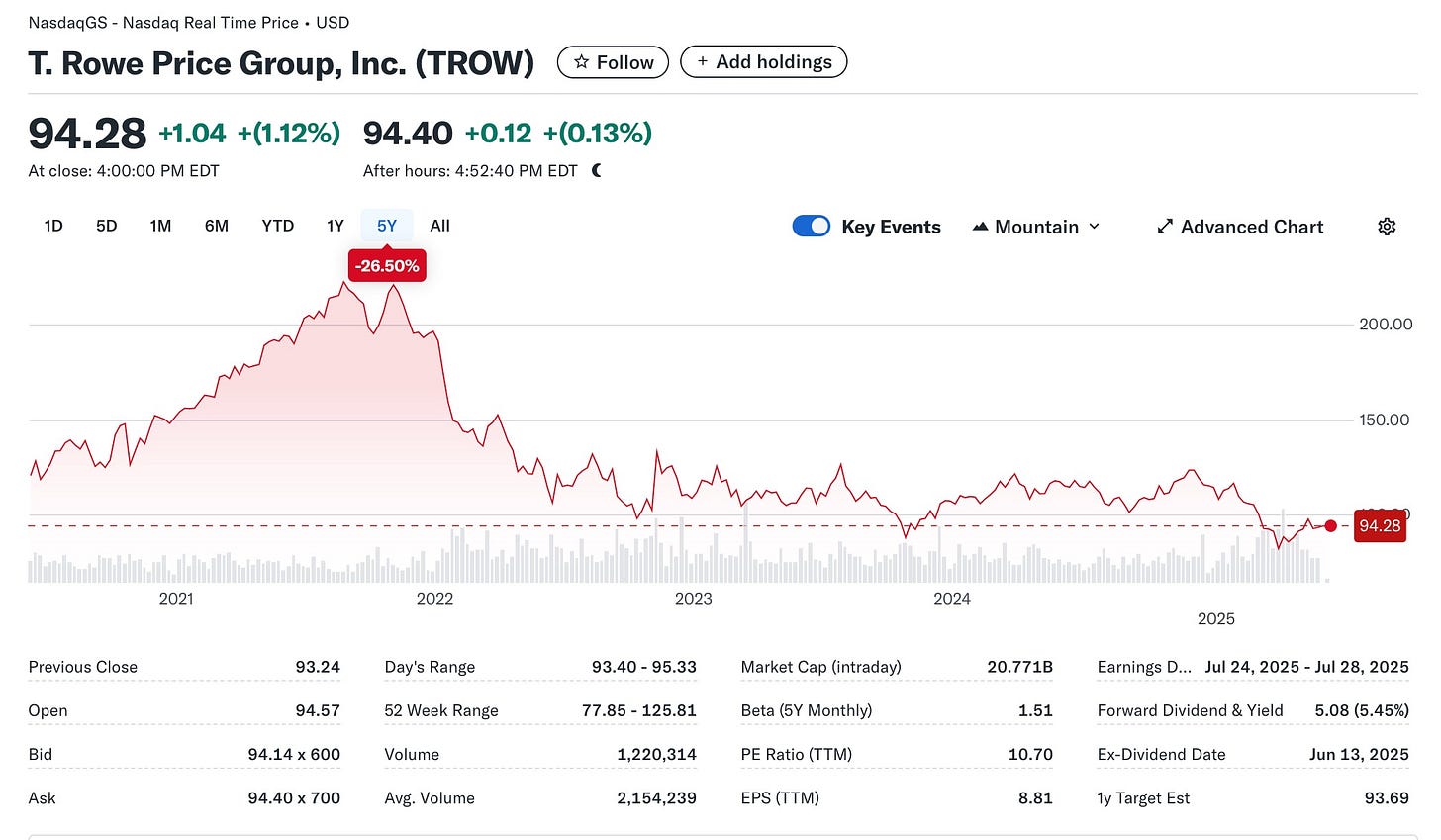

Diamondback Energy, Inc. (“FANG”) is headquartered in Midland, Texas. Operations are deeply rooted in the Permian Basin, one of the most prolific oil and gas producing regions in the U.S., making Midland an ideal base for both executive leadership and field operation coordination. The company carries out its “acquire, exploit, explore, and develop” strategy for onshore unconventional reservoirs.

Price: $140.56 as of June 7, 2025

P/E: Around 8–9x

Dividend yield: ~3.1% (annualized ~$4/share)

Free Cash Flow: Targeting a 50%+ payout ratio through dividends and buybacks

Q1 EPS estimate: ~$3.79 per share, up from ~$3.71

Production & Capex: Continues strong output in the Permian; capex guided ~$3.8–4.2B for 2025

Shareholder returns: Completed ~$400M buybacks in Q1 and raised base dividend to $1.00 per quarter

Low-cost operator with robust Permian footprint. Strong cash flow fueling dividends & buybacks. High debt and potential integration lag. Attractive valuation (~8–9x P/E) with ~3% yield. U.S. shale activity possibly peaking

Diamondback Energy offers solid yields with compelling cash returns, but investors should stay cautious amid signs that U.S. shale growth may be at or near a peak, and as the company works through debt reduction and merger integration.

It’s smart to add FANG and sell some OXY as dividends do make a difference

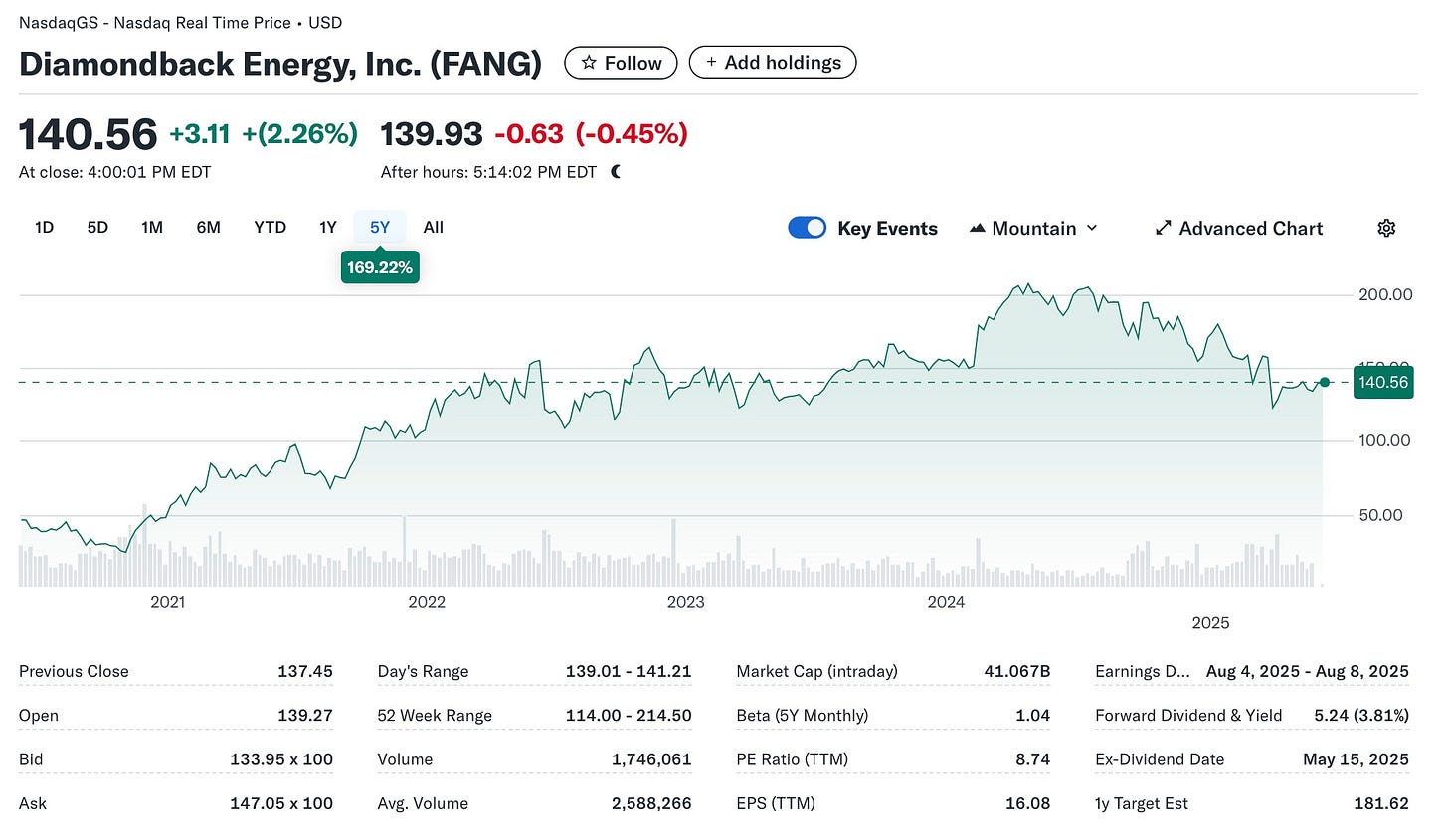

Credit Card Usage Matters

Maybe I see things you do not look for. Credit card usage increased far more than expected. Keep your eyes on this trend. The Federal Reserve does.

Thanks For Being Part

Thanks for the solid interest. It was unexpected. I do care about all who take the time to read what I write. With that in mind, yesterday we posted an “offer” and you replied to a great degree. Thanks.

If you are interested in being a small part of what we’re developing, can afford to be wrong, in other words, you are an accredited investor, and know how to send me an email, let me know at info@tickeredu.com. You never know unless you try. Those who have jumped on board know a good win-win situation when they see it.

A man of his word. Drill, baby, drill makes sense. It makes even more sense to look at where the drilling took place before. I am cost-conscious. I hate to spend money. I like talent. You should, too, but what about its expense? It’s not that I’m a penny-pincher. I just like to keep what I can in my pocket. I sense you agree. Lower risk with a bigger reward works for me. How about you/