The end of the year is always an interesting time in the security markets. It is time for me to prepare to plan for Roth IRA distributions. They are going to be much higher as the portfolio returns have exceeded expectations. The question I need answer is what is coming next year.

Best Dog In The Dow

The only way Boeing (“BA”) could become a better “dog” is if it could bark. If there is a question about this selection, it involves Boeing remaining in the Dow.

I’ve been an accumulator of Boeing for about nine months. It’s been a battle of “love.” I say that for a reason, as options have been my salvation. The stock is down about 8% from my initial outright purchases, but overall, thanks to “shorting” covered calls and selling naked puts below the market price, the position is 12% higher. It better be as Boeing is my largest position.

Patience has been a true virtue. Boeing is a “predictable” security, with revenue being critical to those of us who buy and hold turnaround candidates. Boeing had to raise its capital level, something it did without difficulty. The failed in space and their “planes” are under scrutiny. They’re also a leader in their field. Timing these “events” was very important. Waiting for the “shoe to drop” on raising its capital allowed for excessive covered and naked selling of calls. When the shoe dropped, it was time to sell as many naked puts below the market as I could.

Four Others I’m Long & Strong

I’ve spoken about all four of these in the past, so take the time to dig through my past articles to see why. I’m not flush with time and given I actually buy what I’m “talking” about, it’s only fair that you take the time to read what I’ve written.

The Trade Desk

All things considered, if you only looked at its P/E ratio, you would never buy this one. It’s sitting above the 200+ level at this time. For me, being this company is a leader in its field, I’ll concentrate on its gross profit margin that exceeds 80%. It owns its space, and Google is envious.

Amazon

What can I say? I like to buy stocks in companies where I use their services. It’s not just Thursday Night Football that does it for me, although that helps. I like the fact that if I need something, they have it, and usually, for less than I can find it elsewhere. I’ve been an owner of Amazon for years and buy on dips. The last one came around the $185 level when Wells Fargo analysts panned it. They are usually like the herd, wrong so to me that was a buy signal.

Ford

Someday, my prince will come. We’ve all heard this before, but if there is one company I’ll stick with it the next four years of Trump, it’s Ford. This is the third time over the last sixteen years that I have dug in deeply here. Look, folks, I’m a dividend buyer and it pays me more than 5.5% to hang in there.

Nike

Turnaround City is on its way. Nike has its hands full. Funny, my best move on this one this year came on the downside. I covered 100% of my then-owned and profitable position this summer and used these proceeds to buy short-term puts. What a winner and timing was important. Since then, I’ve been a seller of naked puts below current market prices.

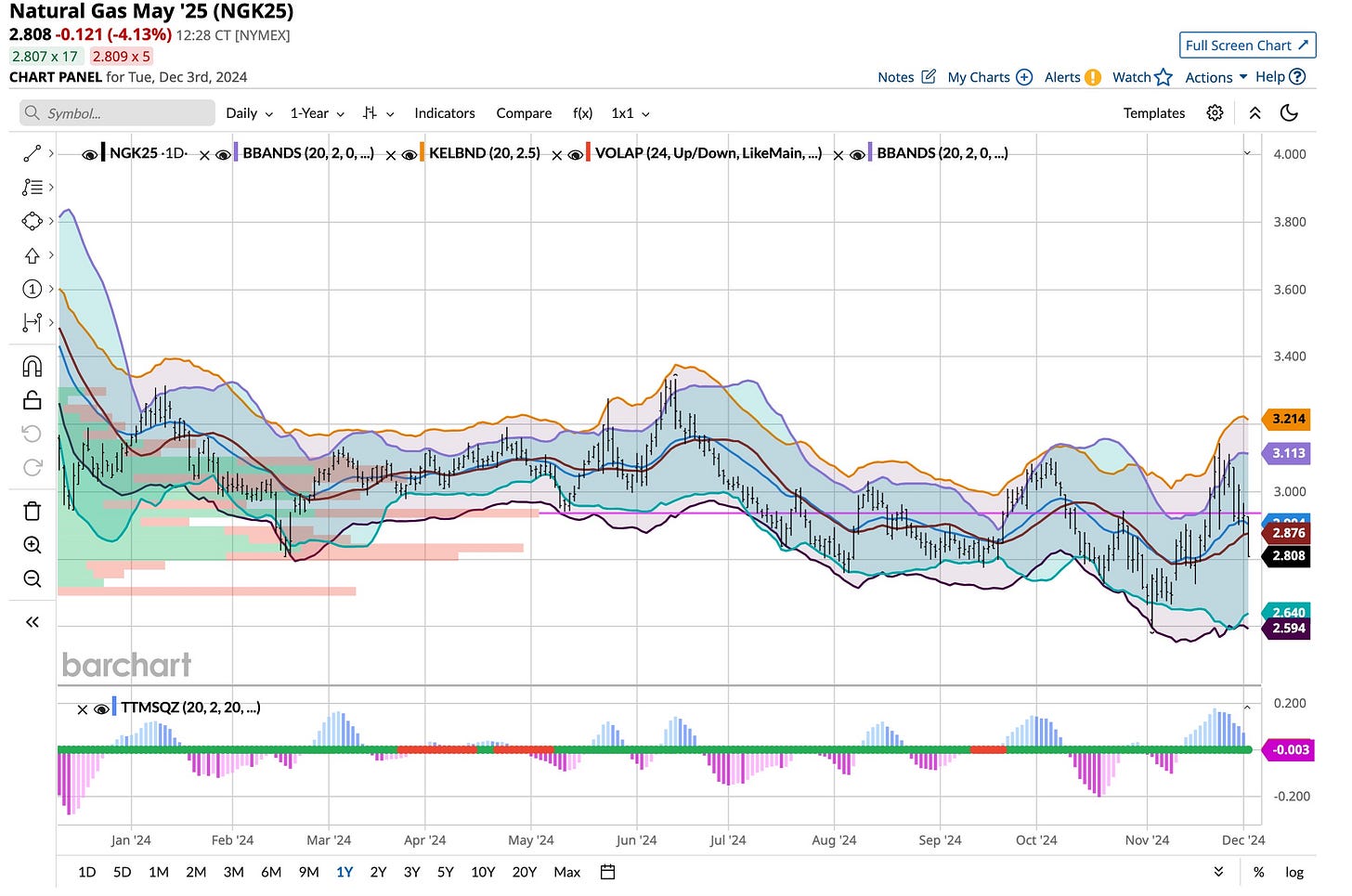

What Else You Ask

Nothing has changed. I still hold 5% of my total portfolio in gold, down from 8%, most of which was accumulated in the lower teens. I’m more than 50% in cash that pays me 5%+. It makes life easy to make distributions. I killed it earlier this year in VIX calls and Silver and still hold both. I have a fairly large position in the “widow maker,” our friend natural gas, but after taking profits in the near-term contracts at the $3.50 level, I’m back in the 2025 May contract, just waiting for Trump.

I’m busy, buying and selling businesses for myself and my friends and doing a little bit of consulting. I’ll turn seventy next year. I don’t know a “whole hell of a lot more” than I did years ago, I’ve just become more patient. It’s a good trait to have.

Jimmy Stewart was pretty good. He should have been, as he had a guardian angel. If I could do one thing, it would be to get you to listen to me. Many “people” do, and that has a way of brightening my day. Too many of you are afraid of hedging. Far too few of you use options. That’s foolish, folks. Options, like time expire. Like I said, I’ll turn 70 next year. I’m not sure how long I’ll be able to give back what I’ve learned. I will keep eating like Buffett, so maybe I’ll keep doing this for years.