Traders need to make a decision. Quite often that means deciding between where to place their trades. Unfortunately, this decision is often precluded by where the trader is located. In many parts of the world, opening a futures account is simply impossible thus the decision is predetermined.

For me, living in the United States gives me a choice. I choose futures most often. The markets themselves take me on a course of transparency and reliability. It also costs a bit less to trade futures than forex. Nonetheless, many solid forex traders in this world do quite well. I don’t simply discard their use of forex as they have no choice.

I Choose Futures Without Question

Trading futures and trading forex both have their advantages and disadvantages, and whether one is "better" than the other. It depends on individual preferences, trading style, and investment goals.

Futures markets are regulated by government entities like the Commodity Futures Trading Commission (“CFTC”) in the United States, thus providing a higher level of oversight and protection for traders. Futures markets are centralized, meaning that all trading happens through a regulated exchange. Centralization provides transparency in terms of price discovery and trade execution.

Futures markets have specific trading hours, which helps traders avoid the “volatility” and unpredictability of 24-hour markets like forex. This can provide a more structured trading environment.

While both futures and forex offer leverage, futures markets have standardized and regulated leverage ratios, which can reduce the risk of over-leveraging compared to the often higher and more flexible leverage offered by forex brokers. Futures markets have specific margin requirements set by the exchange, providing a more consistent and predictable trading experience.

Futures markets allow trading on a wide range of assets including commodities like gold, oil, agricultural products, indices, interest rates, and more. This diversity can provide more opportunities for hedging and diversification.

Centralized exchanges facilitate a transparent price discovery process, reflecting all available information about the market. Major futures contracts, especially those tied to popular indices or commodities, have higher liquidity, making it easier to enter and exit positions without significant price slippage.

In some jurisdictions, futures trading offers more favorable tax treatment compared to forex trading. In the U.S., futures are subject to the 60/40 rule, where 60% of gains are taxed at the lower long-term capital gains rate and 40% at the short-term rate.

Futures trading has lower transaction costs than forex trading, where spreads and additional fees can vary significantly between brokers. Futures are more often used by companies and institutional investors for hedging purposes, providing a very robust mechanism for managing risk. This can add a level of stability and predictability to the futures markets. Futures contracts are standardized in terms of quantity, quality, and delivery date, which can simplify trading and reduce confusion.

Futures exchanges have clearing houses that act as intermediaries to guarantee the performance of contracts, reducing the counterparty risk inherent in forex trading, where the broker acts as the counterparty.

While trading futures has these advantages, it's important to note that forex trading also has its own set of benefits, such as higher leverage, 24-hour market access, and a focus on major currency pairs that provide ample trading opportunities. The choice between trading futures and forex will depend on an individual trader's needs, goals, risk tolerance, and trading strategy.

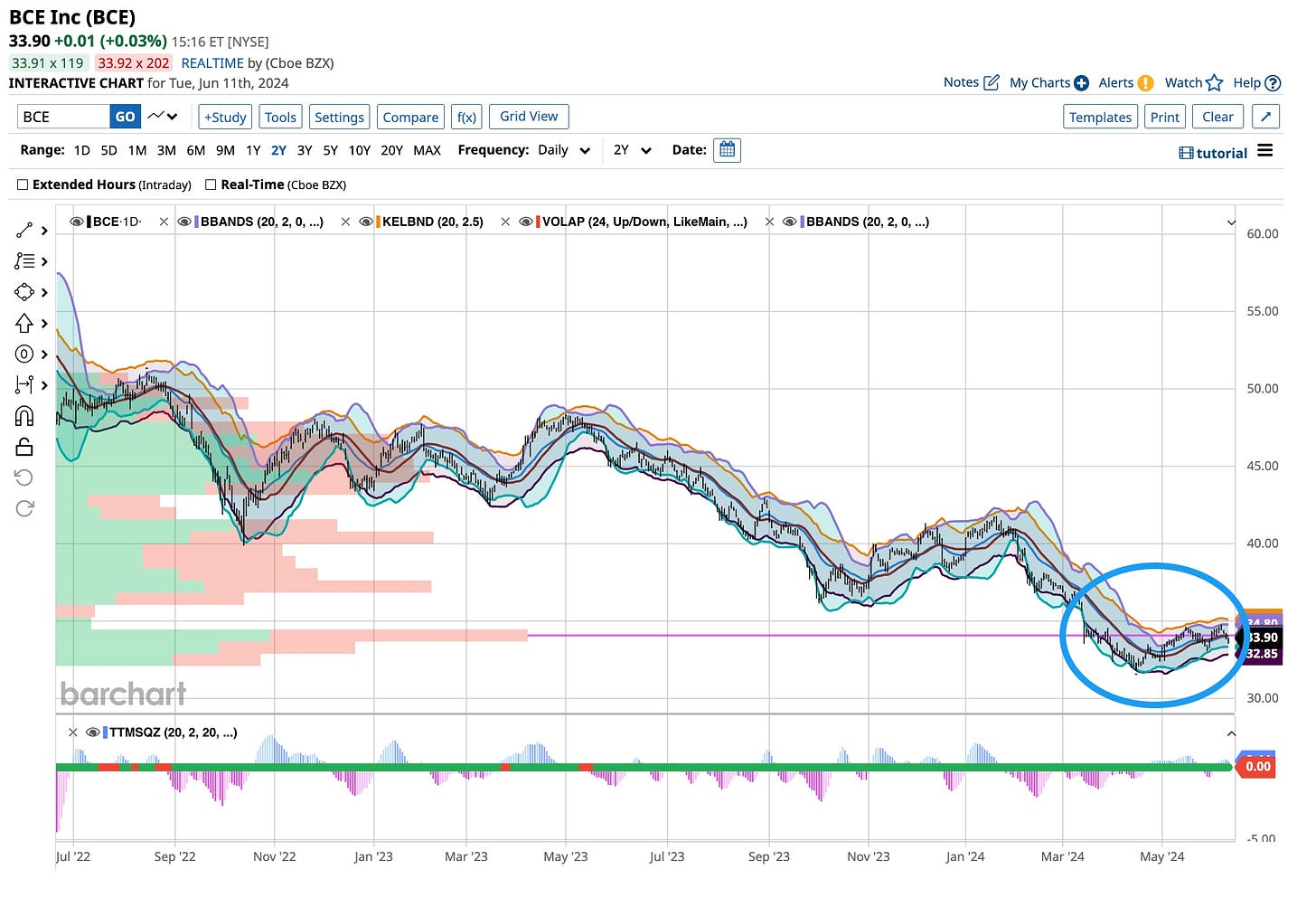

Research Says To Buy This One

I constantly research and stay abreast of the markets. I’m always looking for ‘dividend’ paying and turnaround stocks to add to the portfolio. I found one yesterday and then I jumped on board using the cash I’ve been accumulating. I’m buying “BCE” and here is why. What do you think?

BCE Inc., Bell Canada Enterprises, is a solid Canadian telecommunications company headquartered in Montreal, Quebec. It operates primarily through its subsidiary Bell Canada and offers a very wide range of services, including wireless communications, internet services, television, and media.

BCE is “one of the three” major telecommunications companies in Canada, alongside Rogers Communications and Telus Corporation. It holds a significant market share in both the wireless and wireline sectors. It’s shown steady revenue and earnings growth over the years, supported by its diversified business model. Its solid financial stability is often reflected in its robust dividend payouts. BCE has an attractive dividend policy, making it a popular choice among income-focused investors like me. It has a history of consistent dividend payments and has often increased its dividends annually.

BCE Inc. is traded on the Toronto and the New York Stock Exchange under the ticker symbol ("BCE"). BCE's stock performance is influenced by various factors, including regulatory changes, technological advancements, and peer pressures. It attracts long-term investors due to its stable dividend yield and defensive characteristics.

BCE is often considered a defensive stock due to its stable revenue streams and high dividend yield, making it a suitable choice for risk-averse investors. Investments in 5G and media expansion offer growth potential but like all of my investments, I’m a buyer of this type of stock when the price is right.

BCE Inc. is a cornerstone of the Canadian telecommunications industry, offering a blend of stability through established services and growth potential via technological and media investments. Its strong dividend policy and robust market position make it an attractive option for investors seeking both income and long-term growth. It’s a long-term one for me and I “stepped up to the plate” big time yesterday.

Off to the wild outdoors for me today. It’s time to rebuild the foundation of a planter that needs a little support. That’s exactly how I teach. Foundation first is important as that’s what supports our bricks and mortar. Check out the introductory deal we have on the table for The Ticker and join us. Thanks always for your time and interest.

Angela Lansbury is “Mame”. In “Open A New Window” she did just that. You should too. I find too often that people with a “little” experience are dangerous. They think they know everything. They don’t. I’ll be the first to admit that I learn something new every day. You should too, try it. We offer it to you at The Ticker. Together with what we call our “introductory offer” the $99 price for more than $1,000 of value works. If you want to learn the “right way” join us. You’ll be happy you did.