First and foremost on this Friday, I want to say thanks to all of you who have taken The Ticker to heights unthought possible in such a short period of time. Years ago, as Sally Fields was accepting an Academy award she said, “you like me, you really like me”; it’s very satisfying and again thanks.

For years I’ve watched “fly-by-nights” appear then abruptly disappear on many social media sites. Their message, one of pounding their chests with their “investment of the day”, is only then silenced by their next so called “can’t miss” pick that “misses” badly. When I started posting on Substack, my primary objective was reflecting upon my 55+ years of investment industry experience. I wanted to present concepts logically to get you to “think” about the “rules” I follow in making longer term investment decisions. “Give a man a fish and he will eat for a day. Teach a man how to fish and you feed him for a lifetime”. That quote fits what I’m doing and trust you agree. Again my sincere thanks and stay tuned.

With that in mind, by popular demand, next week starts the “Position Trading” course I’ve been putting together. Probably going to present it like the last series “Investing & Trading Psychology”, another one of my favorites and one of yours as well. It’s ‘all between your ears” and that’s a good thing. Once you handle your emotions you’re well on your way to success and enjoying what you are doing; that’s very important in anything you do. If you’re not enjoying yourself, life is short; do something else.

Additionally, at least so far today, the “newbie” traders are hitting the bid and driving a less than worthy market higher. As quoted in movie more, “they’re back”; it’s time to take advantage of what they’re giving us. It’s still early on a summer Friday morning so anything can happen. If the market runs through the close I’m set-up for what I’ll call a perfect storm for tomorrow’s article on “wick trading”and Sunday’s “The Week That Was & What’s Next” but again, it’s a Friday afternoon summer so anything can and will happen. Now back to today’s outside-the-box thoughts.

Ford & Tesla

I like to think “outside the box”. Sometimes they are presented on Sunday nights as I sit in front of the “camera” and talk about what happened the week before and what to expect. From time to time, more long term than not, ideas, visions, just “common sense” thoughts, logical combinations of existing entities come to mind. It appears to me that one is starting to come into focus; Ford and Tesla either merging or one entity acquiring the other.

My esteem for Ford goes back decades when they refused to take government bailout money, “mortgaged” their logo and rebuilt their identity from the inside out. I’m not a true fan of Tesla but do admire the business acumen, the tenacity and straight forward approach Musk takes in all he does. He’s nobody’s fool and it shows. He must see the inherent flaws in what he’ll need to further the “Tesla story”. Without the worldwide service locations to “fix” his fleet of aging automobiles, we’re going to have more of the attention getting video demonstrations of owners “blowing up” their antiquated vehicles. When it costs more to fix them, coupled with the fact that there’s no place to take them for service, this will happen.

In addition, and this one is simpler to address, there’s idle automobile manufacturing capacity worldwide that can be retrofitted to produce EV types of vehicles versus just building something from the ground up. More than likely there’s a ready, experienced, able workforce surrounding these plants as that’s one of the reasons those locations were chosen in the first go around. Sounds logical, doesn’t it? I think so.

I like the Ford combination better than others like Volkswagen or other behemoths in the industry. Undoubtedly there’s more than just Tesla on the EV side that’s looking at a similar strategy. There’s simply not enough volume for most Tesla competitors to ever become cash flow profitable in the automotive marketplace. It’s time for these combinations to start being announced; it’s just the math that will drive the equation.

Don’t Be A Yahoo!

There’s another event taking place that jumps out at me in two different ways, the “AI” revolution. Having lived through the Dot.com era and “bubble” I see the same two sides of the coin previously exposed. First the negative: what goes up must come down. The “newbie” traders have their next “meme” and this time it’s a whole market segment. At least half of the resources I follow have something to say about AI, good or bad; it’s a major discussion point. There’s a new, next greatest AI entry popping up every day. If that’s the case just think about how many new entries are going to hit the marketplace as AI causes layoffs in the technology workforce industry worldwide. It’s logical for that to happen; people have to eat and are going to compete. Besides that they’re really talented.

Given the lofty valuations companies like Nvidia have achieved, it’s logical for them to put those valuations to work. Why not identify the “best of breed”, whether public or private entities, and buy them up. Control your competition before it becomes actual competition or ends up being acquired by existing competitors. I’ll leave it to industry experts to determine what that subset of entities is and what they’re worth. Let’s just hope there isn’t a repeat of one of the biggest acquisition fiascos I remember. About nine months after its IPO, on April 1, 1999 Broadcast.com was acquired by Yahoo! in perhaps the biggest practical joke ever. Don’t get me wrong, I’m a Mark Cuban fan, as much for what he’s done for the City of Pittsburgh as how he’s not afraid to speak out. In this case however, Yahoo! didn’t do its homework and essentially discontinued the product less than three years later. Be careful how you spend your money be it “green” or otherwise valued from your lofty stock price’s current value.

I have other misgivings about the effects of AI in today’s world and in the future. It is ironic that “Oppenheimer”, an upcoming movie about the “Manhattan Project”, hits the theaters this summer. Those who developed the technology knew that they were essentially developing something that could end civilization as we know it. History repeats itself; are we moving the timeline forward to our own demise with AI? That one is bigger than me but investors and traders need to think about “regulation” in two ways; (1) the technology will undoubtedly draw the attention of the world with multiple governments acting to protect their constituents and (2) antitrust laws on the books will quickly come to the forefront as combinations between “already to large” entities will arise. Think before you act; remember, it’s “all between your ears”.

China’s Municipal Debt Crisis Revisited

It’s being proven out worldwide, the United States is not the only country adept with “kicking the can” down the street when it comes to creating then delaying repayment of their debts. Let the next generation worry about the problems we’re creating, right?

China's local governments are cash-strapped, a fact first brought to my attention by a good friend, Brandon Donahue. Like here in the U.S. local Chinese governments have found a temporary solution where they can “skirt” restrictions on onshore borrowing.

These local government financing vehicles (“LGFV”), the latest black hole in China's financial system, have accumulated excessive debt levels that are still rising. They’ve been selling "pearl bonds", foreign debt issuances through Shanghai's free trade zone, at twice the rate of years past. Will the creativity that destroys financial structure ever cease? I doubt it.

The "pearl" or free trade zone (“FTZ”) bonds have been around since 2016 but are only now becoming popular as tighter central government supervision on the LGFV debts starts to bite. About 5.5 trillion yuan worth of onshore LGFV bonds are due to mature this year, the highest amount since 2021. Issuers are active in the FTZ market as they require funding and refinancing now and the onshore market is essentially closed off to them.

Remember, the Chinese central government stands behind, basically guaranteeing the debt of local municipalities. This market seems to have at least the implicit backing of authorities and its popularity coincides with expanding yuan based financing. Perhaps that is why the Dollar is appreciating against the Yuan. Is the Yuan becoming the next great internationalized currency? Occurrences of this nature suggest it might be part of an overall plan if nothing else. I wonder when they’re going to change the color of world currencies? Wait, it’s all going electronic; think about the damage caused to the ink and paper markets; ain’t technology great?

I’m more of a novice than not in this segment of the macroeconomic environment. I do see more and more articles coupled with growing relationships between China and what used to be exclusive “partners” of the United States. Change is coming but with the two largest economic entities in the world fighting for “debt financing” the price paid for that cash is only going higher.

OK, enough, it’s Friday and the grandchildren are spending the weekend. Good thing, there’s a little work to be done around the yard. At my age I’m better at showing them how to do it versus actually doing it. Besides, it might even get done before the end of summer if someone else does it other than me.

Hope you enjoyed this post. I’m just a young 68 years old; my Dad became a broker when I was 13. It’s time for me to ‘give back’ to all of you what’s in my head. It’s not always pretty but it’s based on history . . . and history, unchecked, repeats itself as you are witnessing. Check back over the weekend as it’s time to go “wick hunting” . . . and that’s my favorite time to find value in these markets.

Everyone learns at their own pace. If you pick everything up the first time through, great but if not email me at david@thetickeredu.com so we can further help. Again, let me know what you want to learn, I’m all ears.

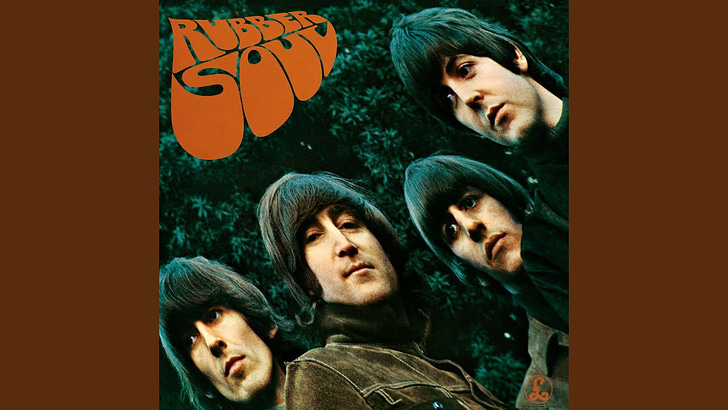

Let’s end the week with a little of the Beatles from “Rubber Soul”. Baby you can “Drive My Car” as long as we have generated enough power in the grid and find a place to recharge it. Nothing like putting the cart in front of the horse but I guess they just call that progress, or insanity; guess you have to decide what side of the fence you are on first.