For some, their crystal balls became a little less cloudy, for others they became opaque and some simply picked them up and smashed them on the ground. For me status quo was the result. Do you realize that it’s been more than a year since we’ve been dealing with and talking about the same issues? At least I have and it’s verifiable just go back and review the articles on my site.

I’m sick and tired of our government trying to determine who the “biggest crook” is or whether we should let Fetterman wear a speedo and cut off T-shirt. The Fetterman issue is more reflective of what really, as Peter from Family Guy would reiterate “just grinds my gears”. Seriously, if you have no respect for the position you were elected to why should anyone respect that institution?

There’s something happening here and it ain’t exactly clear what its effects will be but opportunities based upon what transpired here are starting to come into focus. Being a rather longer term position trading “kind of guy” it’s still a time to be risk averse but it is also time to react to what’s come across our plates this week and formulate a plan.

Powell Set The Table

The best analysis of Wednesday’s Fed speak was that the “street” finally got on board and took longer bonds out to the woodshed. For years I’ve been a proponent of exactly what is transpiring. Interest rates were heading higher and were going to remain high for an extended period of time. Nonetheless, they are not going to stay there forever so if someone is willing to pay me about 5% while I wait for rates to drop, I’m in. Risk in buying 30-year treasuries is minimal. The reward of earning 5% while awaiting 20% to 30% increases in the underlying intrinsic value of the bond when rates head lower is where I want to be. The table is set; buy bonds.

Kazuo Ueda Knows Japanese Monetary Policy Must Change

In a policy statement post its September meeting, the Bank of Japan stated it would maintain short-term interest rates at -0.1%. The BOJ also capped the 10-year Japanese government bond yield around zero, as widely expected.

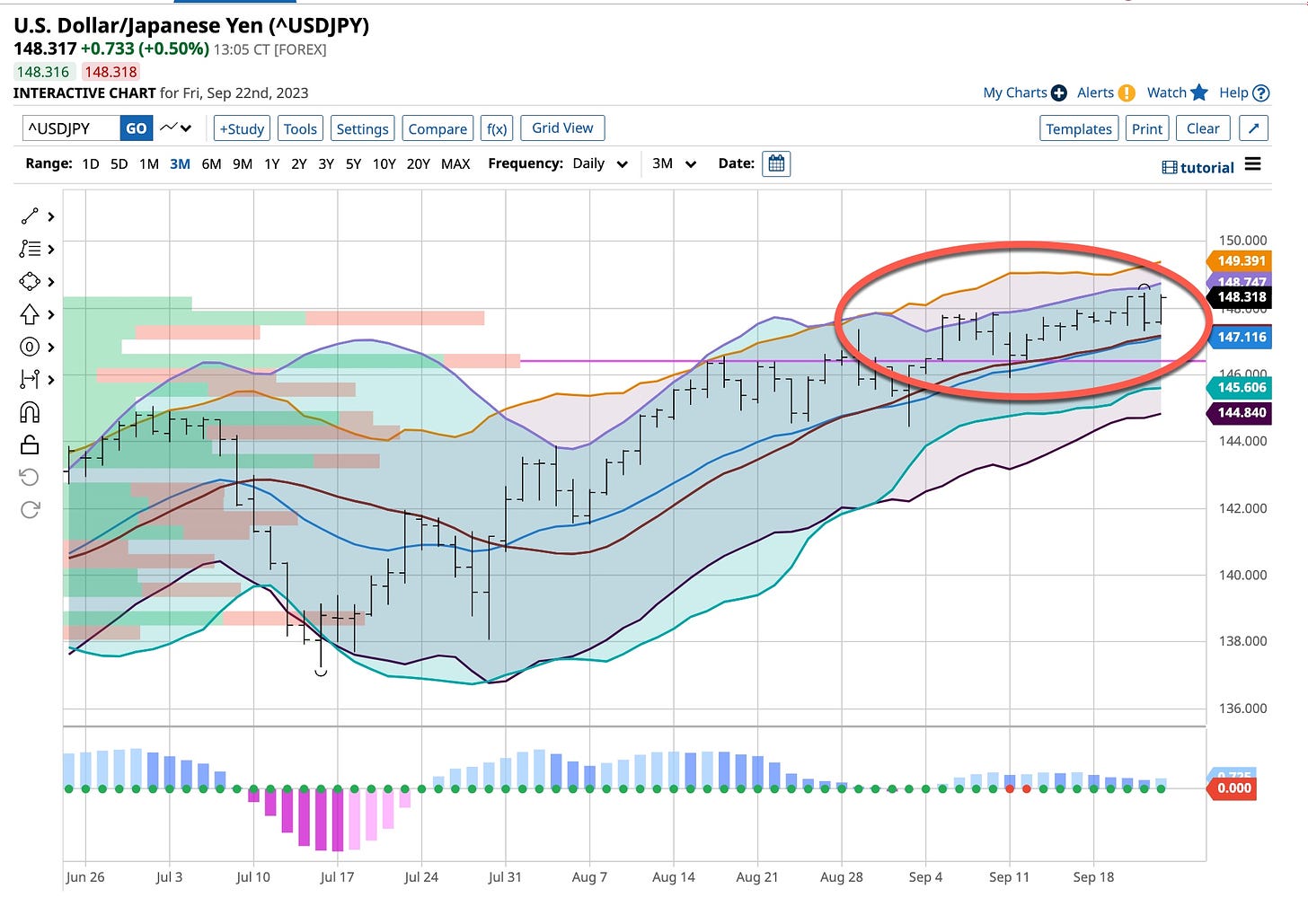

Citing extremely high uncertainties surrounding economies and financial markets at home and abroad, Japan chose to patiently continue with monetary easing and like we do here stated it will continually evaluate all conditions. Damn, these central banks all use the same verbiage when they issue statements. Read between the lines and watch the technicals.

If Japan’s central bank perceived lower rates remaining in place for a longer period of time the Yen would have dropped precipitously on this news but it didn’t. I’m already in this position looking for the Yen to revisit the 125 level while protecting myself by using 150 put options just in case. Remember, I’m risk averse first but macroeconomic conditions with a geopolitical bend controls how I react. Like bonds buy the Yen.

Oh Woe Is Me It’s Shutdown Time Again & More

The combination of the auto strike, a government shutdown and the restart of student loan payments will crimp growth as we head into the end of the year. It’s the big three we should worry about, right but which “big three”?

An autoworkers strike, a government shutdown and the scheduled resumption of student loan repayments are on the table. What about that soft landing, is it in the rearview mirror? Maybe that’s a blessing in disguise for Powell, eh? Other than the student loan repayments the other two are temporary so we’rec going to have to wait for most people to just stop spending.

Even if the economy manages to avoid a technical recession, we are still likely in for a period of below-trend growth as higher interest rates and tighter lending standards, lower excess savings and weaker job growth move through the economy. That’s just what we need, isn’t it? Sell the Russell Index; it’s loaded with banks that are headed to the junk pile and this time there’s no reason for the “big boys” to pick up the pieces, they’re going to get the deposits one way or another.

Meet Otavio Costa

I don’t have to reiterate every piece of news that crosses your screen, phone, television or other medium. It really doesn’t matter as you’re going to believe the source you all follow. Me, I’ll reflect on my experience and those I follow like Otavio Costa, one of many who have crossed my path on LinkedIn. Recently Otavio spoke of a spread that “continued to defy gravity”. The surge in interest rates versus the “earnings yield” for the Russell 3000 index is below 10-year yields for the first time in 21 years.

He augmented his points by stating that “it is becoming increasingly challenging to rationalize today's high valuations when the cost of capital is rising so rapidly.”

He then cited the following:

▪️ A deeply inverted yield curve

▪️ The potential lagging impact of the Fed's steepest tightening in decades

▪️ The ISM manufacturing index below the recessionary threshold of 50 for the past ten months.

▪️ Oil prices above $90 per barrel

▪️ The narrow leadership in the stock market

▪️ Contracting corporate fundamentals

I’ve been doing this for more than 55+ years. As I’ve often said, I learn something new each and every day. It would more than double the length of this article to include all I follow and go back and forth with on LinkedIn. I wish I had started to use it years ago.

Well it’s reflection time in my life. Being Jewish the ten day period in between Rosh Hashanah and Yom Kippur has meaning to me. I’mm not very observant but tradition is important as are the ethical and moral structures that were embedded in me during my upbringing. I’ll be absent on Monday as I ask to be inscribed in the “Book of Life” for another year. It’s a more important book than the one I’ve just completed. Hey if I’m granted another year I just might be able to complete the series.

Buffalo Springfield and the messages they provided in song affected my life. They still do. In “For What It’s Worth” they talk about something being wrong. It doesn’t make a difference when, there’s always something going wrong. It’s not as much what it is. It’s more important how you react to and deal with it.