So admit it. You missed me this week. Well just so you know, I missed you too. It’s a two-way street. I love to teach and to give back my years of “experience”. I know you just want to learn so it’s a good match but often it’s best to sit on your hands and do nothing. I’ll never do nothing but there are times when I’ll wait for opportunities to find me. I acted on a couple of them this week so let’s start there.

Hedging Works

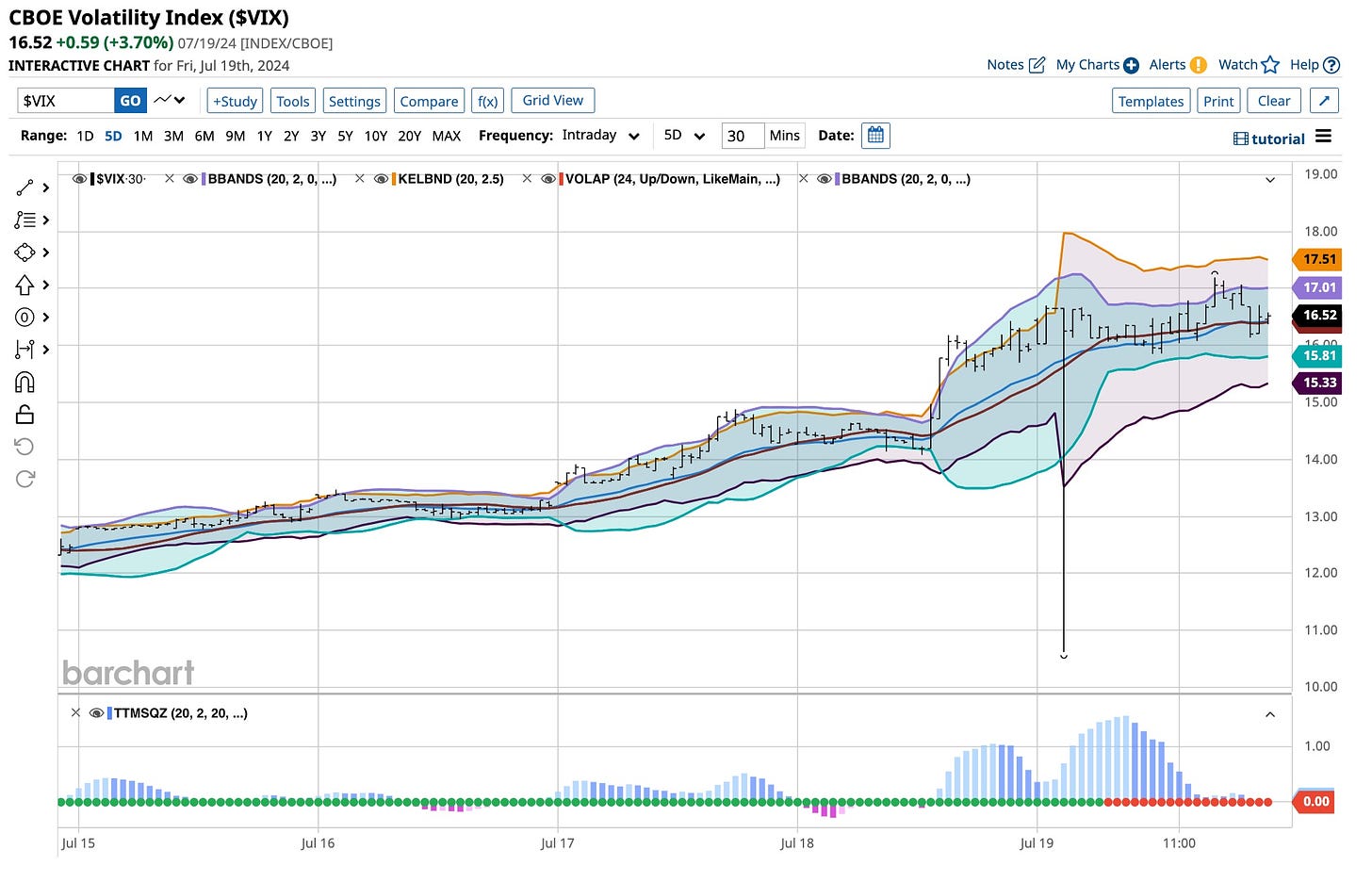

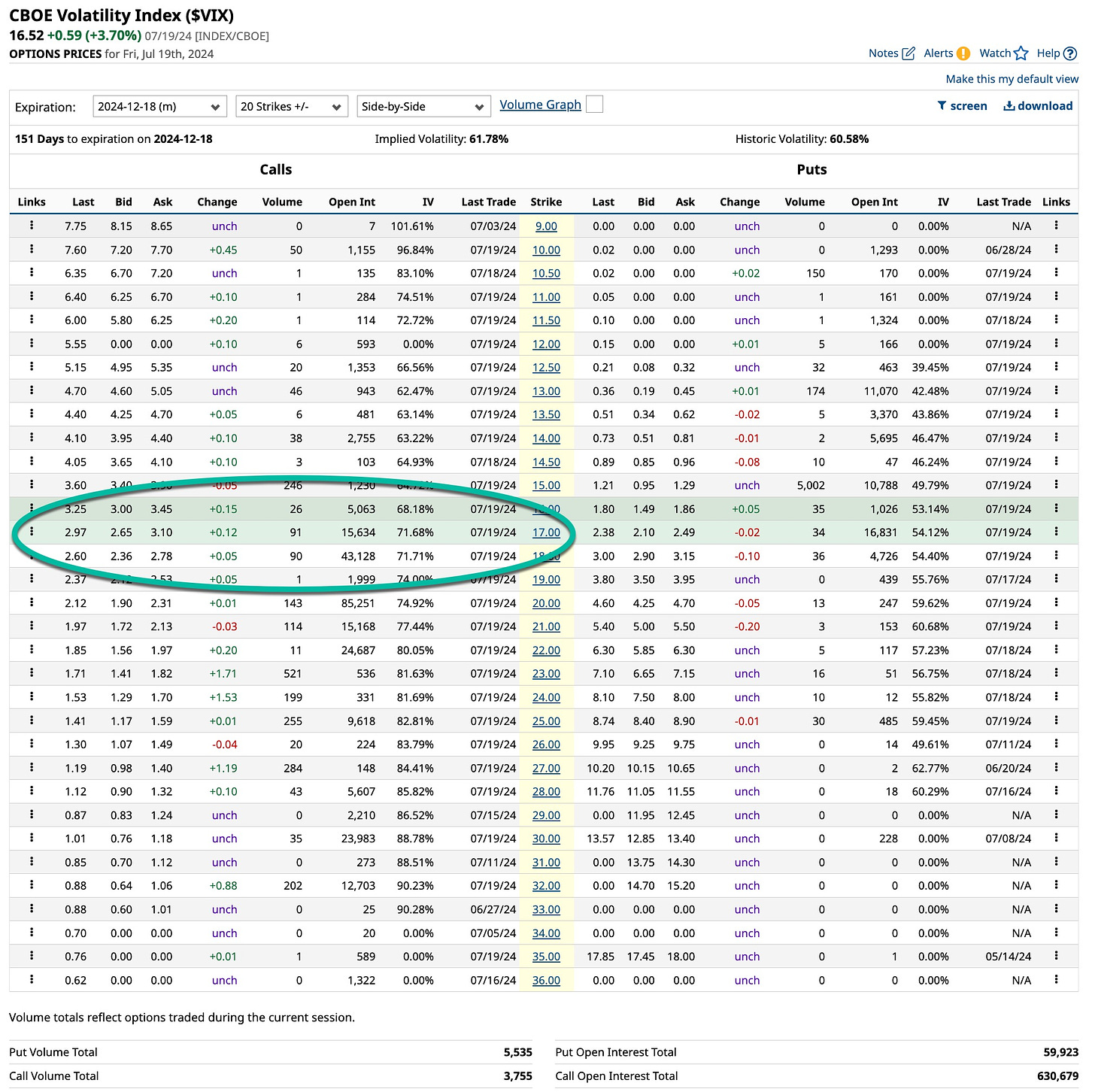

I’m a bit of a preacher, a prudent one but more so than not, one that likes to buy low and sell high. It’s the inverse way I treat VIX call options. When the “herd” is selling I’m buying and that’s what happened as the markets were hitting new highs.

Two rules I follow. Buy options with four to six months of life before expiration and work with options having the highest volume and open interest. Sure, I always use a GTC order because option market makers are whores. I should know, I used to be one. Remember, option market makers are only required to transact one contract at their posted bid or ask price. If you put in a market order over a “single contract” you must beware. They make their money on the spread. That’s where they win and you lose.

There’s Gold In Bitcoin

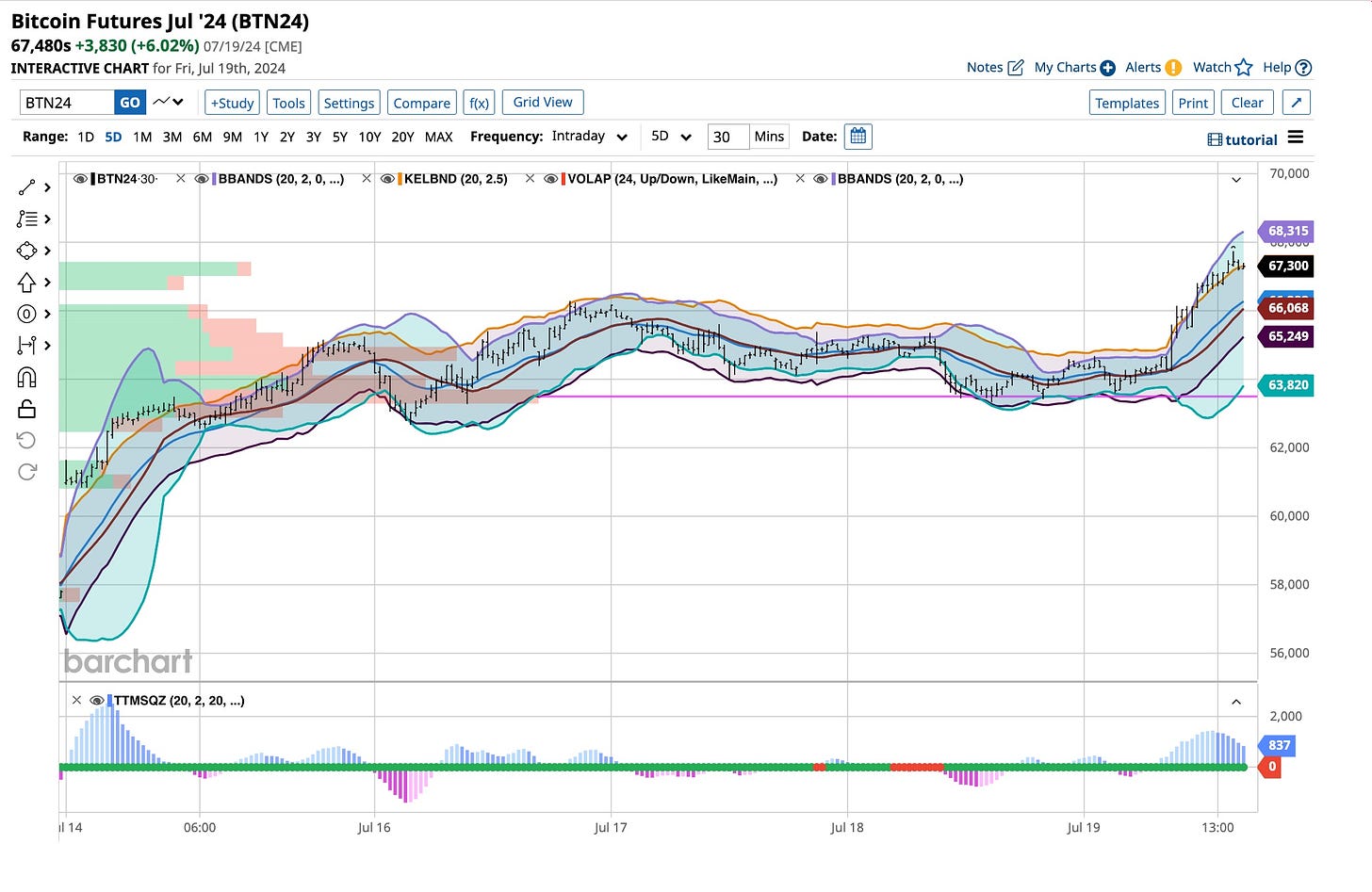

Many people are looking to gain information from the Republican party platform. I’m one of them but remember, I’m one to let opportunities find me. Trump’s an advocate of cryptocurrencies, especially Bitcoin. When Trump was “shot” last Saturday night I did what logical people do. I bought a bunch of Bitcoin futures contracts. Bitcoin will trade around the clock. Any trader with an account and bucks can trade 24 / 7. Having “cat-like” instincts doesn’t hurt either but I’ve been looking for a reason to buyers so I was ready. I’m long and strong Bitcoin and have sold many then “in-the-money” puts to bolster my profits. I’m just getting started.

If there is one thing I’ll follow it’s the Republican platform adopting Trump’s position on cryptocurrencies. I had slightly less than 25% sitting in cash last weekend. Today at the close of business that amount was down to 20%. Most of it went towards Bitcoin. I did pick up a few shares in Groupon as well but the bulk is in Bitcoin.

So What Else

I’m looking at many opportunities at this time. I’ve been long Treasuries and started to shorten my maturities this week. Inflation is not going away but Powell is going to bring rates down so unemployment doesn’t soar. I hope you have loved the AI world. It’s a two-edged sword. It’s going to enhance productivity. That means some people are going to lose their jobs. It’s only natural and it’s started. The Russell 2000 is about to go even higher because short-term interest rates are going lower.

I still own my gold bullion, I buy more silver as it bounces off its lows and I’m still a big buyer of high dividend-paying stocks especially if they are turnaround candidates. I’m still buying Boeing but I’m not certain whether I’m going to buy back my covered calls or extend them out a few more months at lower strikes. I hope you have the same problem.

It’s my pleasure to post this message. I’ve been more active on The Ticker and suggest you join me there. If you had been there you would have known as I bought Bitcoin. If you had been watching you would know I harvested 60% of my 2024 December 16 call options. Yup, that trade made enough so the 40% that’s left is free. I’ll let them ride. So join us on The Ticker. You’ll be glad you did.

In 1967 Buffalo Springfield hit the charts with “For What It’s Worth”. They were right then and they’re right today. How anyone can just sit back post Trump’s assassination attack is beyond. What the hell is wrong with this world? It would have been different this week if the assassin was victorious. But for the grace of God, he might have been. I’m a boring kind of investor, trader, and hedger. I’m going to hit a bunch of singles and doubles. Maybe a triple or home run, now and then, but that’s not part of my plan. I’m happy just waiting for the opportunity to find me. Follow me on The Ticker and you’ll know first hand what my next major move is when I make it.