One of the first “The Ticker” articles I published was during my tenure at a school that’s named for my classmate David Tepper. He had the school named after him; me, I got a plaque above the middle urinal in the third floor men’s room. Nonetheless, The Ticker was born during the days of Volcker when the Fed raised interest rates to 20% before dramatically dropping them. The article was titled “Buy Bonds”. History does repeat itself; it’s time to look at buying bonds once again. Chances are they’re going to perform better than equities over the next couple years.

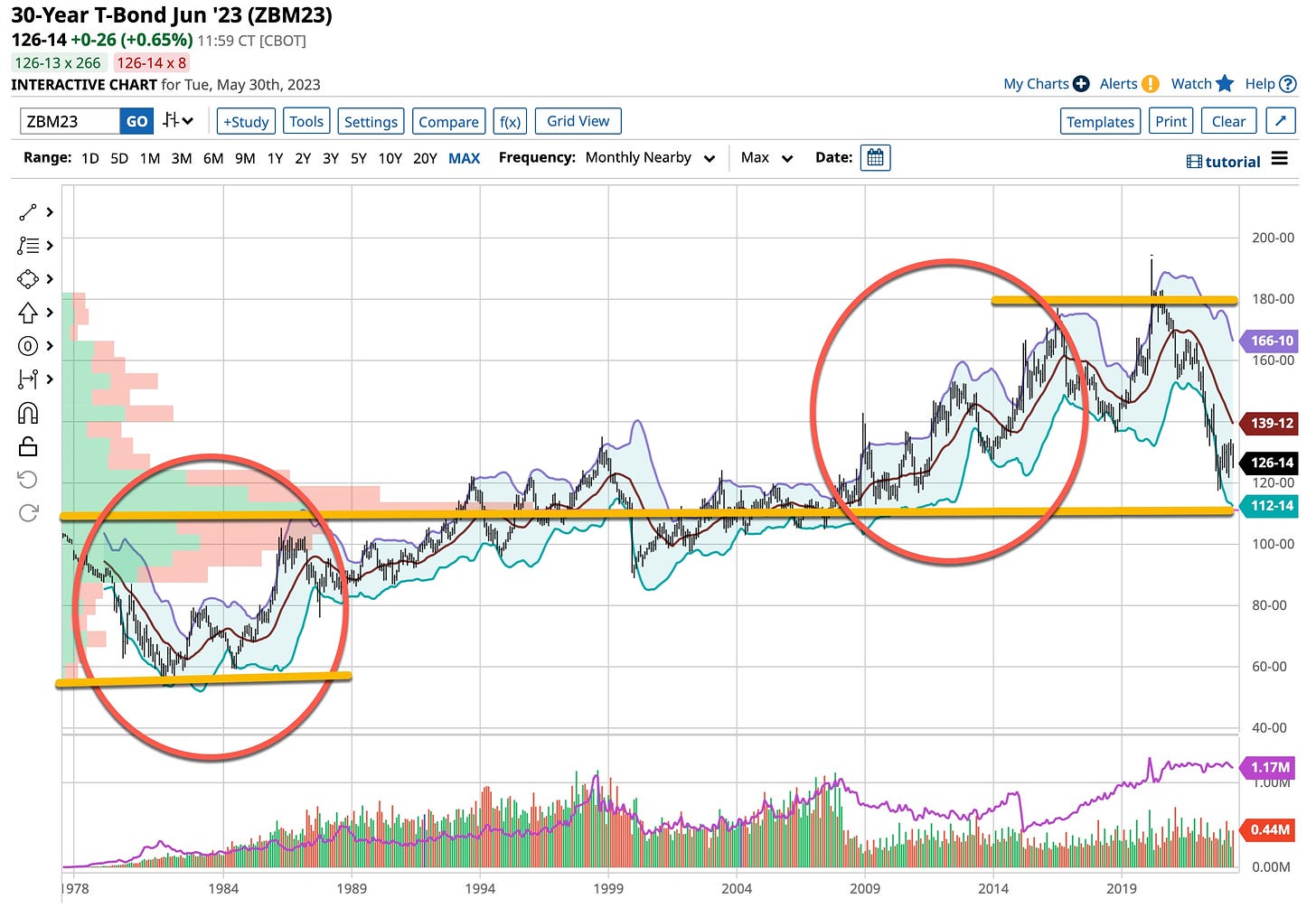

The timing of this decision buttresses a basic investment rule I’ve followed for years; “buy when they sell and sell when they buy”. Give it a try, it works and considering that bonds have had their biggest drawdown since 1786, the “risk / reward” suggests the timing is getting closer depending in part the outcome of our recently self-created debt ceiling crisis. Will we ever learn?.

The Federal Reserve has taken interest rates higher looking to defeat inflation and to slow economic growth. While they cannot “ring the bell” signaling success in their efforts. they’re closer to pausing than they were earlier in their campaign. Economic growth will eventually slow giving rise to disinflationary or even deflationary pressure with rates tracking economic growth lower. It’s natural, interest rates reflect general economic growth and inflation trends. Augmented by what can only be considered as an artificial monetary intervention to combat COVID, as the printing press fades the yield will move lower. As rates move lower, the price of bonds inversely move higher. It’s just math but most investors, at least those “newly minted” over the past decade or so never looked at bonds to provide “capital appreciation” in addition to interest.

Why Buy Bonds

There are three main reasons to buy bonds:

Risk Reduction – Lower volatility bonds offset higher volatility equity assets.

Capital Appreciation – For the same reason we buy growth oriented equities.

Total Return – For interest income like a dividend plus capital appreciation.

The only remaining question is the timing of entering an investment of this nature. In the past, the Fed cut rates to offset the risk of a recession or more. If deflation catches hold and rates return to COVID period lows bond prices could increase upwards of 50% or more. Still, it’s best to wait until the “swamp”, both political parties, acts then evaluate the timing of this transaction.

If I had to pick a specific asset class to buy it would be either the U.S Treasury 30-year bond, the 10-year note or futures or option derivatives of those instruments. If you are a trader there’s many ways to increase your leverage. When I “bought bonds”, early in the 1980s, the margin on U.S. Treasury instruments was 10%. In other words all I had to “put down” was 1/10th of the value of the underlying asset purchased. Sure, margin interest rates were high but the increase in price was rapid. It worked for me and my clients. It’s getting close to being time to “buy bonds” once again.

Technically speaking, the middle line that traverses the entire chart, from 1978 to the present time, represents the most heavily traded price. In essence we are returning to the mean and “mean reversal” is normal for most any traded entity. The oval coupled with the lower bottoming line, reflecting the early 1980s, shows what can happen as interest rates decline. The oval coupled with the topping line, extending through the most recent period of increasing interest rates, exhibits what happens when reversals in the opposite direction occur. Most interesting to note is that both patterns reverted to the mean.

As of September 2021 China held approximately $1.05 trillion of U.S. debt, roughly 4.6% of the total amount issued and outstanding. Why is that important? Yesterday China reported that upwards of 20% of its population, between the ages of 16 to 24, is now unemployed. The exchange rate on the Yuan versus the Dollar currently sits at 7.08, much higher than its recent lows around 6.50. Chinese municipalities are having problems paying their debt service. The Chinese government “insures” its municipal debt. With the recent failures with China’s commercial real estate developers, coupled with a slowdown in its overall economy, China could become a net “seller” of its U.S. debt holdings which could very well put a damper on any upside rally in bonds. Keep both eyes open for movements and macroeconomic economic reports coming out of China in the near future. Looks like COVID didn’t discriminate in the havoc caused around the globe.

While Congress has more than likely delayed the inevitable by “kicking the can” down the road with another $4.0 trillion possibly being printed and injected into an already far too high inflationary cycle, it also bring us closer to the reality that “this too shall pass” and when it does, bonds are going to fly. When, sorry my “Magic 8-Ball” is a bit cloudy today but after this week’s debate in the “swamp” things might become clearer. Stay tuned.

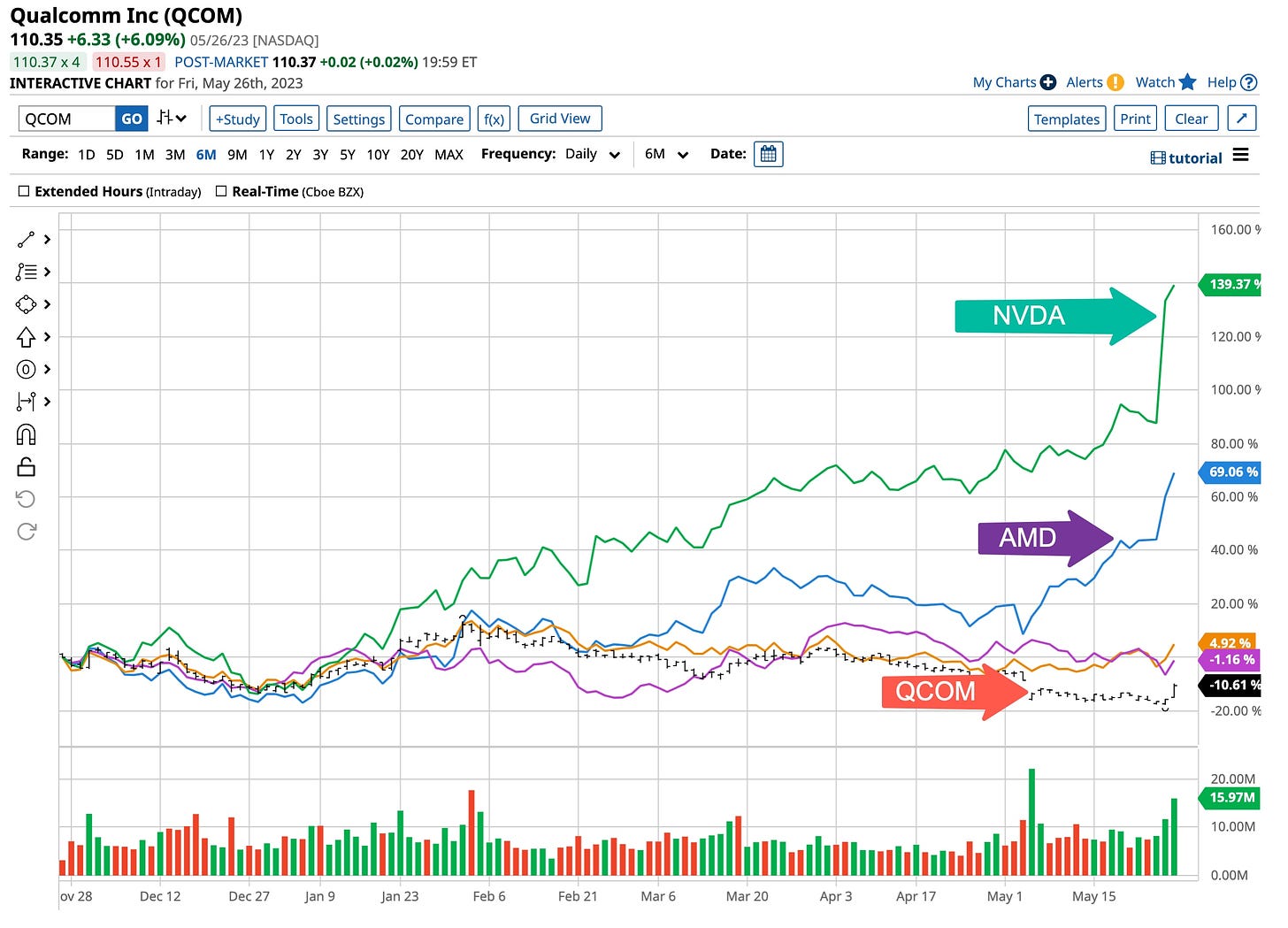

Nvidia (“NVDA”) Versus Qualcomm (“QCOM”)

Nvidia stock has skyrocketed since the AI “bubble” has formed and at this juncture is highly overvalued. Purchasing NVDA at this time appears a little risky. In my opinion it’s time to start looking for alternatives. Although not writing this post to suggest you “pull the trigger” immediately, I suggest you keep your eyes on QCOM and decide for yourself when it’s time to take a position. I’m reluctant at this time of uncertainty to buy most anything right now except perhaps the long bond as discussed above but that’s me. You decide for yourself. I can “lead you to water” but I’m not one to “make you drink”.

The semiconductor industry has garnered significant attention due to the surge in demand for artificial intelligence (“AI”) technologies. Nvidia’s EPS came in at $1.09, 18.8% higher than the 0.92 expected, while revenues reached $7.1 billion, a positive surprise of 10.3% versus consensus. In addition, NVDA issued an optimistic forecast, thanks in large part to the positive outlook for AI. Undoubtedly Nvidia will be one of the biggest beneficiaries of AI's widespread use but it’s come a little too far too fast and parabolic technical chart patterns share a common trait; “what goes up fast often comes down fast”. With a current P/E above 200 chances are that it’s seen its highs.

Consider the Bottom Fisher Qualcomm

Examining the technicals of Qualcomm shares doesn't scream out that it’s time to pull the trigger and invest. After all, it hit its high around $190+ back January 2022 and has gone nowhere but down since bottoming out slightly above $100+ at a price not seen since the days of the COVID pandemic. Recently they missed on EPS, beat marginally on revenues then, like PYPL were taken out to the woodshed and punished. If buying good stocks when they’re getting beat up is part of your plan, like it is mine, QCOM should be one you’re watching.

Did you know that QCOM actually pays a dividend of about 3% at this price level? It’s financial health is solid as well so it should continue to pay that dividend. With a P/E of slightly below 12, a gross profit margin above 55%. a net profit margin around 25% and return on equity approaching 65% it’s time to consider QCOM. Again, your call; I’m just the messenger.

Thanks for your positive commentary about our regularly scheduled Sunday offering I call “The Week That Was & What’s Next”. In looking to develop additional video type offerings, The Ticker looks to kick-off another regular feature, “Trader & Investment Tuesdays” where, when appropriate, some potential investment and trading ideas will be shared. There’s more on the agenda so stay tuned and thanks for following what is being presented; it’s a labor of love and I trust it’s been beneficial.

Because of you, our early adopters, Substack has taken notice. Our thanks go out to Barchart as well as they’ve adopted us; not a bad comparison chart, eh? They’re going to form the foundation of how I illustrate to you “what tools I use & how I use them”, just finished negotiating the best deal possible for you, our followers. Stay tuned.

Hope you enjoyed this post. I’m just a young 68 years old; my Dad became a broker when I was 13. It’s time for me to ‘give back’ to all of you what’s in my head. It’s not always pretty but it’s based on history . . . and history, unchecked, repeats itself as you are witnessing..

Everyone learns at their own pace. If you pick everything up the first time through, great but if not email me at david@thetickeredu.com so we can further help. Again, let me know what you want to learn, I’m all ears.

From “Quadrophenia” to “Tommy” growing up “The Who” had meaning in my life. “We Won’t Get Fooled Again” is one I can relate to as we change the political face of this country. Let’s face it, the “basement” candidacy of the current administration just “fooled” everyone. Start today; f you want change, go out, make it happen. McCarthy has the wheels pointed in the right direction but there’s undoubtedly a better answer out there . . . it’s up to all of us to speed them up a little bit in finding it.