My Dad became a broker when I was 13. I never looked back and now it’s time to give back the “right way”. I began life as a “hedger”. In today’s world, you would call me an investment “position” trader. As the opportunity arises, I’ll trade just like “day, scalp, and swing” traders do but those incidences are few and far between. I’d much rather remain on the longer side of the investing and trading equation.

I have great respect for day, scalp, and swing traders. The problem remains that few people who act in this manner make money. That’s why I’m here. It’s not feasible to believe people will change their trading philosophy on a dime. Some have but for the others it takes time. That’s OK, I just ask that you take the time to run this marathon with me and give position trading a chance. It’s worth it and you’ll never look back.

Relationships Are Important

When it comes to the relationships I follow, it’s best to keep it simple. While possible to discuss the “basics”, matrixed permutations will prevail. It takes time to understand these common interrelationships and like anything else, you must first visualize them to see how they work. Let’s get started and email me if you have any questions.

Interest rates certainly have a way of altering the landscape. Interest rate discussions are prevalent. Quite often interest rates create their own pathway. At other times they are dependent upon the action of related indicators. When interest rates increase the costs of products and services decrease everywhere except in the “export” markets due to the higher cost of domestic currencies. Consumer and producer inflation decreases, an effect central banks count on to fight prior rising prices.

If the US dollar decreases, products and services tied to the dollar increase and are cheaper to buy. Economic output, basic Gross Domestic Product increases. It makes sense as both consumer and producer inflation increases as prices have a tendency to increase and corporations pass these costs on to end users. Naturally, if the Dollar is down currency values of other inverse related currencies rise.

When the Consumer Price Index increases, products and services tied to the “Dollar” increase along with the value of the Dollar decreasing. Prices for equities, debt, and associated products, decrease. Inflation increases at the consumer and producer level making perfect sense. The Consumer Price Index is a direct measure of these prices and if CPI is higher prices have increased.

Keep two criteria in mind; just because it happened before doesn’t mean it’s going to happen again and a “what if” or “what happens” is never mutually exclusive. The first “what if” may be affected by a second or even third “what if”, altering the actual effect of “what happens”. Expected results are not always the case. More often, exclusive of other effects and events, what’s illustrated and spoken of is the case.

What The Street Predicts

I happen to agree with “the street” on a conditional basis. Interest rates need to come down, the U.S. Dollar needs to decrease, and the BRICS currency needs to increase its market share.

If interest rates decline, the ‘intrinsic’ value of those countries and regional currencies will decrease. It only makes sense. If the interest you can earn decreases, the reason to buy that currency decreases. That’s important especially if the BRICS currency takes a larger market share.

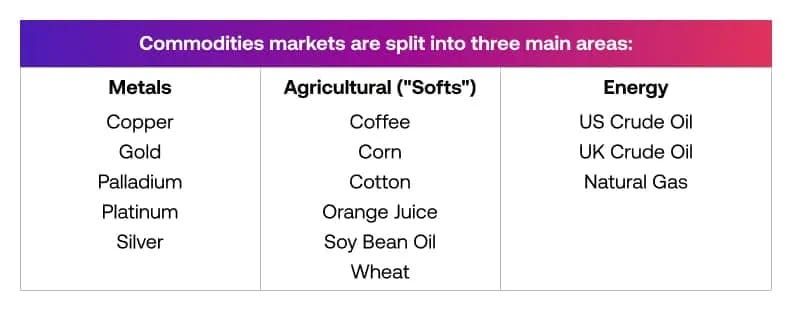

Basic “raw” commodities, everything from metals, construction, agriculture, and basic energies are priced upon an underlying currency. If the value of the currency declines the underlying price of the commodity increases. Again, it’s a simple relationship.

The street’s right on this one. The question, as it’s been for years is when. I’m holding a large position in gold bullion and U.S. Treasuries. I am heavily invested in ‘dividend’ paying stocks. I would love to see interest rates decline, the dollar decrease in value, and commodity prices soar. Again, for me, it’s a when not an if. How about you?

In “Stop The World I Want To Get Off”, Anthony Newley proudly sang “Gonna Build A Mountain”. It’s your turn to do just that and learn how to do it, the “right way”. I had the pleasure of working with one of my many tutorial students yesterday. We were just comparing notes. He’s a damn good investor but like far too many people I’ve met in this investment world, he trades too much. If you are going to ‘build that mountain‘ it’s best to learn how to be patient. If you look at my current positions it will become apparent that I’m patient. That’s how you build mountains from little hills.