From Powell speaking today and tomorrow to Congress to President Biden’s State of the Union and Katie Britt, Alabama’s junior Senator offering the Republican rebuttal, the actual “state” of the “union” is definitely in play. So is the basic perception of the overall world markets as many differing opinions are being floated and tested across the Internet and channels that profess to “report” what they call “the news”. Give me a break.

Whether we as Americans and voters like the current outcome, it’s a rematch between Donald Trump and Joe Biden. While I’m upset that these two candidates were the best we could do, it’s time to centralize our decision-making and evaluate what the overall markets are telling us. Differing opinions across the globe persist. Obviously, what is more important to most will prevail and the initial indications of where the states are heading is apparent.

Initial Reactions

Everyone has to start somewhere. From where I stand, the best perception I observe is one of “schizophrenia”. If you watch the averages, what goes up must come down and vice versa. That’s why I’m a long-term position investor, trader and above all, a hedger. If you have a “crystal ball” that can determine what’s next, sell it on eBay and you will make a fortune. Mine is still “fair to partly cloudy” at best so I’ll stick with my plan.

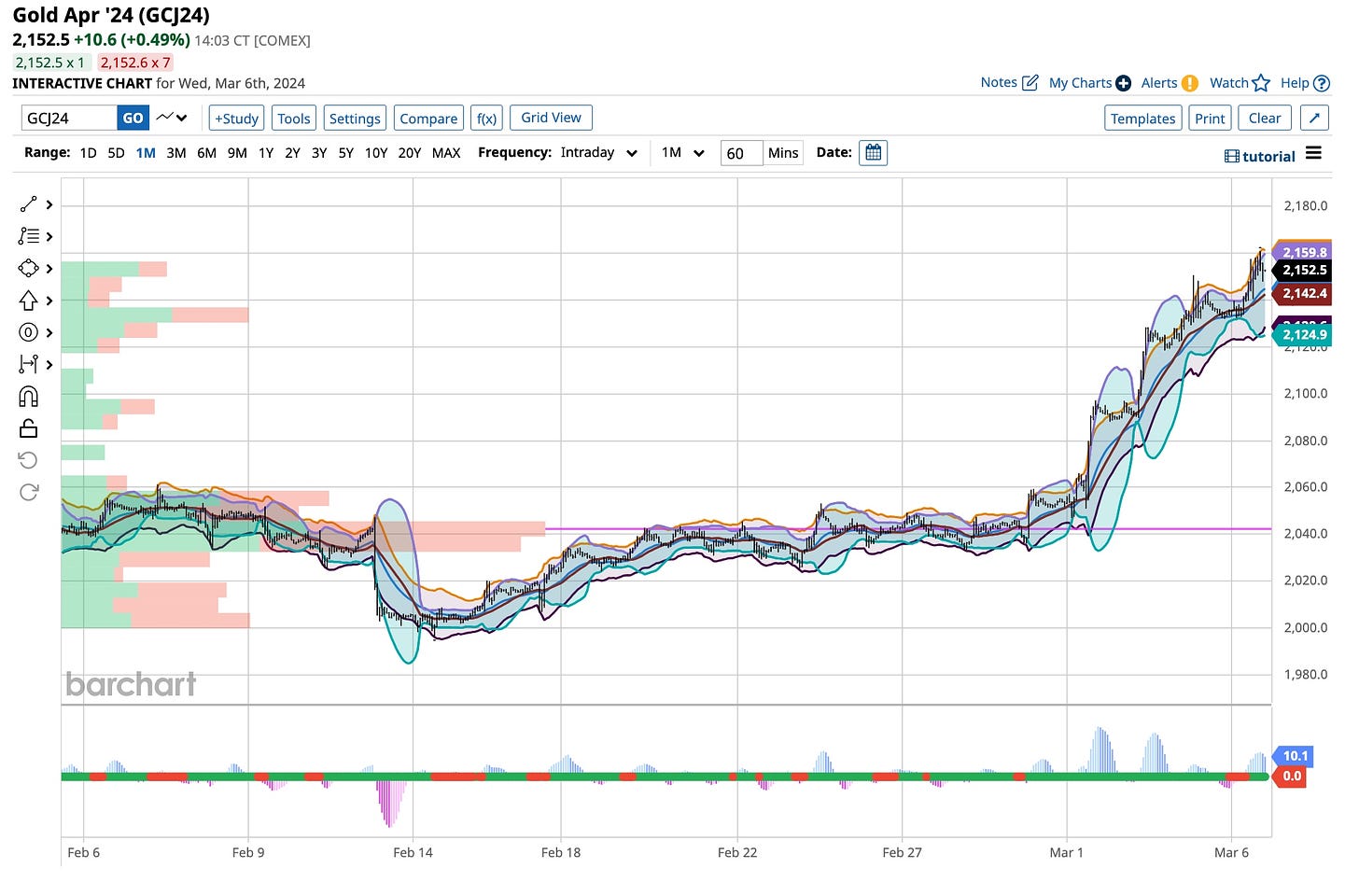

I’m looking for interest rates, worldwide, starting in Europe to head lower. The Yen is going to come back to earth as inflation is real on Japan’s main island. Gold is taking flight, now coupled with silver giving hope to the overall metal arena. I’m just waiting for the “Copper” markets to move higher as they “seasonally” do this time of year but there is more. much more.

The Bitcoin world is alive and living in the hearts of younger traders who believe the “sky is the limit”. I’ve traded Bitcoin twice. In early 2020 when PayPal made it possible to buy Bitcoin on it’s site I went long around 12,500 and sold what I consider to be just “smoke and mirrors” when it hit 48,000. Then, when the “herd” took the crypto tokens to higher levels I went short. That’s it until now. I’m back watching for what should be a “double top” but I have not acted. I’ll just keep watching what the “winners” tell me they’re doing across social media and when they are all “long” I’ll go “short”.

Otherwise, given the “schizophrenic” nature of what’s happening, I’ll continue to use the VIX calls to hedge against the inevitable. There is more, but you’re going to need to wait for this weekend’s “paid” for Substack post to see exactly “what’s next” in my saga of stock picking. I’m spending a lot of time reviewing many different investments so stay tuned and look for my picks this weekend. I’m usually a little early so keep that in mind. Additionally, while you are waiting, practice your own “due diligence” skills and tell me what your picks are at david@thetickeredu.com. I’m all ears.

From The Horse’s Mouth

While differing opinions prevail, one I’ve attached myself to, in addition to others on the same page is that 2024 is an election year. Indices, and the securities that comprise them usually go higher during the campaign process. From the Trump camp, markets heading higher expecting a Trump victory are prevalent. With “stagflation” being the real problem, interest rates, although perched to head lower are not going to shatter a record or two with a precipitous decline. They are however, regardless of who emerges as our next President, going to head lower. Face it, Biden wants to win, Powell wants to remain in his role and Yellen wants to keep “selling her mushrooms”, the blue ones.

There’s a problem point with respect to this scenario and it’s one that created havoc in the 1970s, energy. As the “Apollo 13” crew reported on it’s way to the moon in April of 1970, “Houston, we have a problem”. Oil is at a “tipping point” around $80.00 a barrel. It’s inflationary effect is real and the 1970s are emblematic of how its “pricing” effects all segments of the world. I have “two eyes and ears” tied to this commodity. I wonder just how high it can go so picking up a few way “out-of-the money calls”, perhaps the 2024 August 100 calls for less than fifty cents simply makes sense as a hedge. What do you think?

The last three years of the Biden administration did not thrill me or anyone else. Basic living costs increased, the view of the United States from within and afar was reduced and the effectiveness of the Executive Branch was questioned. Many woke tendencies, the need to support minority goals and incorrect, ineffective decisions prevailed from the Afghanistan withdrawal to the Ukraine battle and now the Middle East. It seems to me that proponents of the current administration question its decision-making and overall effectiveness. Perhaps this is underlying what we see in the markets and many of the components that comprise all averages. Regardless, it’s definitely going to be an interesting several months politically and economically.

Just like Freddie Mercury of Queen, “i’m Going Slightly Mad”. It is impossible not to when it comes to these markets and the world revolving around it all. Perhaps one of my favorite Queen tunes, if you listen to the lyrics you’ll realize that for many, being just a bit “crazy” is a way of life. If you think you have the innate ability to day trade these markets congratulations, you’re there. Sure, some days you are going to puff out your chest and tell anyone who will listen how well you did, Then there are the days when no one can find you anywhere because, just like in a casino you “crapped out”. Learn how to take the “long-term” approach. At least you’ll go slightly mad less often.