It's a short one, folks, but a good one. Technical indicators abound in today’s market, but the Russell Index rules for some reason.

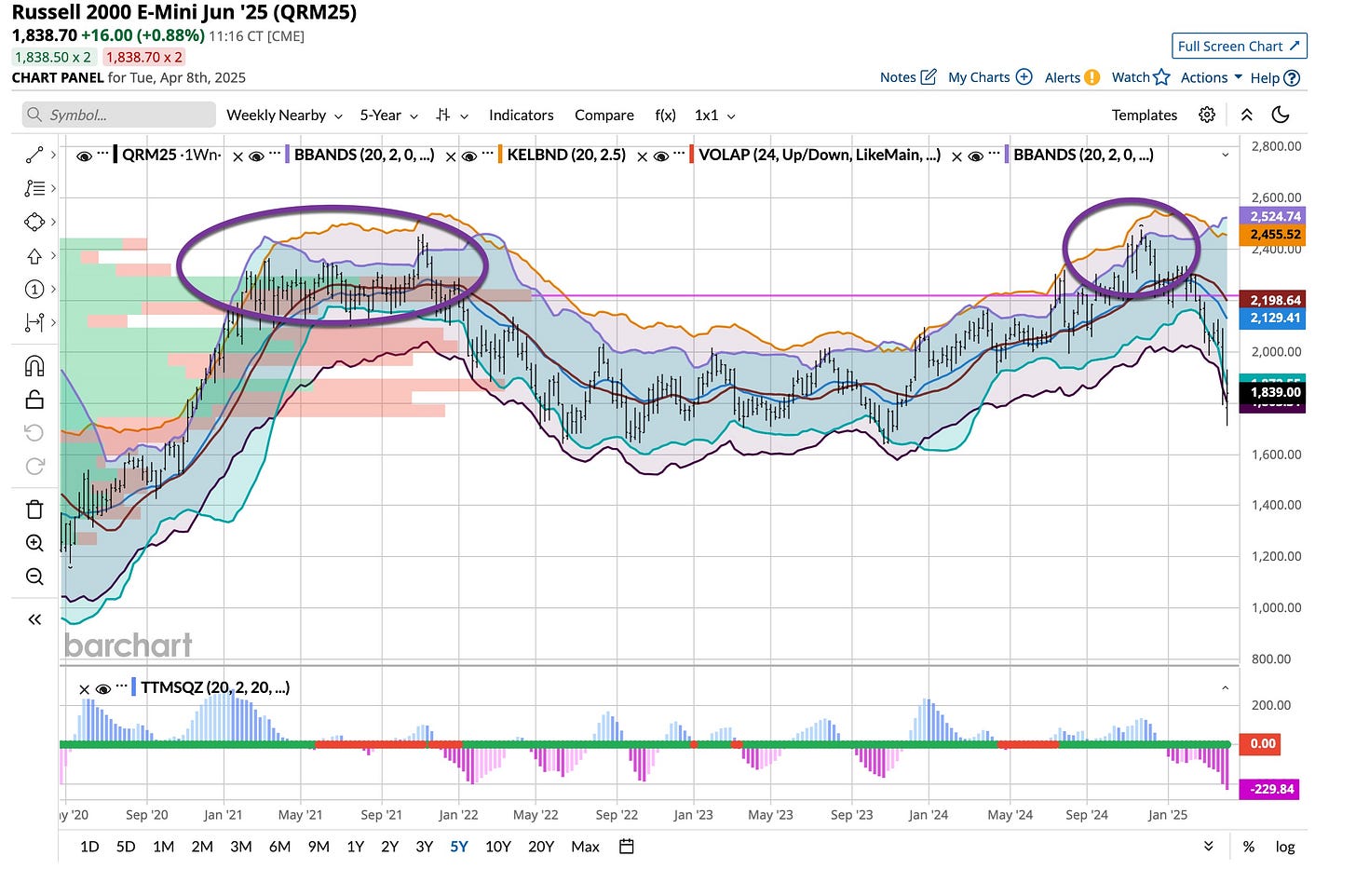

Double Tops Are Trouble

I’ll always remember shorting the Russell Index above 2,400 in October 2021. It was a simple trade as inflation was brewing, and despite their growth, this index could not deal with higher rates.

More importantly, the Russell gave us a signal when it touched the old highs late last year only to fail to go higher. Hell of a. signal and one I follow. You should too.

Memories are important. Just ask Streisand and Redford. For me, it’s a history of looking at but a few indicators. The worst is over for this decline. I’ve lived through many of them, and they are pretty much the same. I bought a bunch of stocks at lower prices because I’m patient. It’s easy when you are sitting on cash. Building that cash as that cash is not as easy as the “herd” always thinks everything is rosy. It’s not, so hedging with nine-month VIX calls is essential. If something is going to go wrong, you are protected. I bet the Democratic Party wished they had options like that, eh?