Over the past couple months I’ve been “slaving” away putting 55+ years of “hands-on” experience to the test. Based upon today’s rhetoric I might be a reparations candidate. All politics put aside, environmental, social and / or governance, “ESG” investing has changed the playing field from equities to bonds, from ETFs to futures and more. It’s such a dramatic change, as I’ve developed my courses, a separate section just on ESG is taking shape.

When it comes to selecting a company capable of managing such a change one needs look no further than Blackrock, the “King of ESG”. Larry Fink, Blackrock’s CEO does not need me to tell his story. Just click on the link; he tells it better than I ever could. In addition to the Barchart visuals below, click here for a “complete list” of currently available Blackrock Investment Funds. Here’s a few of their largest ones:

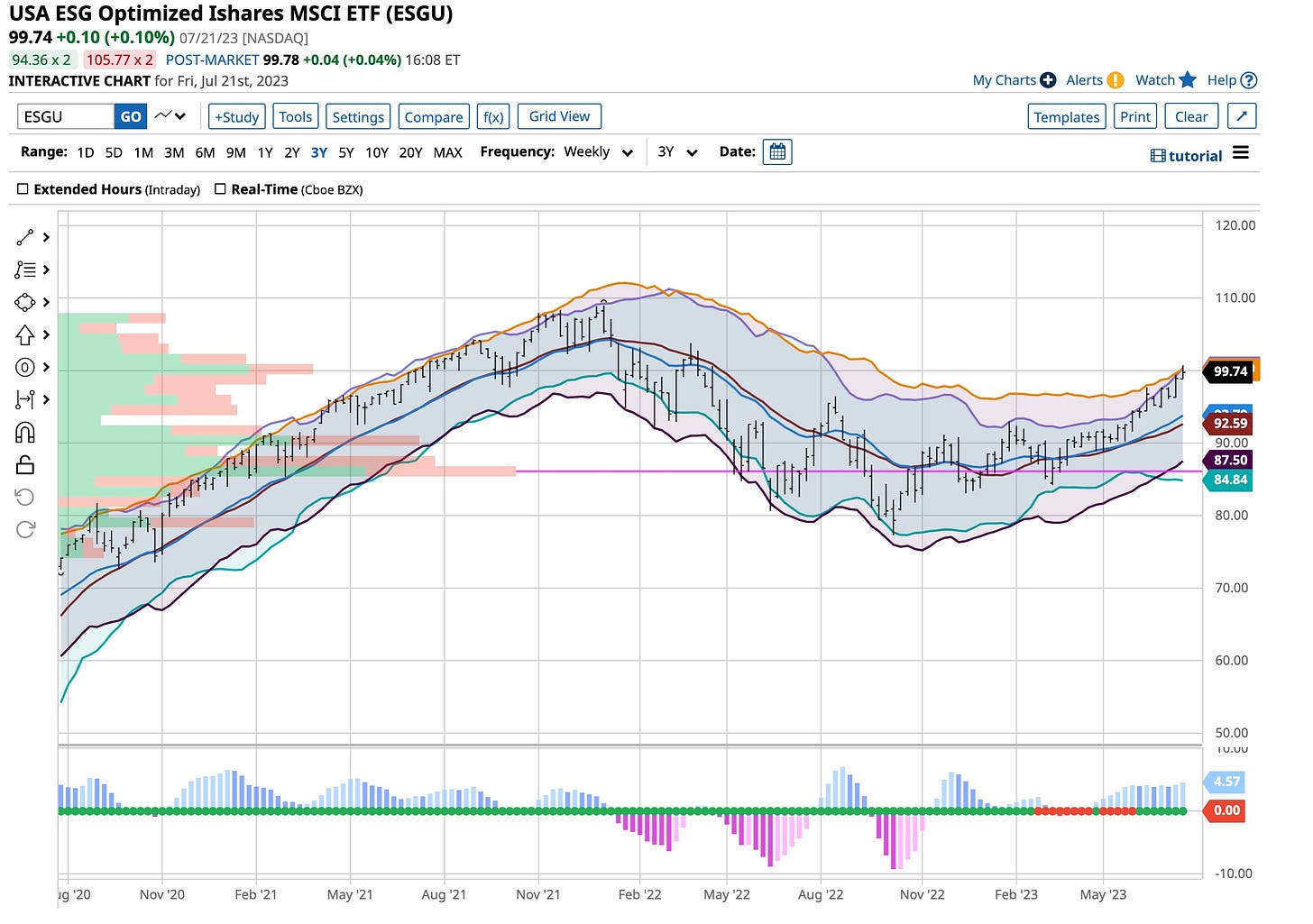

USA ESG Optimized “ESGU”

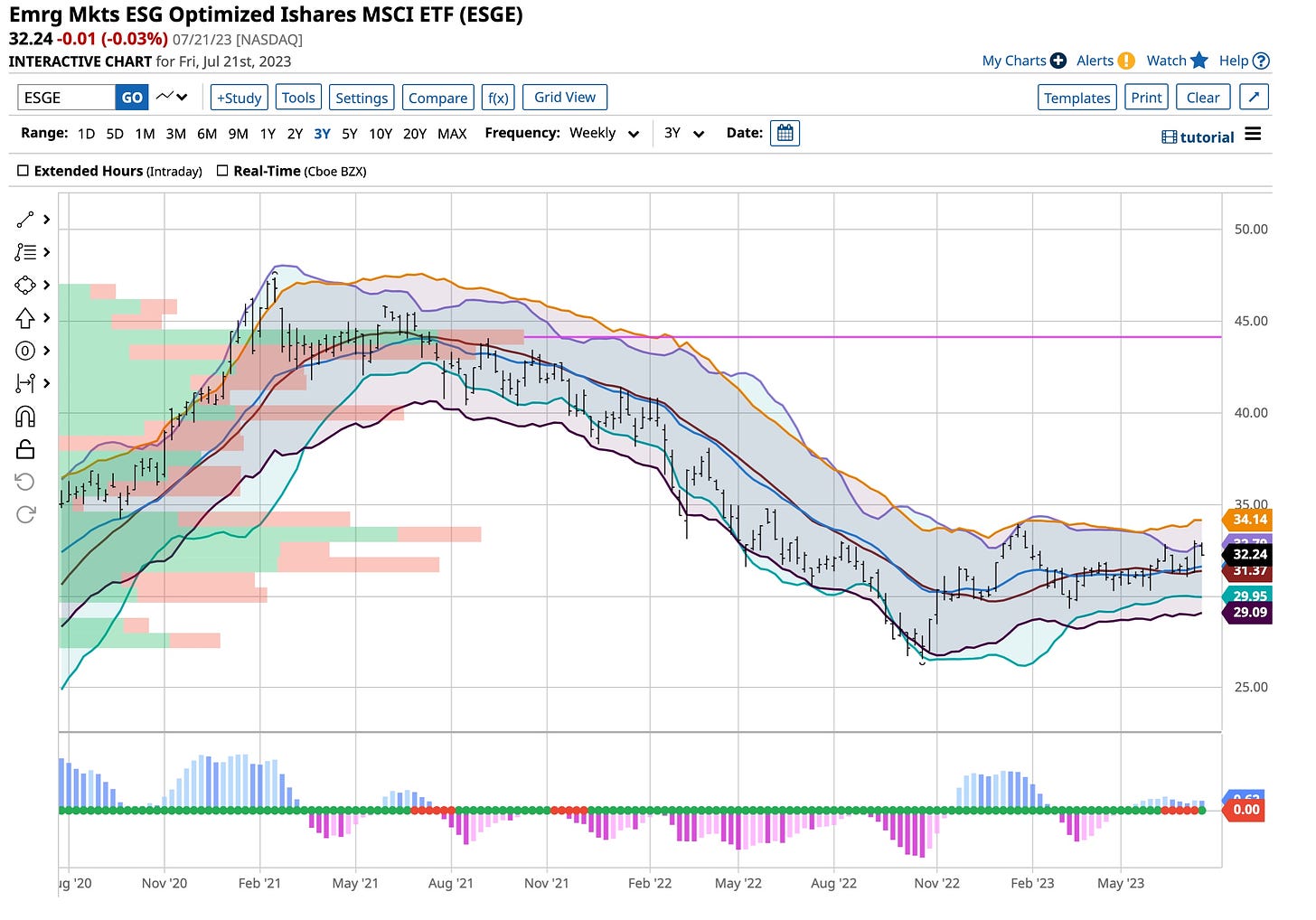

Emerging Markets ESG Optimized “ESGE”

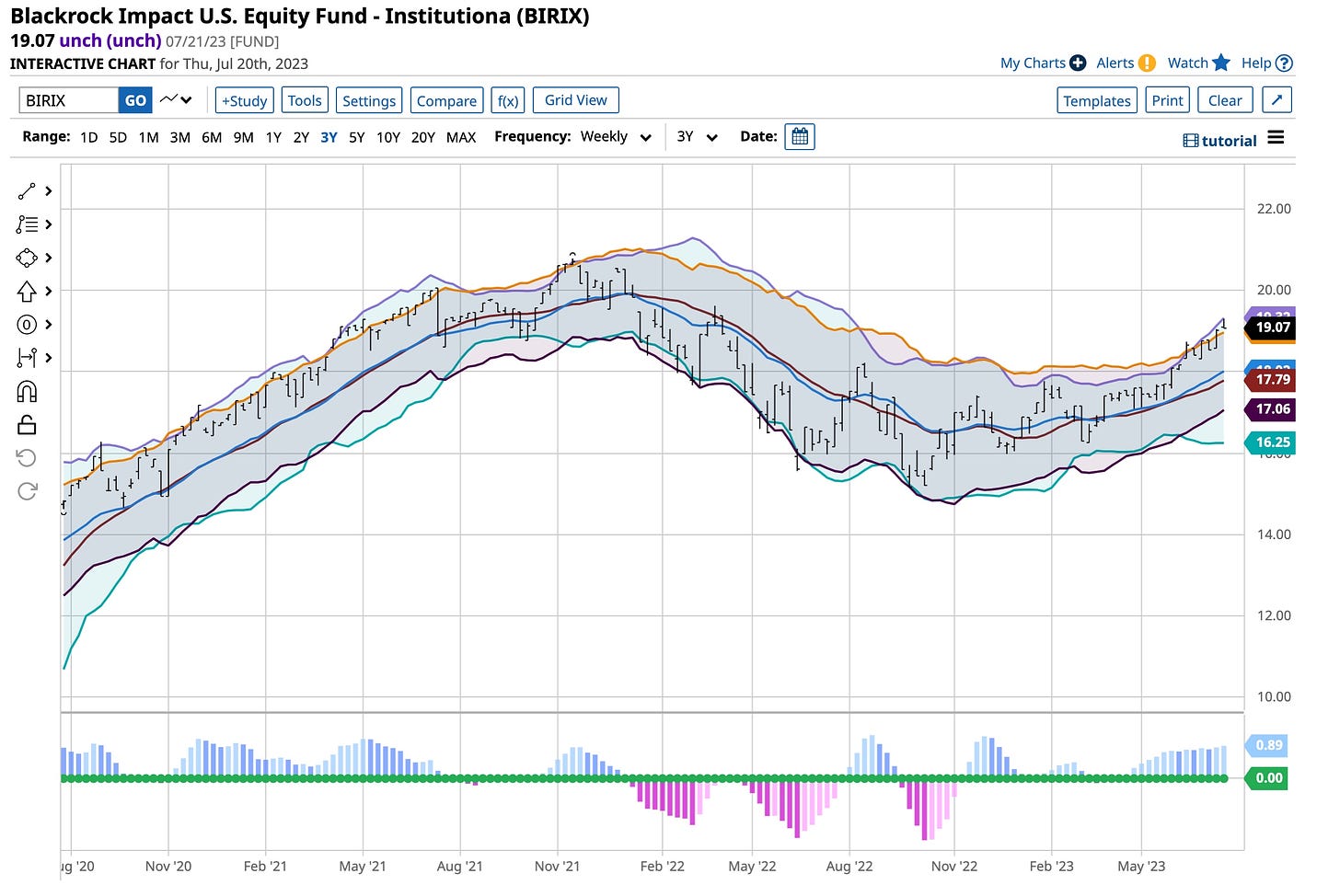

Blackrock Impact U.S. Equity “BIRIX”

Investor demand’s been driving this growth for many reasons. What follows is being used in my upcoming course more so as an addendum regardless of the format; ESG’s earned its place in today’s investment world. Let me know if I’ve missed anything.

Ethical & Sustainable Investing

Ethical and sustainable investing, also known as socially responsible investing “SRI”, is an approach to investing that considers both financial returns and the social and environmental impact of investments. It involves selecting companies and investment opportunities that align with ethical or sustainability criteria. Here's an overview of ethical and sustainable investing:

Values & Impact: Ethical investing allows individuals to align investment decisions with personal values and beliefs. Investors may support companies that demonstrate responsible practices, positive social impact, environmental sustainability, or adhere to specific ethical standards.

ESG Factors: Environmental, Social, and Governance “ESG” factors, considerations in ethical investing are critical. Environmental factors focus on company impacts on the environment, like carbon emissions, waste management, renewable energy initiatives and more. Social factors look at a company's treatment of employees, its community engagement, diversity and inclusion, human rights, and labor practices. Governance factors assess company leadership, transparency, board structure, compensation, and overall governance practices.

Ethical Investing Options: Investors have many options for engaging in ethical and sustainable investing:

a. Socially responsible mutual funds and exchange-traded funds (ETFs) that follow specific ethical criteria.

b. Impact investing funds that focus on generating positive social or environmental impact alongside financial returns.

c. Proxy voting and engagement, where investors use their shareholder influence to advocate for better ESG practices in companies.

d. Direct investment in specific companies or projects that align with ethical and sustainability principles.

Ethical Investing & Sustainable Finance

Ethical investing & sustainable investing are approaches to investment that consider environmental, social, and governance factors in addition to financial considerations. These investment strategies seek to generate financial returns while aligning certain values and principles. Here's a brief introduction to ethical investing and sustainable investing:

a. Ethical Investing: Ethical investing, also known as socially responsible investing (SRI), focuses on investing in companies that align with specific ethical guidelines or values. It involves avoiding investments in companies involved in activities that are deemed unethical or harmful, such as tobacco, weapons, or companies with poor labor practices. Ethical investors may also actively seek out investments that contribute to positive social impact, like companies that promote sustainability, renewable energy, or social justice.

b. Sustainable Investing: Sustainable investing or sustainable finance or impact investing, generates financial returns while still considering long-term environmental, social, and governance factors. It involves investing in companies prioritizing these sustainable practices and demonstrating commitments towards environmental and social challenges. Sustainable investors seek to support businesses that contribute to a more sustainable & responsible future, focusing renewable energy, clean technology, resource efficiency, and social equality.

c. ESG Factors: Environmental, social, and governance (ESG) factors represent key considerations in ethical and sustainable investing. Environmental factors focus on a company's impact on the environment, such as carbon emissions, waste management, resource usage and climate change strategies. Social factors assess all labor practices, treatment of employees, community engagement, diversity & inclusion, human rights, and product safety. Governance factors, a company's leadership, transparency, board structure, executive compensation and adherence to ethical business practices are important.

Impact Investing & Socially Responsible Investing “SRI”

Impact investing and socially responsible investing are two approaches to investing that focus on generating positive social and environmental impact alongside financial returns. SRI investments are commonly made through mutual funds, exchange-traded funds “ETFs”, or other vehicles that follow specific ethical guidelines. While they are similar, there are some distinctions between the two:

a. Impact Investing: Impact investing generates measurable, environmental and social impacts alongside financial returns. Investors seek companies, organizations, or projects that address specific social or environmental challenges, like alleviation of poverty, renewable energy, sustainable agriculture, education, or healthcare. Impact investors allocate capital intent on creating positive and measurable outcomes aligned with their impact goals. Impact investments are made across various asset classes, including private equity, venture capital, debt financing, and public equities.

b. Socially Responsible Investing “SRI”: Socially responsible investing, also known as ethical investing, focuses on investing in companies that align with specific social and ethical guidelines or values. SRI investors apply screens, exclusionary criteria to avoid investing in companies involved in unethical or even harmful activities, like tobacco, weapons, or companies with poor labor practices. SRI investors seek out investments in companies that demonstrate responsible practices and positive social impact, such as those promoting sustainability, renewable energy, or social justice.

Long-Term Sustainability

Evaluating long-term sustainability and ethical practices requires a comprehensive assessments of various factors. Here are some key considerations and approaches to evaluating sustainability and ethical practices:

a. Environmental Practices: Assess a company's environmental impact, including its carbon footprint, resource usage, waste management, and antipollution measures. Seek companies that offer commitments to sustainability, renewable energy, climate change mitigation, and environmental stewardship. Review certifications, such as ISO 14001, or participation in sustainability initiatives like the Carbon Disclosure Project “CDP” or Science-Based Targets “SBT”.

b. Social Practices: Evaluate how a company manages its employees, customers, suppliers, and local communities. Consider factors such as labor practices, employee welfare, diversity and inclusion, community engagement, human rights, and supply chain transparency. Look for companies prioritizing fair labor practices, safe working conditions, equal opportunities, and positive community impact.

c. Governance Practices: Examine a company’s governance structures, its board composition, executive compensation, transparency and adherence to all ethical business practices. Consider the company's commitment to responsible corporate governance, integrity, and compliance with laws and regulations. Review instances of corporate governance controversies, legal violations, or unethical behavior.

The world is changing and with it comes trends that need to be identified & addressed but in the case of ESG careful examination of what’s available for investment varies. I see that in some cases overall financial returns are somewhat muted. This new class of investors are currently willing to “take less” so their inherent beliefs are met. Equities are now “ranked” based upon their adherence to these “new rules”. One needs to only look as far as Target and Bud Light to observe the negative ripples that are beginning to run through this type of investment strategy. While ESG has become a watchword in today’s world, as investors get burned their objectives and philosophies may just go “up in smoke”.

I’m here to show you what I’m observing. While you’re at it click on Barchart and take advantage of the free month offered and learn. I hope you all enjoy the charts posted from Barchart. Give Barchart a try, just “click here”; get a trial for free at no risk. It just might be the best ‘click’ you’ve ever made.

It’s not getting any cooler down here in Texas. I’m still drafting courses, pretty much around the clock taking what’s “in my head” to put it “between your ears”.

Udemy is going to be the “mechanism” used to deliver these courses. They are going to review my first course later this week. I’m getting pretty good on these “newfangled editors” including a few new ones supported by Nvidia’s technology. About a year ago Nvidia accepted me into their “beta” program because I attended Carnegie-Mellon in my hometown of Pittsburgh. Both were beneficial decisions. Now it’s time to decide whether my “smiling face” is best replaced with an Avatar. James Cameron was right.

Together with Substack, I’m putting together a method to receive payment for what I post. Hopefully you’ve found my words and thoughts beneficial. I do learn something new every day and hope you do as well. I’m not switching to a “Paid” Substack model at this time so don’t worry. There’s too much that needs to be addressed, learned and practiced but starting soon I’ll have a link where “founder contributions” can be made but in the interim just enjoy and please refer your friends . . . and thanks.

I’m just a “young” 68 years old looking to help you become the best damn investor or trader you can possibly be. Everyone learns at their own pace. If you pick everything up the first time through, great but if not email me at david@thetickeredu.com so we can further help. Again, let me know what you want to learn, I’m all ears.

Becoming the best damn investor or trader you can be is “all between your ears”. The first thing you need to control is your emotions. Quite often it’s best to step away from the screen if everything in your mind isn’t aligned with your objectives. It’s all mental, from how you apply macroeconomic and geopolitical theory to hitting that button. It seems to me that Pink Floyd had a good handle on that with lyrics like “the lunatic is on the grass”. What were they smoking?