It’s been a couple of weeks since the Trump assassination attempt and we’re still faced with a discussion of what happened and what went wrong. Are you surprised? I’m not and you should not be either.

Nothing has “changed” and reality is in the eyes of the beholder or the context of the news channel or source you follow. That makes sense but the differences between fact and how it’s reported varies to such a great degree it’s impossible to discern reality.

The best story this week is the coronation of Queen Kamala Harris. The king is dead. Long live the queen. Now the question becomes how she’ll be dressed. Democrats are in a state of flux. The Obama team is on board. That brings more certainty to the real illusion that the queen is a carbon copy of the former king. From my recollection, and I do have a pretty good memory, Kamala was tasked with solving the crisis at what we call the “southern border”. Now, along with her reintroduction, that picture’s changed. What a surprise and what else will the “fake news” look to alter perception-wise?

The same extends to the investing and trading world. Some of the “big boys” say that the market is heading south. An equal number says it’s going higher. Many predict the Federal Reserve is about to lower rates perhaps as many as three times this year. Some others think they’ll wait. Not exactly the certainty one looks for in making decisions.

So what is next in this upside-down world? Is there any indication that can be used to solidly predict “what’s next”? For me, it’s simply the “same old story” as told in “Keep The Customer Satisfied” by Simon and Garfunkel. Everything you see and hear in this day and age is designed to keep you aligned with the beliefs they want you to follow. I think differently and you should too.

This Is What I Do See

Experience helps. With more than a half-century of being aligned with watching and listening to everything I can, some events just repeat themselves. One to observe is what’s happening in the tech and biotech world.

Everyone thinks the AI tech world is in or close to being in a “bubble”. While there are significant differences between this time and the Internet bubble, this observation hits home. What also hits home is that the biotech world is the first place where the money flows when the tech world corrects. I’m long a couple of behemoths but since others know more than I do, my biggest holding is in the Biotech ETF better known as ‘XBI”. Smart analysts run that one so I listen to them.

It’s The U.S. Dollar I’m Watching

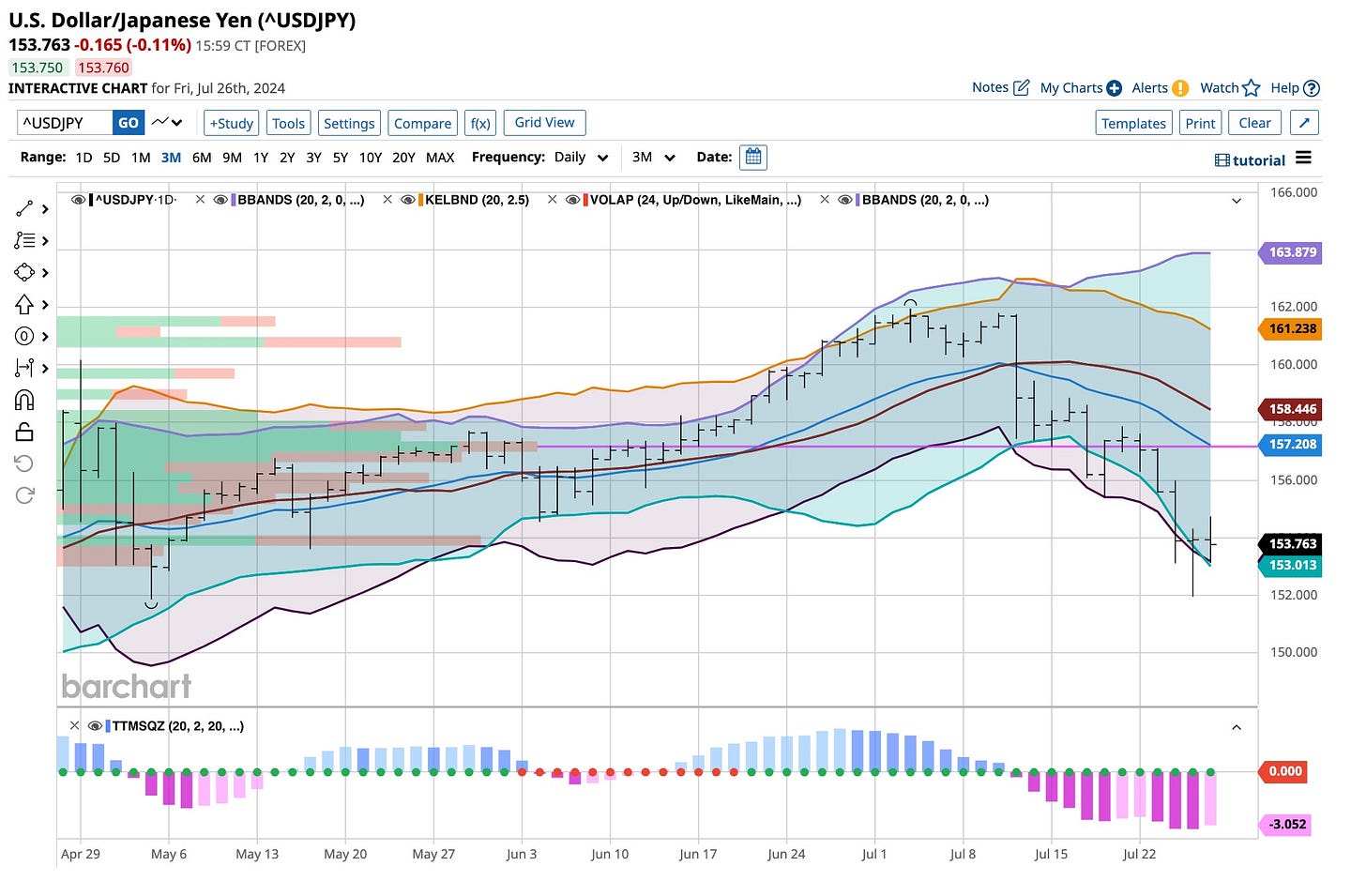

In order for the plans being set forth by most investment houses and the two primary political parties to work, the U.S. Dollar is going to have to weaken. By weakening, I am not talking about a couple of cents, I’m talking between 10% to 15% with my real target being about 88. The disappearing “carry trade” on the Yen is a good place to start and it’s cooperating. Take the price back to the 125 range and I’ll proudly wave a victory flag but it is going to take time.

Think about it, we in the United States need to sell what we grow and manufacture all around the world. We’re not the only country exporting grain, there are lots of nations out there doing the same. When it comes to basic manufacturing we are not doing all that well. Do you think perhaps that one of the reasons is that due to the price of the U.S. Dollar, we just are not competitive? I do but what happens if the U.S. Dollar goes down?

Jerome Powell would be very happy and better able to lower rates if more people were working. That happens when the dollar goes down. Trump would be very happy too as he wants to increase tariffs. A lower dollar enables that to happen but only if interest rates decline at the same time. Corporate profits would skyrocket as well if we started to make more things here. This is one of the reasons I’m buying lots of Boeing. If it is able to produce more revenues then the stock’s price is headed much higher. We need the dollar to collapse if this is all to happen. That’s how I am positioned. How about you? Are you short any Yen?

Summertime & We’re Looking For Fall

It’s getting closer every day. The Jewish holidays come late this year so we’re probably going to start to see some reactions after Labor Day. Rosh Hashanah and Yom Kippur hit at the beginning of the next earnings season so all hell should break loose about a month before we decide whether we have a country or not.

We’re going to be making a lot of decisions here at The Ticker based on what you are asking us to do. we have lots of followers here, on LinkedIn, and those who watch me on The Ticker. I’m not doing this for my health. I’m doing it for yours but I have to do it better.

I’m always open to suggestions so let me know what you think. I have two ears and one mouth so regardless of appearance, I listen twice as much as I talk. Let me know your thoughts and enjoy August.

History of the World Part I by Mel Brooks is a classic. The French Revolution is also a classic and the opening ceremonies of the Olympic Games will soon join them. Sorry, Mel but face it brother there is not a “snowball’s chance in hell” that you could make that movie today but the French can desecrate the Catholic religion at will. What the hell is wrong with this world? Bad enough that we have a country run by a man who cannot think straight. What’s happening worldwide just keeps on getting worse. If you think Hezbollah isn’t going to shoot more rockets into Israel, think again. If you think the world leaders are going to sit on their hands for the next few months, think again. Keep buying long-term VIX call options, they work for good reason.