It’s been an interesting time in the markets. I’ve always been a proponent of long-term investing. That doesn’t mean I ignore short-term opportunities as they find me. If you ask the better half, she’ll tell you that sleepless nights are common for me. In the wee hours of the morning, you’ll find me online, listening and watching the “world turn.” Give it a try, folks; it works.

Last night was a perfect example. It was brought to you by the “herd.” I’m seldom one to compliment the herd, but I am one to thank them. It happened last night as most of the “rookie” traders thought the “sky was falling” when in reality it was not. Buy when they sell and sell when they buy worked again. It always does.

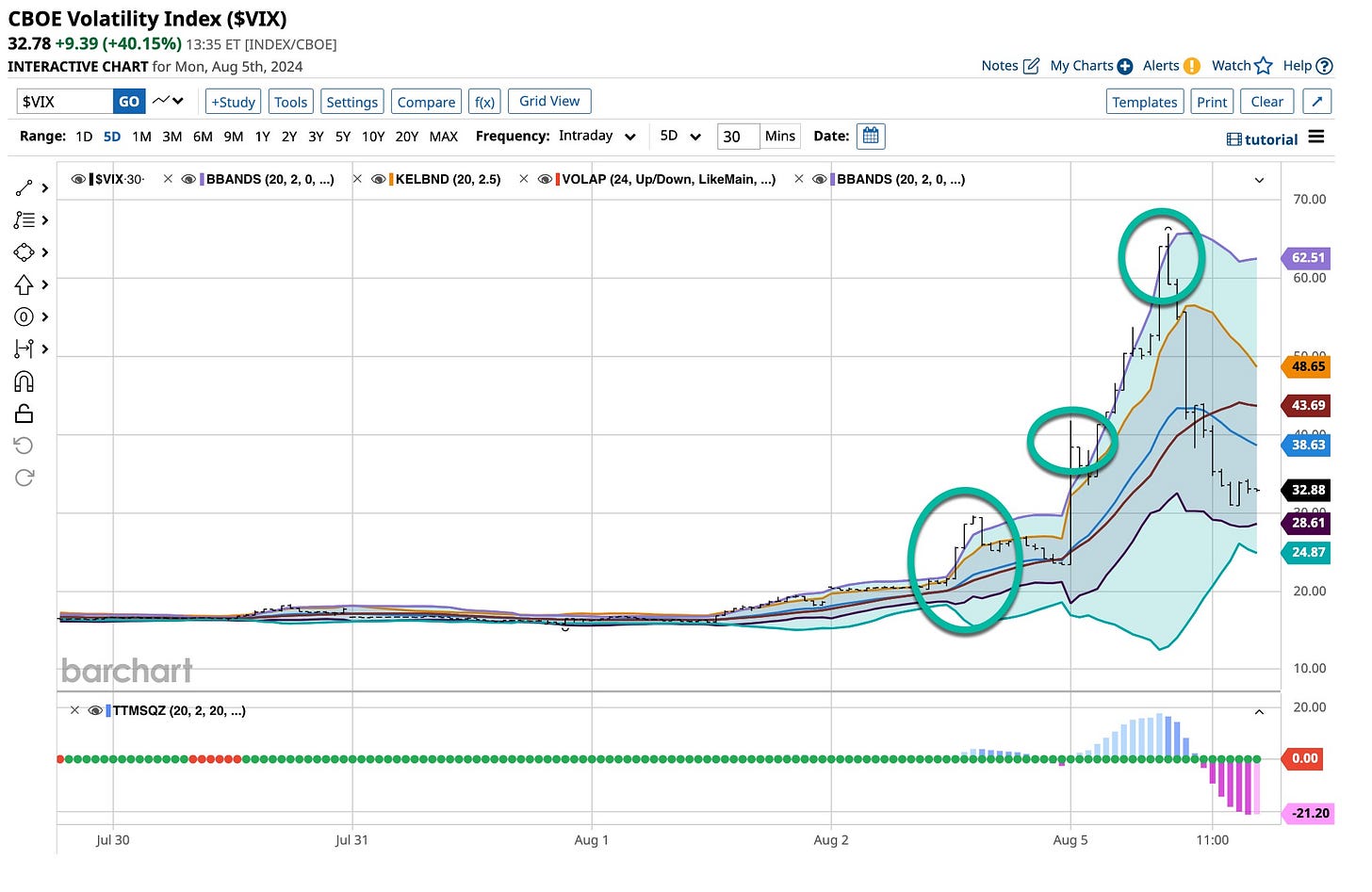

How About Those VIX Calls

It was a great week for the long-term VIX calls. It does not happen as it did last week, so maintaining a simple hedge strategy makes sense. That hedge, representing about 1% of our total assets under management, “soared” by more than 5% over the past few days.

Three trades, three buys, three exits, and I owe it all to the “herd.” I always use six to nine-month VIX call options for a reason. They don’t expire tomorrow. I stick with a strategy that identifies the higher volume, open interest contracts so when I place my “Good-Til-Cancel” orders (“GTC”), they get filled. Market makers need only to supply one contract on the buy or sell side on their posted spreads. They like to make money, which is how they do it, especially this morning when the markets were running.

I use trailing stops as well, and no, it’s not easy to do when the markets run. It keeps me up. Maybe I should buy coffee futures. In any case, my 2025 March 30 VIX calls were sold at around a 1,000% profit, a little less than I earned in 2020 when COVID-19 ruled the markets.

So What Else

The same philosophy and strategy of buying when they sell and selling when they buy worked. I like Boeing (“BA”), but I realize that revenues need to increase before it goes and remains higher. I’ve accumulated a bunch of shares over the last six months, and I’m in the market to buy more. When the stock price runs higher, I sell “covered” calls as well to increase my returns, but this morning, at lower prices, I bought more shares.

I like Trade Desk (“TTD”) and Amazon (“AMZN”) as well and did the same thing with these two. It’s a very simple strategy and that’s good because I’m a simple person. Lots of people follow me, and we appreciate it. Keep watching The Ticker as we’re about to make some changes. Until then, stay awake at night and take advantage of the herd.

Who needs sleep? I do, but there are times when staying up just makes sense. It made a lot of sense for The Beatles more than sixty years ago, and it made sense last night. I am not a very complex investor or trader. I’m usually early as I see things happening. It is a good thing to be right, but it is more important to have staying power. I have a lot of free cash sitting on the sidelines as it was obvious that this market was going to correct. It’s started, but it is far from over. Anything can happen between the upside-down world we live in and the upcoming presidential race. I am hedged, how about you?