It doesn’t take a rocket scientist to figure out that “something” is wrong today. I’m not certain about the exact reason the world finds itself between a “rock and a hard place”. Reading economically related articles and listening to various “opinions” expressed by others suggests the “green economy” is behind the recent inflationary pressures we’ve endured.

It’s often impossible to blame any one event for any given problem. Face it over recent decades, decisions made by the “powers that be” more so addressed problems with the incorrect decision they made prior. Short of Jerome Powell actually raising “rates” to a much higher level, when’s the last time the Federal Reserve did anything more than to “chase their own tail”? While that is a story for another day and time, one cannot deny that decisions made politically have exacerbated economic patterns.

Sometimes “Green” Does Not Mean “Go”

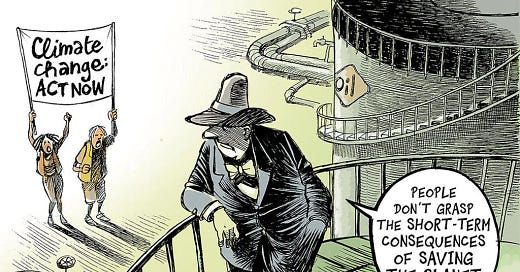

I am by no means an advocate of “climate change”. Don’t get me wrong, like everyone I would love to address the alleged problems cited within the world’s climate debate. The problem I perceive is inherent within that actual debate. What is real and what is “Memorex”? If you assume the climate debate is meaningless, nothing allocated to its solution is useful. If it “ain’t broke don’t fix it” seems to be an appropriate answer but in today’s world that’s simply unacceptable.

With that in mind, let’s assume like Apollo 13 that “we have a problem”. Whether it is man-made or not, controlling the effects of pollution causing byproducts is essential. The question we must address is the cost of taking these necessary steps. How we are addressing it today isn’t working.

During an interview with Bloomberg on Thursday, May 16th, JPMorgan CEO Jamie Dimon stated that he sees “a lot of inflationary forces in front of us” including “the green economy, the remilitarization of the world, the infrastructure requirements, the restructuring of trade, fiscal deficits.”

Dimon reiterated, “We’ve had good, healthy markets for quite a while. They’re kind of predicting a soft landing . . . that’s all good. It doesn’t tell you what the future’s going to be. I can point to a lot of times in history where that was true and the next year it wasn’t true. And so, we’ll see. I don’t pay as much attention to monthly numbers as most people do.”

He added, “I’m a little more worried about it. We’ve had very big fiscal deficits and I think the underlying inflation may not go away the way people expect it to”. Dimon, a somewhat political visionary, sees that the “green” economy is inflationary. He also is one to notice that environmental decisions more than likely may keep inflation a little bit higher than people expect in the near term. He stops short of signalling opposition to the “powers that be” but face it, they’ve been consistently wrong in the past.

I don’t own an electric vehicle and I’m not considering acquiring one anytime soon. If I did it would be a hybrid. My better half’s kids bought a Tesla a couple of years back. The dinner table discussions, most “woke” oriented centered around ‘saving the earth’ so their kids had a better life. A couple years later, we discuss getting rid of the Tesla. It just did not work out, nor has saving the environment. Plans that ‘better’ this world seldom work as expected. The turn to “green” created more of a turn to "red” and it is time to put a halt to this politically flawed experiment.

Hey Joe Bidenomics Is Not Working

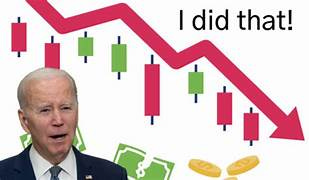

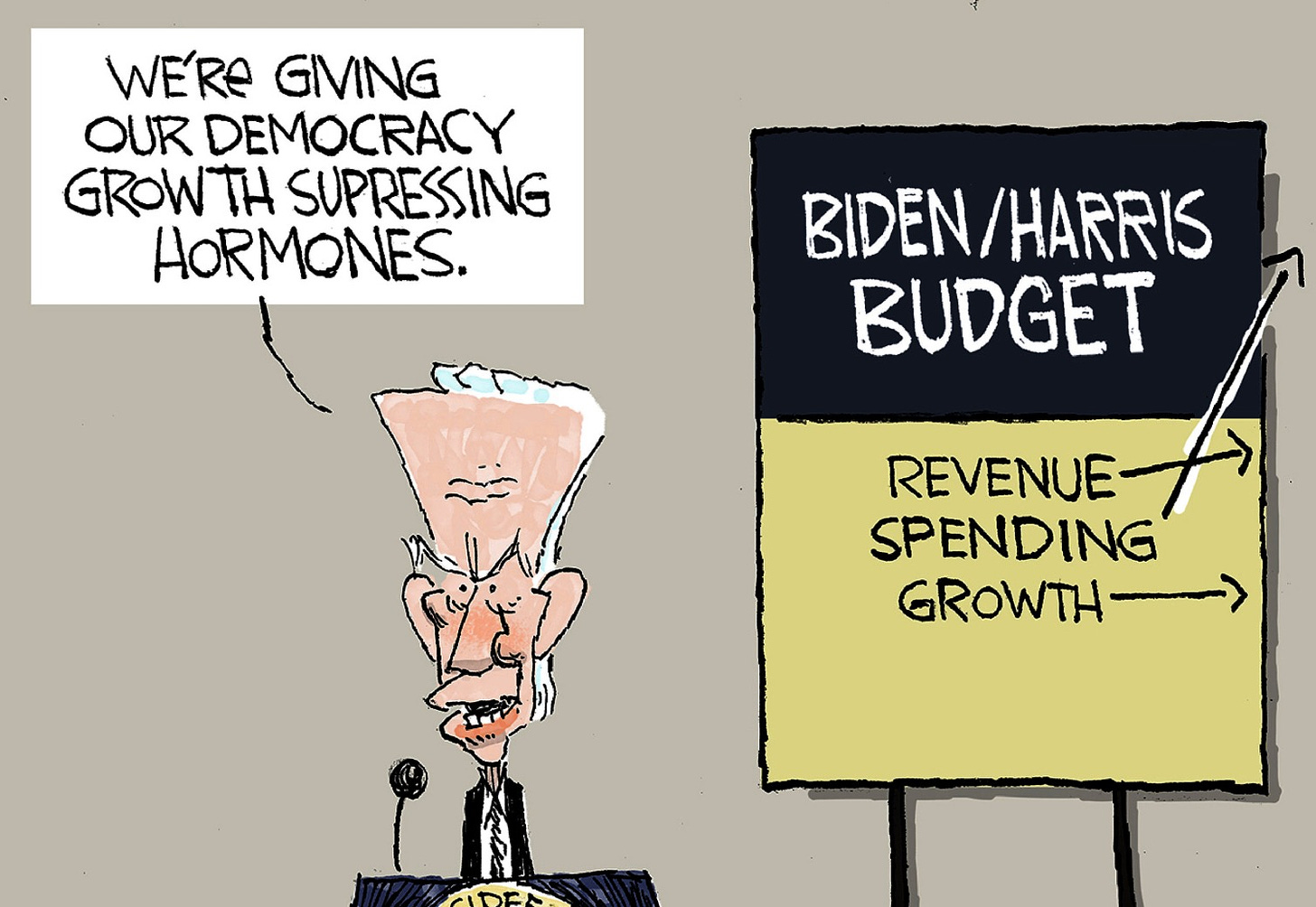

“Bidenomics” is failing. President Biden and his allies in Congress are trying to sweep his failure under the rug. Recent “Bureau of Economic Analysis” reports confirm what all Americans know. Biden wants you to ignore and forget their assessment. In reality, Bidenomics means higher, inflationary prices and a slower economy.

The American economy grew a mere 1.6% during the first three months of 2024, well below what many experts forecasted. The economy grew at a turtle’s pace, but prices keep rising above the Federal Reserve’s 2% target, with the Consumer Price Index at 3.5% over the last year.

Biden has spent years trying, and failing to spin the way out of his “failed” economic policies, bragging for months about low unemployment rates and slowing inflation. Of course, he conveniently forgets inflation got to record levels under his watch and Americans are paying $11,400 more to keep the same standard of living as they did four years ago.

Biden’s attempts to frame Bidenomics as a success are not fooling anyone. 53% of Americans disapprove of the president’s handling of the economy, according to the latest YouGov poll.

The president might blame Putin, businesses, and even Republicans for inflation, but if he wants to blame the “guy” guilty for stubborn inflation, he should look at himself and his allies in Congress. During his administration the U.S. government has printed much more dollars than the markets could handle. Biden and all of his Congressional friends added nitroglycerin to the fire by authorizing $5.5 trillion, about $17,000 per American, in new spending during his time in office. More is planned.

Like any other good, money’s value depends on supply and demand. Inflation happens when the federal government prints more dollars than the market can absorb and your money will buy you less than it used to. The markets could not handle the mountains of freshly minted cash from the U.S. government, and inflation skyrocketed to levels not seen since the worst days of the 1970s stagflation.

While inflation is no longer rising at 9% yearly, prices are 19.4% higher than they were four years ago, and they keep rising well above the Fed’s inflation targets. Regretfully, actual earnings are not keeping up with Biden’s inflation. Bidenomics has failed and it is time for the “big guy” to tell the truth.

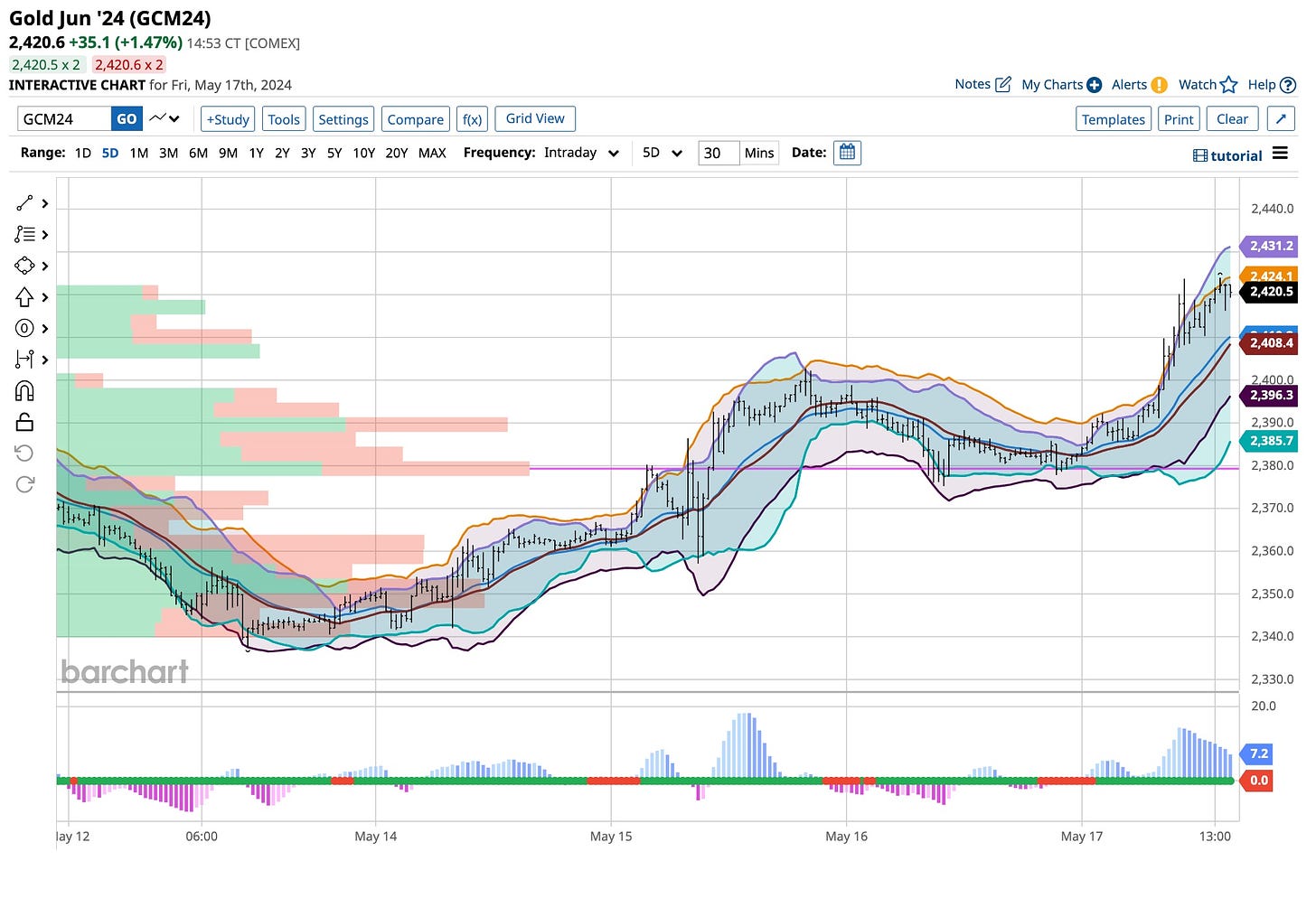

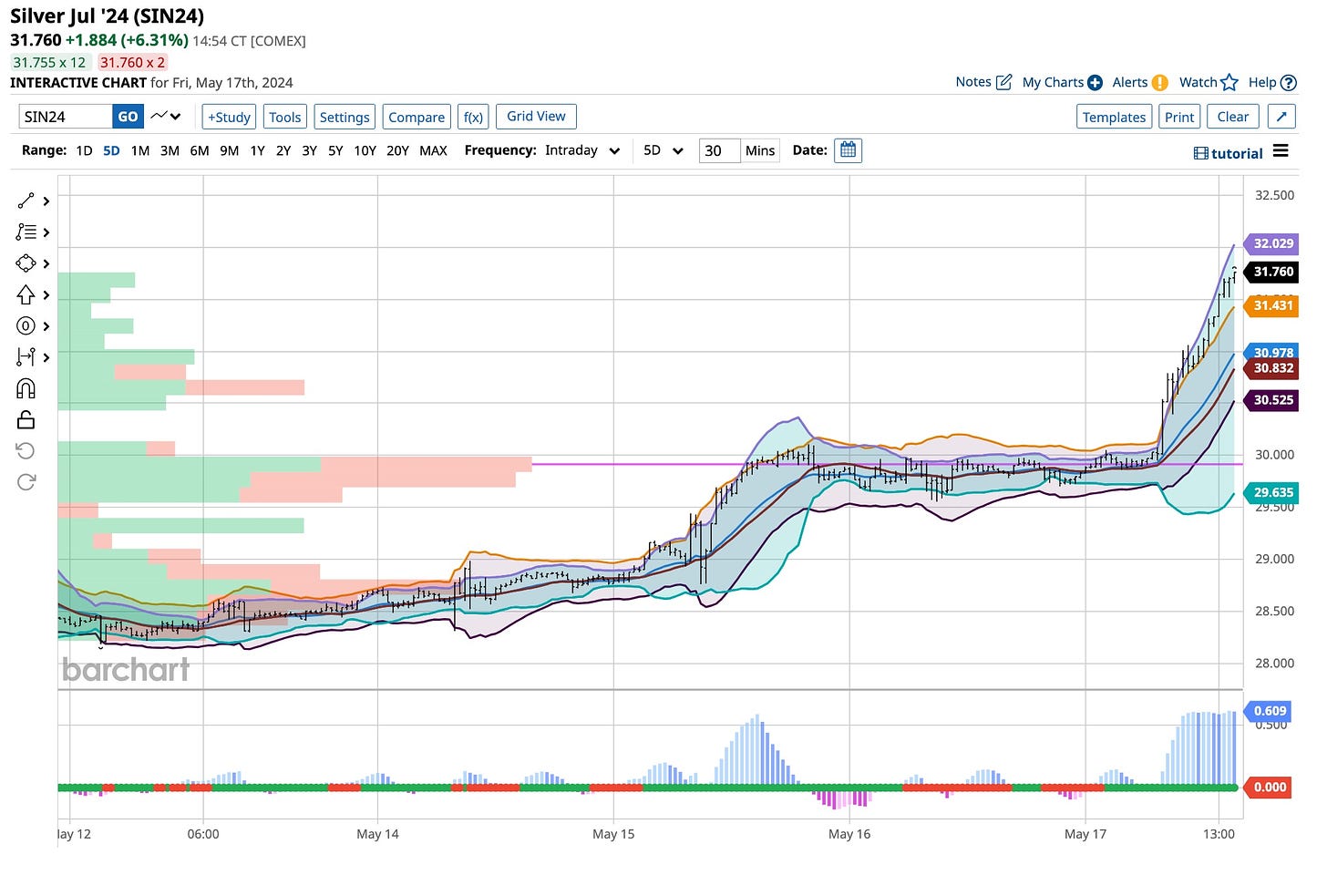

How ‘Bout Them Metals

June is ‘busting out all over’ and it’s only May. It’s always nice to be right. It’s better to be timely. Such is the case when it comes to the metals. Our paper currency exhibits a few problems, one of which suggests that the central banks will keep buying gold. My belief is that they’ll turn their attention to other metals sooner than not. I’m not alone in my beliefs. Another poster on the LinkedIn message board is Otavio Costa. He’s a well known analyst and worth following. Check out his site and realize his message is similar to others. We don’t always agree and that’s a good thing. We do share a mutual admiration of each other and that’s a good thing too.

In 1956 Rogers & Hammerstein made a movie on their Broadway smash “Carousel”. I’m a fanatic when it comes to entertainment of this nature but there’s a reason for its presence today. The metals are breaking out and if nothing else you have to watch. I do not have a crystal ball. What I do have is a memory of ‘times gone by”. Nixon took the United States off of the gold standard more than 50 years ago. Everybody makes a few mistakes but this is one that keeps on giving. How high the metals market will go is anyone’s guess. I’m long and strong. How about you?