What a nice break we all had, especially if we entertained this past holiday weekend and didn’t have to deal with our airports. I don’t know how people do it. I used to love flying when I was younger sometimes racking up hundreds of thousands of miles per year. As I’ve aged that’s changed, I hate to fly; in reality I hate leaving my house. In any case, I hope your holiday weekend was as happy as mine was.

So have you been reading and listening to the same “advice” and “opinion” as I have been over the weekend? People are talking about a “moon shot”, rates coming down and that the world is just a rosy place. I’ve heard that before, usually right before the market heads lower. Let’s watch and see what happens.

On the educational side I’m seeing a lot of comments and postings about how high the S&P P/E ratio is and that something has to give. As I have said before “buy when they sell” and that’s exactly what I’m doing. I don’t know when this market is going to top and correct but at some point it has to, right? We can only hope.

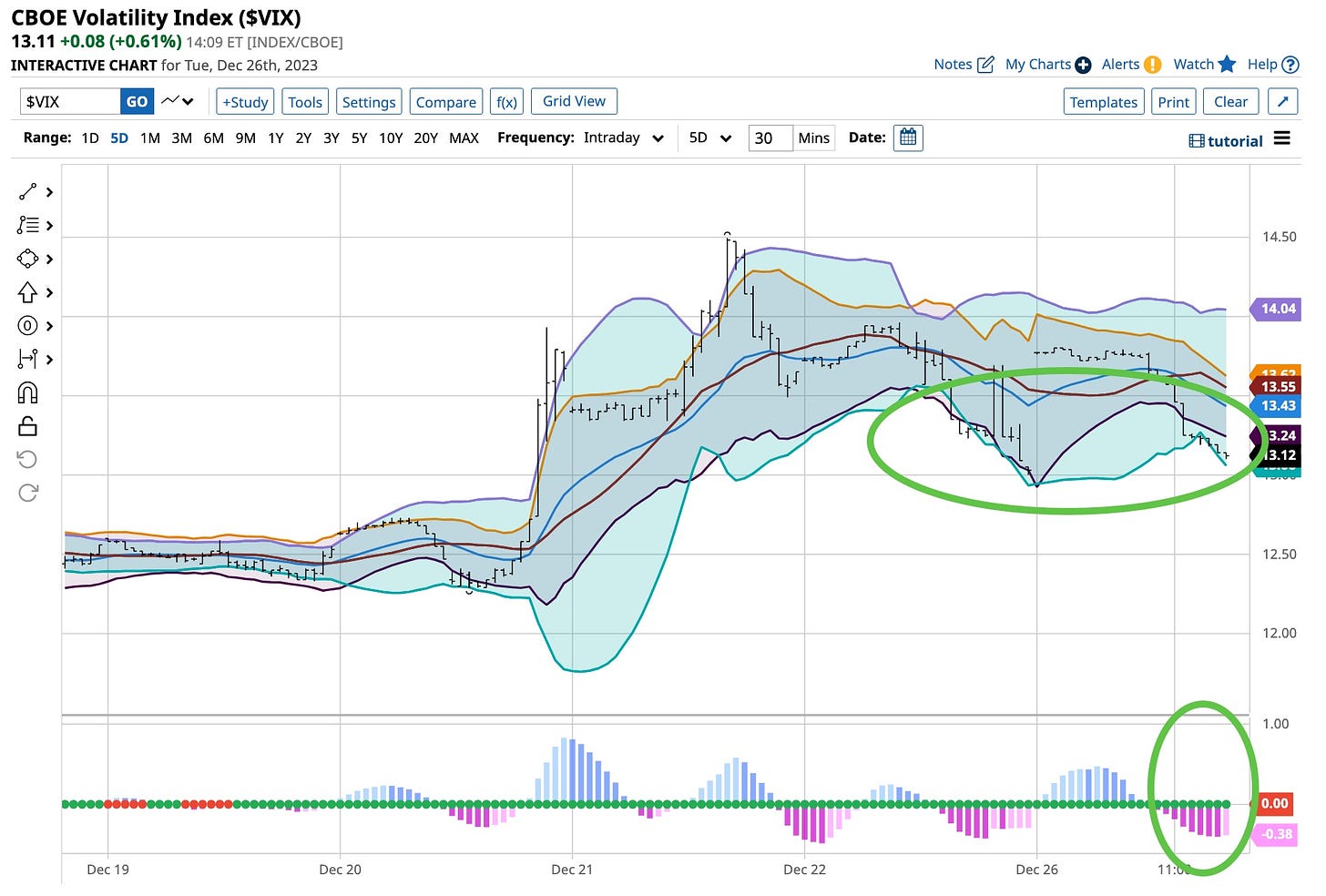

Bought More 2024 VIX March 17 Calls

I do not trade much but when they sell I buy. I’m up large on my WTI July 85 calls and even more so on my Yen short at 150+. They both have legs as rates around the world are in a state of flux, the only one with a chance of going higher is Japan. Oil, if you in any way think the Middle East is going to cool down under Biden I have a few acres of beachfront property to sell you that’s only under water half of the day. It’s not and the Middle Eastern “straits” aren’t exactly where I’d plan a winter vacation.

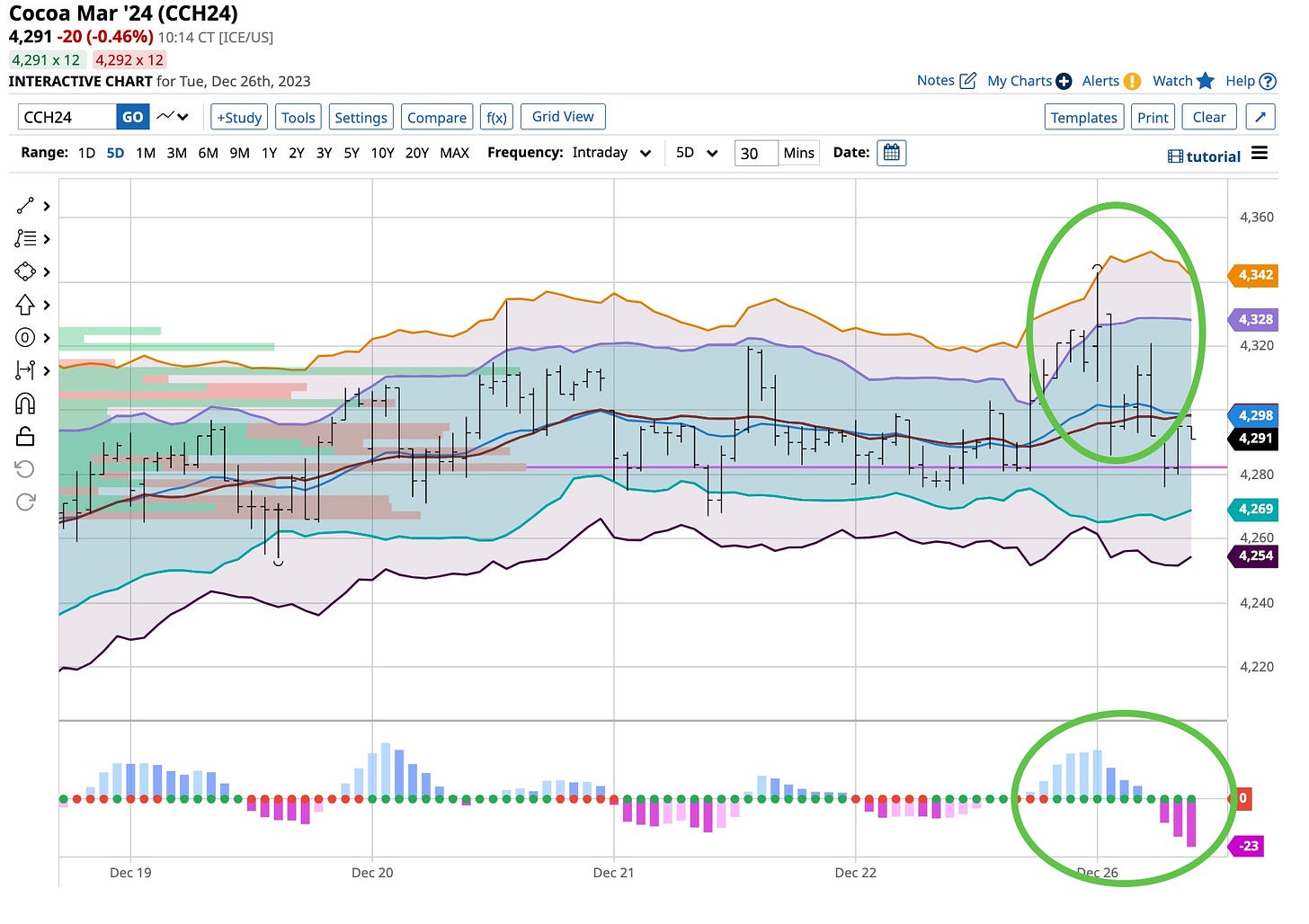

I finally bit the bullet and shorted Cocoa this morning. With Sugar and Orange Juice on the downside, thank you Brazil, it only makes sense that Cocoa is next, right? The total transaction was minimal at best so if I’m wrong it’s not going to devastate me.

Andrew Rosenberg, a good buddy of mine on LinkedIn recognized my earlier post in a way only Andrew can, with a strong chuckle and a smirk. He is one of the best on this LinkedIn thread and if you are not already following him do so; you’ll thank me. I sent him a picture of my favorite “rollercoaster”, The Thunderbolt at “Kennywood Park” in Pittsburgh where I grew up. It’s still there and whenever I visit the ‘Burgh it’s a must. Best wooden rollercoaster ever built. It used to be cheaper but with inflation it costs a bunch more; it’s still worth it.

That’s it from me today. All of my work on the book, Udemy courses and more is just about done. Whatever you do don’t write a book or even try to teach people that there is a better way to invest or trade. What I thought originally would take only a couple months has taken about half a year. Yeah, they are both really good; you’ll see finished products soon or you’ll see me looking for a new place to live.

We don’t play enough Red Hot Chili Peppers today. They were great, weren’t they? Not exactly what I grew up with but their “Love Rollercoaster” song was a hit. This world is topsy turvy to say the least. Love is too but that’s a whole different topic. I’m a very consistent investor and you should be too. As I finish up the “eight” Udemy courses it is easy for me to teach how I do it. Lots of people have followed me and I’m appreciative of that. I’d be even happier if you evolved to my “style of investing” but we all know that Rome wasn’t built in a day. In any case, a happy, healthy new year to everyone and thanks for all you mean to me.