Everything costs money in today’s world. ESG, Environment, Social and Governance has its place in the marketplace today even though many are saying its “hey day” has come and gone. When it comes to commodities it is here to stay, that commodity is cocoa and perhaps the additional expenses are related to its price.

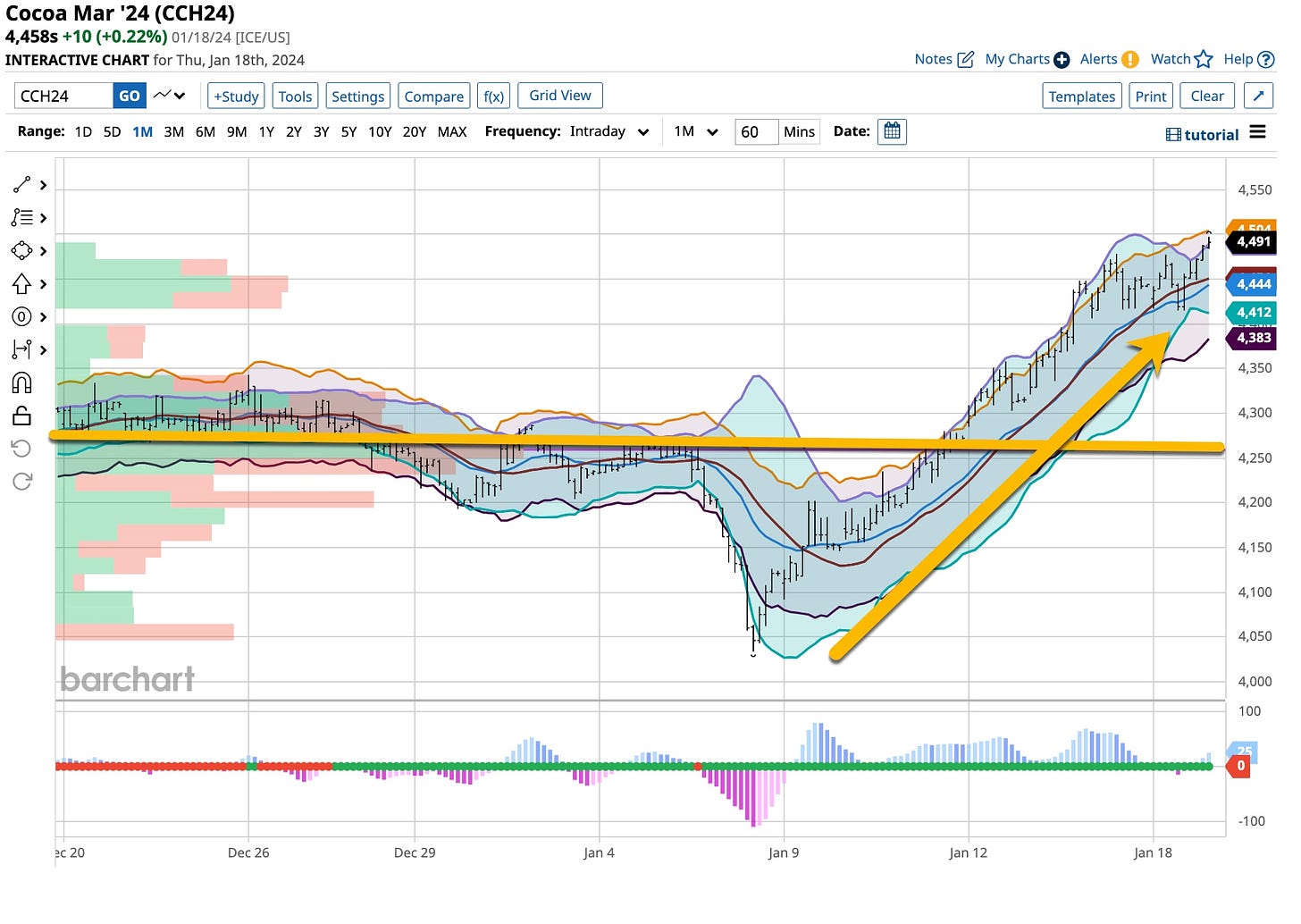

By now you all know that I look at “everything”. I do not react as often as I did in the past but when I do, commodity future and option wise, and when I’m “lucky” enough to be right, I usually use “trailing stops” to preserve my profits. While beneficial to some degree, it has been very helpful as I trade cocoa. I’ve made a few bucks looking for the market to correct but it really has not. From what I see and hear, new all time highs are on their way so I’m happy to just wait for that to happen.

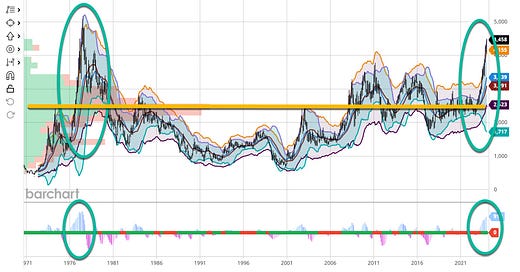

Cocoa Historical Chart

It’s been a long, long time since Cocoa hit the prices we are witnessing today. Times they are a changing as is the process, the tracking of simply growing and getting the product to market. The fact that “chocolate” has been in demand worldwide doesn’t hurt but really, are new high prices in our future? If you ask a buddy of mine who is in the wholesale candy business, all he’ll tell you is that the ‘prices’ he is quoted increase weekly. I listen to everyone especially those directly in the supply chain.

I’ve been known to listen and learn from everyone. For me that includes “people” in the field. Literally, those that are growing and processing the crop, transporting it to and from the marketplace and more. All in all, no one is telling me that the price has topped so I’m listening and bringing this information to you. Remember, I am not a person who is always right but I am consistent. I this case “knowledge is power” and the more I can put between my ears and yours the better for everyone.

We’re Watching You

I see it done in the Coffee market but more so, the Cocoa market has made tracking a science. If you assume cocoa is “farmed and grown” in the “usual” way it undergoes a process of essentially being “marked” as the “ESG” methods suggests. After the beans are dried, they are cleaned to remove defects. Then they are weighed and packed into jute sacks. Farmers sell the sacks of beans to an “intermediary” representing a buying company sourcing directly from the farmers. What’s in the bags is already “marked”.

Farmers transport the bags to an exporting company. The exporting company inspects and grades and “marks” the cocoa once again, and sends it to a warehouse near a port. Sometimes additional drying is necessary at this point.

The structure and length of this supply chain can differ. Intermediaries such as small traders and wholesalers play a role between cocoa farmers and exporters as described above. Sometimes, cocoa beans are sold directly to exporters by cooperatives, or even directly exported. Direct sourcing is the method most often chosen as its traceability, proximity, trust, and efficiency in the supply chain far outweigh other options due in part to price. Farmers get more for their crop handling it in this manner.

Once cocoa beans have been “graded” and loaded into cargo vessels, they are shipped either in new jute bags or in bulk. Shipment of cocoa beans in bulk has been growing in popularity because it’s one third cheaper than conventional shipment in jute bags. Loose cocoa beans are loaded either in shipping containers or directly into the hold of the ship, the so-called “mega-bulk” method. The latter method has been universally adopted by larger cocoa processors but remember, the “tracking” of where the actual cocoa came from is already in place, there is no way around this tracking.

While that may explain away some of the price change is doesn’t tell the whole story. The trading of Cocoa is unique. Of the many existing futures exchanges, cocoa futures are primarily traded on the NYSE Euronext and the New York Mercantile Exchange (“NYMEX”) part of the CME group. It trades around the clock but major participants in the marketplace control it’s movements. When you think about it, it makes sense that’s the case and entering into this market is not the easiest thing to do. If you’re a person interested in trading this market use “limit” orders for both futures and option orders. It’s the only way I’ll trade it and you should too.

So is cocoa going to set new highs in 2024. Given the way markets work, despite the fall in Sugar and Orange Juice, it seems to me that the chance of Cocoa hitting their highest levels set almost 50 years ago is possible. Regardless you are going to find me looking for tops despite the increases in “processing” prices brought to you by those who regard ESG as the way of the future. It’s real in this case so take note and agree to accept what’s happening as a way of the future. Which commodity is next?

I do my best to talk about “things” that others may or may not observe. Nothing has changed in my basic investment thinking and I’m still plugging away with courses to “teach the masses”. During the late 1970s through the early 1990s I taught for the best major “test teaching” companies getting students into law, medical and grad school. It was fun, I loved it and so did my students. Being able to teach is a gift and from what is being put together at “The Ticker EDU” I’m sure you will agree.

In “Willy Wonka & The Chocolate Factory” Gene Wilder brought us pure imagination and attracted both the young and old to be part and enjoy. We all love chocolate, some more than others, but we associate the end product with something good. Me, I just like to look, listen and learn and that’s what I’m trying to do here with you and others who read what I write. The information is out there. You just needs a way, a method to be able to process it and get it “between your ears” so everyone can become the best damn investor or trader they can possibly be. Best always and enjoy your Hershey Bar.