Experience is very important. What I’m trying to do with The Ticker is to take what is “between my ears” and put it “between your ears”. People do not read as much as they should so we developed courses that teach everyone how to become better “investors and traders”. Check out The Ticker and jump on board as we introduce everything.

So far so good but remember, Rome was not built in a day. Often a few topics come to light that need to be discussed and presented. I’ve been watching and listening to this situation and scenario since “Nixon” took the U.S. off the gold standard in August of 1971 and now it’s a great time to share it with you.

For decades, the U.S. dollar has enjoyed unparalleled dominance as the world’s reserve currency, underpinning global trade and finance globally. However, its “unchallenged” reign might be approaching an end. The International Monetary Fund (“IMF”) reports a steady decline in the dollar’s share of global foreign-exchange reserves while there’s been a growing appetite for alternatives. This “shift” is fueled by many factors such as the relative economic decline of the U.S., the “weaponizing” of dollar-based sanctions and the emergence of innovative financial instruments like China’s digital yuan.

Alongside these individual challengers, multi-nation currency arrangements threaten to carve away at the dollar’s supremacy. The recent rise of these alternative currencies, particularly China’s digital yuan and potential multi-nation currency blocs, reshapes global trade and finance in many ways.

The Global Reserves Landscape Is Changing

The global financial landscape is undergoing a pronounced transformation as central banks globally shift their composition and management of foreign-exchange reserves. Its an erosion of the status of the U.S. dollar alongside the emergence of “alternative” reserve currencies and evolving geopolitical concerns. While the U.S. dollar maintains its position as the world’s primary reserve currency, its overall share has declined over the past two decades, In the second quarter of 2023, the dollar controlled about 60.0%.

Factors fueling this diversification away from the dollar include the rise of alternative “currencies”, the euro, British pound, Canadian dollar, Australian dollar and Chinese renminbi. They have steadily increased their presence within global reserves, with the euro becoming the second in line as a reserve currency. Geopolitical tensions, such as the use of dollar-based sanctions by the United States, accelerated the exploration of alternative currencies for international settlements. They aim to reduce “reliance” on the dollar’s traditional predictability.

Concerns about the decline in U.S. exports and higher national debt fuel uncertainty about the dollar’s long-term strength. Changing global status carries with it a “large” global implications for international trade and currency markets. This could very well destabilize the dollar’s role as the “primary” global reserve currency. The result would bring heightened volatility and “uncertainty” to the currency markets. Basic economic relationships increasingly influenced by geopolitical allegiances would prevail and its effects worldwide could alter the playing field.

Here Comes China’s Digital Yuan

The digital yuan, the e-CNY, is China’s central bank digital currency and it represents a significant step in the evolution of money in the digital age. This ‘digital’ yuan offers advantages over traditional currencies, like faster transaction times, lower costs, and a greater control for the issuing government, the People’s Bank of China. It’s available across much of China, and individuals can use it for various goods and services. The digital yuan is being used in international trade, with PetroChina completing the first international crude oil trade using e-CNY recently. Times are changing.

There are major concerns that “digitization” could increase government surveillance and control. All transactions made with the digital currency could be traced. Despite these concerns, its potential for international use is real. It could very well become a challenge to the dollar in international trade if it becomes widely adopted for settling transactions between China and its trading partners. It’s a real-time potential game changer with its ability to facilitate faster and cheaper transactions. Face it folk, the Chinese seek governmental control and always look for ways to reshape international trade dynamics. Keep your eye on its development and use as it’s set up to compete.

The BRICS Are Real

The concept of multi-nation currency arrangements by the BRICS nations, Brazil, Russia, India, China, and South Africa, represents a major shift from the traditional reliance on a single dominant reserve currency, typically the U.S. dollar. Agreements between countries to peg their currencies to a basket of currencies, aims to reduce reliance on any single currency and enhance economic stability among participants. Implementing a shared reserve currency among the BRICS nations would necessitate overcoming substantial economic and political coordination challenges. These five nations have diverse economic structures, political systems, levels of development and more. This complicates the alignment of “monetary and fiscal” policies required for a successful basket currency. These are very complex issues that often arise from such arrangements bringing discrimination and instability into global exchange rates.

A shift towards a multipolar reserve system, where the dominance of the U.S. dollar is reduced, could have profound implications for global trade and finance. International entities could experience increased transaction costs, heightened volatility and a basic uncertainty surrounding the establishment and functioning of a “new” reserve system. Other regional economic blocs with their own dominant currencies, leading to a more fragmented global trade system could take shape. The BRICS is real and growing so it is another “bloc” to keep an eye on.

Where Is The World Heading

The world of finance is in flux. Central banks around the globe are changing how they hold and manage their foreign exchange reserves. This is chipping away at the dollar. New reserve currencies are rising and geopolitical tensions are adding fuel to the fire. The dollar is still king but for how long. Its share of global reserves has been steadily shrinking over the past 20 years.

Why the move away from the dollar? A few reasons. First, other currencies like the euro, British pound, and even the Chinese renminbi are gaining influence worldwide. These contenders are carving out a bigger piece of the pie. The euro, in particular, has solidified its position as the clear number two. Secondarily, geopolitical tensions are playing a role. Countries, tired of having the U.S. wield dollars as a sanctioning tools, are looking for alternatives. They seek ways to lessen their dependence on the dollar’s historical “predictability.” Finally, worries about the US economy, slowing exports and ballooning national debt, are raising questions about the dollar’s long-term strength.

This changing landscape of global reserves has big consequences. International trade and currency markets could become more fragmented. If the dollar loses its top spot, things could get bumpier. We might see more volatility and “uncertainty” in currency markets, with economic ties becoming more tangled with political alliances than pure economic benefits.

So What Am I Doing

That’s why you’re hear and reading this post, right? I hope so and the dollar’s demise is always front and center with a large portion of the funds I manage. Remember, I am a position investor and a “hedger” at heart. There is always good stocks to recommend as long as you understand how to rebalance your winners and losers. It is important to have a long term strategy in place. At this time I’m short the dollar for many reasons, including what’s described above.

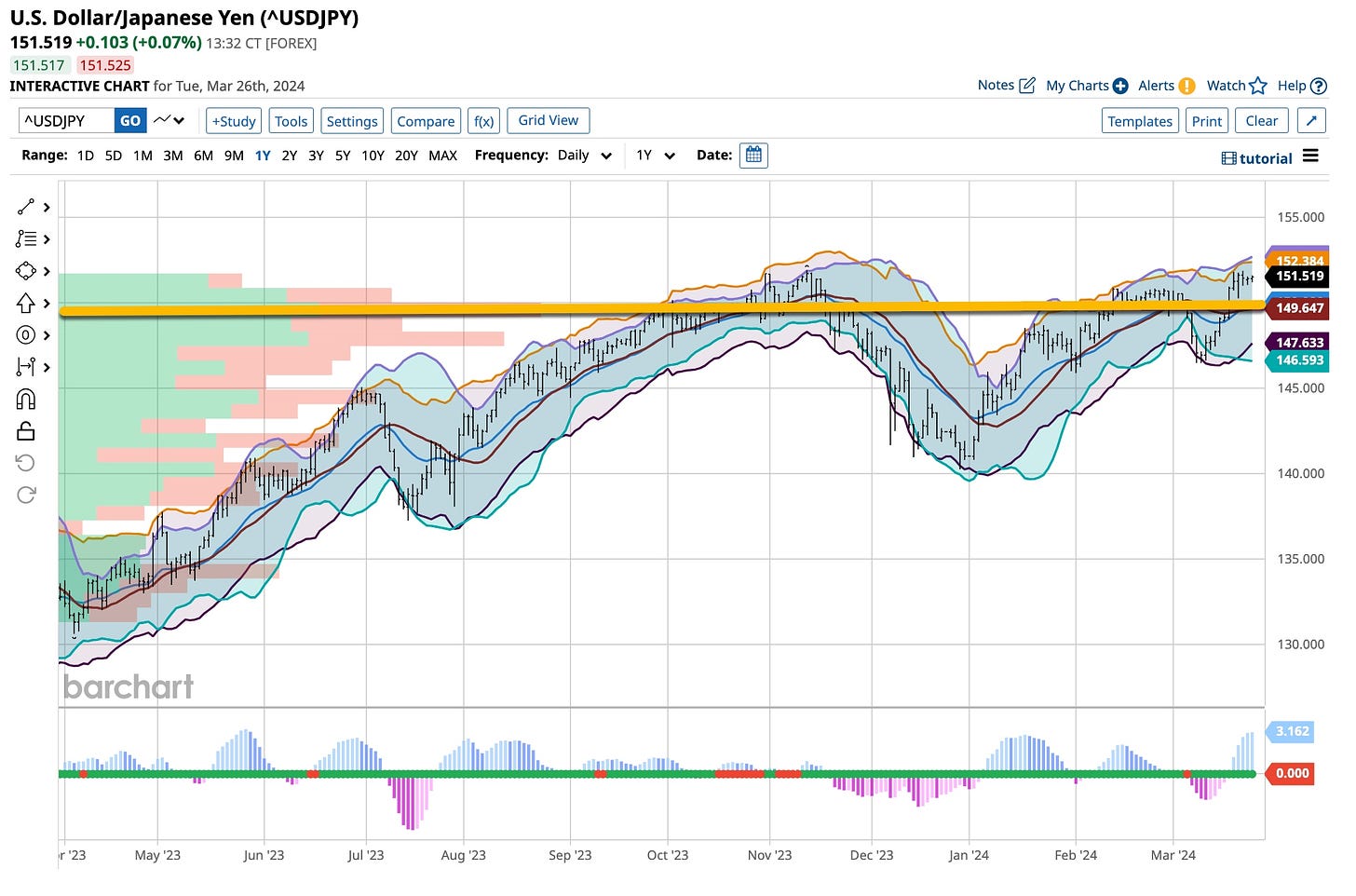

I’m expecting interest rates in the United States to decline. That means that investors will sell dollars as they move money around the world seeking better interest rates. I doubt they will find them in Japan so my position also suggests the Yen will drop from its 150 level to 125 over time. In addition, since our fiscal and monetary policies are at best troubling, I’m long gold bullion and other “poor man’s” metals with futures.

In short, I’m short the dollar and given the above scenario, one that I’ve “watched” for many years, it’s going to get much worse before it gets better. If fewer entities need to exchange their currencies for dollars the demand will decrease. I could talk further about the money center banks but we’ll leave that for another time.

It’s hard to believe that Bob Dylan wrote and recorded this song sixty years ago. Damn I’m old and if you remember when it hit the radio you are too. It is true “regardless” of when we listen to it as “The Times They Are A Changing”. That’s a good thing, right? I find it to be the case but in reality, history left unchecked repeats itself. Changes in a global spectrum have been happening, albeit slowly, for years. The internet and basic information transfer has sped that all up. News services, so to speak, get what’s new in the world out to you more quickly now. Get used to it, that’s not “changing”.