Uncertainty in the markets is highly detrimental. Long-term investors often move to the sidelines just like me. We are patient, sitting on a “pile of cash” waiting for change and that’s what I’m starting to see and hear. Change takes time, sometimes it takes a bit longer but it’s worth waiting. Sitting on the sidelines earning upwards of 5%+ on a cash horde is not too shabby, especially when managing tax-free Roth IRA accounts.

Nonetheless, we’re always looking for “what’s next”. Over the last few days of May, our “crystal ball” is getting clearer for many reasons. Here are a few interesting changes to hit our radar that should also be front and center in your scope.

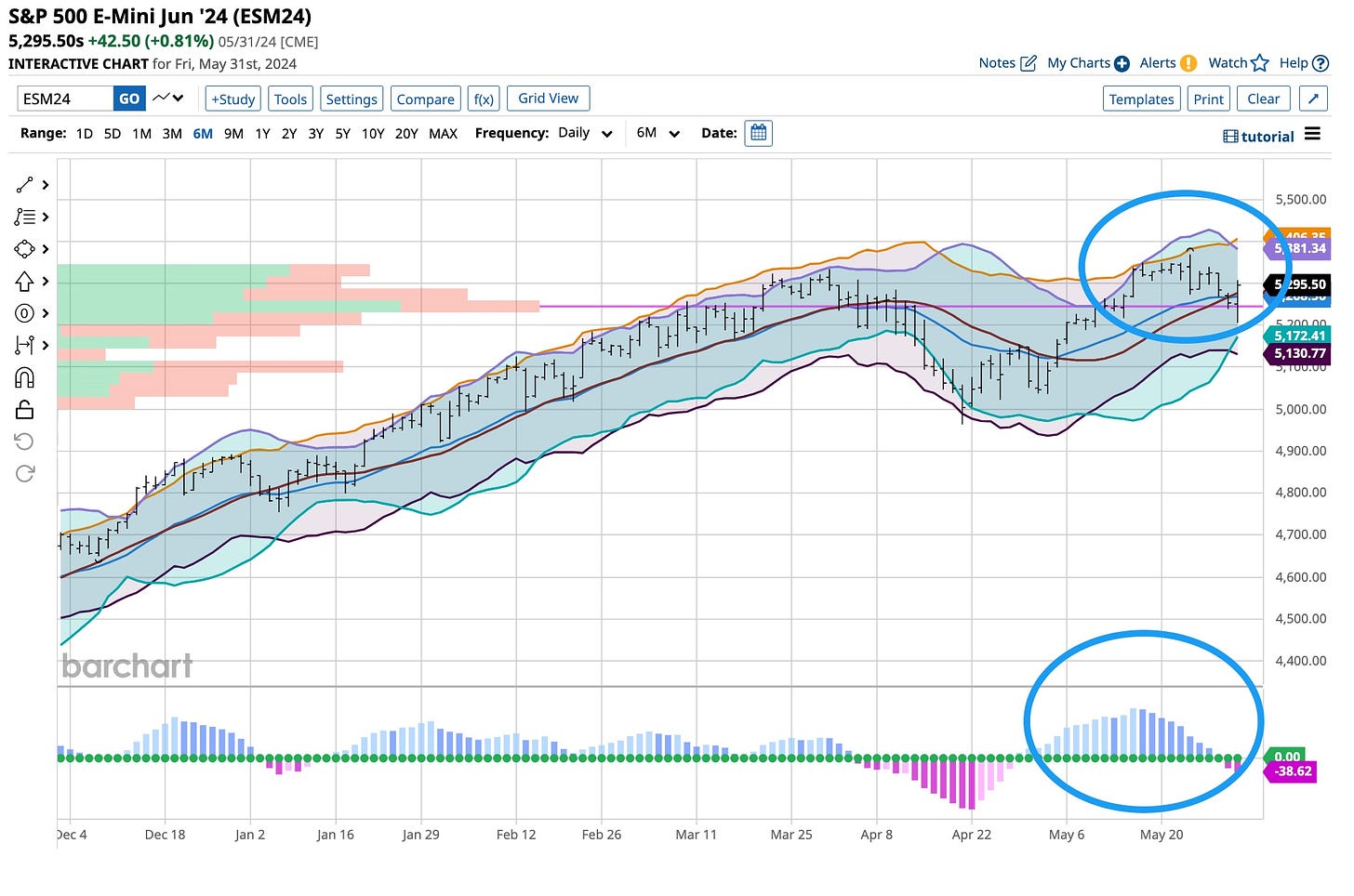

Market Breadth Is Abyssmal

The thrill of the Dow Jones Industrial Average breaking the 40,000 level for the first time in history feels like a distant memory. The blue-chip index has since plummeted to suffer its sharpest slide in over a month despite Friday’s 500+-point upside.

Clinging to a roughly 2% gain in May, the 30-stock index still lagged behind the tech-heavy Nasdaq Composite by the widest margin since May 2023. It’s underperformed the large-cap benchmark S&P 500 by the biggest margin in three months. The Nasdaq was up 6.9% in May, its best month since November, while the S&P 500 advanced 4.8% to record its biggest monthly gain since February.

Investors should be “cautious” against relying solely on the recent Dow’s decline from its record high to gauge the stock-market performance in May. While some mega-cap tech firms have given way to previously overlooked sectors like utilities and small-cap stocks, it may not be the rotation investors would like to see.

The downturn has been fueled by a range of factors, including soft quarterly earnings reports from Salesforce. Meanwhile, a batch of robust U.S. economic data and weak government debt auctions have propelled longer-term Treasury yields higher adding to the downward pressure on the stock market.

To be sure, one reason the Dow experienced a significant downturn while other major stock indexes remained near their record levels is due to its nature as a price-weighted index. Unlike the S&P 500, a market cap-weighted index, the Dow solely considers the share prices of its components, making it particularly sensitive to price movements.

Regardless of the actual reason, the lack of breadth is a concern that stocks may be at or near their summertime highs. Remember it’s June and it’s going to be at least three or more months until the “business” surrounding The Hamptons settles down. Other than watching and listening to the “news” that is reported, understand that seasonally the market trends are real. We’ll pick and choose our investments and you should too. Cash is king especially when breadth declines. Keep your powder dry and let the many opportunities find you versus your looking for “what’s next”.

Trump’s “Conviction” Backfires On Democrats

Raising $50+ million in any 24 hours by any political candidate is monumental. When you take into consideration that the sheer number of ‘new contributors’ exceeded 30% of the total, you should take note. Despite Joe Biden’s wry smile underneath the fog of war, the Democrats are concerned. Being careful of what anyone wishes or hopes will happen is always under consideration.

Trump has a plan to run for, not against the people of the United States. He impresses with a calm demeanor despite the aggravation he endures in the legal realm. I expect Trump to maintain his message. If a “lawfare” campaign can be executed against him it can be executed against anyone. Trump remained above the fray he’s now subjected to during his first administration. If he acted similarly to what he now faces, Hillary Clinton would be wearing “orange” but he didn’t. Keep that decision in mind as you decide who to cast your vote for.

If Donald Trump returns to the presidency, expect “significant” shifts in economic policy, particularly tariffs and tax policy. A second term would emphasize extending the expiring provisions of the 2017 Tax Cuts and Jobs Act and implementing new tariffs. Trump might look to change Federal Reserve leadership, although Trump's ability to directly influence monetary policy would remain limited. Personally, the job Jerome Powell has done exemplifies his core ability to handle the inflationary problem he helped to create. What happens with interest rates over the next couple of months will tell the tale. I’m watching and seeing “positive” signs regarding the battle against inflation.

Tariffs are somewhat inflationary although they are often offset by ‘economic’ growth. Trump has proposed a sweeping 10% tariff but the ‘grapevine’ suggests he might raise tariffs on Chinese imports to 60%. That might be a little steep, especially given today’s “precarious” nature of the Chinese economy, but again it’s early. Trump’s agenda will depend on the ‘composition’ of Congress. Tax policy changes cannot be implemented without congressional approval. A President’s authority regarding tariffs is executive.

We’re still early in this election window so keep both of your eyes and ears open. With respect to what you’ll see and hear, both parties want you to “vote” for them. Naturally they will give you a choice and tell you why what they propose is in your best interest. Administrations seeking your vote simply because the other candidate is unworthy is not enough. What they propose to accomplish is and the Democrats know that. Now we have a chance to decide which platform is best going forward.

Bond Yield Are Heading Lower

The US bond market continues its volatile performance in 2024, with Treasury yields recently reaching four-week highs. However, despite near-term strength, bond yields are likely to end the year lower, due to several macroeconomic factors.

Primarily, US inflation is among the key catalysts influencing bond yields. According to the latest data from the Federal Housing Finance Agency, US house prices edged up just 0.1% month-over-month in March, down from a 1.2% rise in February. On an annual basis, prices increased by 6.7% in March, compared to 7.1% in February.

The softening housing market and the slowing price trend in new rental leases hint at a further inflation slowdown. Hard data suggests that inflation should trend lower for the rest of this year following April’s encouraging print.

The Federal Reserve's monetary policy is another crucial factor that may contribute to a decline in bond yields. Fed President Neel Kashkari indicated that further rate hikes are not yet ruled out, but the overall tone from the Fed remains patient. He mentioned that the odds of the Fed raising rates are quite “low”. This aligns with Jerome Powell’s view that the central bank's next move is unlikely to be a hike.

With a softening labor market and slowing economic growth, the Fed should start to ease rates in September. We expect a total of “50 basis” points of rate cuts in 2024. In addition, the pace of the Fed’s balance sheet runoff should taper. Starting next month, the Fed will slow its quantitative tightening efforts, reducing the monthly cap on the sale of US Treasury securities from $60 billion to $25 billion. This reduction is likely to lower the upward pressure on real rates, contributing to a decrease in bond yields.

The growth in the US economy will make an impact. The world’s biggest economy is slowing, illustrated by a softening labor market and reduced economic momentum. A real case for lower yields as investors seek safer assets amid economic uncertainty is upon us, finally.

How low rates go depends upon many criteria. We expect rates to decrease across the board but that’s yet to be established. With recession entering the discussion, together with an upcoming election, there’s still a little “cloudiness” in the crystal ball but it is much “clearer” than it’s been for years.

A while back Johnny Nash sang “I Can See Clearly Now”. Out of darkness comes light and calm from chaos. It’s a natural event but something that historically happens. It’s happening again worldwide and what we hear and read suggests it will continue. That is a good thing as we’re sitting on a pile of cash. More than likely, on the futures side, it’s going to find its way into a strengthening Yen and 30-year Treasury Bonds. We’re ones to put our money where our mouth is, that’s the plan. Consistency and patience pay off. Best to all as always and have a good week.