The Candy Man Can

Illustrate Embedded Inflation

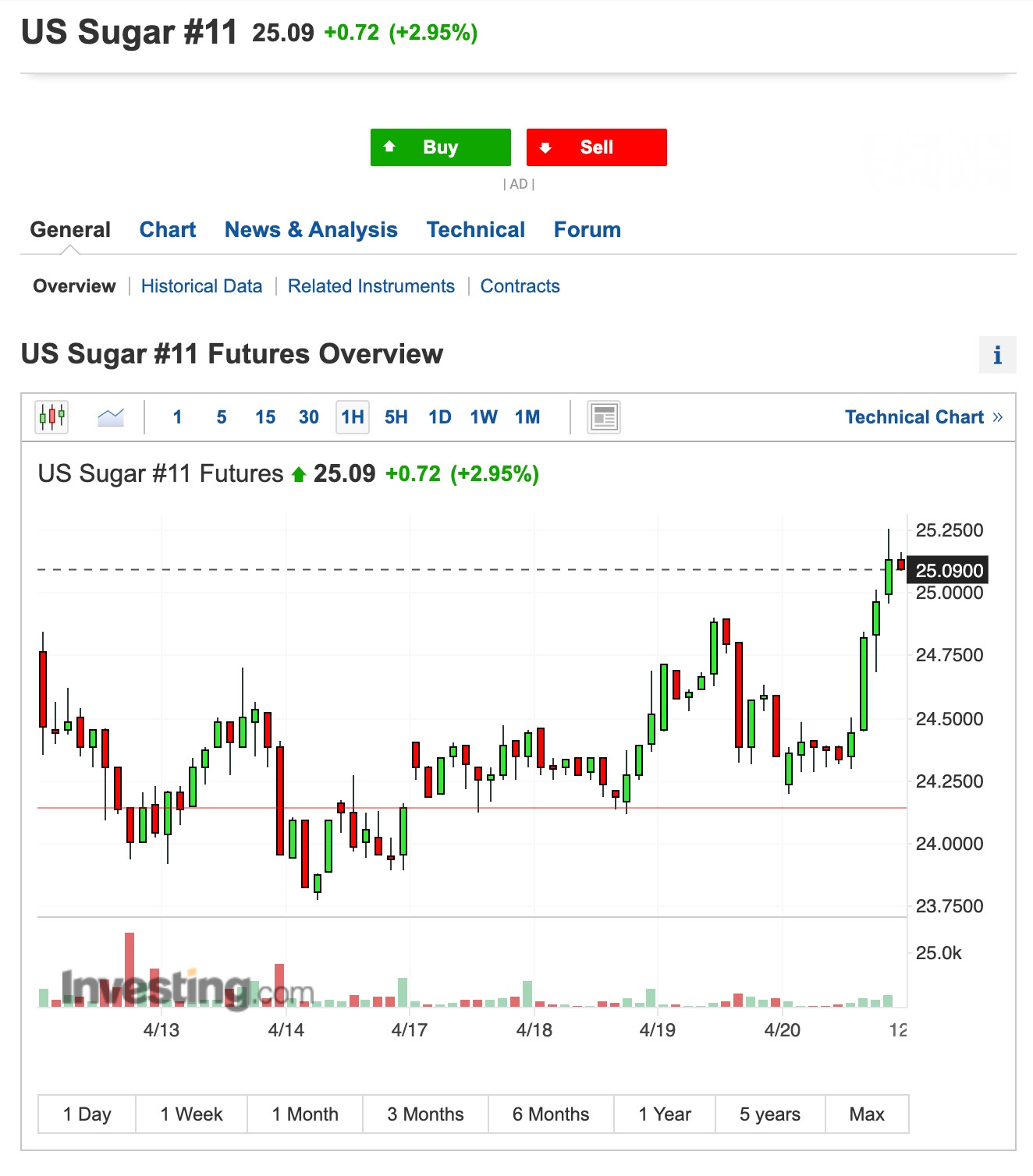

What do you get when (1) technical indicators align with (2) published media . . . you get a rally, or in this case a continuation of a rally. It’s not always what you see. More often it’s what others see then write about on the Internet. If they are followed you get a reaction like you are seeing today in sugar.

This is what position trading is all about. Movements like these are infrequent but they are reliant on perceiving historical patterns and reacting to them. Give it a try but don’t try to fit a square peg in a round hole. They don’t happen regularly; don’t fool yourself into thinking they do. All factors need be in order then often triggered by someone’s opinion who is respected as well as crop reports. Supply and demand are real factors in futures trading. They create the technicals you perceive.

The rise in prices of the raw materials necessary to make a candy bar are as good of an example as you will find to define embedded inflation. Unless you are like me, eating less candy and sweets for health reasons, you’re going to spend more on things you buy like candy bars and everything that contains sugar. Inflation is embedded; it ain’t going away.

Hope you enjoyed this post. I’m just a young 68 years old; my Dad became a broker when I was 13. It’s time for me to ‘give back’ to all of you what’s in my head. It’s not always pretty but it’s based on history . . . and history, unchecked, repeats itself.

Everyone learns at their own pace. If you pick everything up the first time through, great but if not email me at dzimmer@substack.com so we can further help.

As you’ve become familiar with my postings, I like to add a little nostalgia, usually a song or cartoon . . . this one by Sammy Davis, Jr. is perfect. In addition this article is dedicated to my dear candy warehousing trading buddy “bdee” . . . he helped make me what I am today, a Type II diabetic . . . then cured me with sunflower seeds and nuts.