There are two reasons to stick with the basics. First, it’s summer folks, and sitting on your hands is a common activity. Second, it’s time to consider that some “trends” are just waiting. Nothing goes straight up. Most retrace and consolidate as we’re seeing in the metals.

Patience is the key. Sitting on your hands while your plan comes to fruition is a smart thing to do. I’m boring in that way. I’m also very profitable and above all consistent. I want you to be more like me but learning takes time. It’s a marathon, not a sprint. You will improve your investing and trading acumen but it’s not going to happen daily.

Gold Is Going Higher

Bank of America predicts a surge in gold prices, with estimates reaching $3,000 per ounce within the next 12-18 months. They acknowledge current market flows don't necessarily support this price point but like me, they’re patient. That’s a good thing.

BofA explains that reaching $3,000 hinges on increased “non-commercial” demand. A Federal Reserve rate cut could trigger this, leading to inflows into “physically” backed gold ETFs and higher trading volumes.

Central bank purchases are another key factor. "Ongoing central bank purchases are also important, and a push to reduce the share of USD in foreign exchange portfolios will likely prompt more central bank gold buying," BofA says. Listen to them. They’re right.

This shift is driven by gold's status as a long-term value store, hedge against inflation, and effective portfolio diversifier. Their model considers various factors, mine output, recycled gold, and jewelry demand. To estimate a balanced market price, they need to factor in investment demand. Currently, these non-commercial purchases support an average price of $2,200 per ounce. A significant increase could push prices to $3,000.

Their report highlights a recent World Gold Council survey indicating central banks' intention to purchase more gold. This aligns with the growing concerns around US Treasury market fragility, potentially prompting further diversification into gold by both central banks and private investors. While a Treasury market breakdown isn't BofA's base case, they acknowledge it as a potential risk. Under this scenario, gold may fall initially on broad liquidations but should then gain.

What Is The Federal Reserve Hiding

UBS is not one of my “favorites” but they do make sense at times. They currently warn that markets might be misjudging the extent of future interest rate cuts by the Federal Reserve. They argue that while the timing of the first cut is debated, the endpoint of the easing cycle holds greater significance for investors. Investor expectations on Fed cuts have been a major driver of market sentiment.

UBS emphasizes that the overall destination of rates matters more for the investment outlook, not the beginning of the journey. The bank highlights “equities' resilience” despite shifting expectations of Fed action. The S&P 500's stronger performance this year, despite a significant reduction in anticipated cuts, underscores the role of solid economic fundamentals. Whether the first Federal Reserve cut happens in September or December likely won't make any material difference. I think they are right.

Recent economic data, consumer confidence, job vacancies, and real inflation figures, suggest a softening economy, prompting the belief that the weakening in data, which is likely to continue in the coming months, should justify Fed rate cuts. UBS expects the Fed to cut rates more than currently anticipated, citing a significant gap between the Fed's projected long-run rate of 2.75% and the market's expectation of around 4%. Overall, they believe markets are underestimating the likely number of Fed cuts over the cycle. I see this as being the eventual outcome as you don’t lower rates when things are good.

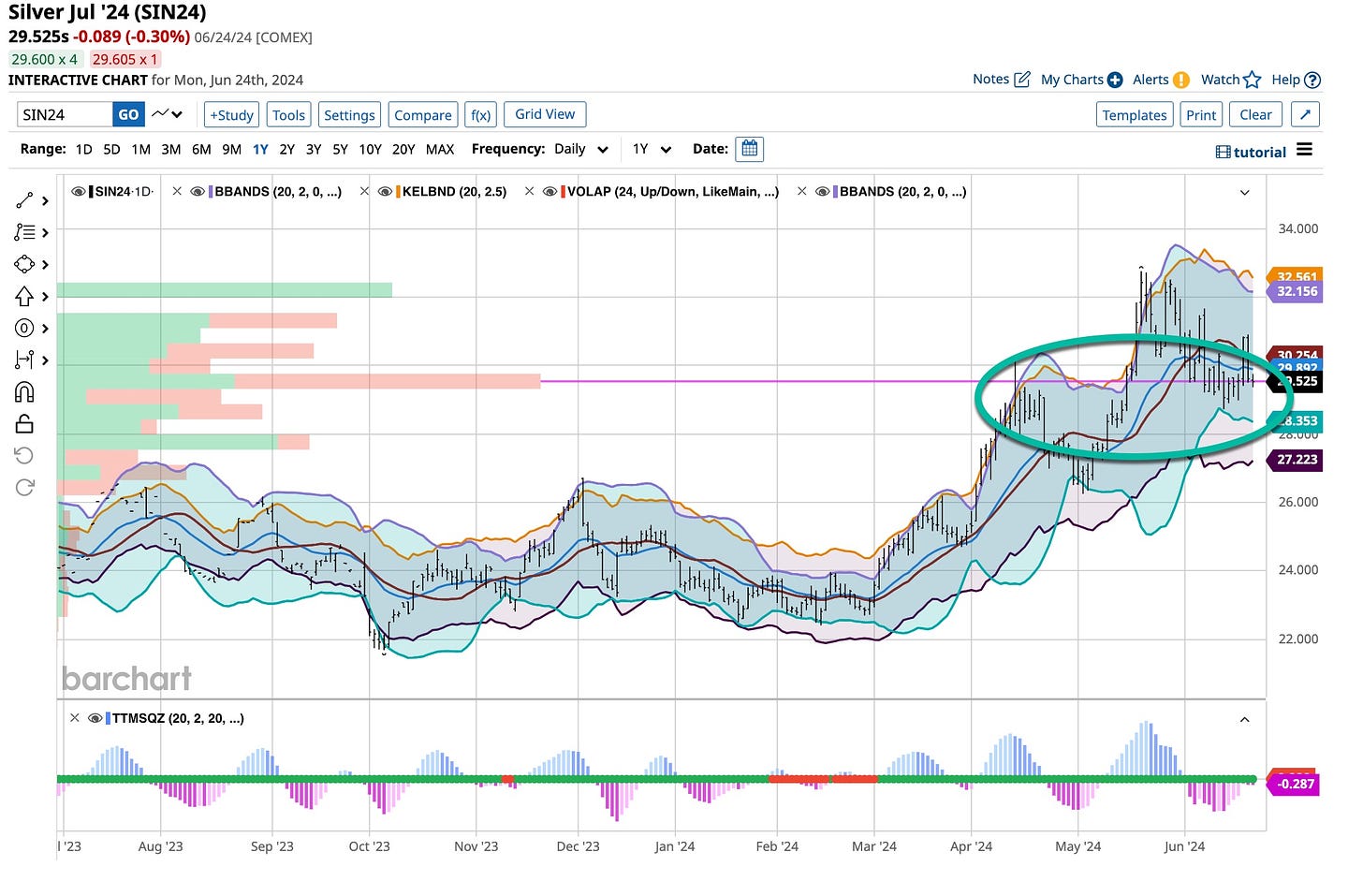

Silver Is Not Done

Precious metals have started this week on the front foot, thanks in part to a weaker US dollar. But with several risk events ahead of us in the next three weeks or so, we may see the dollar remaining largely supported on the dips, which could potentially keep a lid on metals prices. The path of least resistance on the longer-term horizon is still to the upside. I’m more inclined to buy the dips than to look for bearish setups.

One big risk event is taking place next Sunday, June 30. This will mark the first round of the French parliamentary election. But, likely, the extent of Marine Le Pen party's progress will only be known after the run-offs on July 7. This uncertainty should keep the EUR/USD under pressure or at least limit the upside potential, keeping the dollar index supported.

The single currency has started this week brightly, even if the latest polls continue to show Marine Le Pen’s far-right RN party remaining in the lead. Meanwhile, in the US, starting with the May core PCE inflation figures this Friday, followed by the June non-farm jobs report next Friday, July 5, and the month’s CPI report on July 11.

Following the release of stronger-than-expected PMI data from the US on Friday, the US dollar strengthened, and this weighed heavily on precious metals prices. It caused silver to drop more than 3.8% during the session, and gold turned sharply lower after briefly rising to a new high for the week earlier in the day on Friday.

Despite Friday’s slump, the “long-term” bullish trend for silver remains intact as both metals continue to consolidate their 2024 gains. In the next few months ahead, silver could extend its climb towards $35 per ounce, if not higher. Inflation continues to rise in the US, and although it has significantly decreased in Europe and other regions, the risk of deflation is minimal, particularly with the recent surge in oil prices.

Investors and central banks who missed the recent major “upward” trend will acquire the precious metal during any significant price drops. Many perceive overall metals as providing appropriate protection against rising prices. Some things never change.

Friday’s drop in silver has sent the metal below $30 where it was probing liquidity at the time of writing and testing key short-term support around the $29.50 area. In light of Friday’s big drop, I wouldn’t be surprised if any “small” gain evaporates later on in the day. This, however, will not necessarily make silver’s technical forecast bearish.

While there is a risk that silver could drop a little deeper, remember volatility happens inside a bullish continuation pattern, namely a bull flag. Silver can potentially drop to the support trend of this pattern, and still maintain a bullish technical outlook.

Key support at $28.70 held a couple of weeks ago, which is a positive sign. Assuming the metal can continue to hold above this area, and defend its bullish trend line, silver looks like it is gearing up for another major breakout. A potential rise back above the trend resistance of the bull flag around $30.50 is what could trigger the next phase of technical buying pressure now that prices are no longer at overbought levels.

So, a potential rally to $35 for silver in the coming weeks wouldn't be surprising, given the significant breakout recently observed on long-term charts. However, it's prudent to wait for confirmation before making any premature assumptions.

So What Else

Nike reports on Thursday, Biden and Trump debate on Thursday and I’m still buying BCE with its 8.75% dividend. I’ve been adding Boeing and Occidental Petroleum to the mix and waiting for the shift out of the “techies” to the “biotech” sector. Licking my wounds on Microstrategy but Bitcoin’s a different kind of beast and my position is rather small.

That’s it. Busy week building The Ticker. “1-on-1” tutorials have been in demand. We will be promoting this next week during our Independence Day deal but you can take advantage of it now. Learning is fun, but doing it the “right way” takes time. It’s not a sprint, it’s a marathon.

“Everything That Glitters Is Not Gold” and Dan Seals sings it well. No question, I’m a fan of country music. I’m also a fan of the metals. It’s a hedge but when it comes down to it, it’s an investment and a pretty one at that. It glitters, and so does silver, but gold looks better in the vault. I’ll trade silver when the time is right. I’ll hold “gold bullion” at all times. Some things just make sense, basic common sense. These are the rules we do not question. You should not either.