I’m a seasonal kind of person. Mixed well in between are earnings, in particular from our banking industry. If there is one industry that is adopting Artificial Intelligence to their advantage it’s the banks.

Versus a baseline dissertation, and given that time is not on my side as we “build” out the many new features of The Ticker let me get right to the point. Tomorrow’s reports are very important. Let’s take a look at what the “gurus” think will happen>

It’s Bank Earnings Kick Off Season

Three of the biggest U.S. banks open the Q1 earnings season this Friday, Wells Fargo, JP Morgan and Citigroup. Investors will be looking far beyond just earnings and sales. They'll want to know about the overall health of the commercial real estate sector and if there's a strong demand for loans. Investors will also want to know what's expected for the upcoming quarters, especially considering recent rate cut shifts by the Fed.

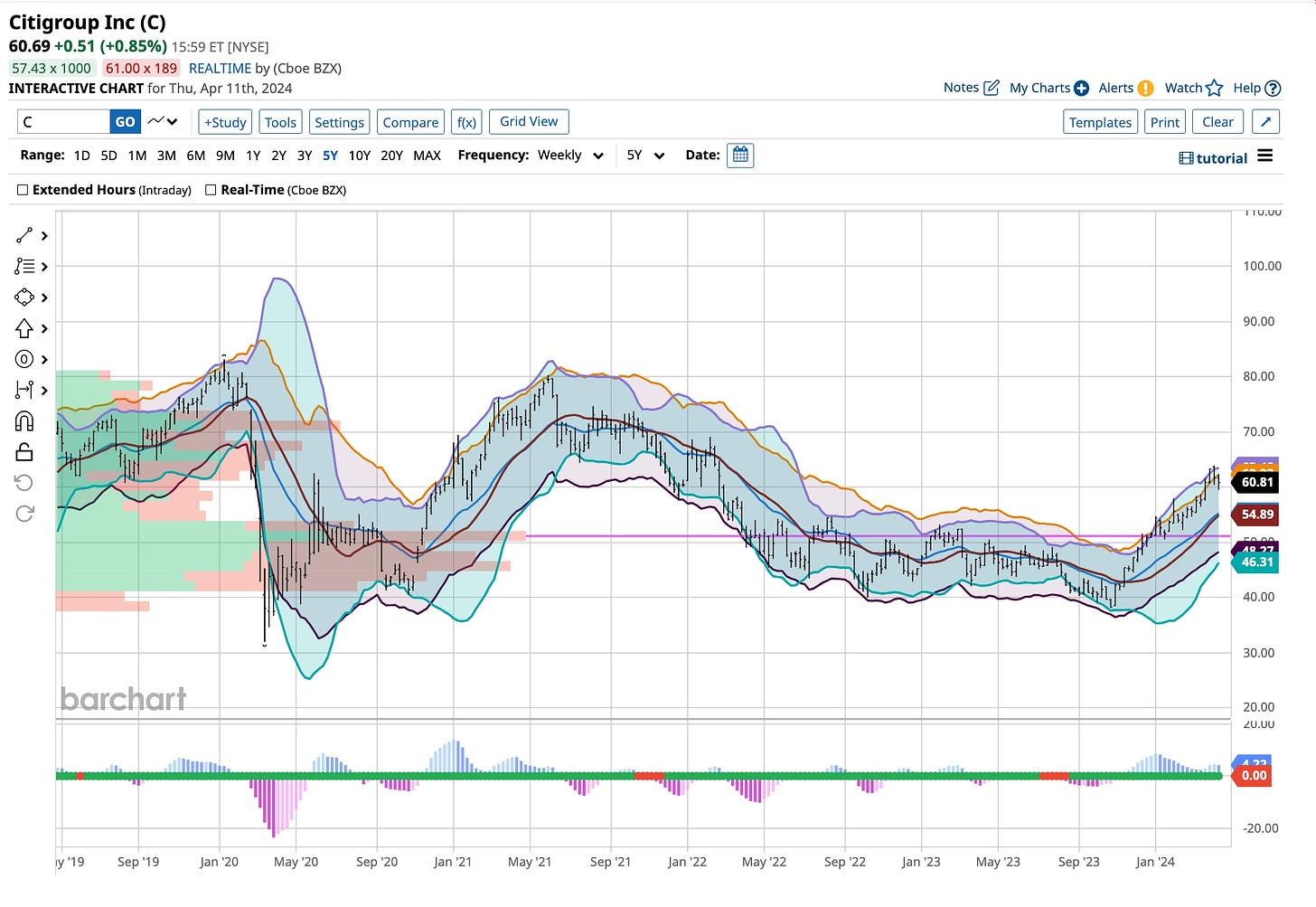

Citigroup

Not my favorite in the group but Citigroup is expected to post Q1 EPS of $1.29, 53% higher than in Q4. That’s a pretty good number but remember, it’s almost 30% lower than in the same quarter last year.

Sales are expected to reach $20.395 billion, up 16% quarter-on-quarter, but down 5% year-over-year. Regarding the outlook for Citigroup shares, the average target of the 22 analysts who follow the stock is $66.47. Do the math and you’ll find, as I have that Citigroup is a laggard when it comes to buying the stock. For me, as an overall hedge I’ll probably be on the short term put side.

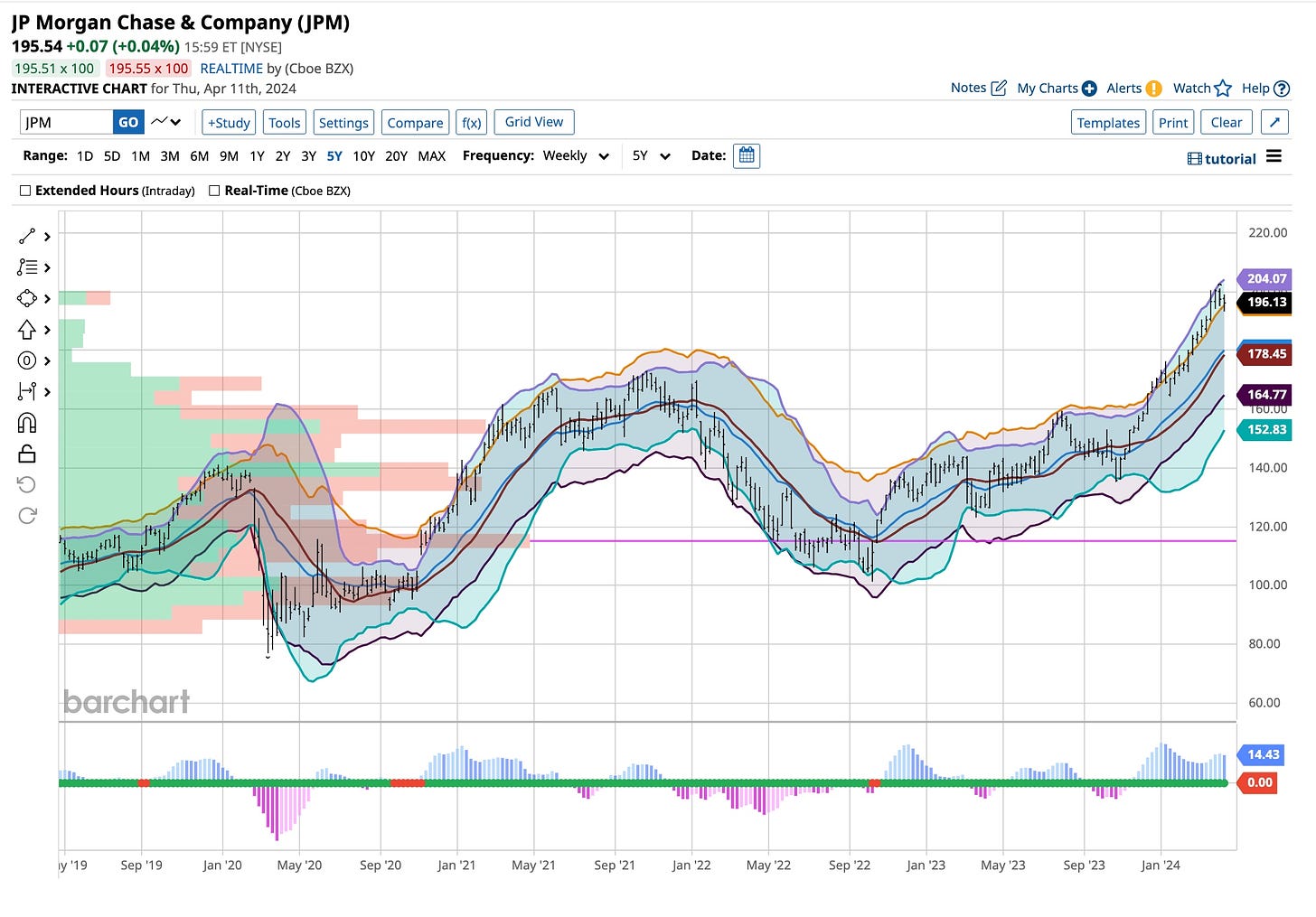

JP Morgan

For JP Morgan, the $4.11 EPS forecast would be an increase of 35.2% on the previous quarter and stable year-over-year. Sales should reach $41.672 billion, 8% higher than in Q4 2023, and 8.6% higher than a year earlier. The 23 analysts who follow the stock post an average target of $206.81, slightly above the current price.

While this does not excite me Jamie Dimon does. Since the demise of the financials in 2008 he’s pulled off a few “miracles”. If I was going to buy calls on any of these three, JP Morgan would be the one. I’m a bit bearish on the industry based upon the demise of the commercial real estate industry so more than likely I’ll be on the sidelines.

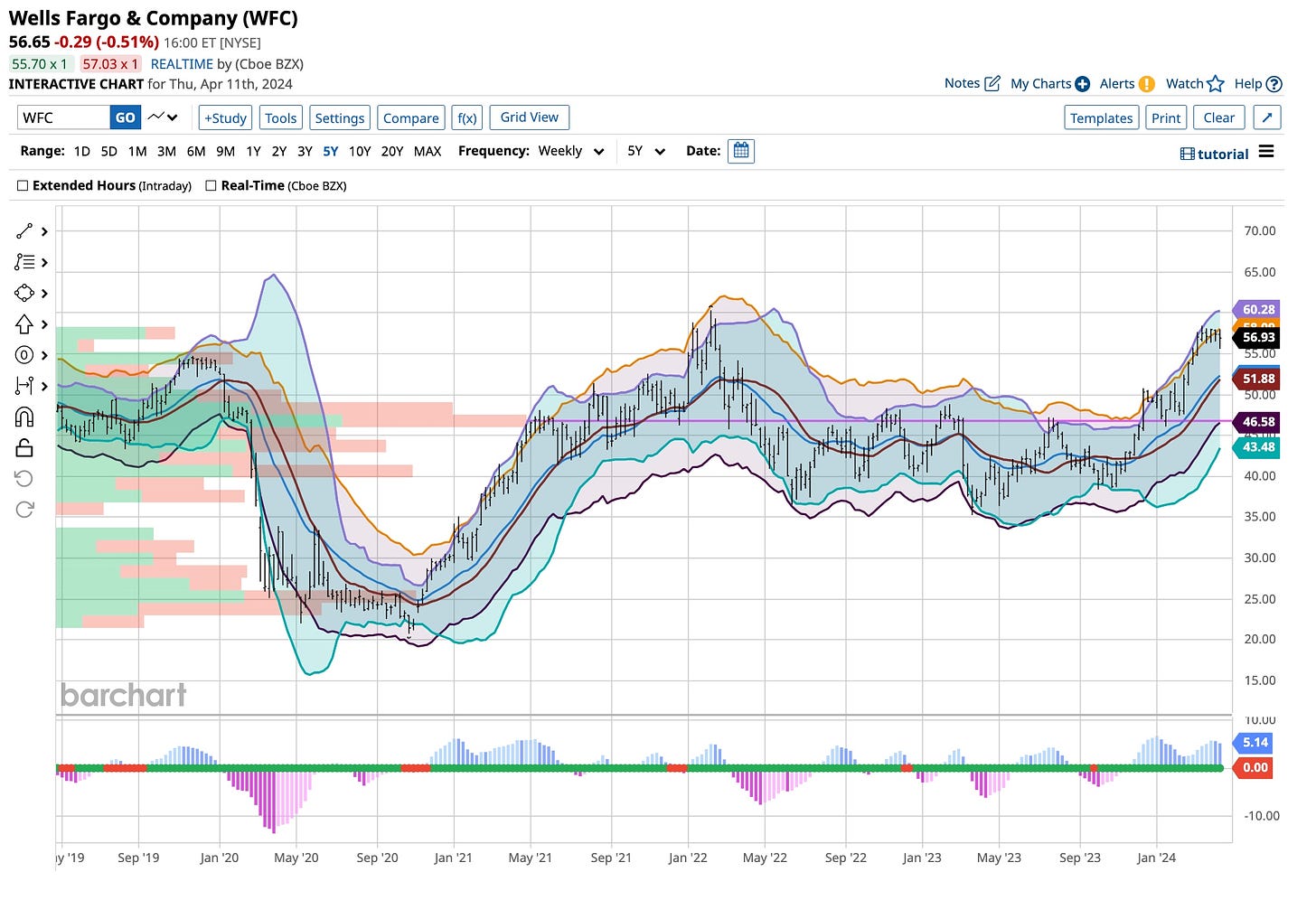

Wells Fargo

Wells Fargo's EPS forecast of $1.09 would translate into a 15.5% decline in earnings compared with the previous quarter, and 11.4% year-over-year. Sales are expected to be roughly stable year-over-year and quarter-on-quarter, at about $20.15 billion. As for the share's potential, an average target of $61.36, just above the current price is set.

Other than Wells Fargo reporting today, it would not be on my list. Quite frankly it has not been for years. It’s never been a pick of mine as it is undoubtedly a laggard in the overall industry and I do not expect that to change.

It’s not surprising that JP Morgan will lead in earnings and revenue growth. However, analysts and valuation models suggest JP Morgan has the least room for a big upside move. in reality, none of these three look to do much. I’ll stay on the sidelines and just watch The Masters.

New On The Radar

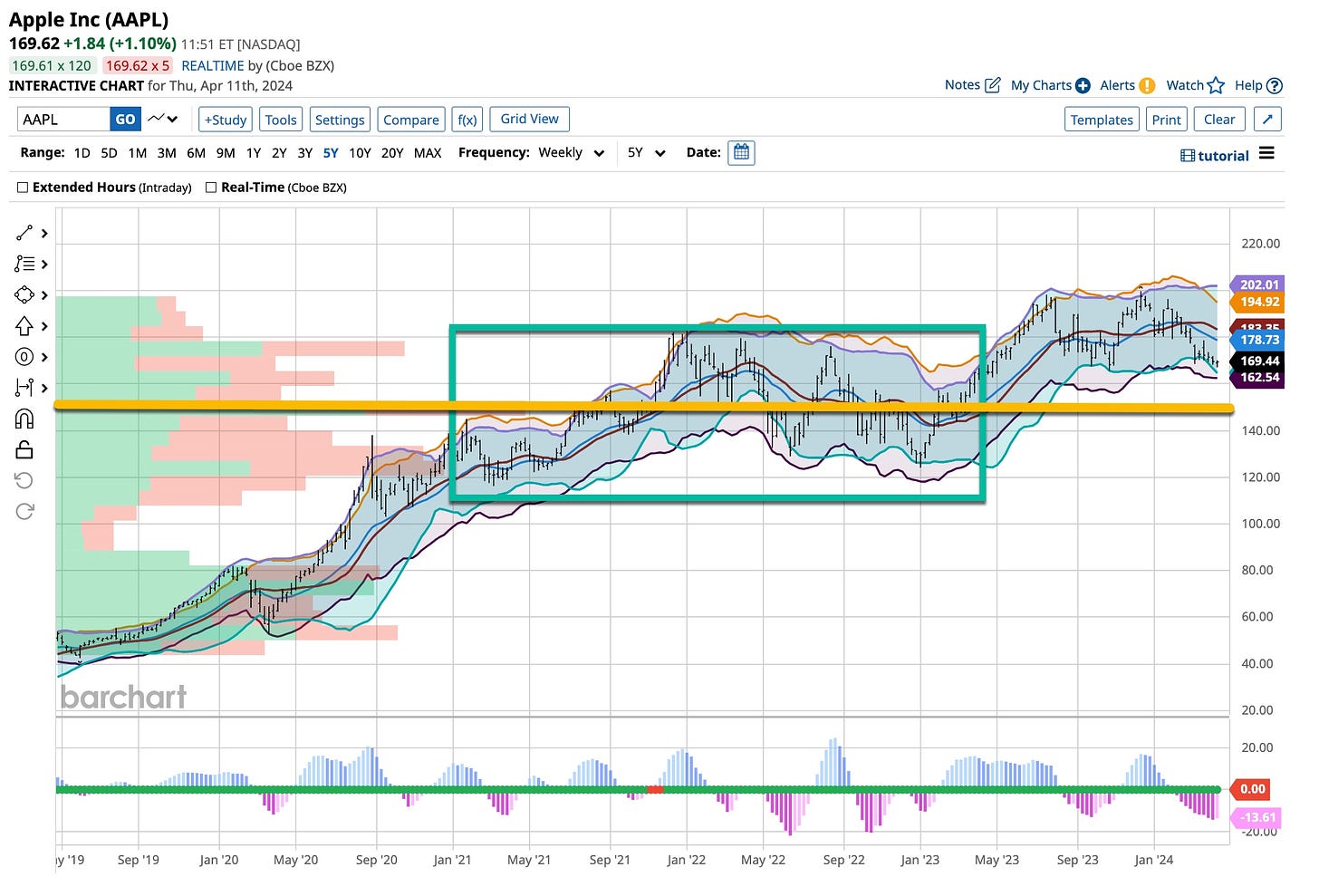

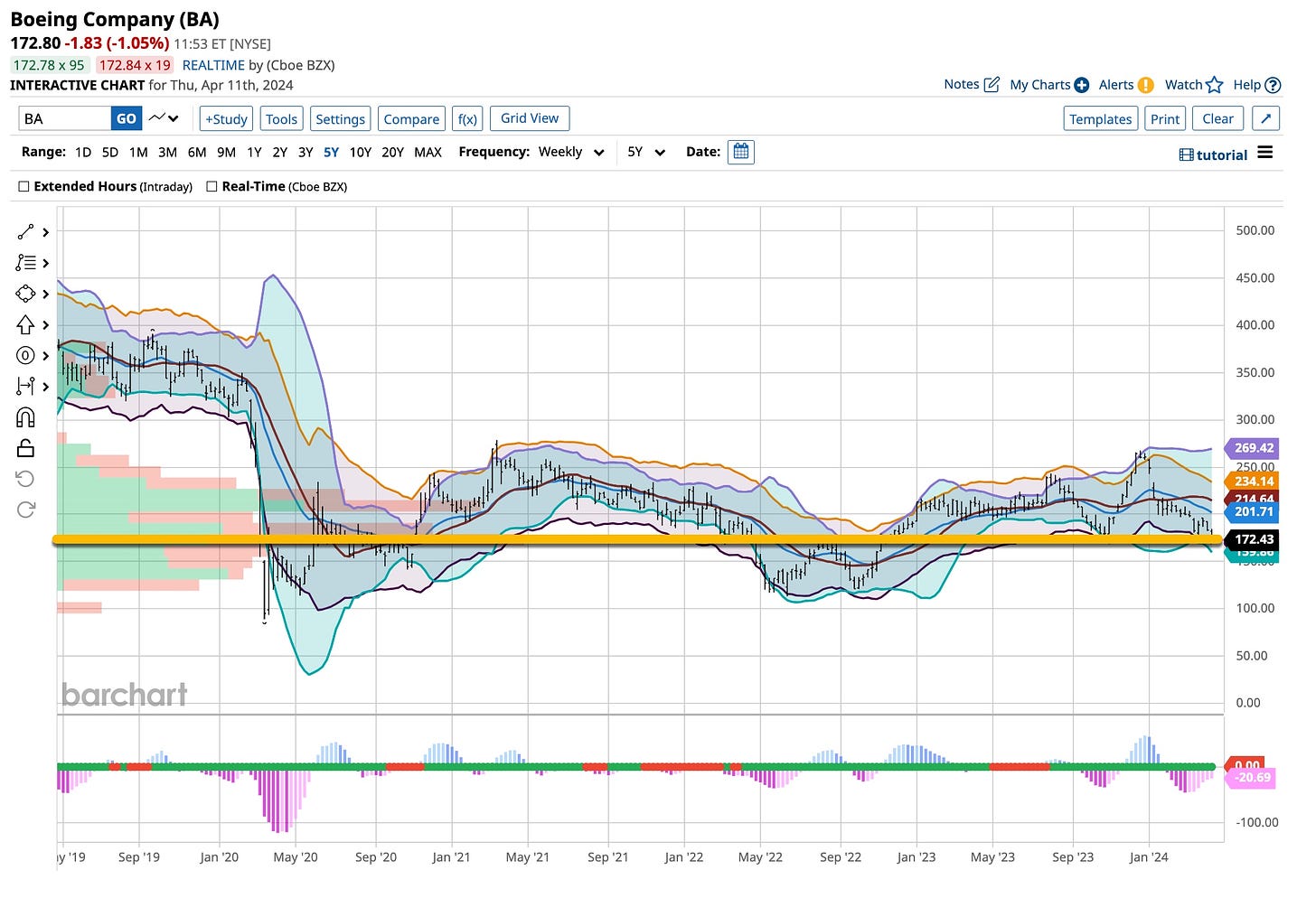

Apple doesn’t need an introduction or an analysis. To me, it’s kind of a “go to” stock I buy when everyone doesn’t. While I’m sitting on the sidelines, just like I’m doing with Boeing (“BA”) at this time, I’m just watching and you should too.

It’s always important to have a quiver filled with arrows. I’m a very long term, “brand name” bottom fisher and both of these securities fit that model. I’ll always be one to practice what I preach. I have a plan and I stick to it. Quite often I’m early. It works for me and hopefully you as well but patience is important, in this and all aspects of life. Practice patience as often as you can.

A Quick Review

On Tuesday, I bought both a point out-of-the-money 2024 April 17th VIX put and call options. I sold the calls at the open this morning almost paying for both sides of the transaction. I’m still holding the puts expecting the markets to retest the upside. In using Barchart, in particular the “delta” numbers as reported, making decisions like these were not difficult. Give Barchart a try. I’ve used it for years and always will.

In addition, my average price on the futures awaiting a downside in the Yen versus the U.S. Dollar to the 125 level sits at 152.25, about a one point overall loss. I am not changing my belief often finding that “consistency” works. I do not, I repeat, do not recommend this type of strategy for anyone unless you have “lots” of money. Risks are very large and every time I have “averaged up”, it costs twice as much to maintain the margined position. I’ll be right eventually. The question is when and only Ueda knows.

From Five Miles Up

I first want to thank everyone for taking the time to read what I write. In the first year we’ve been on Substack and LinkedIn, you have helped to make us feel like we belong. Thank you for that. We’re building out The Ticker to impart upon everyone our years of experience and more. Stocks, bonds, futures, funds and options represent a big part of today’s investment world but not everything that’s available. Adding in real estate, oil & gas, cryptocurrencies, High Frequency Trading and more simply makes sense.

Rome was not built in a day. The Ticker is following that premise but we cannot do it without you. That’s why, as we embark on this next chapter of our story, we’re offering an introductory package for $247.00. Take a look and join with us on our adventure. It is a great way to learn and through all of you, I learn something new every day.

In 1971 Cat Stevens, now known as Yusuf Islam, released “Wild World”. Any way you cut it, this world is wild. No one knows what is going to happen from day to day. That is why I’m long term in nature. Over time my “plan” has survived changes in the Fed, many different political administrations, pandemics, financial catastrophes and more. I’m still standing and hopefully you are too. I’m not afraid of “what’s next” because I have a plan and you should too. Building a plan is important. Following your plan is more important. That’s how I handle this “wild world” and you should too.