Earnings kick off this week but remember, it’s still summer. The books are thin and the interest, at best is muted. It should be, it’s summer and it is a summer of what I’ll call uncertainty.

Will Joe Biden still be the Democratic candidate? Will Powell lower interest rates? Is it possible for “Europe” to successfully change its political direction with elections? It seems more like the questions they would ask on “Soap”, a 1970s-based take-off where soap opera-like characters ruled television. I can relate to Tubi for old-timers like me. I must admit, it’s funny. Check it out and laugh with me.

What’s transpiring across the globe is not as funny but it is real. Far too many analysts have an opinion. I read them all but act on but a few. I’m a Warren Buffett fan. I don’t like the “fly-by-night” posters or their thoughts. Still, I read and listen to all of them. You should too.

It’s Raining

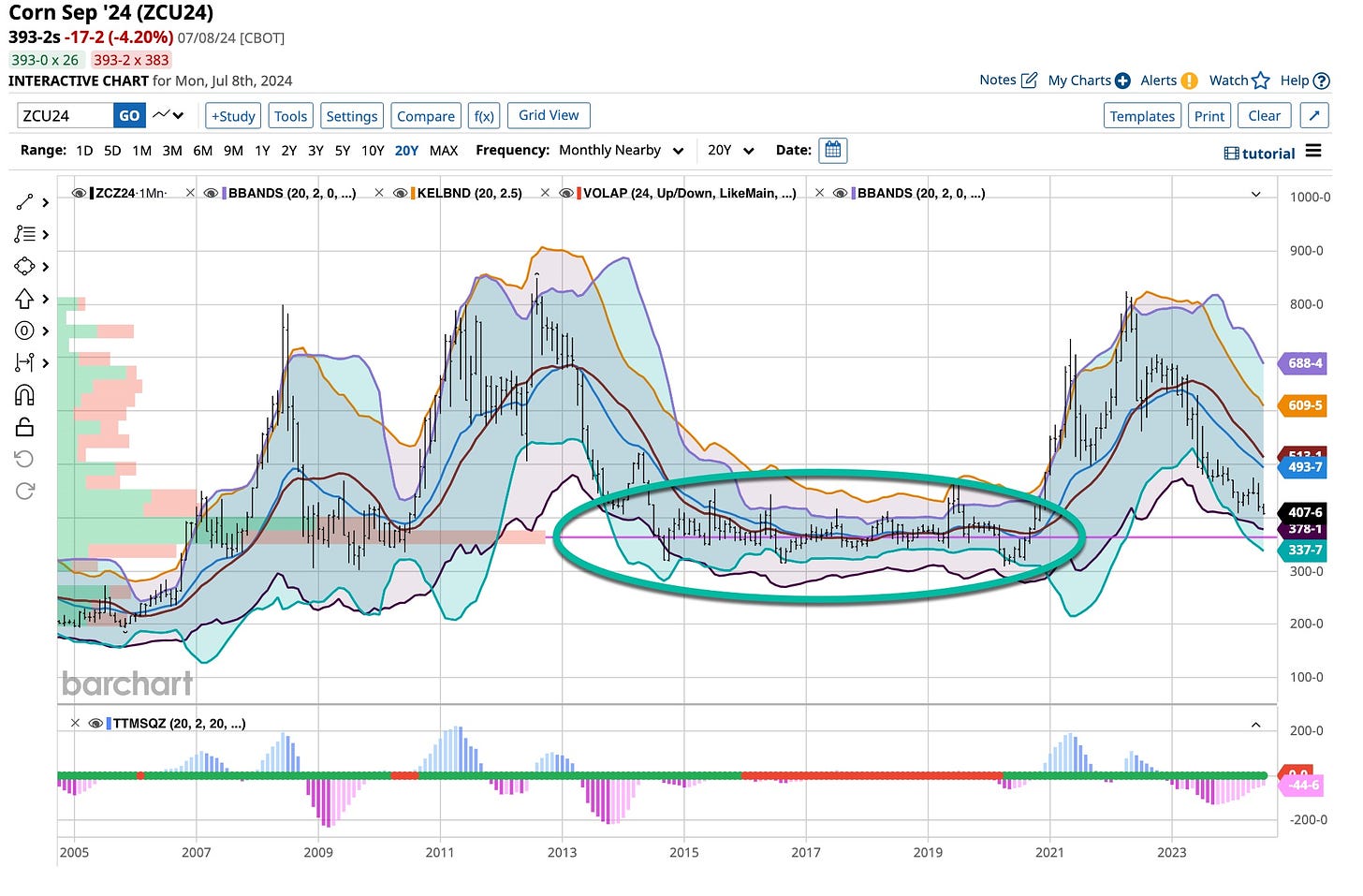

Roger & Hammerstein in “Oklahoma” talked about what a “beautiful morning” it was back in the Midwest. Well, is it? I watch those weather reports, I buy a lot of industry analysis, and more. Corn is an important indicator for many reasons.

Corn and cash go in opposite directions. The U.S. Dollar is hanging in there. Japanese Yen keeps hitting new lows despite warnings of intervention. Powell could have more reason to lower rates going forward but the question remains how much and for how long. For me again, it’s summer. I’m on the sidelines but technically, Corn is looking like it’s time for a trade on the upside.

What Will Drive The Russell 2000

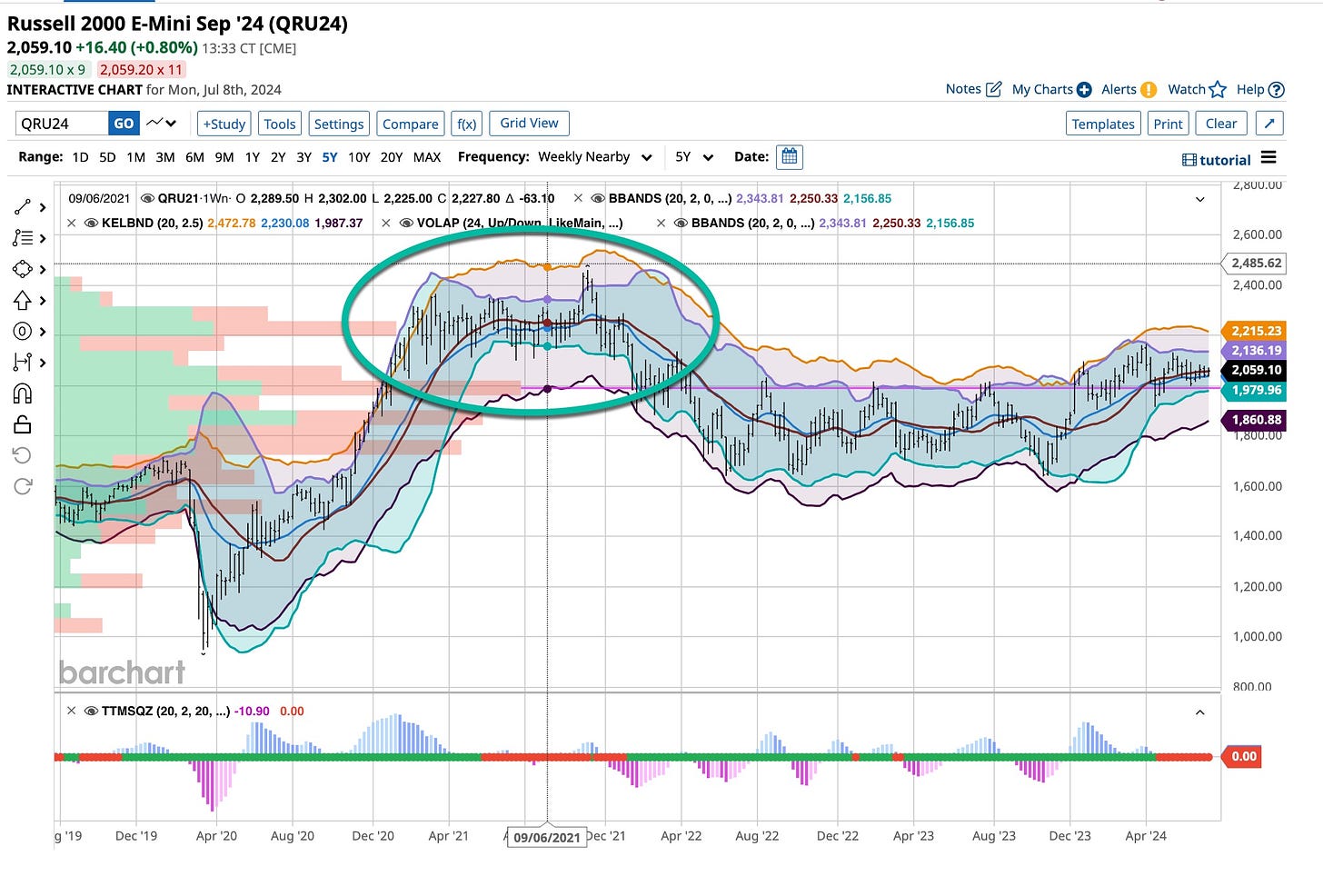

No question here, interest rates. The “stocks” that make up this industry are far from small but all are interest rate dependent. One of my best trades of all time happened in late 2021. I aggressively shorted the “Russell 2000”. It was obvious that much higher interest rates were on their way.

Today, despite an inflation target of 2%, that will never be met, the Russell 2000 is far below it’s all time high. There is reason for this, interest rates more than likely are not headed much lower for quite some time. While the other indices have exceeded recent highs, the Russell 2000 has not. It’s been a great hedge, a philosophy that is not going to change anytime soon. It’s part of my plan. How about you?

Patience rules my life. Planning is important and it should be for you as well. I’m not one to chase opportunities. I sit back and let them find me. There is always something on the horizon to watch, listen to and look for. More than half of a century witnessing events that transpire makes that possible. That in a nutshell is what position trading, investing and above all hedging is all about. For more follow The Ticker. You’ll know when I take action if you do.

Like the Stones sang on The Ed Sullivan Show, “Time Is On My Side”. It’s on yours as well, especially if you have a plan and exhibit patience. It’s OK to do nothing. It’s what I do more often than not but it doesn’t mean I’m not watching, listening and more as I wait. Opportunity is something that finds you if you are looking in the right place. It seems to me that far too many traders think they can beat the market. Perhaps about 1 out of every 10 can. Studies have proven that most traders die broke. Not enough are dealing with Roth IRA accounts so they’re paying taxes and taxes are a negative cost. Think about what you are doing and if you are not making money change. We at The Ticker are here to help.