It’s just another day on Wall Street. At least that’s what the “powers that be” want you to believe but there’s something in the geopolitical air, change. It was a long night for me as votes in an election in the largest democracy in the world were counted.

Were you watching? It’s a big world out there. With a population of close to 1.5 billion people, India is the largest democracy in the world. When they speak the world must listen, especially when the “exit polls” predict a landslide victory that did not happen.

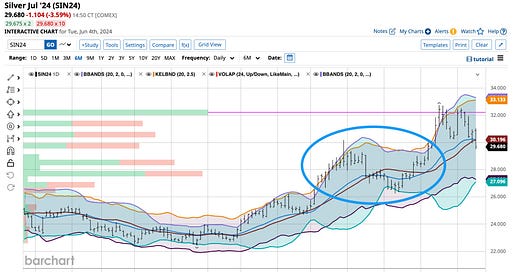

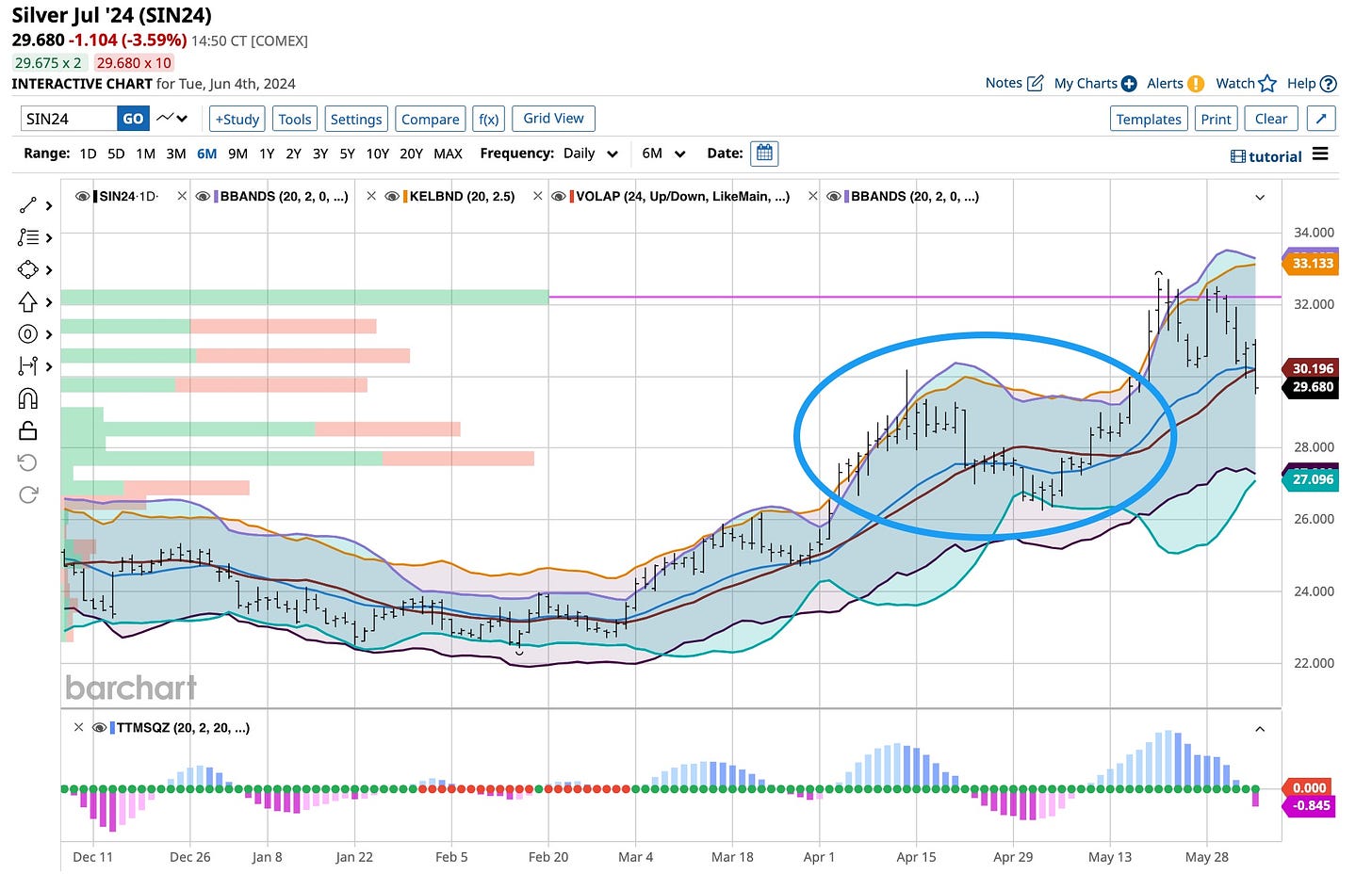

I’m starting to see some cheerleaders take the forefront when it comes to the metals. I have been waiting for this to happen. Nothing ever goes straight up or down. Copper was the first to trigger a “correction” shortly thereafter followed by silver. Reports of lower inventories and supply constraints continue to proliferate but technically, they are both reacting to support and resistance levels. Reversion to the mean is important when it comes to using trailing stops.

Never be afraid to take a profit. You will never lose money taking a profit. Greed kills as bulls and bears make money and pigs get slaughtered. Trailing stops work and cash is king. Sitting on the sidelines is a position. It’s summertime and watching the world just spin on its axis is fashionable. With the “meme” stocks taking flight, it’s smart to sit back and “smell the roses” as they’re blooming, especially down here in Texas.

Democracy Speaks

Indian stocks suffered their worst intraday decline since March 2020 on Tuesday and foreign investors sold the most on record. Prime Minister Narendra Modi's alliance was unlikely to win the overwhelming majority predicted by exit polls.

With over half of the votes counted, Modi's own Bharatiya Janata Party (“BJP”) looked unlikely to secure a majority in the 543-member lower house of parliament and would need allies in the National Democratic Alliance (“NDA”) to form the government. The potential of uncertain economic policies, and the push for “investment-led” growth, a cornerstone of the Modi government's rule, is in question. The Indian economy grew 8.2% in the financial year ended March 2024. That may be changing.

The NSE Nifty 50 index closed down 5.93% at 21,884.5 points, and the S&P BSE Sensex fell 5.74% to 72,079.05. The indexes fell as much as 8.5% earlier in the day, after hitting record highs on Monday. At the day's low, the indexes saw their “biggest” intraday fall since March 2020, when stocks were battered by the first lockdown during the COVID pandemic.

The exit polls projected a big win for Modi's NDA, taking markets to “all-time” highs on Monday as investors expected sustained economic growth. The benchmark indexes have more than tripled since Modi became prime minister in May 2014. Most foreign investors, who poured a net $20.7 billion into Indian equities last year but pulled back ahead of the election. On Tuesday, Foreign institutional investors sold a record 124.36 billion rupees. They bought shares worth a net of 68.51 billion rupees on Monday.

The lack of clarity on the margin of victory for the NDA saw intraday volatility on the share index rise to its highest level in 26 months. Selling by “high-frequency” traders accelerated the drop and the sharp fall triggered margin calls. Markets are witnessing a significant correction due to margin calls as retail investors employed “leveraged” positions. The rupee ended at 83.53 against the dollar, down 0.5% on the day, marking its worst single-day fall in 16 months. The benchmark 10-year bond yield rose 10 basis points on the day, its biggest one-day rise in eight months, ending at 7.0382%.

Investors expect the Modi government to continue focusing on turning the country into a manufacturing hub, a project that has courted “foreign” companies including Apple and Tesla to set up production as they diversify beyond China. Time will tell in this monstrous democracy but for certain, the “whole world is watching”.

Trailing Stops & The Sidelines

If you think that I like to “drill” things into your head you are right. I use railing stops and consider being “flat” as a position. There is absolutely nothing wrong with being on the sidelines, especially with money market rates around 5%. Not every stock is a “meme” stock and “supply & demand” when coupled with price is variable.

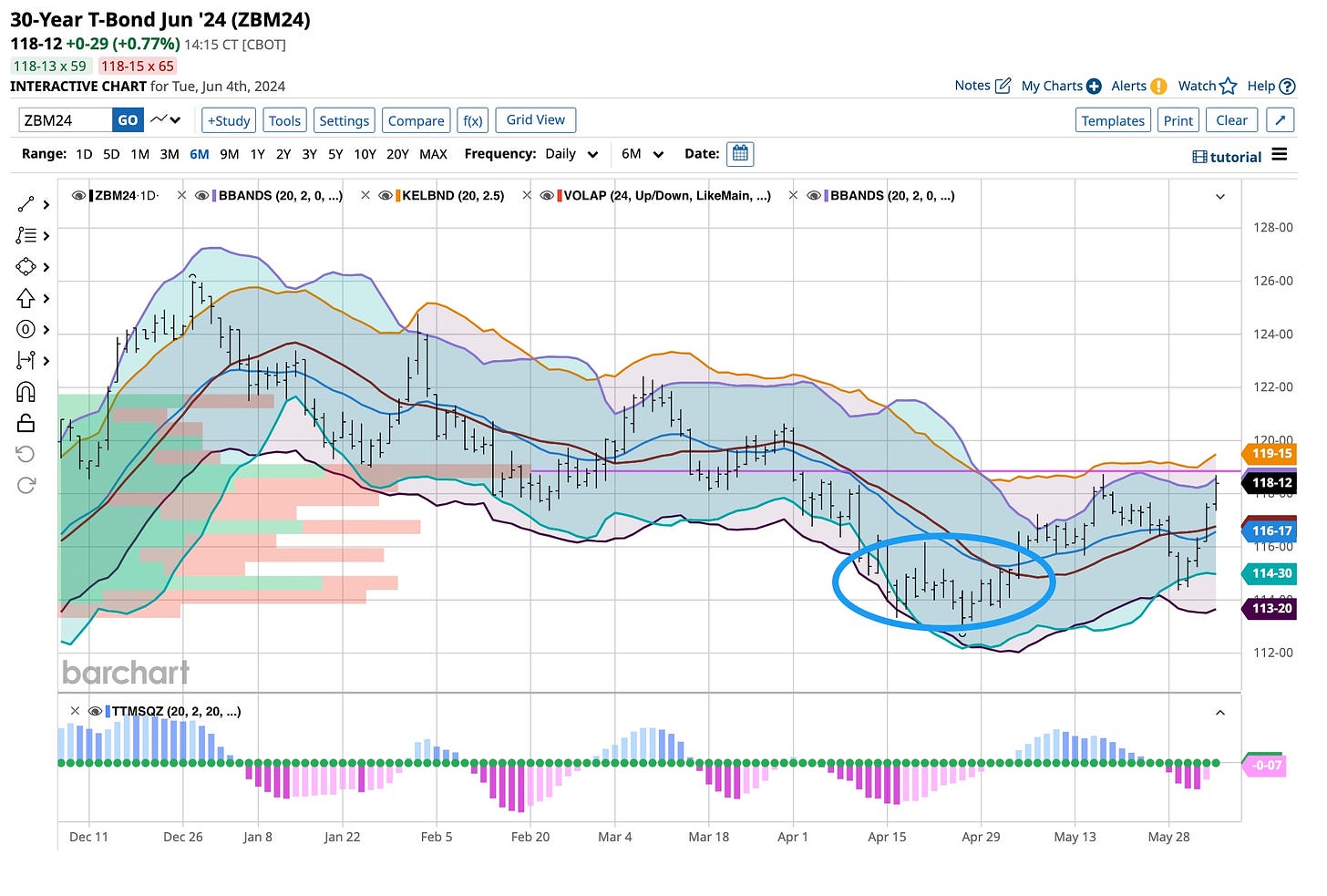

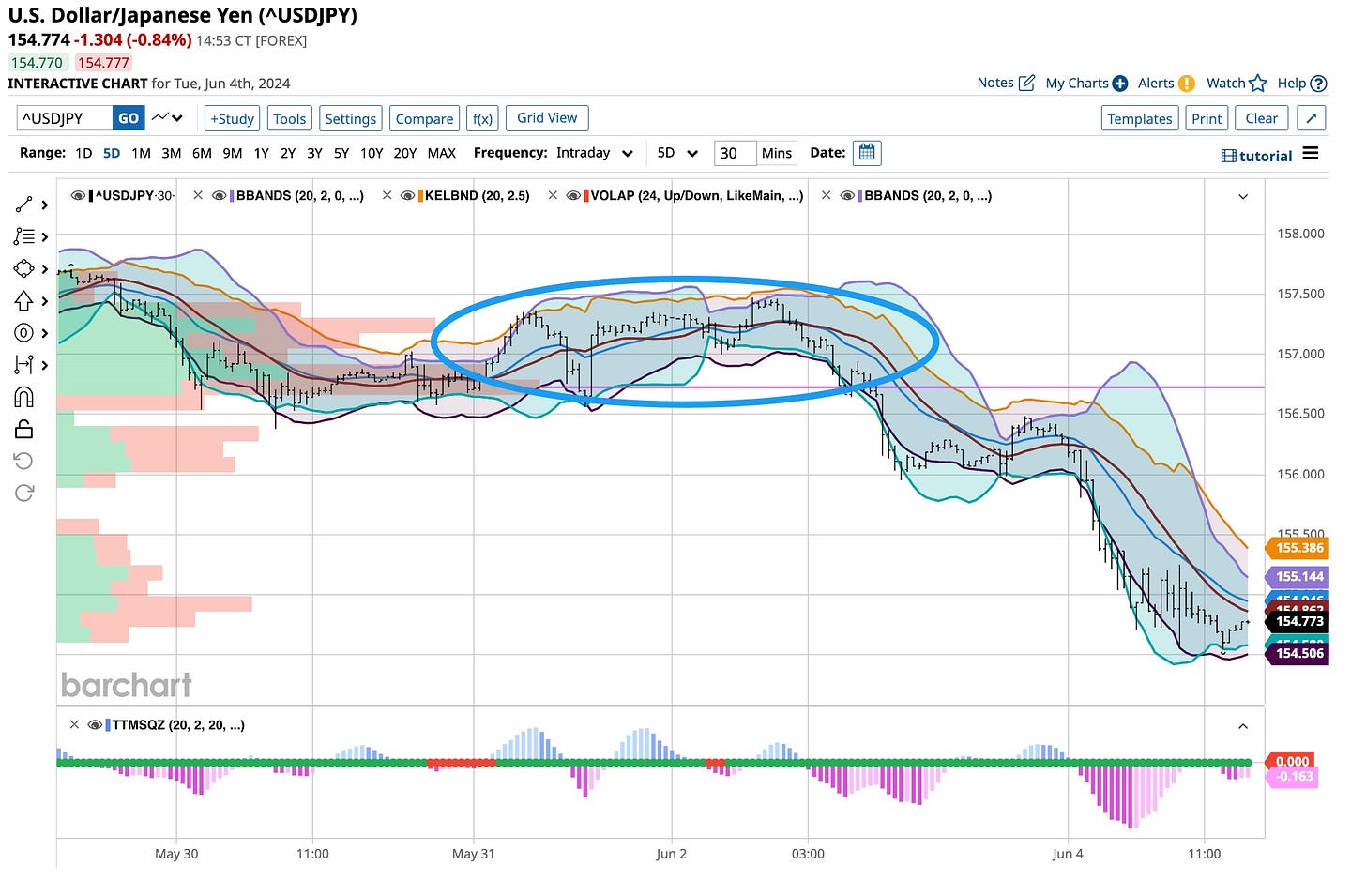

Take advantage of what’s “put on your plate” and “go with the flow”. It all sounds very simple but it is not. It takes tears of experience to see and hear what drives all of these trends. We’re just here to tell you what we see and what actions we are taking. Bonds and currencies, especially the 30-year U.S. Treasury and Yen are in play. We bought the long bond around the 114 price level and the Yen versus the U.S. Dollar at 157.50.

It’s a busy day down here for us in Texas. Our grandchild is visiting us for a couple of days. That’s right, Penny, our beloved one-year-old long-haired Dachshund is here and she demands a lot of attention. You all know what that’s about, eh? There’s a lot more happening so stay tuned. Realize that geopolitics comes into play in many ways.

Almost fifty years ago Fleetwood Mac released “World Turning”. Face it folks, it’s still rotating on its axis. We’re just puppets to its actions but with a “little” common sense and research, we can figure it out. I’m here to bring you the “common sense” side of the equation. It’s up to you whether or not you want to learn. I’m simple, boring, and a bit lazy when it comes down to it but that comes with experience. I’m happy to sit and wait for an opportunity to find me. I preach this philosophy in the “foundation” part of the courses offered in The Ticker. We’re running a limited-time offer for $99 so you can learn from me, right out of the “horse’s mouth”. It’s priceless so join and learn.